Unemployment Insurance Division Registration Section Harriman State Office Campus Building 12 Albany New York 12240-0339. Return completed form type or print in ink to the.

Nys Department Of Labor Nyslabor Twitter

Online at wwwtaxnygov.

Nys unemployment tax id number. Click the Gear icon then select Payroll Settings. On the Preferences page go to the Tax Setup tab. Calling the IRS at 1 800 829-4933 or.

The IRS issues ITINs to taxpayers and their dependents who are not eligible to obtain a Social Security number SSN so that they can. They let your small business pay state and federal taxes. How Do You Get Through To Nys Unemployment Contact UsUnemployment Insurance.

Generally businesses need an EIN. Youll need your EIN to identify your business to the IRS and New York State. Mail or fax federal Form SS-4 Application for Employer Identification Number to the IRS.

A New York State Employer Registration Number is assigned to an employer who is liable to pay Unemployment Insurance tax. STATE OF NEW YORK. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

NYS Assessment Receivables PO Box 4127 Binghamton NY 13902-4127. This number is formatted as 9 digits a space 2 digits a space and 1 digit ie. For office use only.

Step 3 Call your most recent employer if you cannot locate your former employers federal EIN because you dont have a W-2 form to check. 833-3000General Inquiries Unrelated to Individual UI Claim Assistance. Find the employers Federal Employer Identification Number in box B of the W-2 form.

After you have your EIN register with New York State by. Department of Labor Website. By calling the Tax Department at 518 457-5434 and using the PIN indicated in their letter.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. The online registration at. Or mail the coupon enclosed in their letter to.

If you have any questions about registration call the Employer Hotline at 888-899-8810. Address above or fax to 518 485-8010 or complete. Learn how to locate or obtain an EIN.

For office use only. If Selected for Additional Verification. Call the NY Department of Labor at 888-899-8810.

Unemployment Insurance Registration Number. Individual UI Claim Assistance. You may apply online at.

Calling DOL at 1 888 899-8810 or 518 457-4179. You can go to the Tax Setup preferences to view your Employer Account Number from thereHeres how. Select the appropriate State and review the.

Find this on any previously filed quarterly tax return Form NYS-45. Return completed form type or print in ink to the. Wwwdolnygov UI registration information.

Additional information can be obtained by calling the New York State Department of Labor or the New York State Department of Taxation and Finance at the numbers listed below. An Individual Taxpayer Identification Number ITIN is a tax processing number issued by the US. Employers may also be required to.

Types of legal entity appear in Part A Item 2 of this form. Pay the metropolitan commuter transportation mobility tax MCTMT Resources. Total the New York State tax withheld amounts from all IT-1099-UI forms.

If you have already been processing payroll and filingpaying withholding and unemployment taxes to New York then there is no additional registration needed. Locate any of your previously filed federal tax returns as this number matches your FEIN. For Unemployment Insurance Withholding and Wage Reporting.

It has a Payers Fed ID No. You can get your EIN by. Applying online with the New York State Department of Labor DOL.

Filing requirements NYS-45 NYS-1 Filing methods. You can find both of these numbers on any previously filed quarterly tax return Form NYS-45 or by calling the NY Department of Labor at 888-899-8810. Pay unemployment insurance contributions.

27-0293117 on the UE form. New York State Employer Registration for Unemployment Insurance Withholding and Wage Reporting. An ITIN consists of nine digits beginning with the number nine ie 9XX-XX-XXXX.

The second account number is your Withholding Identification Number. The first and second part of this ID is issued by the State of New York. New York State Department of Labor-Unemployment Insurance Albany NY 12240-0001 Box b Payers federal identification number State New York State tax withheld 2 7 0 2 9 3 1 1 7 N Y Box 1 Unemployment compensation.

Visiting the IRS at Apply for an Employer Identification Number EIN Online or. Calling the Tax Department at 518 485-6654. You must complete an employer registration form for us to decide if you are liable under the New York State Unemployment Insurance Law.

If selected for IDme verification you will receive an email text message or letter to the email address phone number or address submitted with your application for unemployment benefits. 1-888-899-8810 Telephone assistance is available from 800 AM to 500 PM. Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business.

To locate your New York Employer Withholding Identification Number. Internal Revenue Service IRS. Yes towens1And Id be glad to walk you through the steps to find your Unemployment ID number.

External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. Household Employer Registration for Unemployment Insurance Withholding and Wage Reporting NYS 100 NYS-100 Household. You must obtain a federal employer identification number EIN from the Internal Revenue Service IRS.

Even if you have already submitted identification documents through mail fax or our online system you should still follow the. My client received Unemployment payments from NY state as reported on form 1099-G. There is a free service offered by the Internal Revenue.

Publication NYS-50 Employers Guide to Unemployment Insurance Wage Reporting and Withholding Tax. NY State Unemployment Federal ID Number. It is used to identify an individual account for recording tax payments due and Unemployment Insurance benefits paid.

NYS-100 0213 New York State Employer Registration. You may apply for an EIN in various ways and now you may apply online.

Accounting Resume Accounting Resume Sample Free Resume Examples Professional Resume Samples Resume Examples

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Insurance Rate Information Department Of Labor

Why Middle Income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

Browse Our Image Of Direct Deposit Form Social Security Benefits For Free Separation Agreement Template Contract Template Social Security Benefits

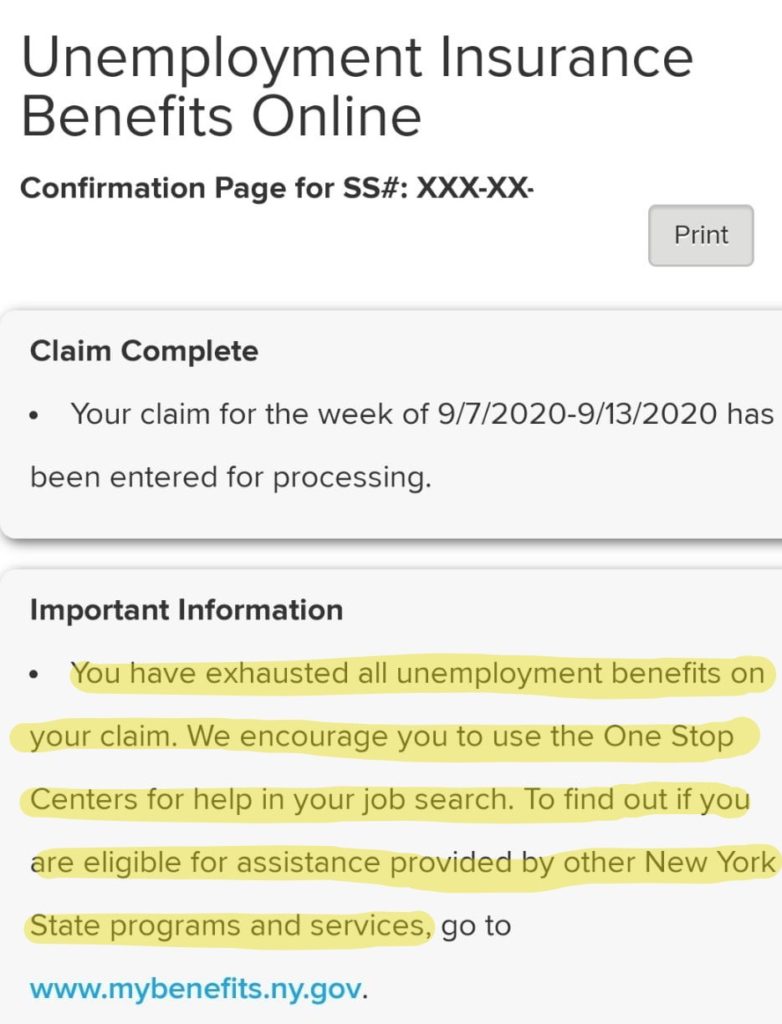

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

The Small Business Legal Checklist Infographic Business Checklist Business Infographic Infographic

0 Post a Comment: