If you get one but did not apply for unemployment that is a. The e-mail notification will instruct you to log into the Ohio Department of Taxations Income Tax Online Services where you will have the ability to view andor print your 1099GINT form s.

800-860-7482 and ask for a replacement 1099G.

1099-g unemployment ohio. You can also call the IRS and theyll mail it to you if you cant get it online. Miscellaneous Information or Form 1099-NEC Nonemployee Compensation. Back to my original question Ohio Department of Job Family Services sent me a 1099-G for unemployment benefit of 549600 and they reported the amount for the Federal withholding.

The refund amount reported on the 1099-G is generally from the Overpayment line of your Ohio andor school district return. 1099Gs are available to view and print online through our Individual Online Services. Miami Valley vaccines.

Unemployment compensation program or to a governmental paid family leave has received a payment as a nominee that is taxable to you. This will help save taxpayer dollars and allow you to do a small part in saving. If you have moved since your last claim please update your mailing information online by logging into your account or call 1-877-OHIO-JOB 1-877-644-6562 and select Option 1.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. How to get my 1099 g from unemployment ohio. Only actual recipients of unemployment benefits must file a 1099-G form to report their unemployment income when filing their annual taxes.

How to get my 1099 g from unemployment ohio. If you get one but did not apply for unemployment that is a. ODJFS issues IRS 1099-G tax forms to recipients of unemployment benefits so they can report this income when filing their annual tax returns.

In addition this form will be sent by US. You can elect to be removed from the next years mailing by signing up for email notification. Mail to the most current address on your claim.

Statements to Recipients If you are required to file Form 1099-G you must furnish the same information to the recipient. Every year we send a 1099-G to people who received unemployment benefits. In fact its recommended that you obtain a business license.

How to get my 1099 g from unemployment ohio. Enter Gross Wages Unemployment compensation box 1. Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the form.

All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. Where you can schedule a. However the amount reported on the 1099-G may differ from the amount you requestedreceived based on corrections made to your return.

Unemployment benefits are taxable pursuant to federal and Ohio law. Select the SSN Social Security Number for this 1099-G. ODJFS issued approximately 17 million 1099-G forms in 2021 and 200000 forms in 2020-30- The Ohio Department of Job and Family Services manages vital programs that strengthen Ohio families.

Enter FEIN PAYERS federal identification number. Enter Federal Withholding Federal income tax withheld box 4. Most city county and state municipalities.

If you are entering a 1099-G for Ohio Unemployment Compensation then. Issuing 17 million 1099-G tax forms throughout the month of January pursuant to federal law that requires reporting of unemployment benefits. This may program and received a payment from that program the payer must issue a separate Form 1099-G to report this amount to you.

The state said it will be issuing a record 17 million 1099-G forms to Ohioans for unemployment payments received last year. Furnish a copy of Form 1099-G or an acceptable substitute statement to each. You can log onto irsgov and request wage and income transcripts As long as Ohio reported it they 99999 did then you should be able to get those amounts off the transcript.

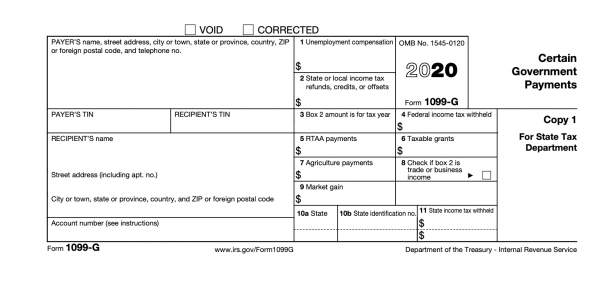

A 1099GINT is a report of income required by the IRS to be provided to someone who is the recipient of certain government payments. All 1099Gs Issued by the Ohio Department of Taxation will be mailed by January 31st. The 1099-G form is used to report taxable benefits when filing with the IRS for anyone who was paid unemployment benefits or Alternative Trade Adjustment Assistance payments during the calendar year January 1 to December 31.

For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. That included their Fed Tax id number. How Do I Get My 1099 -G Form For State Of Ohio.

You can view and print your 1099-G from your correspondence inbox. Httpsunemploymenthelpohiogov click on the REPORT IDENTITY THEFT button and complete the form. While on your states website copy the contact information so you can contact the office directly if necessary.

UNEMPLOYMENT COMPENSATION--Generally includes any amount received under an unemployment compensation law of the United States or of a stare. It includes benefits paid by a state or the District of Columbia from the Federal Unemployment Trust Fund and railroad unemployment compensation benefits of 10 or more. The agency still recommends consulting with the IRS or a.

You Can Reset Your Pin Online Or By Calling The Pin Reset Hotline At 866 962. I Need A 1099 G Form To Fill Out My Taxes Where Do I Find It. COLUMBUS Ohio As the Ohio Department of Job and Family Services begins issuing 1099-G tax forms to individuals who received unemployment benefits the previous year Director Matt Damschroder says the department is taking additional steps to ensure 1099s go only to legitimate claimants amid widespread identity theft experienced by unemployment.

The amount reported on the 1099-G also includes any portion of your refund that was. If you itemize deductions. See the Instructions for Forms 1099-MISC and 1099-NEC for more information.

There will be a number of Ohioans who receive a 1099-G tax form in the mail stating that they received unemployment benefits in 2020 when in fact they did not. Legitimate unemployment claimants who received benefits in 2021 need 1099-G forms so they can report this income when filing their annual taxes.

Income 1099 G And 1099 Int From The Department Of Taxation Department Of Taxation

Pdf Telecharger 1099 G Ohio Gratuit Pdf Pdfprof Com

Surprise Tax Forms Reveal Extend Of Unemployment Fraud Omaha Daily Record

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

0 Post a Comment: