This booklet provides important information about unemployment insurance benefits in Ohio including how to apply how eligibility is determined and what must be done to receive benefit payments. Employers and employees in every field are implementing new and innovative ways to operate under the threat of COVID-19.

Ohio Adds 20 100 Jobs In October As Unemployment Rate Dips To 5 1

Employers with questions can call 614 466-2319.

Ohio unemployment guide for employers. We first encourage employers to engage in dialogue with an employee who expresses reluctance to return to work about the measures that employers are taking to help employees feel safe. Jfsohiogov Quarterly Reporting Unemployment Insurance Tax 9 Methods of Filing IVR File No Employment reports only No workers no wages 1-866-44-UCTAX 1-866-448-2829 Ohio Business Gateway wwwohiobusinessgatewayohiogov Paper Filing Only an option until the effective date of the OAC rule mandating online filing. Employment Programs for Ohioans.

OLE gives Ohio employers the chance to observe the knowledge skills and work ethic of potential employees without paying wages or stipends and with no obligation to hire. Quarterly wage detail reports can be filed online at Ericohiogov. A guide that helps employers claimants and other interested persons understand the requirements of Ohios unemployment law.

Here we explain what public health orders mean for you the way you do your work and your future. In Ohio you generally are considered a liable employer under the Ohio unemployment compensation law if you meet either of the following requirements. Application employers must be registered with Ohios UI program have a UI account number and have access to the Ohio Job Insurance OJI benefit system at unemploymentohiogov.

Click here for step-by-step videos FAQs and more. Register with the Ohio Department of Job and Family Services. Ohio Unemployment Compensation Taxes Ohio employers payroll taxes called contributions which go into the Ohio Unemployment Compensation Trust Fund are used to pay benefits to unemployed workers.

Youll also find ways to weather the storm of unemployment and the business disruptions that coronavirus disease brings. Payments for the first quarter of 2020 will be due April 30. Employers that do not have access to OJI must first register for an account.

It also provides information about handling unemployment compensation matters including unemployment compensation claims which ultimately affect the amount. The Ohio Learn to Earn OLE program is a new statewide initiative developed by the Ohio Department of Job and Family Services. Everyone except workers that remain attached to an employers payroll have to.

Report COVID-19 Work Refusals. New employers generally have a rate of between 003 and 193 for SUTA with a wage base of 9000. View a complete listing of all employers who have given the agency permission to release their.

Jfsohiogov Quarterly Reporting Unemployment Insurance Tax 9 Methods of Filing IVR File No Employment reports only No workers no wages 1-866-44-UCTAX 1-866-448-2829 Ohio Business Gateway wwwohiobusinessgatewayohiogov Quarterly Reporting. Please call 614 466-4047 to obtain a registration code. Go to the Ohio Department of Job and Family Services website to register your.

In order to qualify for unemployment in Ohio you must have lost your job through no fault of your own. Federal and Ohio Minor Labor Laws. And student employees do not qualify for unemployment compen.

Report it by calling toll-free. This handbook was prepared to offer employers information about the Ohio unemployment system and how to control unemployment compensation expenses. Unemployment Withholding Prohibited.

Suspect Fraud or Ineligibility. Money to fund unemployment benefits comes from employer taxes which means employees dont pay any part of the costs to fund. 8 Classify generally industries businesses occupations and employments and employers individually as to the hazard of unemployment in each business industry occupation or employment and as to the particular hazard of each employer having special reference to the conditions of regularity and irregularity of the employment provided by.

Your Unemployment Tax Rate can also be found on the annual Tax Rate Notice in box 2. This Quick Tips and Step-by-Step Guide can help expedite the claims process for unemployed workers. Employees make no contribution themselves and this payroll tax cannot be withheld from an employees paycheck.

For paid work-based learning experiences employers are not required to pay unemployment. Click on the Select Employer button. This guide will help employers understand what to expect and what they may need to do when laid-off employees file for unemployment.

The Ohio Department of Job and Family Services administers unemployment insurance benefits for workers in the state who have become unemployed through no fault of their own. Who Qualifies for Unemployment in Ohio. ORC Section 414120 and Ohio Administrative Code OAC Rule 4141-9-07 require all employers subject to Ohio unemployment insurance laws to file quarterly reports detailing the wages paid to each employee.

Ohio Employers Guide to Electronic Wage Reporting A guide to help employers with electronic filing requirements including the specifications for creating a file in the ICESA format and the preapproval process for the submission of wage. Premiums for these students. A Guide to unemployment benefits in Ohio.

Select the employer record. Register with the Employment Security Commission. Report Suspected Fraud or Ineligibility.

Browse through the list of employers that you represent as TPA. Events in Your Area. File a claim for each week you collect unemployment Be actively looking for a new job each week that you.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. ODJFS is required by law to ensure that unemployment benefits are issued in accordance with established eligibility requirements. Please email all WARNs and related inquiries to rapdrespjfsohiogov.

Download the Workers Guide to Unemployment Compensation available in English Somali and Spanish. You have at least one employee in covered employment for some portion of a day in each of 20 different weeks within either the current or the preceding calendar year or. No matter if your company is large or small its important to understand exactly how the unemployment insurance system works and what happens when a former employee files for benefits.

Compensation sation at the conclusion of the work-based learning experience.

Details Of Ohio S Responsible Restartohio Plan

How Ohio Has Underfunded Unemployment Compensation

More Ohioans Learn Identities Were Stolen Used For Widespread Unemployment Fraud

Audit Ohio Unemployment System Paid More Than 3 8 Billion Because Of Fraud Errors During Coronavirus Crisis Cleveland Com

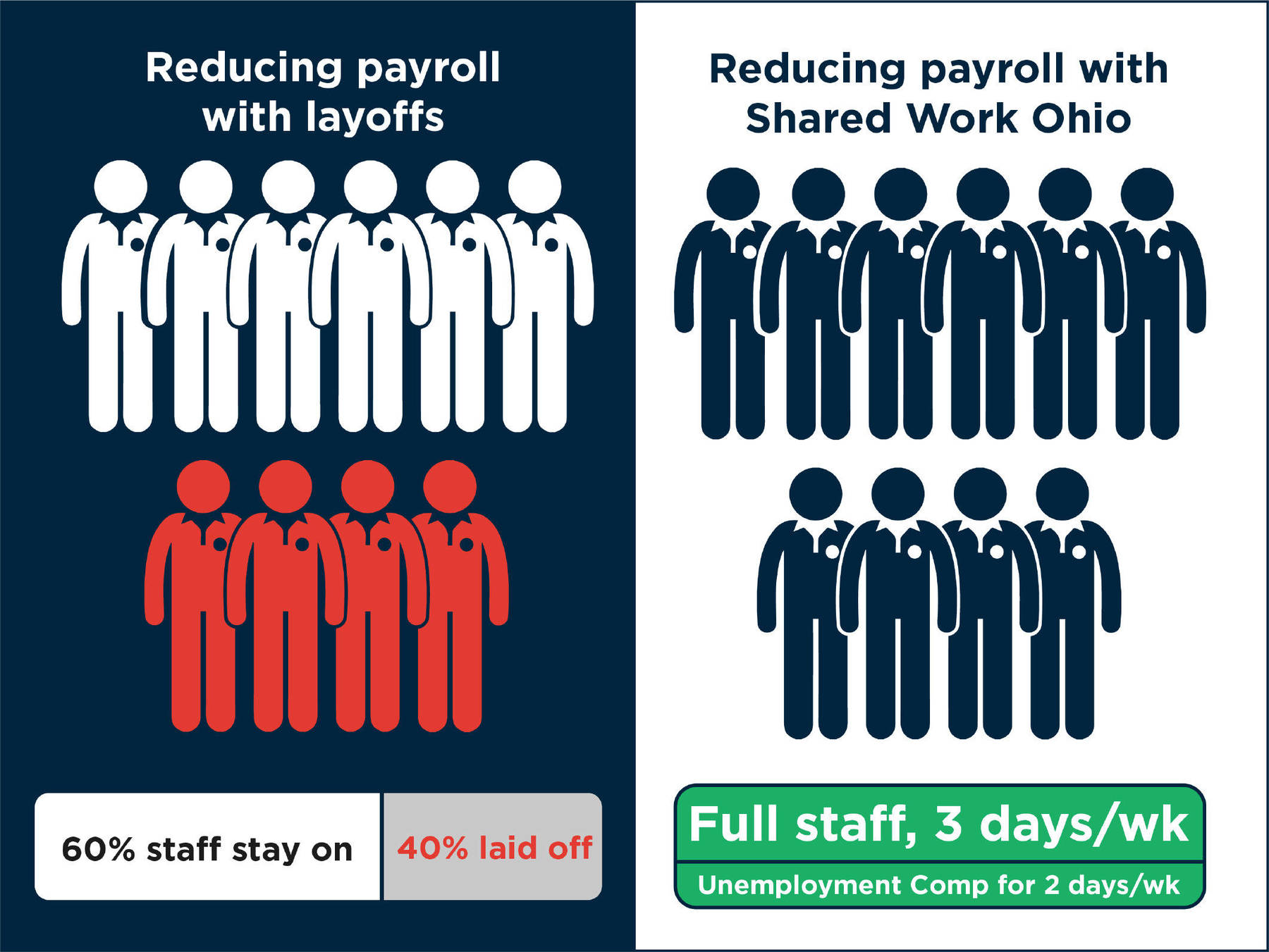

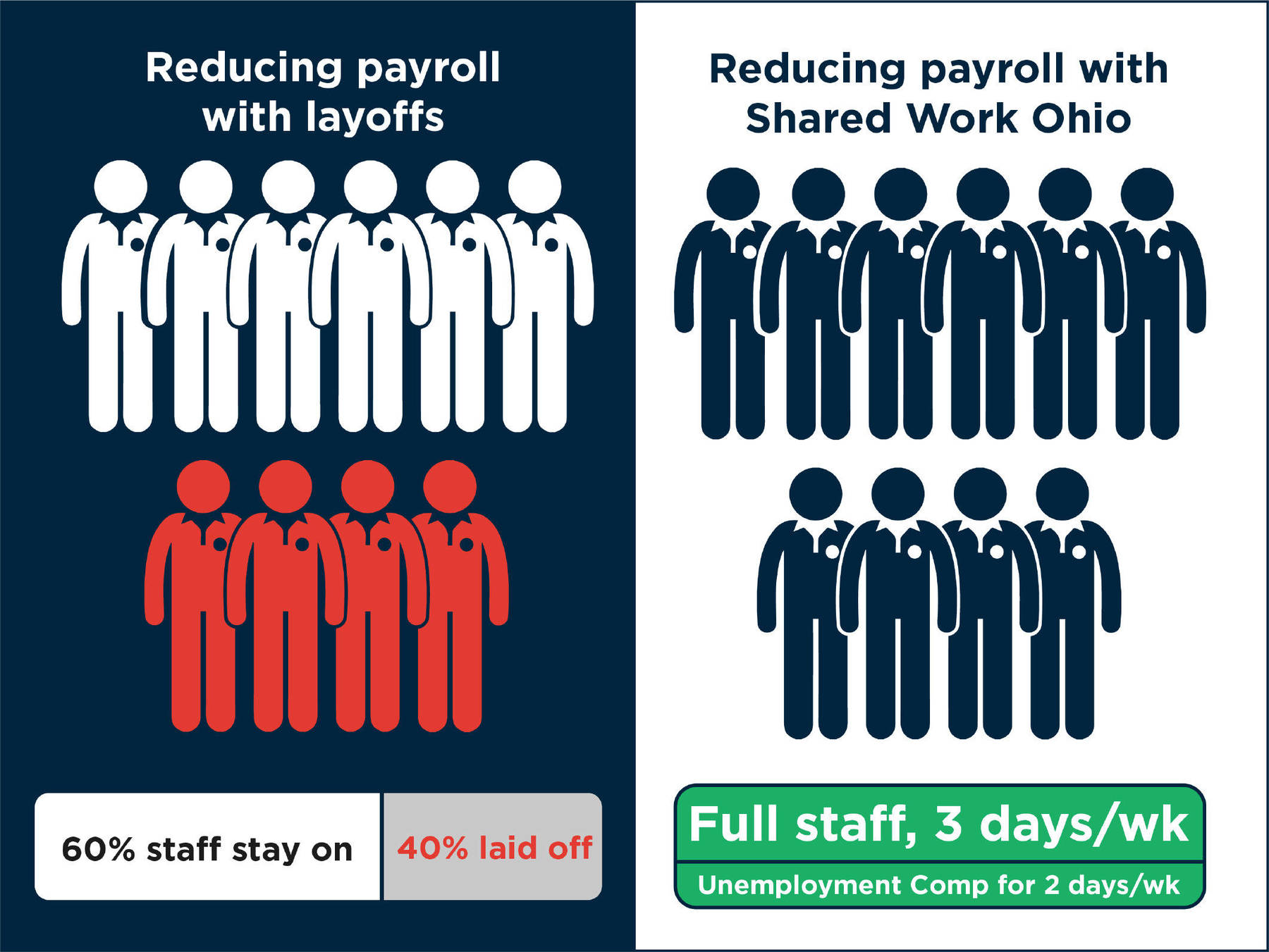

Avoid Layoffs With Shared Work Ohio

Coronavirus Covid 19 And Your Employment Everything You Need To Know

With Businesses Hiring Columbus Area Unemployment Rate Falls To 5 In March

0 Post a Comment: