However Unemployment compensation is taxed by New York State. The refunds are for people who collected unemployment last year and filed their 2020 returns before mid-March.

Unemployment Benefits Comparison By State Fileunemployment Org

TTYTDD users should call 800 662-1220.

Nys unemployment nj. This is also called certifying for benefits You can start certifying as soon as you receive a notification from the DOL. In New York State employers pay contributions that fund Unemployment Insurance. That means someone living out of state can claim UI benefits in New York.

Be sure to write your Social Security number on your request. About 500000 New Jerseyans are on the verge of losing unemployment benefits but Gov. Nys withholding are withheld on my 1099.

2022 State of the State. If You Already Filed a Claim. Last Friday state labor officials trumpeted they fixed the problem and that 75000 people would be paid.

Unfortunately like the situation in New York the New Jersey. Both New York and New Jersey still grapple with high unemployment which has led residents of both neighboring states to wonder if benefits will be extended. New Jersey NJ Unemployment Number.

Pregnancy and Health Issues While Unemployed. Unemployment compensation is not subject to New Jersey gross income tax and should not be included on the New Jersey gross income tax return. June 6 2019 117 PM.

No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ. Box 1195 Albany NY 12201. Once you have filed a claim for benefits you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements.

Report the same amount on your. To file a New York unemployment claim you will need. I am a resident of nj and file a nys203 nys non resident return.

Local Area Unemployment Statistics - New York City. 2022 State of the State agenda. Seasonal employees may face different rules for overtime and unemployment than regular year-round workers.

You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. To collect benefits you must be ready willing and able to work and actively looking for work during each week in which you are claiming benefits. See the resource page on this site for more information and reader comments.

Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Avg. Can I collect unemployment in NY and NJ. View the Current Schedule for Claiming Weekly Benefits.

Unemployment The State of New York. Phil Murphy has not yet determined whether to extend federal payments. Itll be easier to fill out your application that way.

Questions about your claim. Likewise temporary disability including family leave. You must continue to certify every week you are.

In her 2022 State of the State Address Governor Hochul announced a bold ambitious agenda focused on coming back from the COVID crisis and unlocking a whole New Era for New York. If they do it does not matter whether they reside in New York. Read our COVID-19related FAQs.

How to apply online for Unemployment Insurance benefits. So even if you live in New York if you work in New Jersey you should apply in New Jersey. Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county.

Your Rights. Full pay would be available to these employees if this bill is passed as written. Bonding and Caregiving While Unemployed.

NEW JERSEY WABC -- There are more problems plaguing the New Jersey unemployment system. If you are living andor willing to look for work in the state of New York you may also file your claim by calling the Telephone Claims Center at 1-888-209-8124 during regular business hours. Disaster Unemployment Assistance.

The Telephone Claims Center can be reached at 888 209-8124. For most year-round jobs part-time status is defined as less than 35 hours per. Here are the best contact numbers and tips to get in touch a live agent at the NJ Division of Unemployment Insurance Labor and Workforce Development LWD.

In general you should apply for unemployment in the same state in which you work. Seasonal employment in New Jersey is defined as work that is performed or 36 weeks or fewer per calendar year and is based on seasonal need or local draw. Bureau of Labor Statistics New York-New Jersey Information Office Suite 808 201 Varick Street New York NY 10014.

Otherwise you should contact the Out of State Residents Office. Are unemployement benifits i am a electrican employed in ny taxable in nys. That means that unemployment eligibility requirements are identical for out-of-state claimants and for New York residents.

The newest round of refunds has. New York State offers unemployment insurance benefits to qualified workers who have worked in the state during the prior 18 months and who meet certain criteria. They have information about unemployment benefits and more.

Status of the Civilian Labor Force - New York City Civilian Labor Force - Seasonally Adjusted. Get your information ready. You will use this pin when you call the New York unemployment number the Telephone Claims Center to claim your weekly benefits or to certify your benefits.

Mail your request to Unemployment Insurance Division NYS Department of Labor PO.

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Unemployment Tips Hotel Trades Council En

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

Nj Unemployment 75 000 Residents Still Owed Thousands In Benefits Abc7 New York

New Jersey New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New York Unemployment Benefits Eligibility Claims

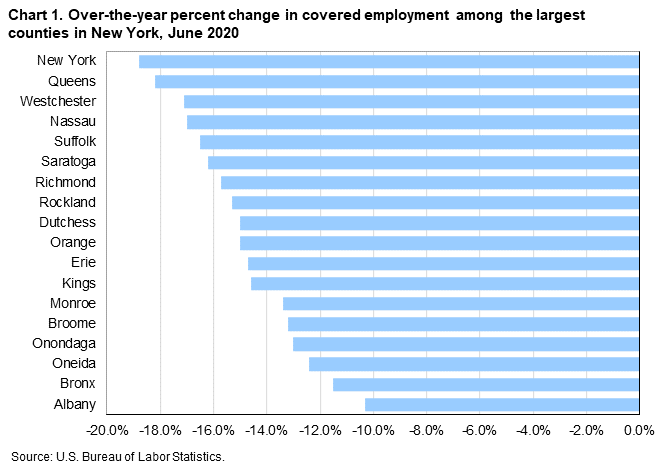

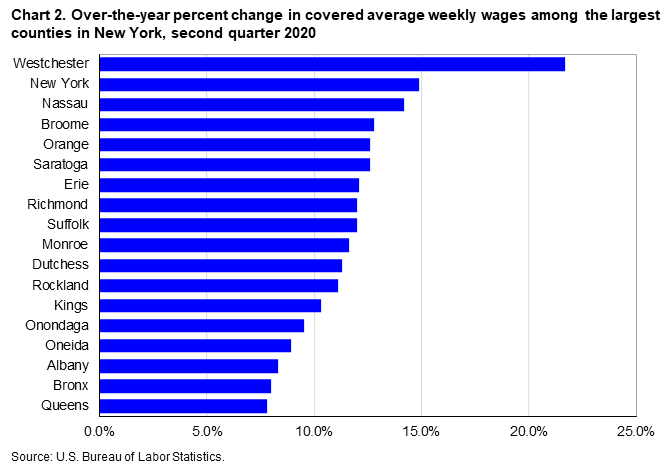

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

![]()

New York Unemployment Tips Hotel Trades Council En

Unemployment Rate In New York Newark Jersey City Ny Nj Pa Msa Newy636urn Fred St Louis Fed

Nj Unemployment 75 000 Residents To Start Receiving Thousands In Owed Benefits This Weekend Abc7 New York

New Jersey Ends Covid Unemployment Benefits The New York Times

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

0 Post a Comment: