Individuals affected by COVID-19 can apply for PUA benefits online through Unemployment Benefit Services 24 hours a day seven days a week or by calling a TWC Tele-Center any day between 7 am. Pandemic Unemployment Assistance PUA Benefits Extended Additional 300 The American Rescue Plan was passed in March 2021 that extends PUA benefits until September 4 2021 for eligible claimants.

How Does The Cares Act Affect Your Benefits

Most states will begin distributing benefits in the middle of the month.

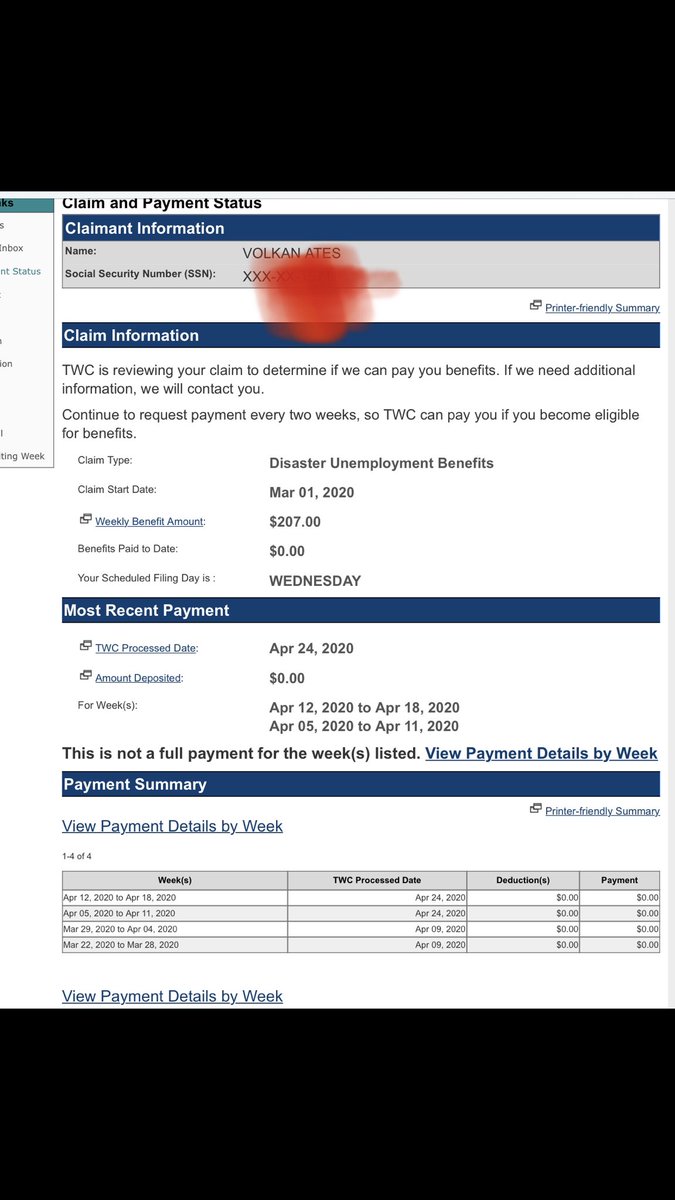

Pua unemployment benefits texas. The Texas Workforce Commission will continue to run this program and regular state unemployment benefits under the CARES Act until March 14 2021. If they backdated your claim you should receive. Unlike regular unemployment benefits the PUA program is temporary.

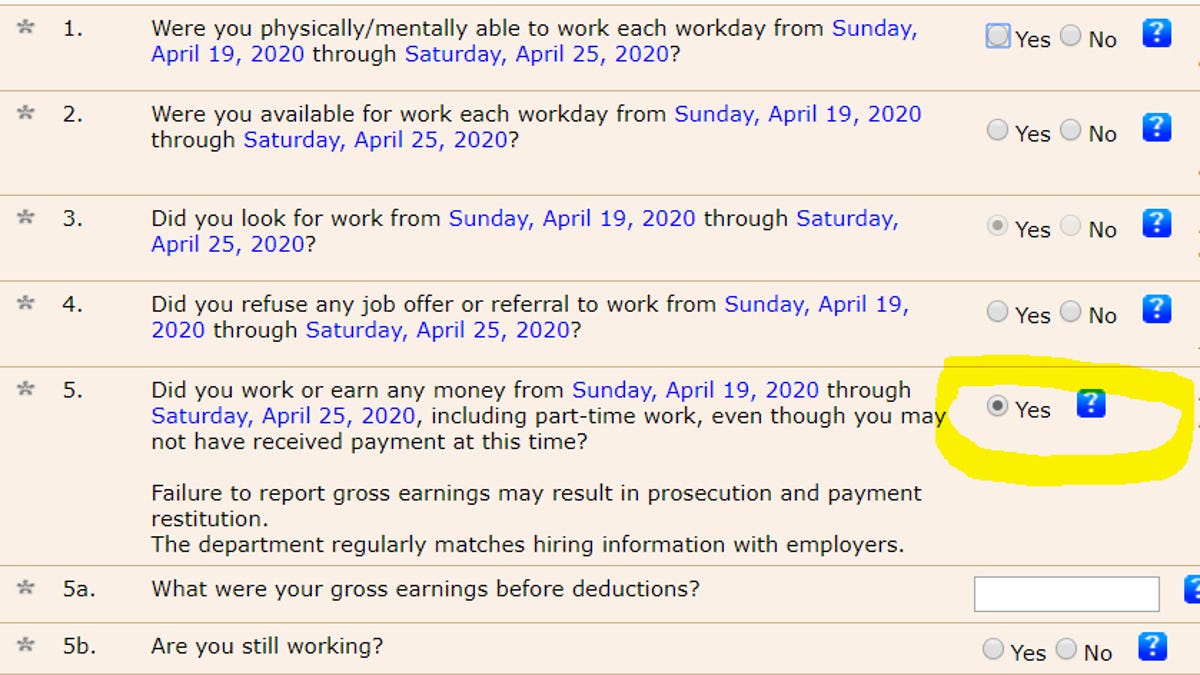

Go down the web and click on submit an application for employment benefits. The Pandemic Unemployment Assistance PUA program was put in place primarily for those out-of-work Americans who are not eligible for regular state unemployment benefits and are unemployed partially unemployed or unable or unavailable to work because of certain health or economic consequences of the COVID-19 pandemic. If you filed a PUA claim before January 31 2021 or received payment of PUA on or after December 27 2020 you must provide proof substantiating employment self-employment or the planned commencement of prospective employment or.

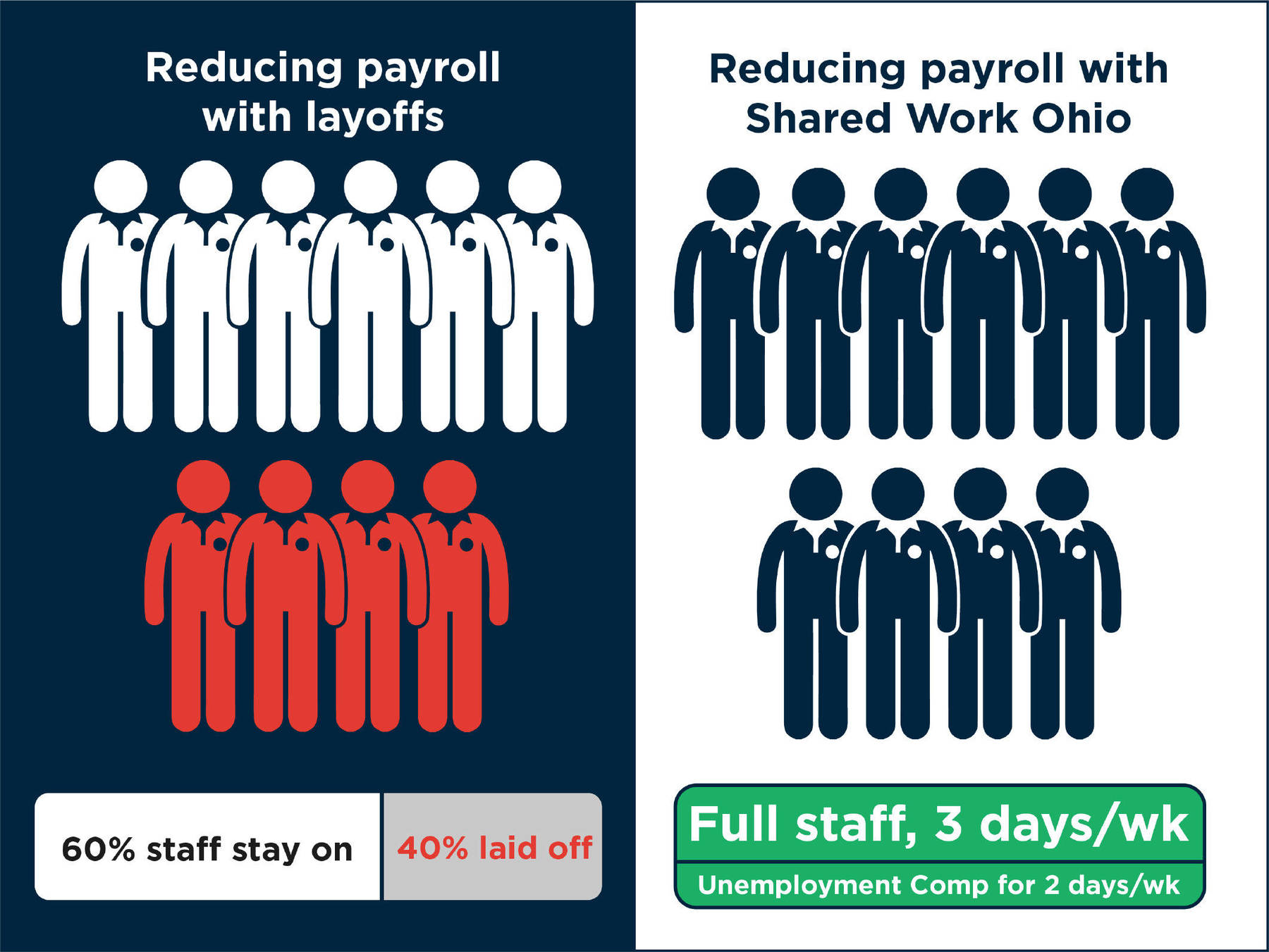

This brings the total number of weeks in the program to 79. It is part of the federal 22 trillion CARES Act which came into law late last week. Eligible workers still receiving benefits as of March 14 2021 would be able to keep receiving benefit.

The Pandemic Unemployment Assistance PUA program for those who traditionally did not qualify for regular state benefits such as self-employed and independent. To request information on how to repay the unemployment benefits you were not eligible to receive contact the Benefit Overpayment Collections Unit Monday through Friday 800 am. The Texas Workforce Commission TWC has advised that you do not need to submit a new claim.

This unemployment benefit is called Pandemic Unemployment Assistance PUA. PUA is based on previous income and now provides benefits for up to 50 weeks. At 800-939-6631When applying individuals affected by the pandemic should indicate that as the reason they lost their job.

No longer should employees have to be disrespected for a living. 4 things to consider to see if you are eligible for a refund under the 10200 exemption on unemployment tax payments. From the main site there is a quick link to the unemployment benefits service in Texas.

Most people can apply for benefits and manage their unemployment. There is a lot of information on this page that you will be able to read including what you will need to apply for benefits and how to view correspondence from TWC. First in order to receive a refund from the Internal Revenue Service IRS under the tax exemption the person must have declared the.

In the past 18 months you must call the Texas Workforce Commission TWC Tele-Center at 800-939-6631instead. Benefit Overpayment Collections Unit. You are responsible for regularly checking.

New York California Arizona Tennessee and North Carolina are the states that as of. Even the likes of Walmart have raised their average wage to 1500 an hour. Congress and President Biden have now passed into law the 2 trillion stimulus package also known as the American Rescue Plan ARPIt includes further unemployment program extensions until September 6th 2021 for the PUA PEUC and FPUC programs originally funded under the CARES act in 2020 and then.

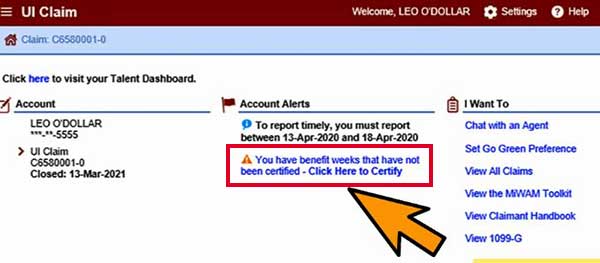

If you have an unemployment benefits claim you can sign up for Electronic Correspondence for online access to your unemployment benefits correspondence. Pandemic Unemployment Assistance PUA PUA provides up to 79 weeks of benefits to qualifying individuals who are otherwise able to work and available for work within the meaning of applicable state law except that they are unemployed partially unemployed or unable or unavailable to work due to COVID-19 related reasons as defined in the CARES Act. However if you worked in Massachusetts Wisconsin or Puerto Rico.

PUA differs from Texas regular unemployment benefits in several ways. Httpswwwtwctexasgovpandemic-unemployment-assistance Claimants receiving PUA are required to provide proof of employment. Electronic Correspondence allows you to receive most but not all of your unemployment notices and forms electronically in a secure online mailbox.

We recommend all parents enroll their kids in RemoteLearningschools online Homeschool or Afterschool program to prevent them from falling behind in their education due to the recent COVID developments and school staff shortages. I stopped receiving benefits since April. You should not work full time and be in poverty.

After applying for Unemployment benefits in Texas and if found eligible would I receive the PUA benefits for the past weeks since they issued the pandemic benefits. Unemployment Benefits Services allows individuals to submit new applications for unemployment benefits submit payment requests get claim and payment status information change their benefit payment option update their address or phone number view IRS 1099-G information and respond to work search log requests. The PUA program only provides benefits for the weeks beginning on or after January 27.

And I just got a notice of PUA-NOTICE TO PROVIDE PROOF OF EMPLOYMENT and it states If you do not send us proof of employment within the deadline you will be found ineligible for benefits beginning December 27 2020 and you will have to repay any benefits you received. Claims online through Unemployment Benefits Services. Biden Stimulus Package Unemployment Extensions.

This act not only extends the eligibility to more people but also adds up to 600 in weekly benefits for 13 weeks to those who lost work due to the coronavirus. At least 11 states are beginning this week to pay the extra 300 in weekly unemployment benefits under the 900 billion stimulus agreement signed at the end of 2020. Even Chipotle is raising their wage to an average of 1500 an hour.

The final benefit week that the Texas Workforce Commission TWC paid federal pandemic unemployment benefits under the American Rescue Plan was the benefit week ending June 26 2021. Pandemic Unemployment Assistance PUA The PUA program designed for freelancers gig workers and independent contractors or those that generally dont qualify for regular state unemployment has been extended by another until September 6th 2021 week ending Sep 4th in Texas. They asking for 2019 employment and i never worked until.

Follow Us

Were this world an endless plain, and by sailing eastward we could for ever reach new distances