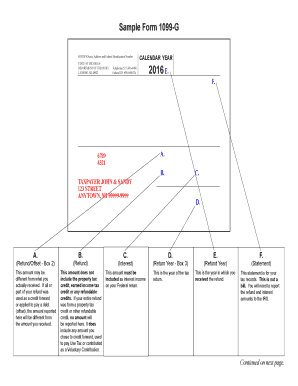

Most state copies of income statements are due to Treasury on or before January 31. The statements are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld the past year.

1099 G Form Michigan Fill Online Printable Fillable Blank Pdffiller

As tax season approaches the Michigan Unemployment Insurance Agency UIA offers those who have received jobless benefits this year two ways to receive a copy of their 1099-G tax form.

Michigan unemployment 1099-g online. State of Michigan Department of Treasury Lansing MI 48922 Federal ID. Click on View and request 1099-G on the left navigation bar. Self-employed workers gig workers 1099-independent contractors and low-wage workers can apply for federal benefits beginning Monday April 13 at 8AM online at MichigangovUIA.

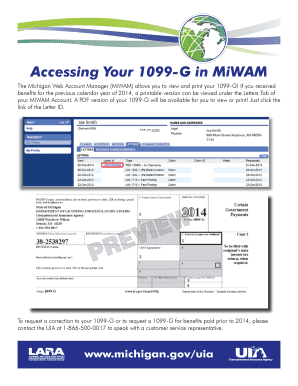

You can choose to receive your 1099-G through MiWAM or US. 1 Log into MiWAM. These are the equivalent of the W-2 that employers send every.

Click on View 1099-G and print the page. Click on the 1099-G letter for the 2021 tax year. Hello Tony Michigan does not make this information available over the internet.

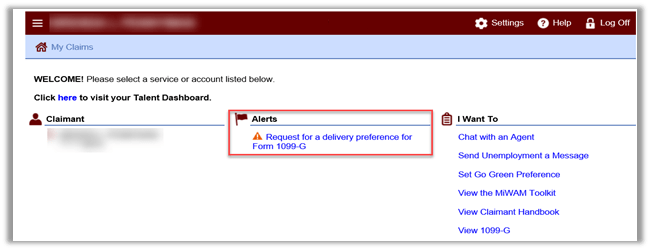

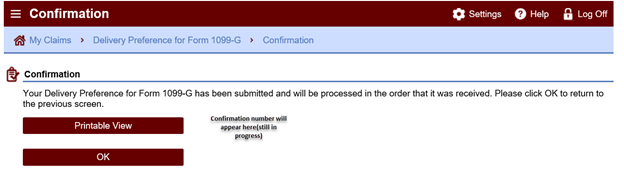

Click on the 1099-G link. How do I get my 1099g online in Michigan. 2 Under Account Alerts click Please select a delivery preference for your 1099 Form.

You will receive an email acknowledging your delivery preference. Through the 1099G page you can view and print tax information on unadjusted benefits Form 1099G for up to five years and can also request. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

To receive your 1099-G electronically you must request your delivery preference by January 9 2021. Form 1099-MISC is the exception. If you received unemployment benefits in 2021 you will receive Form 1099-G Certain Government Payments as proof of income.

To reprint your 1099-G look under the I Want To heading in MiWAM and click on the blue 1099-G link. Deadline to Choose Online Option is Jan. Click the Unemployment Services button on the My Online Services page.

You would need to call or write them to obtain another copy of the 1099-G form. How to requestRequest your unemployment benefits 1099-G. The Michigan Unemployment Insurance Agency is offering both electronic and mail options.

If you do not select electronic you will automatically receive a paper copy by mail. WXYZ Recipients of unemployment benefits can now choose an online option to receive the 1099-G tax form. Heres how to access it online.

4 - Review and Submit. 3 Under Delivery Preference for Form 1099-G. 2 Under Account Alerts click Please select a delivery preference for your 1099 Form.

CBS Detroit Michiganders who received unemployment benefits this year have until Jan. Contact the DUA Interactive Voice Response IVR at. Paper filed due February 28 electronically filed due March 31.

What is the State of Michigan federal identification number used on the Substitute Form 1099-G. 1 Log into MiWAM. To receive your 1099-G online.

You can choose to receive your 1099-G electronically through MiWAM or by US. Log in to your UI Online account. From the UI Online home page select the 1099G link to access the 1099G page.

You can view 1099-G forms for the past 6 years. If the only thing that was reported to you on the 1099-G form was the Michigan state refund that you received last year you could find this amount by looking at your 2008 Michigan state tax return to see what. When are state copies of income statements due.

Workers need to use the UIAs daily filing schedule based on their last names which can be found below. Electronically or by mail. 1 the state of Michigans Unemployment Insurance Agency UIA will make year-end 1099-G statements available online.

To receive your 1099-G online. Your email address will be displayed. Go to the I Want To heading in MiWAM.

Your email address will be displayed. Then click on the 1099-G letter for the involved tax year. 1 Log into MiWAM.

If you do not select electronic you will automatically receive a paper copy by mail. 3 Under Delivery Preference for Form 1099-G click Electronic. To access your Form 1099-G log into your account at labornygovsignin.

To receive your 1099-G online. Online is the fastest and easiest way to access these benefits. Michiganders Receiving Unemployment Benefits Can Choose Online Option To Receive 1099-G Tax Form.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. 3 Under Delivery Preference for Form 1099-G click Electronic. The Payers name address and federal identification number are.

You can choose to receive your 1099-G electronically through MiWAM or by US. 2 2022 to request an electronic copy of their 1099-G tax form according to the Michigan Unemployment Insurance Agency UIA. Treasury has the authority to require 1099-NEC state copy filing per Internal Revenue Code IRC Chapter 61.

Your statement will be available to view or download by mid-January. Self-employed workers gig workers 1099-independent contractors and low-wage workers can apply for federal benefits beginning Monday April 13 at 8AM online at MichigangovUIA. Online is the.

Applicants have until January 2 2022 to request an electronic version of their 1099-G through. Each individual statement will be available to view or. You will receive an email acknowledging your delivery preference.

Your statement will be available to view or download by mid-January. Click on the down arrow to select the right year. 4 â Review and Submit.

If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. Claimants have until January 2 2022 to request an electronic version of their 1099-G through the Michigan Web Account Manager MiWAM. Through UI Online you can access tax information for benefits you have already received from EDD in most cases without having to speak to a representative.

2 Under Account Alerts click Please select a delivery preference for your 1099 Form. To receive your 1099-G electronically you must request your delivery preference by January 9 2021.

Labor And Economic Opportunity How To Request Your 1099 G

Michigan Pua And Unemployment Help And Updates Posts Facebook

Unemployment Insurance Payments Are Taxable And 1099 Gs From The Feds Are In The Mail Mlive Com

Labor And Economic Opportunity How To Request Your 1099 G

1099 Form Fileunemployment Org

1099 G Michigan Fill Online Printable Fillable Blank Pdffiller

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Michigan State Identification Number 1099 G Fill Online Printable Fillable Blank Pdffiller

Labor And Economic Opportunity How To Request Your 1099 G

Michiganders Receiving Unemployment Benefits Can Choose Online Option To Receive 1099 G Tax Form Cbs Detroit

I Am Filling Out The Information For My 1099 G Form Is Payer Name My Name Is The Address My Current Address Or The Address When I Collected Unemployment

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/d1vhqlrjc8h82r.cloudfront.net/02-01-2021/t_097c9f3558714f239e0634ba3af11887_name_image.jpg)

0 Post a Comment: