You can also certify for weekly benefits with our automated phone system by calling 833-324-0366 for PUA or 888-581-5812 for UI. Get and Sign New York 1099 Unemployment Get Form.

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

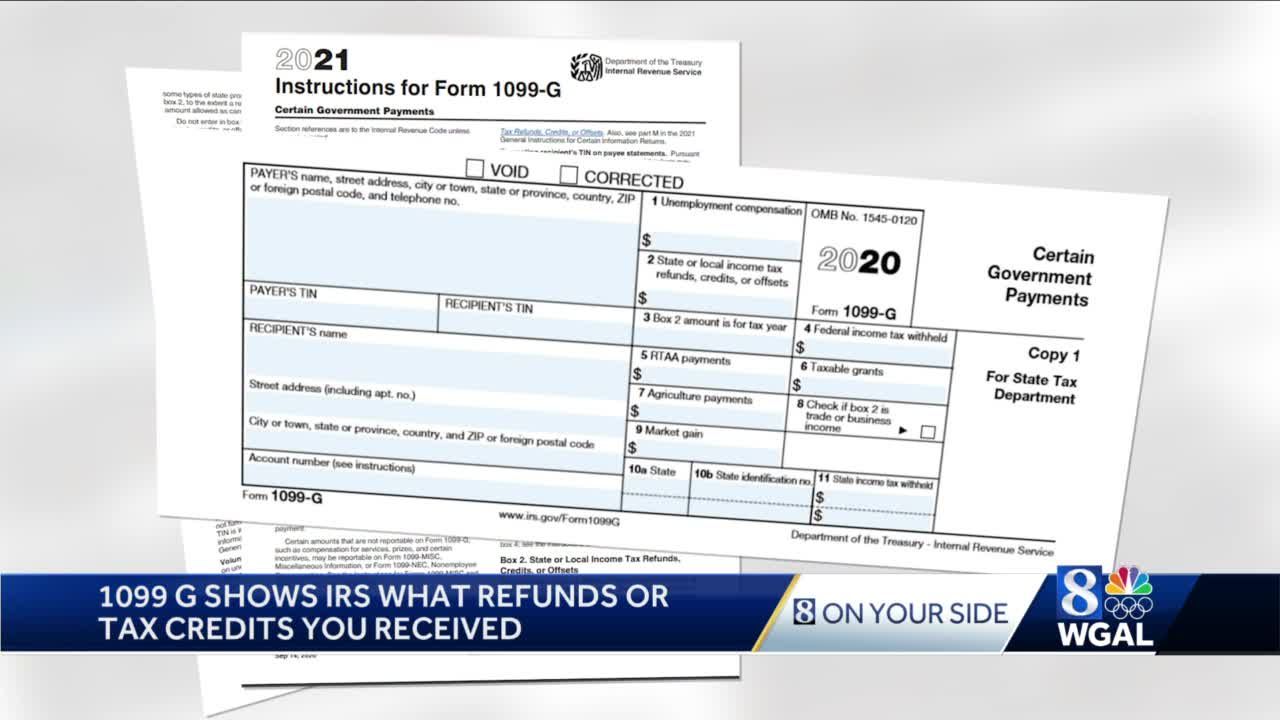

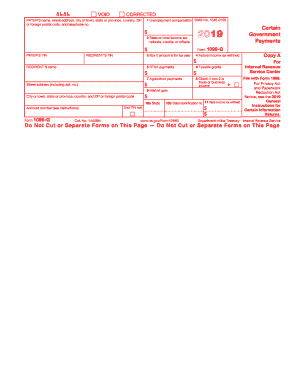

Form 1099 G Certain Government Payments Definition

If you opted into electronic delivery.

Nys unemployment 1099 login. To access your Form 1099-G log into your account at labornygovsignin. Unemployment compensation program or to a governmental paid family leave program and received a payment from that program the payer must issue a separate Form 1099-G to report this amount to you. From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button.

Logging into your account at selecting 1099G at the top of the menu bar View next to the desired year Print or. See the 1099-G web page for more information. The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your. For more information visit dolnygovfedexp. The first thing you need to do when creating a New York Unemployment account is to visit the NYgov ID Login page at httpsunemploymentlabornygov.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. Save or instantly send your ready documents. If you have an online account setup with the NYS Department of Labor you can print the 1099-G form from your online account.

Next you will be taken to a page like the one below. Visit us to learn about your tax responsibilities check your refund status and use our online servicesanywhere any time. It may take 10 business days to receive a copy of your Form 1099-G.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. You can choose to receive your 1099-G electronically through MiWAM or by US.

The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. The following security code is necessary to prevent unauthorized use of this web site. View Your 1099-G Information.

Click the Unemployment Services button on the My Online Services page. Pandemic Unemployment Assistance PUA was a federal program included in the Coronavirus Aid Relief and Economic Security CARES Act. Step 1 Visit the NYgov ID Login Page.

The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year. How to Get 1099G Online - Department of Labor. Enter the security code displayed below and then select Continue.

Add or Edit a 1099-G. In the Unemployment Insurance box on the bottom right section of the next screen select File a. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites.

Click the Unemployment Services button on the My Online Services page. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. Once there click on the LOGIN link. Click the Unemployment Services button on the My Online Services page.

State Department of Labor-Unemployment Insurance Albany NY 12240-0001 Box b Payers federal identification number 2 7 0 2 9 3 1 1 7 State New York State tax withheld N Y Box 1 Unemployment compensation Instructions General instructions Specific instructions Who must file this form If you are. As of September 5 2021 several federal unemployment benefit programs including PUA PEUC EB and FPUC have expired per federal law. To access your Form 1099-G online log into your account at and select 1099G at the top of the menu bar on the home page.

If you get a file titled null after you click the 1099-G button click on that file. After you select your language follow the prompts to obtain your 1099 form. If you prefer to have your Form 1099-G mailed you may request for a copy to be mailed by.

To access your Form 1099-G log into your account at labornygovsignin. 1099-G Tax Form. Welcome to the official website of the NYS Department of Taxation and Finance.

If the New York State Department of Labor directed you to file your claim again or you are filing a claim for the Shared Work program please visit Online Services for Individuals enter your NYgov Username and Password and choose Sign In. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labor website log in to your NYGov ID account and select Unemployment Services and ViewPrint 1099-G. To access your Form 1099-G log into your account at labornygovsignin.

To access your Form 1099-G log into your account at labornygovsignin. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. You will need the PIN you established when you filed your claim.

New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. Complete Ny Unemployment 1099 G Online 2020-2022 online with US Legal Forms. The exclusion will be applied automatically based on the entries in the program.

Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. Form 1099-G Box 1 Unemployment Compensation. Easily fill out PDF blank edit and sign them.

If you itemize deductions you may deduct your contributions on Schedule A Form 1040 as taxes paid. Income Select My Forms. Learn how to clear your browser cache if you experience issues logging in with your NYgov username and password.

If you are using a screen reading program select listen to have the number announced. Call the Telephone Claims Center at 888-209-8124. A New York State Form 1099-G statement issued by the Tax Department does not include unemployment compensation.

Click the Unemployment Services button on the My Online Services page. Click here to be taken there. Beginning October 20 2021 through.

If you received a Form 1099-G for unemployment compensation that you received during the year you can enter this in your account go to. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

Why Middle Income New Yorkers Are Turning Down Affordable Housing 6sqft Affordable Housing Income Affordable

1099 G Unemployment Compensation 1099g

Checklist Of Info And Documents Needed For Taxes Click For Full Pdf Tax Preparation Turbotax Checklist

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Printing Software Writing Software Payroll Checks

1099 G Tax Form Department Of Labor

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

Did You Receive A 1099 G Tax Form Here S Why It S Important

1099 G Tax Information Ri Department Of Labor Training

Form 1099 Nec For Nonemployee Compensation H R Block

0 Post a Comment: