Claimants of all unemployment programs offered during 2021 will receive a 1099 tax form detailing their benefit payments. To request a copy of your 1099-G by mail or fax.

1099 G Tax Form Why It S Important

Pennsylvania Income Tax Rate.

Pa unemployment tax form. This percentage is applied to taxable wages paid to determine the amount of employer contributions due. The Pennsylvania Department of Labor Industry Secretary Jennifer Berrier sent out a reminder on January 14th for all Pennsylvania residents who claimed unemployment benefits in 2021 to monitor. Information MUST be.

The withholding rate for 2022 remains at 307. Ofice of Unemployment Compensation Tax Services Labor Industry Building. Electronic filing of quarterly tax and wage data Form UC-22A and corresponding payment.

2020 Individual Income Tax Information for Unemployment Insurance Recipients. Tax Forms and Information. Claimants of all unemployment programs offered during 2021 will receive a 1099 tax form detailing their benefit payments.

HARRISBURG PA Department of Labor Industry LI Acting Secretary Jennifer Berrier is reminding individuals who claimed unemployment benefits during 2020 to watch their mailboxes and unemployment system notifications for the 1099 form that is required to file their 2020 taxes. Total taxable unemployment compensation includes the new federal. Form 1099G reports the total taxable income we issue you in a calendar year and is reported to the IRS.

LST-710501 and PA UC. This form will soon be viewable on the online system where claimants file their weekly claims. This tax form provides the total amount of money you were paid in benefits from the Office of Unemployment.

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. My spouses W-2 form has the following abbreviations in Box 14. Your local office will be able to send a replacement copy in the mail then you will be able to file a complete and accurate tax return.

Typewritten or printed in BLACK ink. 31 there is a chance your copy was lost in transit. If you havent received your 1099-G copy in the mail by Jan.

Claimants of all unemployment programs offered during 2020 receive a 1099 tax form detailing their benefit payments. Do not use dashes or slashes in place of zeros or blanks. What Is The Irs Form 1099.

As taxable income these payments must be reported on your state and federal tax return. Wages subject to unemployment contributions for employees are unlimited. If you wish to save the blank form to your hard drive and open it at a later time you should use the Save a Copy button within the Adobe application instead of the Save button on your Internet browser.

Through the State Unemployment Tax Act SUTA states levy a payroll tax on employers to fund the majority of their unemployment benefit programs. How does an employer register for a UC tax account. When choosing the tax category in TurboTax would LST be Other mandatory state or local tax not on above list and would.

Open the PDF form in Acrobat Reader. Your Unemployment Tax Rate can be found with the Unemployment account number on the Forms listed above Top right of Form UC-657. ONLINE REPORTING--Manually input tax and wage data in UCMS at wwwuctaxpagov.

1099-G Tax Form Information you need for income tax filing T he Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be mailed by January 31 st of each year for Pennsylvanians who received unemployment benefits. For claimants who want a hard copy physical 1099 tax forms will be mailed no later than January 31. LST and PA UC on W-2.

For claimants who want a hard copy physical 1099 tax forms will be mailed no later than January 31 2022. Pennsylvania Department of Revenue Im looking for. Claimants who have requested the 1099 tax form to be mailed should receive it no later than Jan.

This form will be available online and viewable in the same system where claimants file their weekly claims. Employer identification number EIN Name not your trade name Trade name if any Address. Employers Annual Federal Unemployment FUTA Tax Return Department of the Treasury Internal Revenue Service.

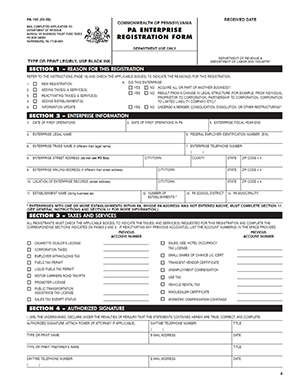

A single form the Pennsylvania Enterprise Registration Form or PA-100 is used to register for most of. There are several options that employers can use to electronically file their state Unemployment Compensation UC wage and tax data. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

This form will be available online and viewable in the same system where claimants file their weekly claims. This form is machine-readable. Wages subject to unemployment contributions for employers remains at 10000.

Form 940 for 2021. Begin Main Content Area. Through research I found that LST stands for Local Services Tax and PA UC stands for PA Unemployment Compensation.

Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. The employee rate for 2022 remains at 006. To report unemployment compensation fraud complete the online fraud form located at wwwucpagov or call the toll-free Pennsylvania UC Fraud Hotline at 800-692-7496.

The Pennsylvania Department of Labor and Industry is reminding taxpayers that the following 1099G forms are being mailed to claimants of the below programs. Notifying Employers of Their UC Tax Rates. Once the form is open click on the desired entry field and a blinking cursor appears.

Existing employers can find the Unemployment Account Number on the Contribution Rate Notice Form UC-657 or Notice of PA UC Responsibilities UC-851 or Report for Unemployment Contribution Form UC-2. FREE Paycheck and Tax Calculators. How Do I Get My Unemployment Tax Form.

Federal income tax withheld from unemployment benefits if any. Electronic Payment Requirement Waiver Request for Pennsylvania This form must be submitted if you are currently unable to comply with the electronic payment requirement and are requesting a temporary waiver allowing you to submit your Unemployment Compensation tax payment via check or money order. Box 68568 Harrisburg PA 17106-8568.

PA Form UC-2 Employers Report for Unemployment Compensation. Although unemployment compensation is not taxable for Pennsylvania personal income tax purposes this form will be an important part of preparing your tax returns.

Pa 100 Filing Service Harbor Compliance

Pennsylvania Unemployment Insurance Paui Setup Cwu

Calculateur Des Frais De Scolarite Fondation Bouebdelli Tunis Accounting Services Accounting Social Media Marketing Planner

Federal Unemployment Benefits End Here Are The Pandemic Assistance Programs That Can Still Help

Pennsylvania Weekly Payroll Certification For Public Works Projects Payroll Payroll Template Legal Forms

Zip Code 19342 Profile Map And Demographics Updated March 2020 Coding Demographics Map

Carrera De Contaduria Publica Tax Services Tax Return Tax

Pennsylvania The Keystone State

0 Post a Comment: