The notification shall include at minimum the following information. Based on recent conversations with clients we are reminding employers that Act 9 also contains a new employer mandate which will continue after the pandemic ends.

Cease And Desist Letter Template Florida Free Uk Trademark Templates With Regard To Cease And Desist Letter Templat Letter Templates Lettering Cease And Desist

An additional 60 days to repay the benefits may be requested by the employer.

Pa unemployment act 9 of 2020. Act 9 of 2020 enacted March 27 2020 added Section 2061 to the Pennsylvania Unemployment Compensation Act. Act 9 of 2020 enacted March 27 2020 added Section 2061 to the Pennsylvania Unemployment Compensation Act which now requires all employers to notify all separating employees of certain information regardless of whether the employee was terminated furloughed or discontinued employment voluntarily. Posted on April 13 2020.

First the Act requires employers to present a notice of unemployment rights to all separated employees. Act 9 of 2020 signed into law by Governor Wolf on March 27 2020 added a section to Pennsylvanias Unemployment Compensation Law which requires all employers to notify a separating employee of the availability of unemployment compensation at the time of separation from employment. This law amends Pennsylvanias unemployment compensation law in several ways.

HomeStatutes of PennsylvaniaUnconsolidated StatutesLaw Information2020 Act 9. Act 9 states if the fee has not been paid a reimbursable employer is not eligible for full reimbursement of COVID -19 related claims but only 50. Contributory employers are treated differently receiving full.

Interested in visiting the State Capitol. Act 9 brings changes to PA employer obligations for unemployment compensation May 15 2020 On March 27 2020 Governor Wolf signed Act 9 of 2020 into law which requires employers to provide employees with information upon separation of employment or upon reduction in work hours. Pennsylvania General Assembly.

Act 9 of 2020 provided for the following temporary amendments. While Act 9 of 2020 was created in response to the impact of the COVID-19 pandemic employers should be aware that this notice. They must provide notice to employees about unemployment compensation benefits at the time of reduced work hours or separation from employment.

Act 9 of 2020 approved by Governor Wolf on March 27 2020 adds a new section to the Pennsylvania Unemployment Compensation Law which requires employers to notify a separating employee of the availability of unemployment compensation at the time of separation from employment. The new law Act 9 of 2020 is one of the many statewide efforts to assist the thousands of Pennsylvanians losing their jobs due to the COVID-19 pandemic. By now most employers are aware of Pennsylvania Act 9s temporary COVID-19 related changes to the states unemployment compensation law.

Act 9 of 2020 provides 120 days for reimbursing employers that did not pay the solvency fee to repay COVID-19-related UI benefits to the Department. Separately Pennsylvanias Act 9 also may also be helpful to certain reimbursable employers. The federal CARES Act and Pennsylvanias Act 9 of 2020 provide the opportunity for those municipal employers of reimbursable status with the Department of Labor and Industry to receive reimbursement for unemployment compensation claims related to COVID-19.

It will now require all employers to notify all separating employees of certain information regardless of whether the employee was terminated furloughed or discontinued employment voluntarily. The Act found here amends Pennsylvania. Wolf on March 27th provides that an employer who has elected to pay the solvency fee under section 213 shall receive.

The PA Department of Labor has released a form to assist employers. HomeStatutes of PennsylvaniaUnconsolidated StatutesLaw Information2020 Act 9. Pennsylvania law Act 9 of 2020 signed by Governor Wolf on March 27 2020 emposes employer health insurance mandates on Pennsylvania employers.

In connection with the continuing challenges arising from COVID-19 Pennsylvania Governor Tom Wolf recently signed into law amendments to Pennsylvanias Unemployment Compensation Law which are included in Act 9 of 2020 the Act. Trigger Rate Redeterminations 7818 75 Section 3019. A new Pennsylvania law Act 9 of 2020 signed by Governor Wolf on March 27 2020 requires Pennsylvania employers to provide notice to employees about unemployment compensation benefits at the time of separation from employment or when an employees work hours are reduced.

43 Session of 2020 No. Pennsylvanias Act 9 connects payment of the 2020 solvency fee and COVID-19 related unemployment claims. On March 27 2020 Governor Wolf signed Act 9 of 2020 into law.

Service and Infrastructure Improvement Fund 7819 77. Pennsylvania General Assembly. Amending the act of December 5 1936 2nd SpSess 1937 PL2897 No1 entitled An act establishing a system of unemployment compensation to be administered by the Department of Labor and Industry and its existing and newly created agencies with personnel with certain exceptions selected on a civil service.

Pennsylvania Enacts New Amendments To Unemployment Compensation Law. Additional Contribution for Interest and Debt Service 7816 71 Section 3017. 2020-9 HB 68 AN ACT Amending the act of December 5 1936 2nd SpSess 1937 PL2897 No1 entitled An act establishing a system of unemployment compensation to be administered by the Department of Labor and Industry and its existing and newly created agencies with.

Generally if not precluded by federal law reimbursable employers who were approved to participate in the relief from charges option for the calendar year 2020 were entitled to automatic relief if a claimants unemployment was due to the COVID-19 outbreak. PENNSYLVANIA UNEMPLOYMENT COMPENSATION LAW iii UC Law Section Purdons Citation 43 PS Page No. The Act imposes new notice obligations on employers and includes emergency provisions that relax eligibility and.

Trigger Determinations 7817 72 Section 3018. Section 1603d1 of Act 9 of 2020 which was signed by Gov. A A A Print.

Burlington Vermont Waterfront Panoramic Vermont Photographers Burlington Vermont Skyline Vermont

Unemployment Benefits Extension 2022 Will Your State Send You Checks In 2022 Marca

Good News Extended Unemployment And More In Stimulus Bill

Infographic How College Grads Flub Interviews Fail On The Job Recentgrad Professionalism In The Workplace Workplace Business Etiquette

Ivan Mahardika Consultant The World Bank Linkedin

Letters Of Intent Benefit Physicians And Employers Letter Of Intent Intentions Printable Letter Templates

What To Know About Unemployment Benefits In The New Relief Package

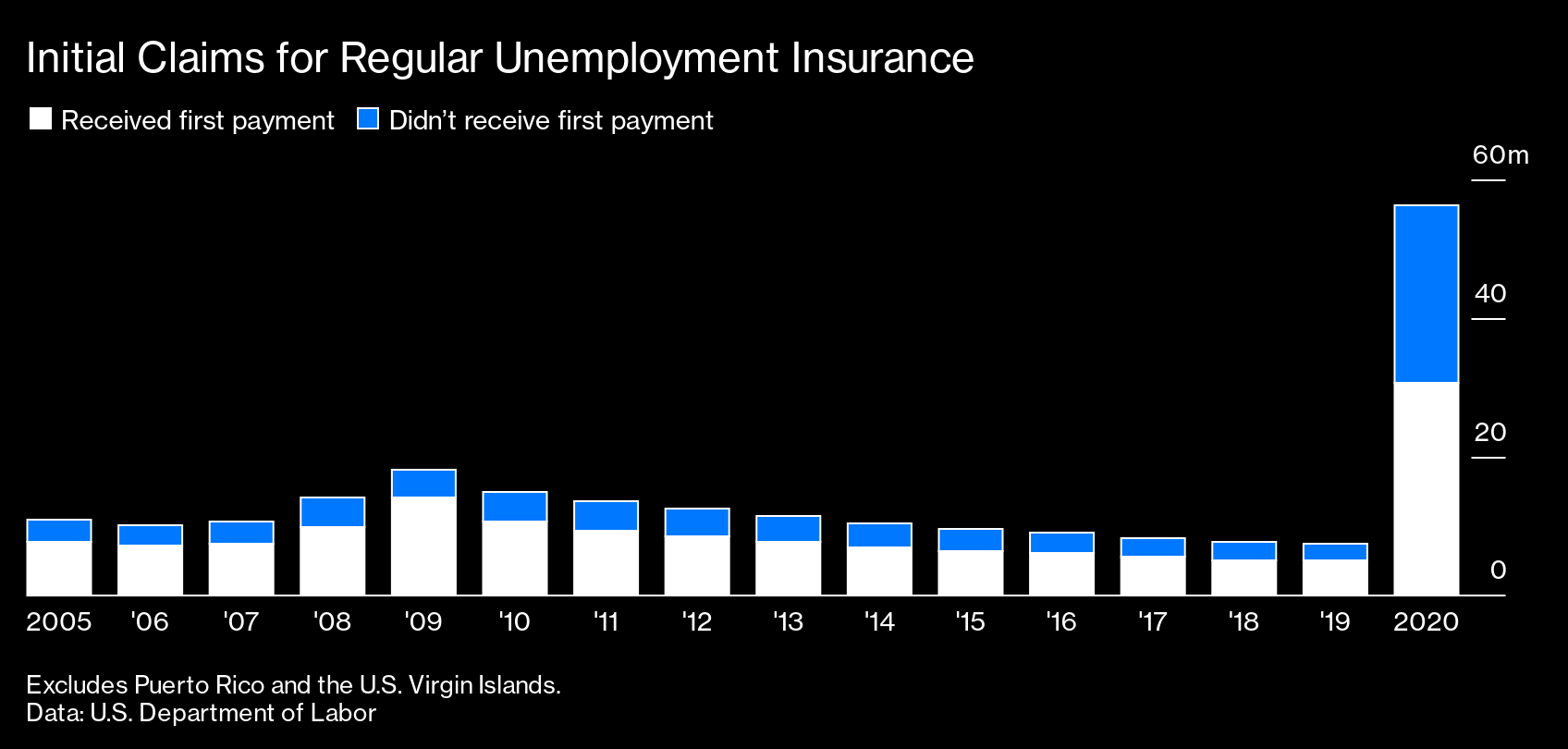

Who Qualifies For Unemployment Millions In U S Didn T Get Any Bloomberg

India Female Life Expectancy 2016 Life Expectancy India Female

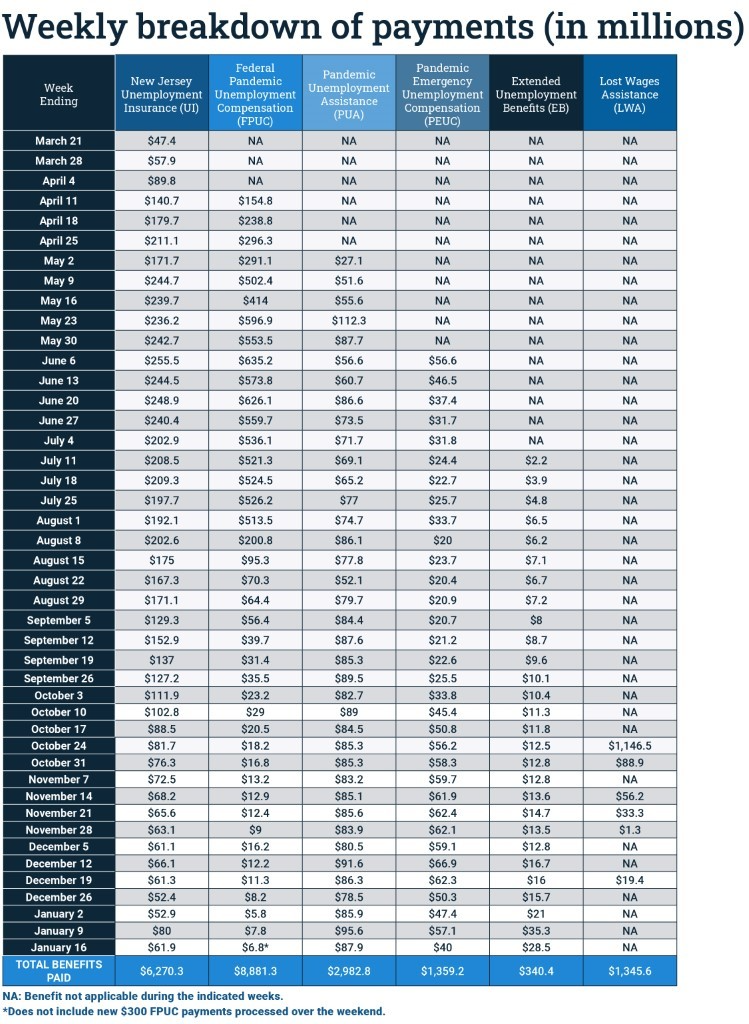

Njdol Jobless Residents Receive New Stimulus Payments

Federal Funding For Extended Unemployment Benefits Ending Sept 11 News Wsiltv Com

0 Post a Comment: