If you need to amend more than seven records per quarter submit additional Request to Amend Unemployment Compensation Quarterly Tax Return forms. IT 1040 Tax Return.

How Non Profits Can Avoid Paying State Unemployment Tax

Who is an employee for the purposes of unemployment tax reporting.

Ohio unemployment quarterly tax return. Pdfpdf fill-in file online. The Ohio Revised Code section 574707G provides that an employee of a business entity or trust having control of or charged with the responsibility of filing the withholding tax return and making payment shall be personally liable for failure to file the. Employers are urged to file the quarterly reports.

Annual tax rate as shown on the employers Quarterly Tax Return JFS-20125 in order to determine the amount of unemployment taxes due for the quarter. You may enter values manually or by upload using one of three approved file formats. The UI tax funds unemployment compensation programs for eligible employees.

COVID-19 Tax Relief - Ohio Department of Taxation new taxohiogov. Enter the quarter that you are requesting to amend. 1st Quarter - April 15 2021.

2021 Payment Due Dates. This report is mandatory under Ohio Unemployment Compensation Law Section 414120 and is authorized by law 29 USC. 7031 Koll Center Pkwy Pleasanton CA 94566.

To submit your quarterly tax report online please visit httpsthesourcejfsohiogov. Also used by employers to authorize the Ohio Department of Job and Family Services to furnish information. Wwwohiobusinessgatewayohiogov Download the Quarterly Wage Reporting Tool QWRT QWRT is an offline tool designed to help employers and third-party administrators TPAs manage employee data and file quarterly unemployment tax reports QWRT allows users to import data from other sources to generate.

3rd Quarter - Sept. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125. Estimated payments are made quarterly according to the following schedule.

Enter the employers Ohio Unemployment Compensation Tax account number. Ohio Unemployment Taxes Form JFS 20125 Unemployment Compensation Quarterly Tax must be submitted at the end of each quarter. Ohio taxes unemployment benefits to the extent they are included in federal adjusted gross income AGI.

Instructions on how to correct information is shown below. Due to the Federal American Rescue Plan Act of 2021 signed into law on March 11 2021 the IRS is allowing certain taxpayers to deduct up to 10200 in unemployment benefits for tax year 2020. Severance Tax Electronic Filing.

Payments for the first quarter of 2020 will be due April 30. You should make estimated payments if your estimated Ohio tax liability total tax minus total credits less Ohio withholding is more than 500. Contributions must be paid until the taxable wage base for each employee has been paid.

Used by employers to authorize someone other than the employer to provide information pertaining to Unemployment Taxes. In Ohio employers are required to file a complete Quarterly Tax Return each quarter. Tax rate as shown on the employers Quarterly Tax Return JFS-20125 in order to determine the amount of unemployment taxes due for the quarter.

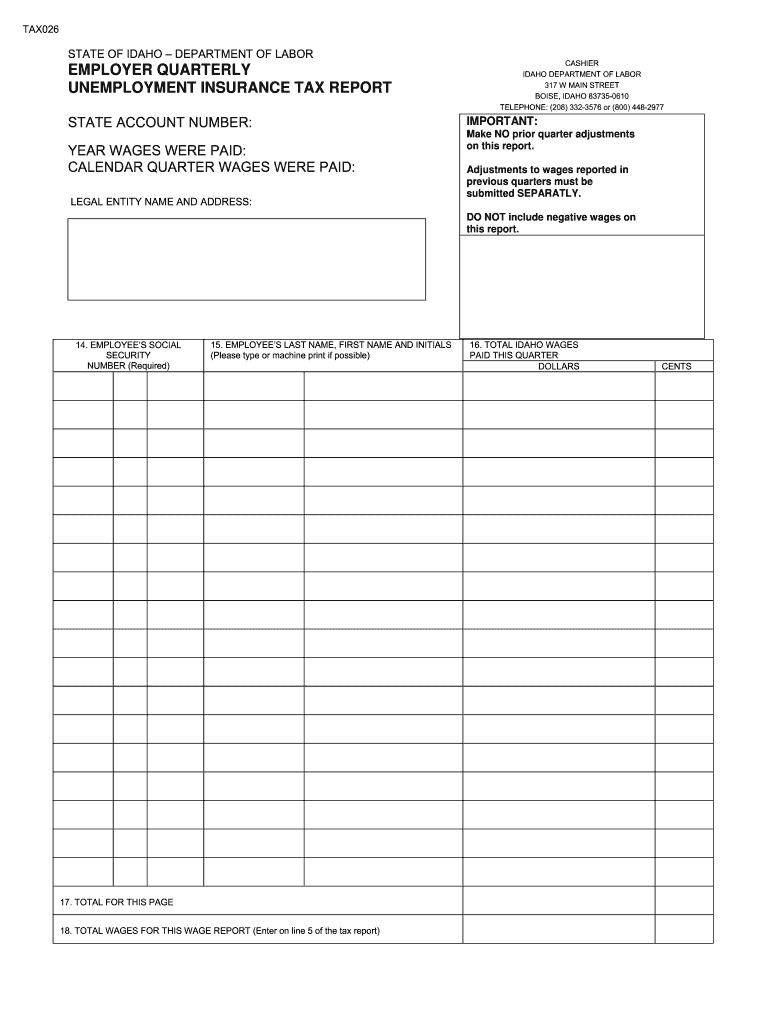

State of Alabama Department of Industrial Relations Unemployment Compensation Division - Unemployment Tax Report. Your cooperation is needed to make the results of this survey complete accurate and timely. In Ohio employers are required to submit their Quarterly Tax Return electronically.

Employers with questions can call 614 466-2319. 2nd Quarter - June 15 2021. Who is an employee for the purposes of unemployment tax reporting.

Payment and forms should be mailed to. To file your amendment online please visit the thesourcejfsohiogov. Arizona Department of Economic Security - Unemployment Tax and Wage Report UC-018 Arkansas.

A definition of an employee includes. If your small business has employees working in Ohio youll need to pay Ohio unemployment insurance UI tax. Ohio quarterly unemployment tax form.

The totals on this form must match the corresponding totals on your Unemployment Compensation Quarterly Tax Return JFS 20125. Visit jfsohiogovoucuctax to determine the taxable wage base for the quarter and year you are reportingThe taxable wages cannot be prorated over the year. Certain married taxpayers who both received unemployment benefits can each deduct up to 10200.

Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Any officer of a corporation. This deduction is factored into the calculation of your federal AGI which is the starting point for the Ohio income tax return.

Enter the year that you are requesting to amend. Certain types of employment are specifically excluded from coverage. The minimum penalty for failure to file a quarterly report when due is 50 and the maximum is 1000.

Ohio Department of Jobs and Family Services PO Box 182413 Columbus OH 43218-2413 13. In Ohio state UI tax is just one of several taxes that employers must pay. JFS-20106 Employers Representative Authorization for Taxes.

Correcting the Wage Detail. In Ohio employers are required to submit their Quarterly Tax Return electronically. Alaska Quarterly Contribution Report.

The forfeiture will amount to twenty-five one-hundredths of one percent 25 percent of the total wages reported. For employers approved by the Office of Unemployment Insurance Operations to submit reports by paper please use the Ohio Unemployment Quarterly Tax Return JFS-20125. 2021 Ohio IT 1040 Individual Income Tax Return - This file includes the Ohio IT 1040 Schedule of Adjustments IT BUS Schedule of Credits Schedule of Dependents IT WH and IT 40P.

A definition of an employee includes. Beginning with the severance tax return SV 3 for January 1 2014 - March 31 2014 first quarter of 2014 which is due May 15 2014 severance taxpayers are required to file electronically via the Ohio Business Gateway at wwwbusinessohiogovThe Ohio Business Gateway OBG offers electronic registration and filing tools for the Severance Tax.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Will You Owe Taxes On Your Unemployment Checks In 2022 Cnet

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

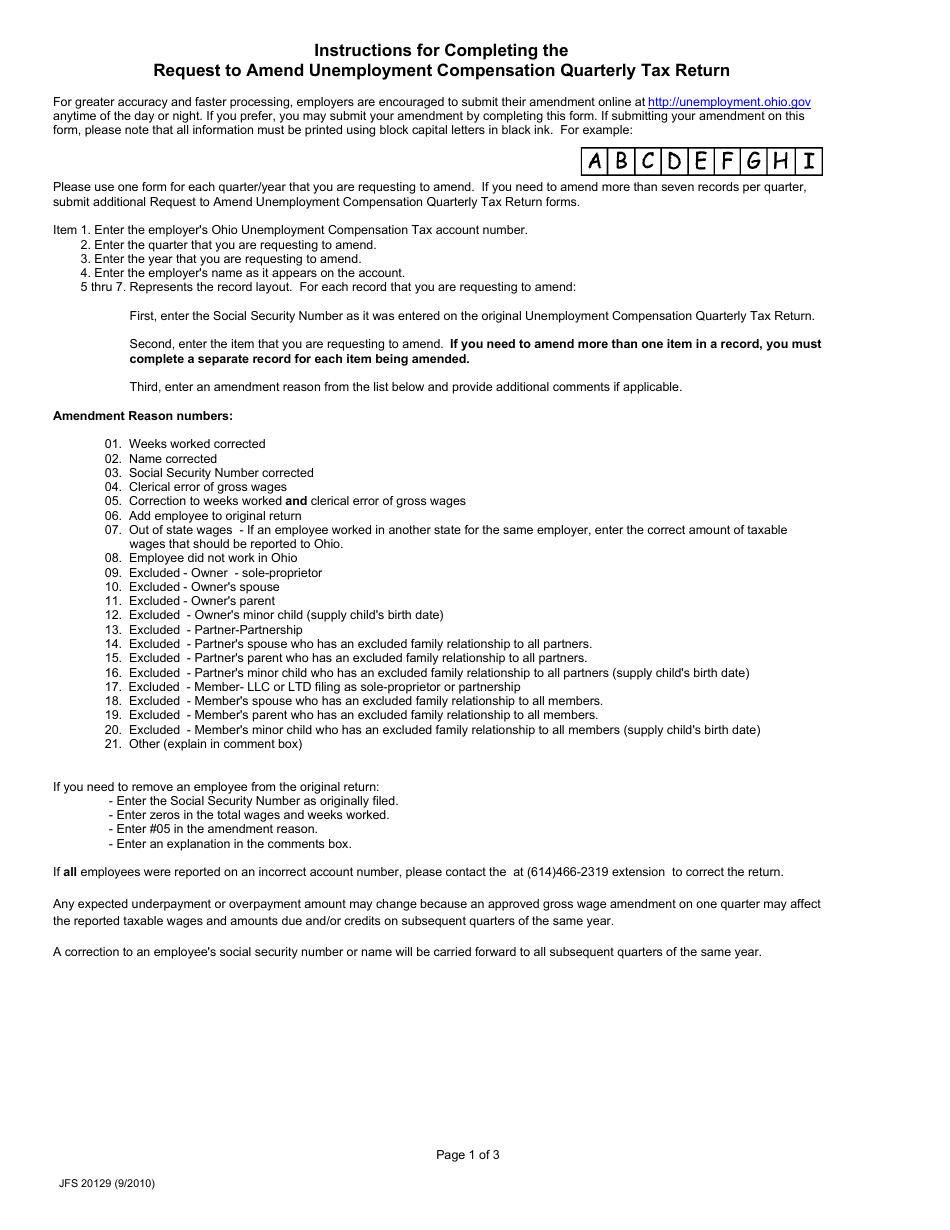

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Printing Software Writing Software Payroll Checks

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

How To Fill Out Irs Form 940 Futa Tax Return Youtube

What Is Form 940 When Do I Need To File A Futa Tax Return Ask Gusto

Form Jfs20129 Download Fillable Pdf Or Fill Online Request To Amend Unemployment Compensation Quarterly Tax Return Ohio Templateroller

Unemployment Tax Form Fill Online Printable Fillable Blank Pdffiller

I Want To File A Tax Return Or Wage Report Youtube

0 Post a Comment: