Faxing a written request to 518 485-8010. Analyst GSP Non-Agency Residential Mortgages.

Do Seasonal Workers Qualify For Unemployment

Employees can receive partial Unemployment Insurance benefits while working reduced hours.

Nys unemployment seasonal workers. However with the addition of online capabilities and the impact of COVID-19 the Department is adjusting best practices for 2020. Section 605 - Qualified employers. If you have worked in New York State within the last eighteen months you have the right to file a claim for benefits.

An employees contribution is computed at the rate of one-half of one percent of wages but no more than sixty cents a week. The Wisconsin state legislature wants to slash unemployment benefits. Calling the DOLs Registration Subsection at 518 485-8589 or.

They are not afforded the same benefits and compensation as full-time employees in most states. Protest a new state rule that restricts them for. With New Yorks unemployment on the decline the need for seasonal workers has increased.

The law requires employers with five or more employees to provide their employees with paid sick and safe leave. The NYS DOL says if you worked in New York within the previous 18 months you have a right to file a claim for unemployment benefits again thats just a right to file - it doesnt mean the claim will be accepted. Out of work and part time workers How long can you claim benefits.

No more unemployment checks for seasonal workers. 3575 or less then your WBA is your high quarter wages divided by 25 or 100 whichever is higher. Section 608 - Maximum payments.

Report it anonymously by contacting the New York State Department of Labor Liability and Determination Fraud Unit by any of these methods. The unemployment insurance program provides benefits to individuals who have sufficient employment to establish a claim have lost employment through no fault of their own are ready willing and able to work and are actively seeking work. Employers often hire part-time workers to help with increased work demands or seasonal industry fluctuations that sometimes occur in certain industries.

The amount increases annually. Section 610 - Commencement. NYS Department of Labor Shared Work Program Consider the Shared Work program as you manage business cycles and seasonal adjustments.

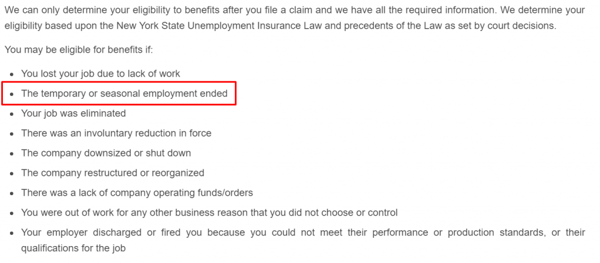

It also says people may be eligible for. Example seasonal employers that have an annual mass layoff often pay more than similarly sized employers that operate year-round If you have not done so already you must register for Unemployment Insurance withholding and wage reporting. Section 609 - Training.

Ring Concierge - Rochester New York. Even seasonal or temporary workers may be eligible for unemployment assistance. For example New Jersey recently passed a law that requires specific classification for certain seasonal jobs in order to qualify for seasonal unemployment.

From 3576 to 4000 then your WBA will equal the wages from your highest paid quarter divided by 26. In fact 15 states already have legislation on the books that eliminates or at least restricts the amount of benefits that seasonal workers are allowed to access. Record of Employment IA 123 is also available from the Forms resource area of.

Visit New York State Department of Labors website at wwwdolnygov Call 1-866-435-1499 24 hours a day or 518-485-2144 between 800 AM and 400 PM Fax information to 518-457-0024. Section 607 - Benefits. The maximum WBA you can receive in New York is currently 430.

An employer is allowed but not required to collect contributions from its employees to offset the cost of providing benefits. Section 603 - Definitions. Section 602 - Application.

Federal legislation has been passed allowing an additional 25 weekly payment to unemployment recipients. But eligibility can only be determined by filing a claim. ALBANY New Yorks unemployment may be at its lowest rate in years but seasonal employers in the state.

The New York Department of Labor is the state agency that oversees administering unemployment insurance claims for citizens. Anyone who has been employed for paid work in New York State within the prior 18 months has the right to file a claim for unemployment benefits. Up to 26 weeks Weekly benefit amount.

Shared Work lets you keep trained staff and avoid layoffs. Fill out the NYS 100 New York State Employer Registration for Unemployment. Checking local unemployment laws can help seasonal workers know if they are eligible under their states laws.

In the latter qualifying for unemployment is a matter of meeting two simple criteria factors. It provides monetary benefits job training job search and other related services for those people who are actively seeking work in New York and who have lost their jobs through no fault of their own. The Walt Disney Company - New York New York.

Citigroup - New York New York. All private sector seasonal workers in New York State are now covered under the states new sick and safe leave law regardless of industry occupation part-time status and overtime exempt status. WAITERWAITRESS FULL PART-TIME Compass Group North America - GLENVILLE New York.

Workers who work only certain times during the year are not considered full-time employees. Unemployed worker to replace unemployment insurance benefits lost because of illness or injury. Seasonal workers rely on that money as job opportunities fluctuate.

1 being unemployed through no fault of your own and 2 meeting your states requirements for wages earned. Section 604 - Eligibility conditions. Albany New York 12240-0339.

Actual high calendar quarter wages Note. Seasonal employees may face different rules for overtime and unemployment than. Unemployment laws change frequently so.

Most states define part-time employees as those who work less than 35 hours per week compared to full-time employees who typically work at least 40 hours per week. Fulfillment Associate - Seasonal. Traditionally the Department assists businesses and employers needing to make mass-file unemployment insurance claims for seasonal layoffs.

Section 606 - Revocation of approval. Seasonal unemployment is unique in that lack of work is caused by a trend that is predictable of a particular industry. Full-time part-time and seasonal employees are eligible.

By Annalyn Censky CNNMoney May 31 2012. School bus drivers in Savannah Ga. Section 611 - Charging of benefits.

Seasonal employment in New Jersey is defined as work that is performed or 36 weeks or fewer per calendar year and is based on seasonal need or local draw.

Do Seasonal Workers Qualify For Unemployment

H 2a Employers And Agents Department Of Labor

Do Seasonal Workers Qualify For Unemployment

Unemployment Benefits Protect Seasonal Workers In These Times

No More Unemployment Benefits For Seasonal Workers May 31 2012

If You Re Collecting Unemployment In New York State Says You Have To Look For Work Syracuse Com

Blog1a Art History Artist Union

Pin On Hotjobs Everywhere Hotjobshere Com

Coronavirus Layoffs Landing Hard On Minorities So Far Npr

Unemployment Insurance Benefit Rules For Teachers And Other School Workers Department Of Labor

Pin On Flexible Jobs We Love Em

Most Unemployed Americans Have Considered Changing Occupations During Covid 19 Pew Research Center

Do Seasonal Workers Qualify For Unemployment

This New Rolls Royce Has A Snarl Rolls Royce New Rolls Royce Rolls Royce Black

0 Post a Comment: