You must be able to work and are not disabled. TRENTON The New Jersey Department of Labor and Workforce Development NJDOL has issued unemployment guidance to help New Jersey workers and business owners understand unemployment law as the states economy reopens amid the COVID-19 pandemic.

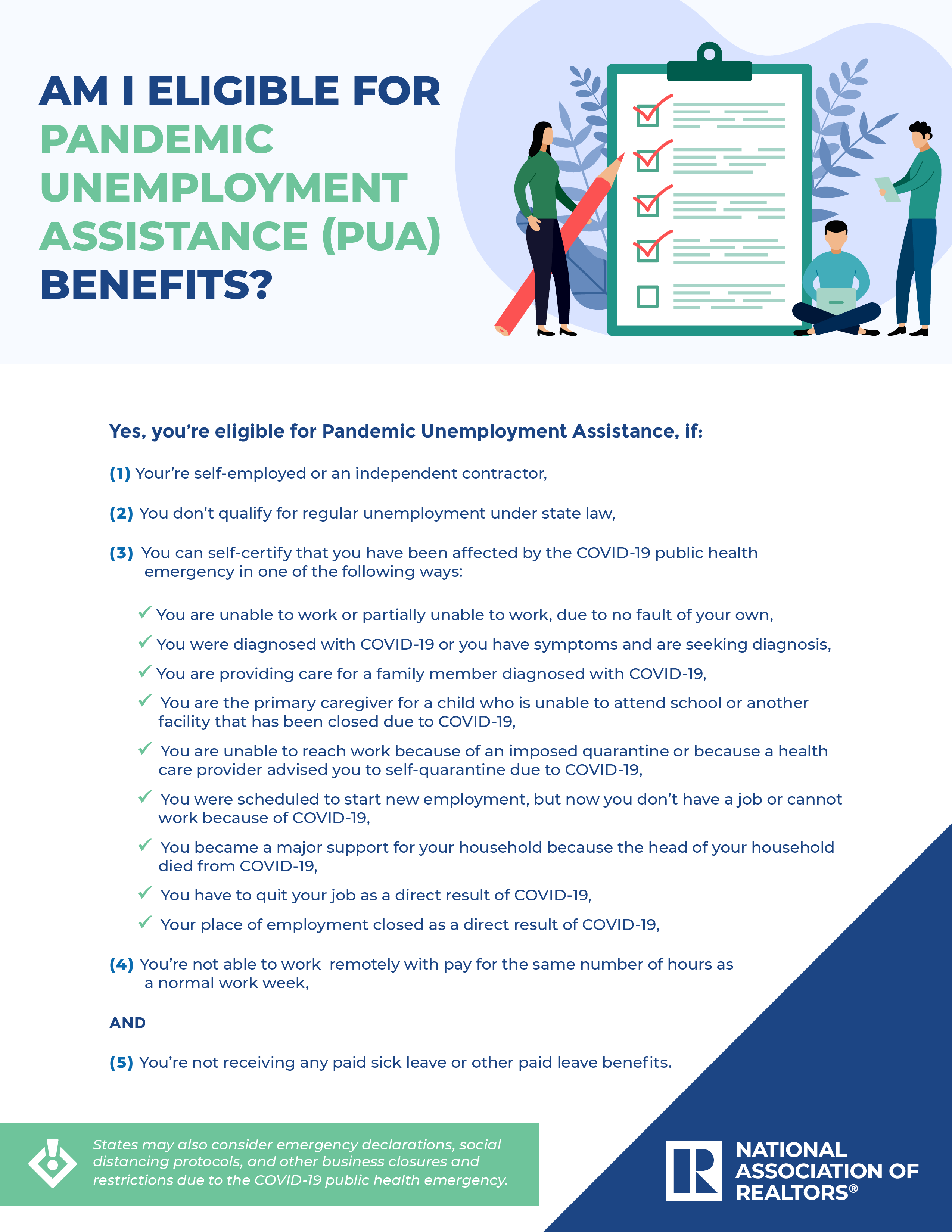

Pandemic Unemployment Assistance Pua Benefits Checklist

To qualify for unemployment benefits you must meet the following initial New Jersey unemployment requirements.

Nj unemployment guidelines. The CARES Act extended it to 39. Under the New Jersey Law Against Discrimination LAD your employer is prohibited from discriminating against you because you have or are perceived to have COVID-19 which is considered a disability under the LAD. Additionally on July 1 2020 New Jerseys high unemployment rate triggered state extended benefits for NJ workers who have exhausted unemployment benefits if among other requirements they meet the minimum earnings.

You cannot receive pay or benefits from more than one programlaw at the same time. Your maximum benefits amount will be calculated by multiplying the weekly amount by the number of weeks that you worked in. Learn more about the LAD and COVID-19 or file a complaint with the NJ Division on Civil Rights.

Your past earnings must meet certain minimum thresholds. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26. If you are approved for unemployment benefits in New Jersey the amount you will receive will be 60 percent of the base rate up to 636 per week.

Basic eligibility requirements Filing claims Amount of benefits. How much money you earned in your base period. You may file your new unemployment claim or reopen an existing claim via the Internet if you meet all the following requirements.

Unemployment Eligibility NJ All unemployed workers are required to meet designated requirements in order to receive benefits. Economists may argue about whether the recession is over but unemployment in New Jersey remains stagnant at 91. You are not permitted to file a claim until you are unemployed.

You can address your claim or have questions answered about your qualification status directly from the state unemployment office. Those who meet the requirements for traditional unemployment insurance may receive benefits for up to 26 weeks during a one-year period. Your maximum benefit amount depends on.

The document provides answers to workers many questions about unemployment as it relates to. Section 2 details the information that subject employers must provide on Form WR-30 Employer. Worked only in New Jersey in the last 18 months or.

Federal benefits created during the benefit expired September 4 2021. FOR IMMEDIATE RELEASE. North Carolina NC Unemployment.

You must be unemployed through no fault of. To be eligible for Unemployment Insurance benefits in 2020 you must have earned at least 200 per week during 20 or more weeks in covered employment during the base year period or you must have earned at least 10000 in total covered employment during the base year period. It is waiting to be voted on by the Governor.

Section 1explains the record-keeping obligations of all New Jersey employers whether or not they are subject to the Unemployment Compensation Law. Unemployment Temporary Disability and Family Leave Insurance benefits require an application to the New Jersey Department of Labor. New Mexico Unemployment Program Information.

You will still be able to receive benefits for eligible weeks prior to September 4 2021. Explains the unemployment benefit claim system from the claimants initial application through the determination of eligibility. You must not make more than your weekly wage allowance.

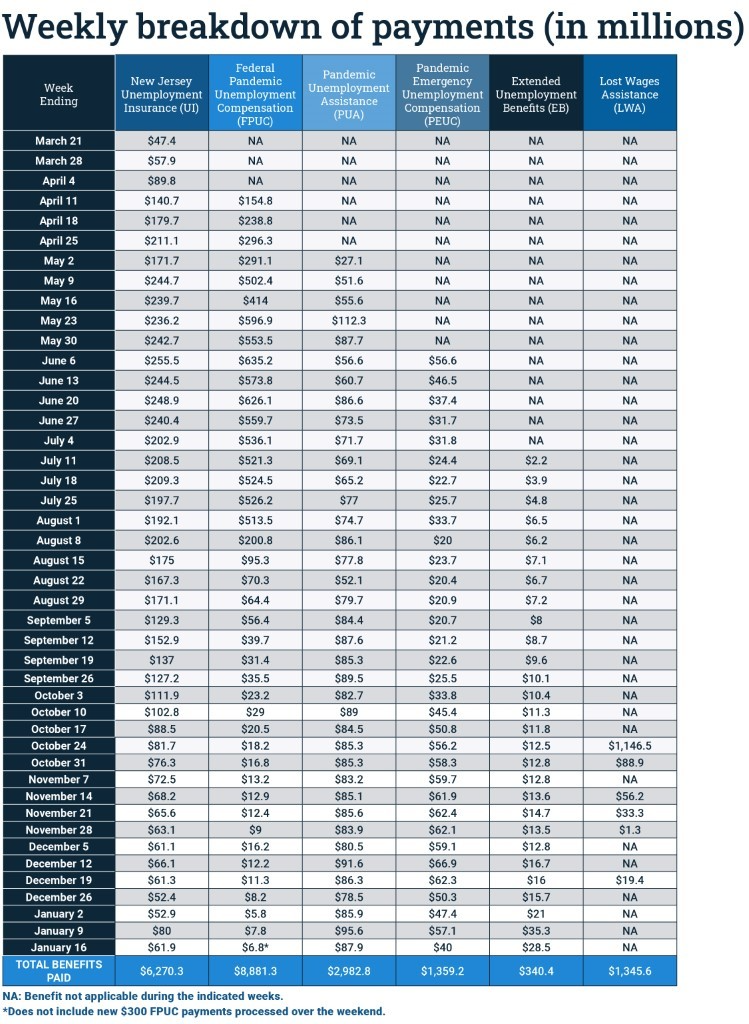

Initially the EB program provided additional benefits equal to 13 weeks or 50 of the maximum benefit amount on your original unemployment claim whichever amount is less This increased to 20 weeks or 80 when New Jersey qualified for high EB beginning July 5 2020. Your base period is defined as the first four quarters out of the past five quarters before you file your initial New Jersey unemployment weekly claim. New Jersey normally has 26 weeks of unemployment insurance.

This section also deals with unemployment fraud and the roles of both the employer and the Department of Labor and Workforce Development in combating it. You must be actively looking for a job and keeping a record of your job search. New Jersey NJ Unemployment.

Read our FAQs on paid leave job protection and caregiving. PEUC also increased unemployment benefits by 600 per week until July 31 2020. New Mexico NM Unemployment.

Locate the NJ unemployment office nearest you to get directions and contact information. In New Jersey the Department of Labor and Workforce Development handles unemployment benefits and determines eligibility on a case-by-case basis. You must file a weekly certification.

Before unemployment benefits can be paid to you you must file a claim. In order to receive unemployment benefits in New Jersey you must follow these rules. July 1 2020 to June 30 2021.

North Carolina Unemployment Benefits and Eligibility. New York Unemployment Benefits and Eligibility. New Jerseys Assembly has passed legislation as of 51320 that makes it much easier to collect benefits between terms even if one has an offer of reemployment the subsequent semester.

Employers pay NJ Earned Sick Leave and may pay federal sickchildcare leave. TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum. Emergency Unemployment Compensation PEUC must be paid prior to Extended Benefits.

New Jersey State law determines eligibility of Unemployment Insurance in New Jersey the amount of compensation and the amount of time benefits can be collected. Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in New Jersey. Unfortunately this is a topic that has impacted many New Jersey residents over the past several years.

The New Jersey Department of Labor and Workforce Development NJDOL has issued unemployment guidance to help New Jersey workers and business owners understand unemployment law as the states economy reopens amid the COVID-19 pandemic. For more information about eligibility guidelines read our guide to New Jersey unemployment eligibility. New York NY Unemployment.

Anyone who exhausted their benefits after July 1 2019 is eligible to receive 13 additional week of benefits. New Jersey Unemployment Benefits and Eligibility.

Division Of Unemployment Insurance Information You Ll Need To Apply For Unemployment Insurance Benefits

New Jersey State Seal Decals Stickers New Jersey State Mottos Jersey

Woah Just Hold Up Bts Scenarios Bts Memes Bts Boys

If Unemployment Benefits Run Out Nj 211

Division Of Unemployment Insurance Training Education Programs

Total Pandemic Relief To Nj Workers Nears 35b As Federal Benefits Expire New Jersey Business Magazine

Njdol Commissioner Njdolcommish Twitter

Storm Survivors May Apply For Legal Help Legal Services Legal Legal Help

Njdol Jobless Residents Receive New Stimulus Payments

Nj Labor Department Process To Speed Mandatory Review Of Unemployment Claims New Jersey Business Magazine

Disqualification New Jersey Employment Litigation Lawyers

Lsnjlaw An Overview Of The Unemployment Appeals Process

0 Post a Comment: