A sole proprietor or an LLC does not pay wages but if you are paying yourself a salary through an S-Corp or a C-Corp you pay unemployment benefits and would qualify if you met the minimum time required. March 28 2020 As small business owners continue to struggle with the state-wide stay at home Executive Order to slow the spread of the COVID-19 virus the NFIB team in Michigan has been working non-stop to provide assistance in understanding how the Order applies to specific businesses trades and industry segments.

Michigan Chronicle Digital Edition 2 10 21 By Real Times Media Issuu

If the S-corp still has earnings after the.

Michigan unemployment s corp owner. Independent contractors Gig economy or freelance workers Small business owners Temporary or seasonal workers. 151A the Appeals Court noted that the same is true for owneremployees of LLCs under the Workmans Compensation Statute GL. On the flipside if you have elected your limited liability company to be taxed as a C or S.

Unemployment costs may be higher. As the owner of a C-Corp or S-Corp that employees W-2 workers in the United States you have the option to file for unemployment if you have closed your business and are no longer receiving any form of. The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act.

According to the Illinois Department of Employment Security. Michigan allows residents to collect unemployment benefits for a maximum of 20 weeks per benefit year regardless of wheter you find a job stop benefits and need to reapply later on in the year. The loans were unsecured demand notes bearing no interest loans were made entirely at the discretion of shareholder and the shareholder regularly performed substantial.

Yes S Corporation owners are eligible for unemployment insurance however depending on some crucial factors. If you havent elected your LLC to be taxed as an S corp or a C corporation then the self-employment tax does not cover federal unemployment insurance. This leaves you unable to file a claim should you ever leave a company.

All that said if you find another job not the S-corp and then find work for the S-corp you can quit the job and go back to the S-corp. Small business owners say Governor Gretchen Whitmers executive order to shutdown non-essential businesses have. S-Corp Shareholders and Unemployment Insurance.

The IRS has officially stated that shareholders who work for S corporations even if the shareholder is the only owner or worker are considered employees for purposes of the Federal Unemployment Tax Act. Employer must inform the Unemployment Insurance Agency UIA of the fact that some or all of the interest owners of the corporation are related to the unemployed worker or that the unemployed worker owns an interest in the corporation. This means that a shareholder can be on the payroll and if he is the S corporation must pay unemployment insurance tax on his behalf.

Hpswwwmichigangov-leo058637-336-78421_97241---00html Examples of workers eligible for Pandemic Unemployment Assistance include. Many corporation officers find it surprising that even though they are owners of a company they still may be subject to paying unemployment insurance UI premiums and taxes on the wages that they paid to themselves. Payments to S Corp owners for services rendered are treated no differently than the salary you would pay an employee.

Under Section 402h of PAs unemployment Code if you are self-employed then then you are are ineligible for benefits. On the flipside if you have elected your limited liability company to be taxed as a C or S. The answer is yes and no.

The unemployed worker works for his wife who is the sole owner of a business that is not incorporated. Can small business owners file for unemployment. However like the rules of many other government programs unemployment guidelines are different due to the coronavirus pandemic.

Purported loans from S corporation to its sole shareholder officer and director were wages for purposes of FICA and FUTA taxes. Contact info for Michigan Unemployment Insurance Agency. The MI unemployment tax must be paid by any business employing 1 or more individual this includes ownersofficers who receive salary compensation from the business.

If the owners and officers receive a salary from the company then they are not exempt from paying unemployment taxes on those wages. A Michigan S-corporation is a standard corporation that has elected for the special S-corp tax status with the IRS. Some states like Arkansas Ohio New Jersey Wisconsin and New York require additional filing at.

If the S-Corp owner has been paying his or her self a W-2 wage as required by the IRS and has been paying state and federal unemployment taxes on those wages then you should be able to apply for unemployment. However even S-corporate shareholder-officers whose S-corporate employers do contribute to the system on their behalf have traditionally found it difficult to collect unemployment benefits in most states including North Carolina because even when business is slow they still have a payroll attachment which impedes the collection of. Yes unemployment for small business owners is now possible if you have lost income or are unable to work due to COVID-19.

In determining that an employeeowner of an LLC could not qualify for unemployment assistance pursuant to the Unemployment statute GL. If you havent elected your LLC to be taxed as an S corp or a C corporation then the self-employment tax does not cover federal unemployment insurance. Department of Employment and Workforce DEW then wages for corporate officersowners must be included on quarterly wage and contribution reports filed with DEW.

This leaves you unable to file a claim should you ever leave a company. This means there must be at least 52 weeks between Michigan unemployment claim filings to receive full benefits. If you are paying unemployment taxes and the business closes you could draw benefits but as an owner not drawing salary you cannot collect unemployment.

This is true for shareholders of an S corporation in particular as they are. The election is done by filing Form 255 3 with the Internal Revenue Service. The answer is yes and no.

This means that if an exemption is not requested by the business and approved by the S. The point here is that you cant keep getting unemployment once you are offered a job. Business entity the option to exempt its corporate officersowners for UI purposes.

Effective June 28 2012 the Michigan Employment Security MES Act was amended by the removal of the 7-week limitation of unemployment benefits for certain family members employed by family owned corporations. An individual who through ownership in stock and his position in the corporation exercises a substantial degree of control over its operation is considered a self-employed business person. Payroll taxes including FICA and federal and state income tax must be withheld from the paycheck and the company must pay FUTA and state unemployment taxes.

John Milikowsky founding partner of Milikowsky Tax Law reviews the options Business Owners and 1099 contractors have to file for Unemployment Insurance.

Michigan Unemployment Benefits For Limited Liability Company Members Rehmann

Labor And Economic Opportunity December 2021

Labor And Economic Opportunity December 2021

Update On Uia Work Search Requirements Semca

State Representative Mike Mueller Facebook

Michigan Corporation How To Start A Corporation In Michigan Truic

10 Reasons Michigan Is America S Comeback State Cool Infographic Economic Development Michigan Michigan Fun

How To Apply For Unemployment Benefits Information And Resources Semca

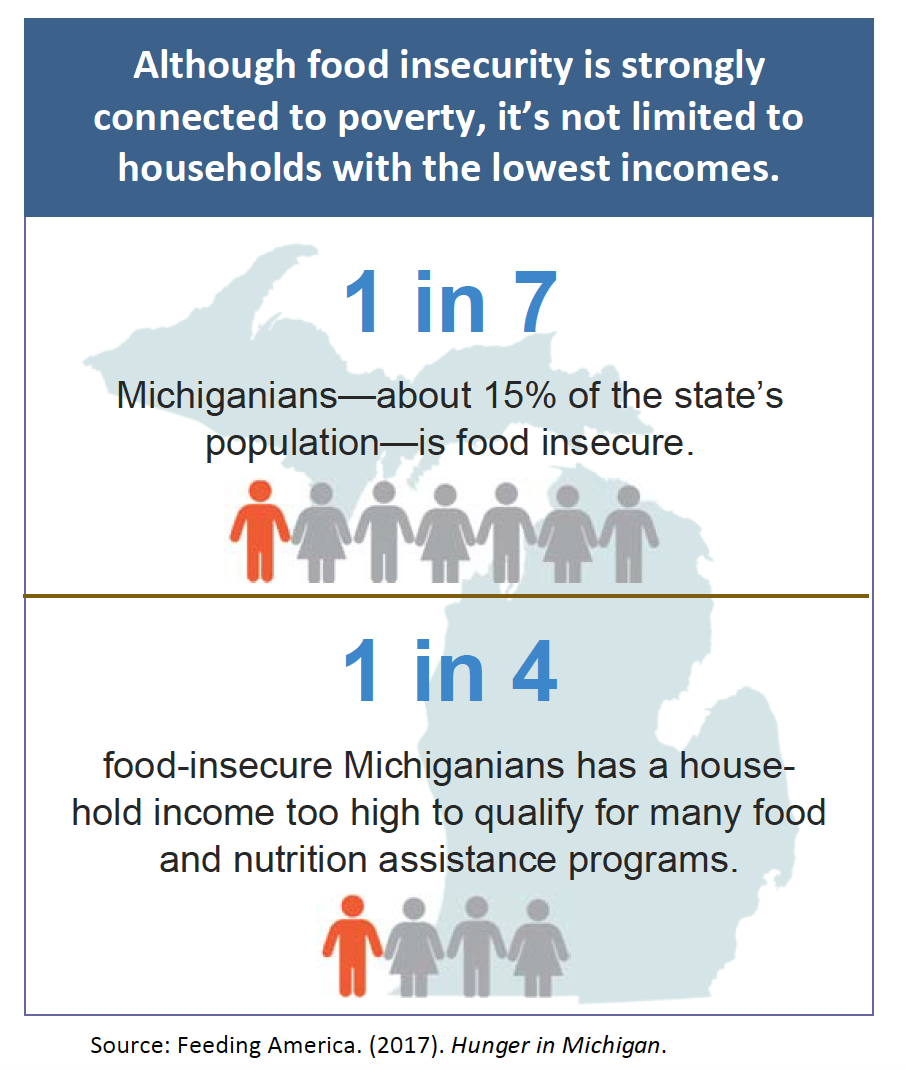

Still Hungry Economic Recovery Leaves Many Michiganians Without Enough To Eat Mlpp

0 Post a Comment: