Will I have to pay taxes on my Unemployment Benefits. Your Washington unemployment benefit claim is available for one year which is 52 weeks from the week you applied.

Esdwagov Calculate Your Benefit

Maximum Benefit Amount in Washington.

Wa unemployment benefits amount. You must report unemployment benefits you are getting from other states. Your local state unemployment agency will send you form 1099-G to file with your tax. Calculating Washington Unemployment Benefit Amounts heading - no content needed Determine Your Weekly Benefit Amount.

In Washington State the weekly benefit amount is determined as the average of the two highest quarter earnings in the base year times 385. No one eligible for benefits will receive less than this regardless of their earnings. The study also shows that Washington ranks second in the United States for the most annualized unemployment benefits due to COVID-19 with maximum benefits paying 72280 So what are the max benefits you can receive.

The amount you receive depends on your weekly earnings prior to being laid off and on the maximum amount of unemployment benefits paid to each worker. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. Washington Revised Code Title 50.

How long can I get benefits. Maximum benefits payable is the lesser of twenty-six times the weekly. No one eligible for benefits will receive less than 295 regardless of their earnings.

The ESD determines your weekly benefit amount by averaging your wages from the. New York State unemployment worker in New York busted for stealing over 300000 in unemployment benefits For those who have suspected fraud at the state unemployment office we have this case of over 300K in stolen benefits. You can view your weekly unemployment benefit amount by.

You need to know what quarters make up your Base Year in order to calculate your Weekly Benefit Amount WBA. 2 An individuals weekly benefit amount shall be an amount equal to three and eighty-five one-hundredths percent of the average quarterly wages of the individuals total wages during the two quarters of the individuals base year in which such total wages were highest. What the Unemployment Tax and Benefits UTAB system is designed to do.

You cannot file another new Washington claim until that year is over. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. Unemployment benefits are distributed weekly in Washington State.

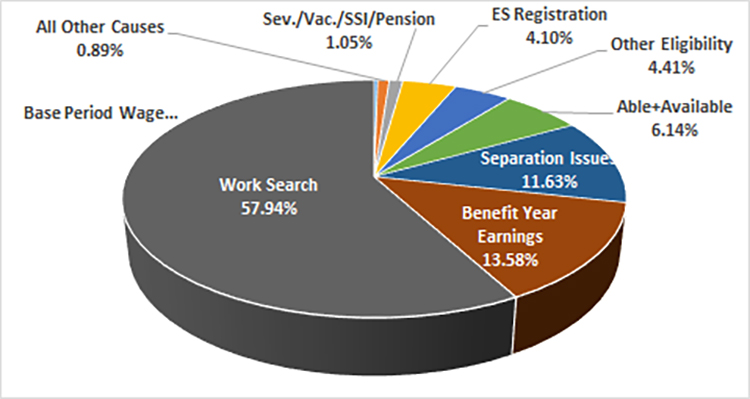

O Determine eligibility o Calculate benefit amount o Process payments o Store claim and claimant data Some background o Replaced legacy payment system o Developed by a third-party vendor o Implemented January 2017 IT systems audit looked at selected application controls 4. Individuals can review their unemployment benefits via. In Washington the maximum weekly benefit amount is 790 and the minimum is 188.

The minimum weekly benefit amount is 188 and the maximum weekly benefit is 790. The amount of unemployment benefits you will receive each week is called your weekly benefit amount WBA. The minimum weekly benefit amount is 188 and the maximum weekly benefit is 790.

The amount of benefits you receive depends on your earnings in your reported base year. Amount and Duration of Unemployment Benefits in Washington State. How to view unemployment benefit amounts.

Unemployment Compensation 5060100. Or federal laws used as the basis for determining an individuals weekly benefit amount and potential maximum benefit entitlement. This 52-week period is called your benefit year.

Amount and Duration of Unemployment Benefits in Washington State The ESD determines your weekly benefit amount by averaging your wages from the two highest quarters in your base period and multiplying that number by0385. In many states you will be compensated for half of your earnings up to a certain maximum. In Washington state the maximum weekly benefit amount is 929.

Employment Security Department website. In Washington state the maximum weekly benefit amount is 929. The minimum is 295.

To find out your WBA the state will take the average of your two highest paying quarters in your base period and then take 385 of the average. The minimum is 295. The weekly benefit amount is listed under the Summary tab in the individuals account and will not include the additional 600 per week.

Your Base Year is the first four of the last five calendar quarters before the week your filed your claim. These benefits which are not based on financial need are funded via taxes paid by your previous employer and are designed to stand in for wages to help cover your cost of living while you search for. SecureAccess Washington SAW.

1 The shared work weekly benefit amount shall be the product of the regular weekly unemployment compensation benefit amount multiplied by the percentage of reduction in the individuals usual weekly hours. The ESD determines your weekly benefit amount by averaging your wages from the two highest quarters in your base period and multiplying that number by 0385. The total weekly amount is listed under the Weeks Summary tab and.

Logging onto your SecureAccess account on the Employment Security Department ESD website. The Washington unemployment department also referred to as ESD is your go-to resource when filing unemployment insurance claims in Washington. Amount and Duration of Unemployment Benefits in Washington State.

Washington has a maximum and minimum WBA. The actual amount you are eligible to receive depends on the earnings in your base year. You can calculate your estimated benefits here.

How much does unemployment pay in Washington State. Most claims receive between 13 to 26 weeks of benefits.

Esdwagov Job Search Requirement Now Optional To Increase Access To Unemployment Benefits Logos New York Wallpaper Printable Christmas Cards

Twitter Worker Get Ripped Inequality

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

World Bank 2015b Georgia Skills Toward Employment And Productivity Step Survey Findings Urban Areas W Literacy Assessment Surveys Educational Testing

Esdwagov Calculate Your Benefit

Esdwagov Calculate Your Benefit

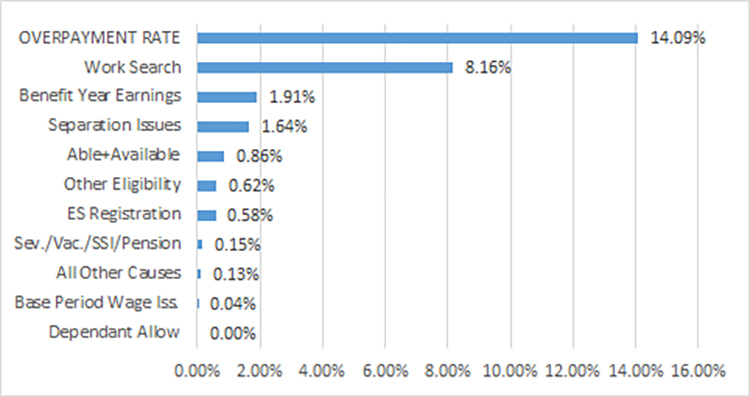

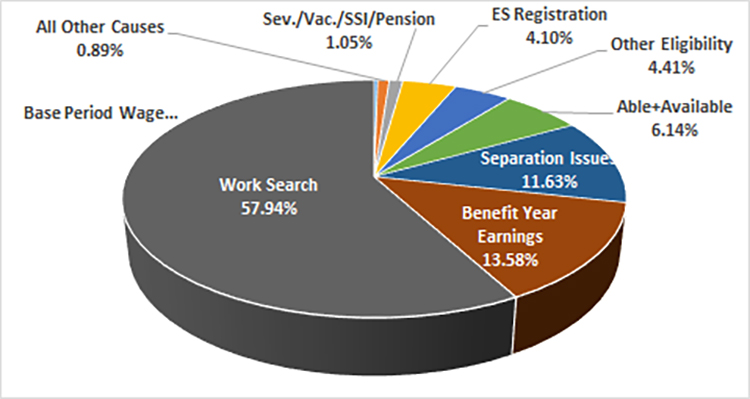

Washington U S Department Of Labor

Washington U S Department Of Labor

Esdwagov Calculate Your Benefit

Mindmeister Mind Map 12 Step Infographic Marketing Sales Letter 12 Step

Washington State Paid Family Leave Update Out Of The Box Technology Medical Leave Living In Washington State Washington State

Opinion Goodbye Readers And Good Luck You Ll Need It Goodbye And Good Luck The Washington Post Economics

Unemployment Benefits Comparison By State Fileunemployment Org

0 Post a Comment: