As of March 11 2021 under the American Rescue Plan the first 10200 in unemployment benefits collected in the tax year 2020 were not subject to federal tax. Employers report employee gross wages each quarter and pay taxes on the first 9000 per employee per year.

Texas Unemployment Login Twc Logon Help Unemployment Portal

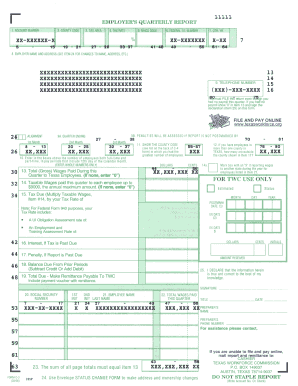

Establish a new unemployment tax account file wage reports and pay unemployment tax.

Texas unemployment tax. Wages are reported when they are paid rather than when they are earned or accrued. The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form W-4 to their employer. Employer costs for unemployment insurance and workers compensation are relatively low in Texas.

In 2020 the minimum rate was 031 and the maximum rate was 631. In order to have qualified for the. The Interest Tax Rate is used to pay interest on federal loans to Texas if owed used to pay unemployment benefits.

Amend employee name wages or Social Security numbers that were reported incorrectly. Can a priest collect unemployment. Unemployment Insurance Workers Compensation.

Also Know does Texas have unemployment insurance. Texas unemployment tax rates are not to change for 2022 the state Workforce Commission said Nov. Learn about unemployment tax and review tax publications and news.

Liable employers report employee wages and pay the unemployment tax based on state law under the Texas Unemployment Compensation Act TUCA. We will update this information as the states do. Employer Tax Rate Range 2021 Alabama.

Herein what is the Texas state unemployment tax rate. For more information about estimated tax payments or additional tax payments visit payment. 36 636 in 2019 and.

Unemployment Insurance tax rates are computed for taxed government employers as a group. Unemployment Compensation Subject to Income Tax and Withholding. Tax rates are to range from 031 to 631.

In 2019 the minimum tax rate is 036 and the maximum is 636. The UI tax funds unemployment compensation programs for eligible employees. Submit domestic employers annual report.

The Texas SUI rate ranges from. You can obtain your tax rate by visiting the Texas Workforce Commissions Unemployment Tax Services website. New Texas Employer Information.

For example Texas will not release 2021 information until June due to COVID-19. All taxed government employers have the same rate in a given year. In Texas state UI tax is one of the primary taxes that employers must pay.

Update and review the status of your tax account. New employers pay 27 on the first 9000 of wages per employee. Unlike most other states Texas does not have state withholding taxes.

Unemployment benefits generally count as taxable income. Adjust previously filed wage reports. Wage base is 9000 for 2019 and 2018.

T he Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15 million refunds sent out adding to almost nine million. Churches associations of churches and religious schools are all exempt from paying both federal taxes under the Federal Unemployment Tax Act FUTA and state taxes under the Texas Unemployment Compensation Act TUCA. Employers typically pay the State of Texas a percentage of the first 9000 in employee wages as an unemployment tax.

Texas SUI Rate State Unemployment Insurance SUI Employers should use the benefit ratio formula for SUI. Businesses that employ one or more individuals may be subject to the state unemployment tax. This percentage will be the same for all employers in a given year.

Typically tax rates are released in Decemberbefore the new year. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636. If your small business has employees working in Texas youll need to pay Texas unemployment insurance UI tax.

The Interest Tax Rate for. A review of state unemployment laws reveals differences in eligibility. The American Rescue Plan Act a relief law Democrats passed in March last year authorized a waiver of federal tax on up to 10200 of.

The Interest Tax is calculated according to Commission Rule. Register a New Tax Account File Pay Taxes. Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27.

065 68 including employment security assessment of. Request a tax rate notice required workplace posters or certification to the IRS of the wages reported to TWC. Manage unemployment tax account access grant update or remove authority.

Using the formula below you would be required to pay 1458 into your states unemployment fund. Do churches pay unemployment tax in Texas. The minimum and maximum tax rates are set annually.

SUI New Employer Tax Rate. A governmental employers annual contribution rate is computed in accordance with Chapter 204 Subchapter F of the Texas Unemployment Compensation Act. 1 2022 unemployment tax rates for experienced employers are to range from 031 to 631 the commission said in a news release.

Contact a tax office for assistance.

How To Calculate Texas Unemployment Benefits 7 Steps

How To Apply For Unemployment Benefits In Texas Fileunemployment Org

Texas Unemployment Tax Rate Decreases Vbr

Texas Unemployment Login Twc Logon Help Unemployment Portal

Texas Unemployment Login Twc Logon Help Unemployment Portal

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

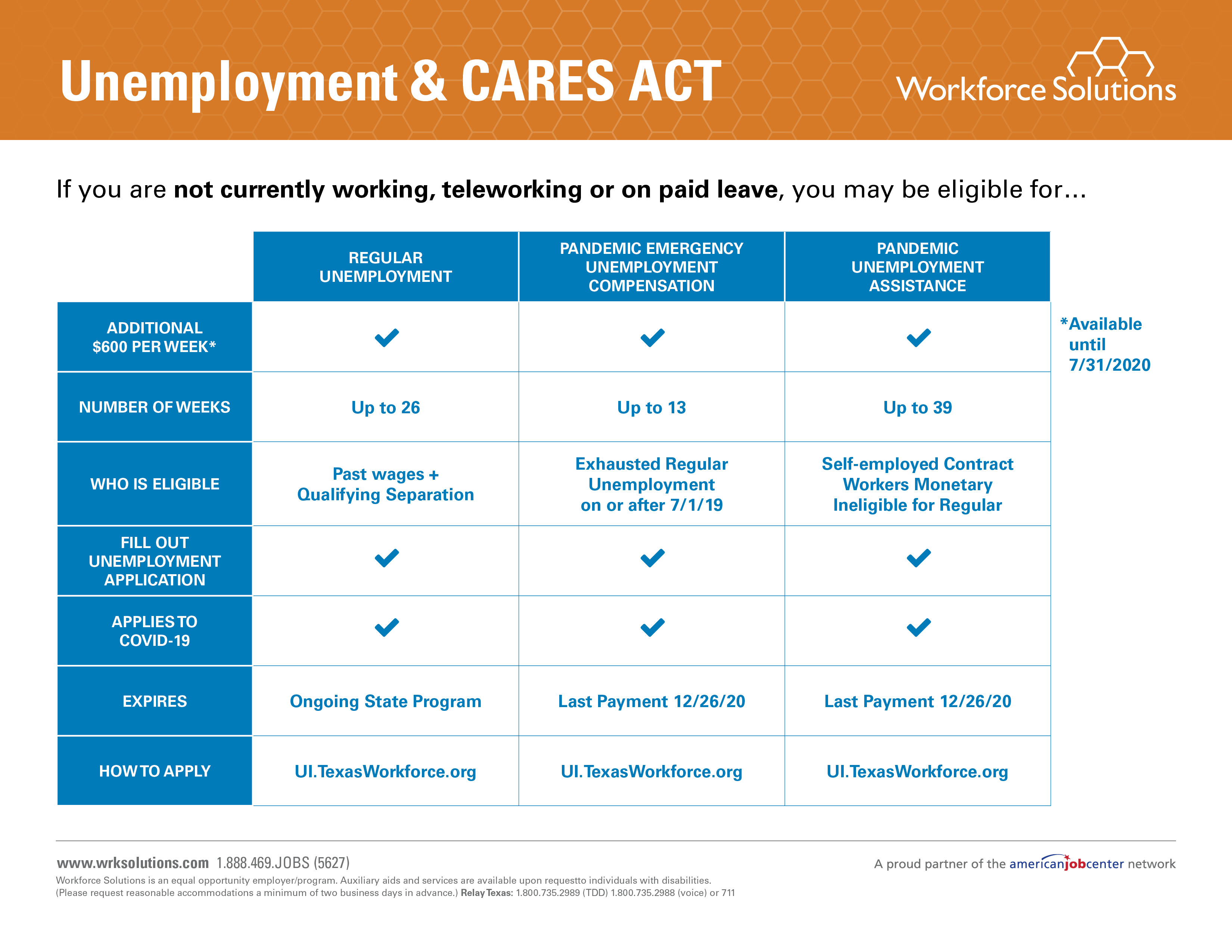

Unemployment Benefits Workforce Solutions

Texas Twc Enhanced Unemployment Benefits With The End Of Pandemic Unemployment Programs How Much You Can Get In 2022 And Claiming Back Dated Payments Aving To Invest

Twc Form C 3 Pdf Fill Online Printable Fillable Blank Pdffiller

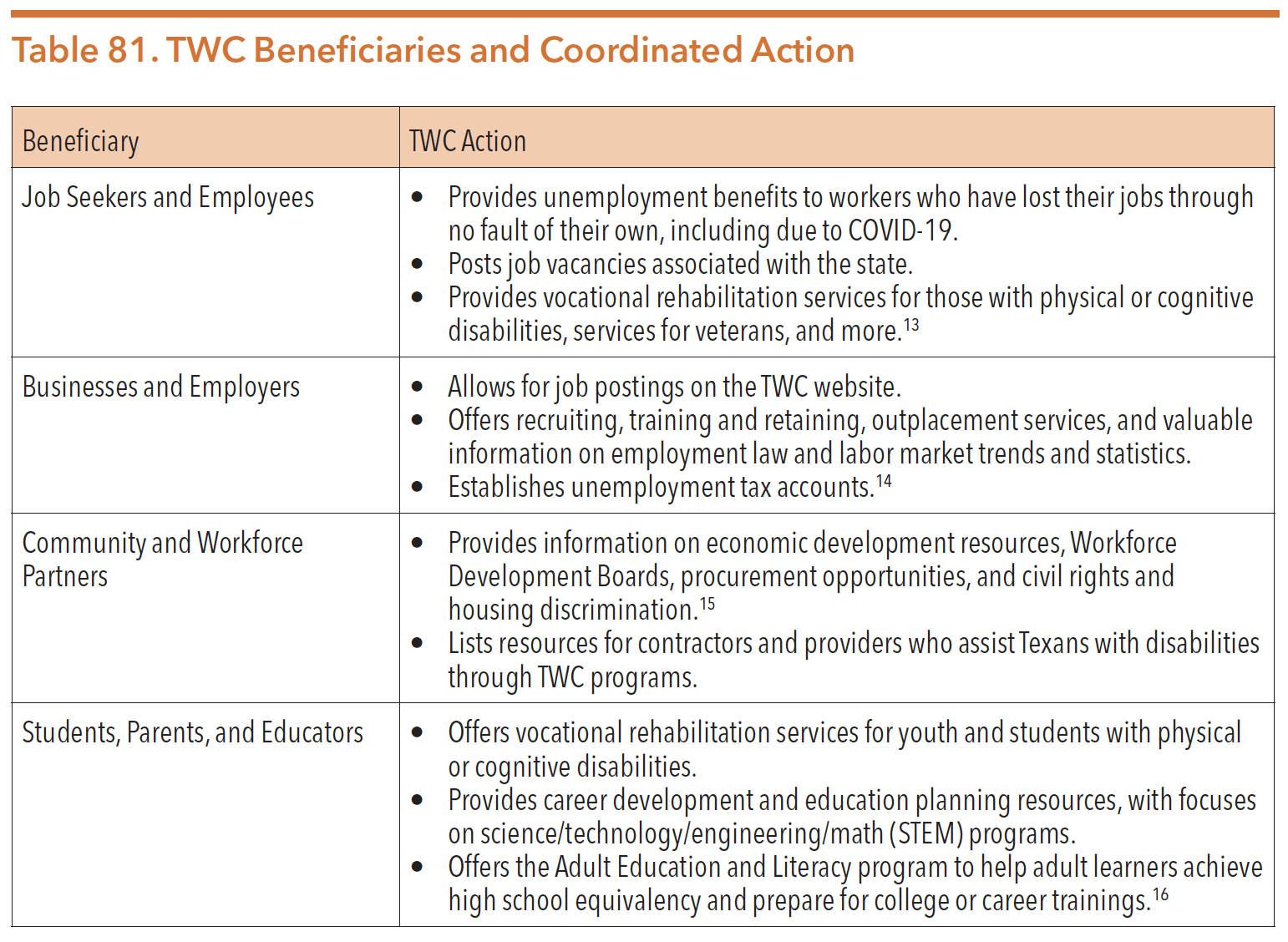

Texas Workforce Commission Hogg Foundation

0 Post a Comment: