We match prescreened qualified candidates to your business. The purpose is to cut down on the wasted time and resources due to claimants who do not enter correct employer information when they open an unemployment claim.

Apply to Accountant Employee Relations Manager and more.

Pa unemployment for employers. Third Party Administrators TPA Services Available When the TPA Accesses Client Account Online. Make an Online Payment. Employers Tax Services.

Access UCMS and find information about starting or maintaining a business in Pennsylvania. You may e-mail Employer Services at UIEMPCHARGEpagov and include your employer account number the claimants full name and the last four digits of the social security number and the nature of your question. File a Benefit Appeal.

If you have questions regarding your business Unemployment Compensation UC Tax and account number visit the Pennsylvania Department of Labor and Industrys DLIs Employer UC FAQ. Employers however generally do not have to pay overtime wages to certain categories of salaried employees including those employed in a bona fide executive administrative or professional capacity or. Dedicated to serving Pennsylvanians with disabilities who want to work we are ready to help you meet your recruitment and hiring needs.

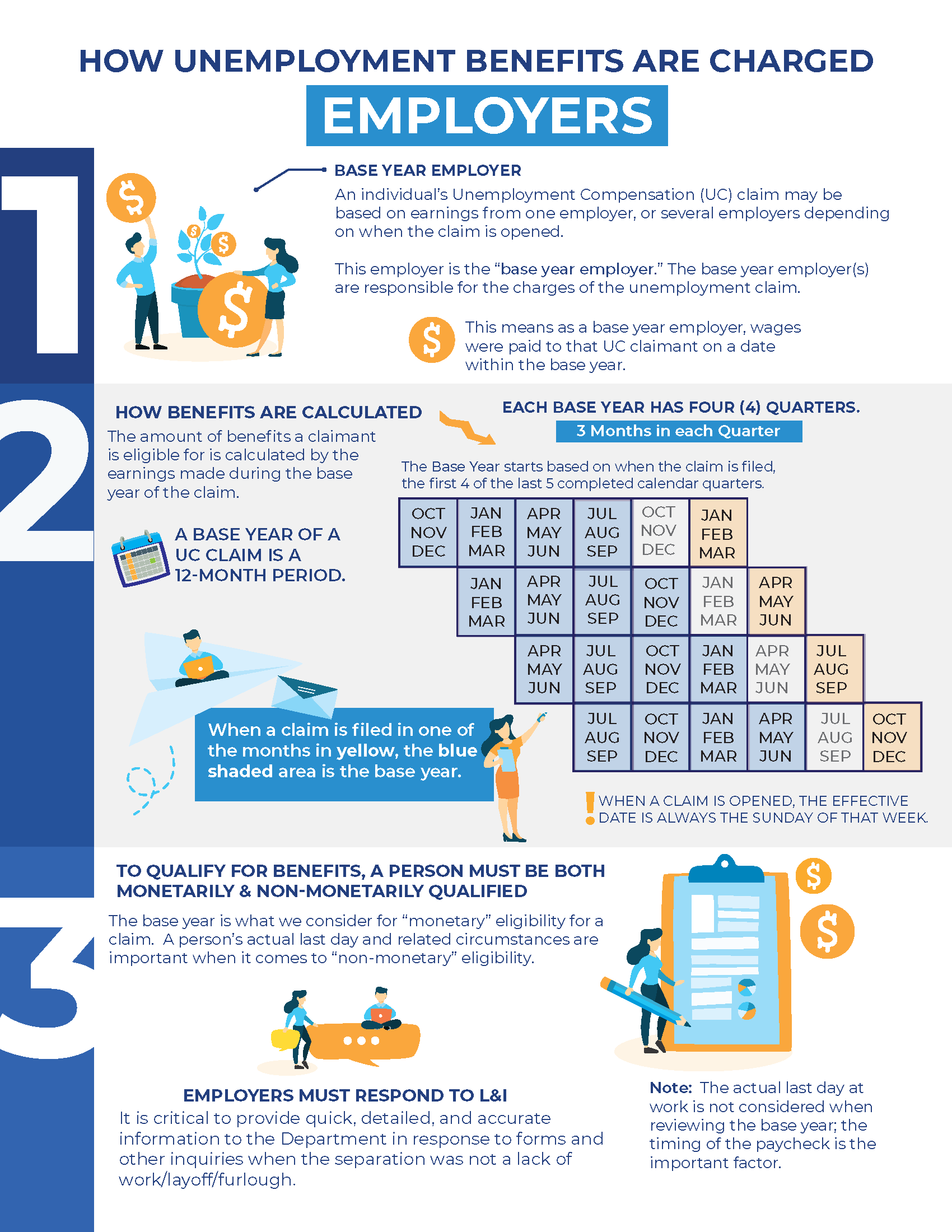

The new employer rate remains at 36890 for non-construction employers and 102238 for construction employers. 1 2022 total tax rates for experienced employers are to range from 12905 to 99333 and are to include a 075 state adjustment factor a 54 solvency surcharge and a 05 additional contributions tax the. Update Account Information eg.

NEW REGISTRATION - To register for employment-search services follow the steps below. The Unemployment Compensation Tax and. If you are not sure if you need to register on the system learn more about the benefits of registering on page.

Click on Unemployment Compensation UC Claimant as the user type. These contributions are used to pay benefits to jobless individuals who meet the claimant eligibility requirements of the UC Law. Pennsylvania Department of Labor Industry Office of Unemployment Compensation website.

Pennsylvania is the same as every other state in this regard. Or you may call us at 833-728-2367 on weekdays from 8 am. Policies are published to aid business partners and contracted resources in maintaining compliance with LI - and the EBR Delivery Center - policies.

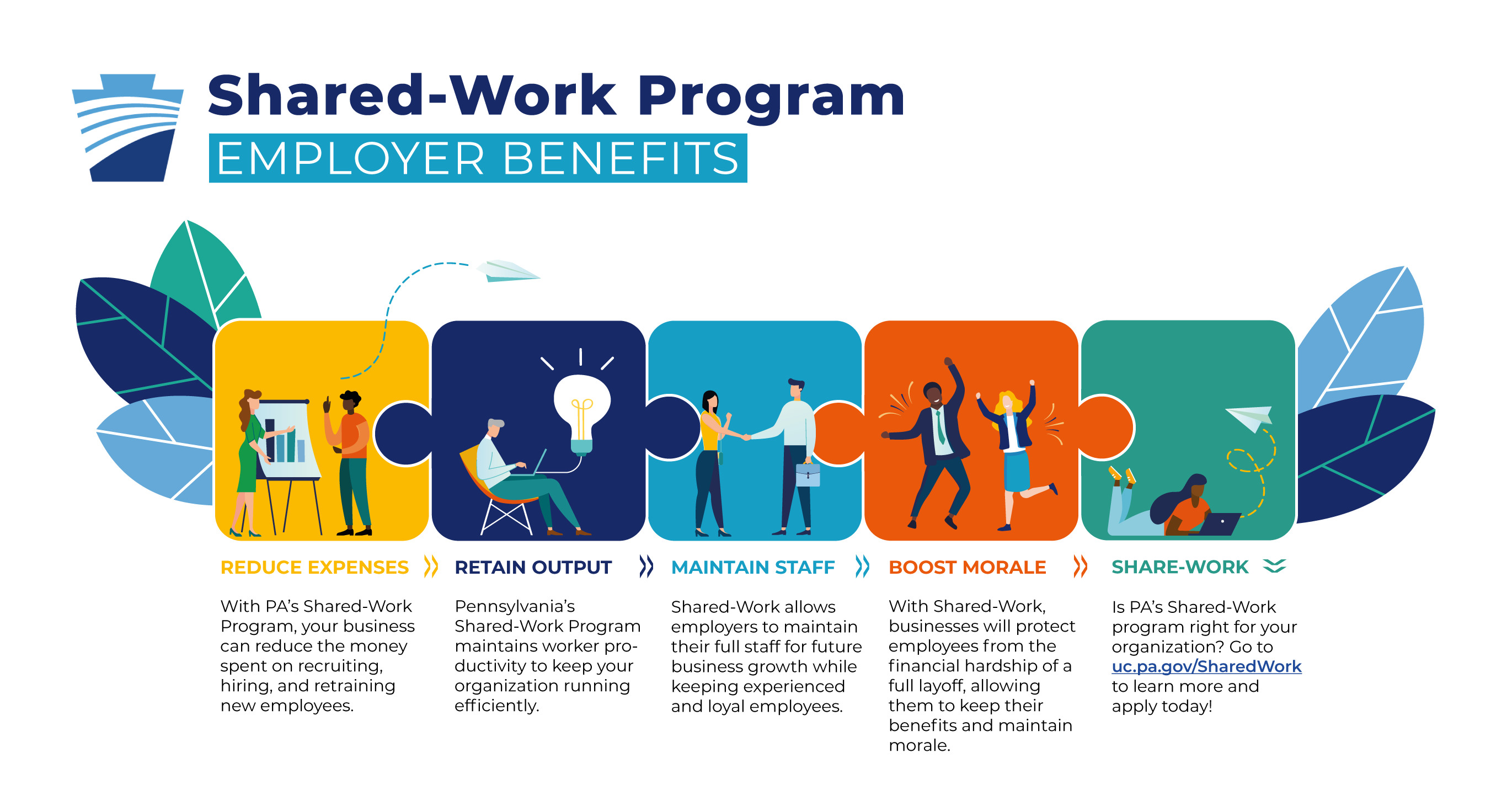

To PA for work you must register for employment-search services through PA CareerLink. Pandemic Unemployment Assistance PUA Login to the PUA system to file a claim or weekly certification. If your employer has reduced the number of hours you can work or shut down completely due to COVID-19 you may be able to file an unemployment claim.

If you would like to become a fully registered user with Pennsylvanias Unemployment Compensation UC Benefits System and have access to all of our online services select one of the following account types. If employment is covered under the Pennsylvania Unemployment Compensation Law Law employers are responsible for UC coverage of their employees. Welcome to Pennsylvanias Unemployment Compensation UC system.

Manage Personal Payment information. To 4 pm Eastern Standard Time. Apply and manage your UC benefits anytime anywhere.

The policies are available here. If your small business has employees working in Pennsylvania youll need to pay Pennsylvania unemployment compensation UC tax. Several of the UC forms are Acrobat files that employers can download and fill in at their computer.

Partial unemployment An individual shall be considered partially unemployed with respect to a week during which he was employed by his regular employer and earned less than his weekly benefit rate plus his partial. The Office of Vocational Rehabilitation provides a wide range of services just for employers. Unemployment Compensation Tax and Employer Services.

In March 2020 Pennsylvania passed legislation requiring employers to give certain information to claimants who are separating from their employment for any reason. Registration Wage Reporting CoverageMultistate Employment Nonprofits Pamphlets Miscellaneous. Administration Application Network Platform Security System Management.

Pennsylvanias unemployment tax rates are not to change for 2022 the state Department of Labor and Industry said Aug. In addition to regular unemployment compensation benefits which provide roughly half of an individuals full-time weekly income up to 572 per week the federal CARES Act expanded UC benefits through several new programs. However political subdivisions and certain nonprofit employers have a choice of two methods of financing this coverage.

In Pennsylvania state UC tax is just one of several taxes that employers must pay. Verify Identity with IDme. If you are employed in Pennsylvania and are unable to work because of COVID-19 you may be eligible for regular unemployment compensation benefits.

The Pennsylvania Unemployment Compensation UC Law requires covered employers to make contributions into a pooled reserve known as the UC Fund. File or Reopen a Claim. These forms can be completed in several easy steps.

Quarterly Tax Reports Submit Amend View and Print Quarterly Tax Reports. UCMS provides employers with an online platform to view andor perform the following. Go to the Pennsylvania CareerLink website at wwwpacareerlinkpagov and click on Register 2.

These policies are broken out into functional areas. Unless otherwise stated Acrobat Reader Version 40 or later provides the best results. The calendar year 2021 employer state unemployment insurance SUI experience tax rates continue to range from 12905 to 99333.

The UC tax funds unemployment compensation programs for eligible employees. Pennsylvanias Unemployment Compensation program administered by the Department of Labor and Industry protects workers during job loss by providing temporary income support to people who become unemployed through no fault of their own. Requiring employers to keep records and make reports and certain employers to pay contributions based on.

The UC Law requires covered employers to make contributions into the UC Trust Fund which acts as a pooled reserve of funding to pay benefits to individuals covered by the UC program. Establishing a system of unemployment compensation to be administered by the Department of Labor and Industry and its existing and newly created agencies with personnel with certain exceptions selected on a civil service basis. File for Weekly UC Benefits.

OVR Services for Employers Business and Industry. Pennsylvania unemployment insurance provides benefit payments for partial wage replacement to workers that have lost their job or have had their hours of work reduced through no fault of their own. The two methods are.

Entry Level Sales Resume Best Of Ten Things You Probably Sales Resume Pharmaceutical Sales Resume Sales Resume Examples

Pin By Dorcas Musyimi On Career In 2021 Resume Templates Modern Resume Template Modern Resume Template Free

Disability Employment Statistics August 2017 Disability Job Seeker Employment Statistics

Research Is Now Showing That Employers Are Now More Willing To Give People Second Chances Criminal Background Check Employment Background Check Criminal Record

How Do Employers View Online Degrees

Marketing Resume Sample Writing Tips Resume Genius Marketing Resume Resume Skills Professional Resume Examples

My Resume Design That Portrays A Fun And Creative Personality Buy The Template For Just 15 Resume Design Template Cv Template Resume Design Creative

Letters Of Intent Benefit Physicians And Employers Letter Of Intent Intentions Printable Letter Templates

0 Post a Comment: