Instead benefits will be reduced in. After 2026 the wage base is permanently adjusted on January 1 of each year to 16 of the state average annual wage rounded up to the nearest 100.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the required amount.

Nys unemployment wage limit 2021. Benefits of this approach include secure online filing immediate data transmittal and confirmation and an online history of your filings. The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the required amount. North Carolina DES 1888737-0259.

The MCTD includes New York City the counties of New York Manhattan Bronx Kings Brooklyn Queens Richmond Staten. Legislation in 2020 held the SUI taxable wage base at 13600 for calendar year 2021 with incremental increases each year thereafter until it reaches 30600 in 2026. The 2022 SUI taxable wage base will be 17000 then 20400 in 2023.

New employers pay 05 of taxable wages if in state plan. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. With this change your benefits will not be reduced for each day you engage in part-time work.

Year 2026 - 13000. State Wage Base Alabama 8000 Alaska 43600. An updated chart of State Taxable Wage Bases for 2018 to 2021 as of April 16 2021 may be downloaded.

Up to 20 weeks of EB Ends 952021 September 6 2021 and later. The state average annual wage is established no later than May 31 of each year. To access the chart from the APA home page select Compliance and then State Unemployment Wage Bases under Overview.

Otherwise experience rating applies. States that have increased their wage bases are highlighted in brown. Year 2025 - 12800.

This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. Year 2022 - 12000. The EB program fully ended on September 5 2021.

014 daily 060 weekly 120 biweekly 130 semi-monthly 260 monthly. New York DOL 1888581-5812. Year 2024 - 12500.

For each year thereafter the SUI taxable wage base will be computed as 16 of the states average annual wage. For each year thereafter computed as 16 of the states average annual wage. The maximum amount the wage base can be is 12000.

Year 2021 - 11800. Withholding Wage Reporting and Unemployment Insurance Return as well as submit payment via ACH debit on our website. If the balance is lower the wage base increases.

States who havent released their SUI wage base limits for 2021 are bolded in black. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. New York The taxable wage base will continue to increase as follows.

North Dakota DOL 701 328-4995. Calendar quarter if they are required to withhold New York State income tax from wages paid to employees and their payroll expense for all covered employees is more than 312500 for that calendar quarter. 26 weeks of regular UI.

For more information see APAs Guide to State Payroll Laws Table 82 Unemployment Insurance Taxable Wage Bases Contribution Rates and Experience Rating. For 2021 it was supposed to be 11100 but remains 10800 unchanged from 2020. Subsequently former Governor Cuomo signed legislation that further ensured the relief to employers of UI.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. The UI wage base. For 2021 the wage base was 10000.

Taxable wage base to increase. The 2021 SUI taxable wage base increased to 9500 for all employers up from the 9000 that had been in effect for the past several years for non-delinquent employers 9500 was assigned to delinquent employers. The number of available weeks of EB was dependent upon New York States unemployment rate.

And 27200 in 2025. Ohio Department of Job and Family Services 1877644-6562. Year 2023 - 12300.

It was 7000 in 2020. Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. This form is sent in late.

States that have decreased their wage bases are highlighted in blue. 56 rows 2020 legislation SB 20-207 sets the SUI taxable wage base at 13600. Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates.

On January 14 2021 New York State Department of Labor Commissioner Roberta Reardon ordered that employers UI accounts will not be charged for unemployment insurance UI benefits paid during much of the COVID-19 pandemic. From August 9 2021 through September 5 2021 this program was available for a maximum of 13 weeks. The following are the 2021 state unemployment insurance SUI wage base limits.

The 2021 SUI taxable wage base increased to 11800 up from 11600 for 2020. The UI wage base will adjust January 1 of each year as follows. 151900 39800 for employers Paid family medical leave.

The new law stops any further increase in the unemployment taxable wage base in 2022. The wage base fluctuates with the balance in the states unemployment trust fund. The SUI taxable wage base will continue to increase over the next several years until it reaches 13000 in 2026.

FUTA Tax Rates and Taxable Wage Base Limit for 2021. The first 7000 for each employee will be the taxable wage base limit for FUTA. The states use various formulas for determining the taxable wage base with a few tying theirs by law to the FUTA wage base.

Balance of costs over employee contributions necessary to provide. NYS-45 Web File accepts wage reporting data for up to 1000 employees. Year 2013 and prior 8500 January 2014 10300 January 2015 10500 January 2016 10700 January 2017 10900 January 2018 11100 January 2019 11400 January 2020 11600.

Pandemic Unemployment Benefits End What S Coming This Week The New York Times

Unemployment Benefits Comparison By State Fileunemployment Org

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

Why Am I Getting Only 182 A Week Homeunemployed Com

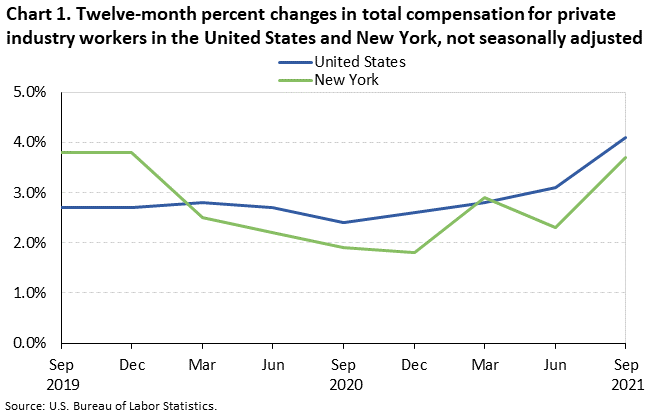

Changing Compensation Costs In The New York Metropolitan Area September 2021 New York New Jersey Information Office U S Bureau Of Labor Statistics

New York Unemployment Benefits Eligibility Claims

Nys 45 Quarterly Reporting Department Of Labor

Heads Up New York Here Are The 2021 Minimum Wage And Overtime Salary Threshold Increases

Unemployment Insurance Rate Information Department Of Labor

Heads Up New York Here Are The 2021 Minimum Wage And Overtime Salary Threshold Increases

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

Ny Preparing The Nys 45 Upload File Cwu

Solved Unemployment Taxable Wage Base

0 Post a Comment: