Arkansas and Maryland will not charge state taxes on unemployment benefits received in tax year 2021. Additionally there are a few states however where unemployment benefits are tax-exempt California Montana New Jersey Pennsylvania and Virginia.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Unemployment benefits are not taxable for New Jersey.

Ny unemployment taxable in nj. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on. Your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents.

If they do it does not matter whether they reside in New York. California Montana New Jersey Pennsylvania and Virginia do not charge taxes on unemployment benefits. To help offset your future tax liability you may voluntarily choose to have 10 of your weekly Unemployment Insurance benefits withheld and sent to the Internal Revenue Service IRS.

Your employer will have withheld New York state taxes throughout the year but youll need to file in New Jersey as well. Are unemployment or disability payments taxable for New Jersey gross income tax purposes. NJ tax attorney not your attorney.

Here an employee relocates from New york unemployment taxable limit of 10500 to New Jersey unemployment taxable limit of 32000. The statute is a poorly written stub but I have seen cases like this before. Report the same amount on your New York.

The following are the 2021 state unemployment insurance SUI wage base limits. How To Get My W2 From Unemployment Nj. Those who received unemployment benefits for some or all of the year will need a 1099-G form.

Unemployment benefits are reported to the state where you live not to the state you got them from unless you still live there. That was the bad news -- it is now time for some good news. No you dont need to file a NY state tax return just because you received unemployment benefits from NY.

There are several that do not though. That means someone living out of state can claim UI benefits in New York. NJ does not tax any unemployment insurance benefits period.

Unemployment compensation is not subject to New Jersey gross income tax and should not be included on the. New York State offers unemployment insurance benefits to qualified workers who have worked in the state during the prior 18 months and who meet certain criteria. Nothing in the statutes implies that this exemption is limited to NJ unemployment benefits and no regulations exist that cover it.

However Unemployment compensation is taxed by New York State. Yes the extra 600 that the unemployed can receive as part of the expanded federal benefits is taxed by the federal government. No New Jersey does not collect taxes on money paid out from unemployment benefits.

No - If you are a resident of NY but receive NJ unemployment income this unemployment is not taxable in NJ. New Jersey residents who work in New York State must file a New York Nonresident Income Tax return Form IT-203 as well as a New Jersey Resident Income Tax Return Form NJ-1040. If youre a business owner or HR manager in New York New Jersey or Connecticut its important to know the state unemployment laws how they impact your benefits programs and whether you have a basis for denying any unreasonable claims.

Max unemployment taxable Limit of New York is 10500. New Mexico 31921 - New Mexico follows the federal treatment of unemployment insurance benefits including the. New Jersey joins California Virginia Montana Oregon and Pennsylvania as states that dont place taxes on unemployment benefits even though they have state income taxes.

Many states tax unemployment benefits too. It may not be just the IRS you have to worry about. 33121 - Unemployment including unemployment received under the COVID-19 relief is not taxable income and should not be reported on your NJ income tax return.

Max unemployment taxable Limit of New jersey is 32000. The unemployment base for the employee will increase from 36200 to 39800 while the rate will remain the same at 425. Michigan Unemployment Trust Fund has fallen below the required threshold.

The employer rate for these taxes is determined by the State and sent in a notice in July. You will not owe state income taxes on your New Jersey unemployment income for 2020. Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020.

If NY withheld NY state income tax from your NY unemployment and you didnt have any other taxable income you. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021. The 2021 taxable wage base for employers in the highest SUI tax rate group is 26100.

Home Latest Industry News Unemployment Laws in NY NJ and CT What you Need to Know. NJ Unemployment and Disability. For 2022 the employer base for unemployment and disability increases from 36200 to 39800.

New York residents unfortunately are subject to state income taxes on unemployment compensation.

How Non Profits Can Avoid Paying State Unemployment Tax

Unemployment And Withholding Taxes Homeunemployed Com

Solved Remove These Wages I Work In New York Ny And

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

Live In Nj And Work In Nyc Where Do I Pay Taxes Streeteasy

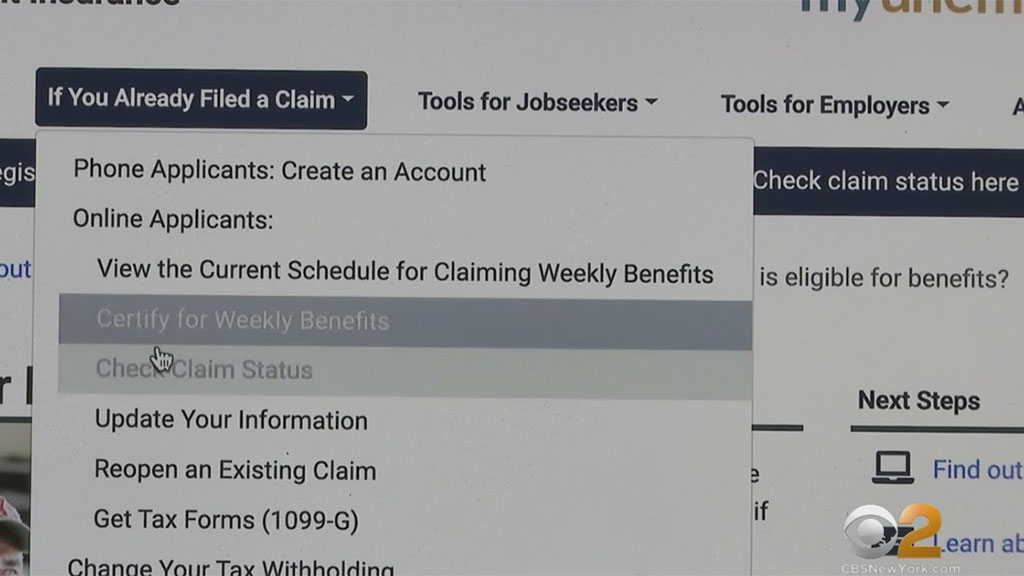

New Jersey Residents Not Counting On Payments From Possible New Unemployment Extension If I Didn T Get The First One How Am I Gonna Get The Second One Cbs New York

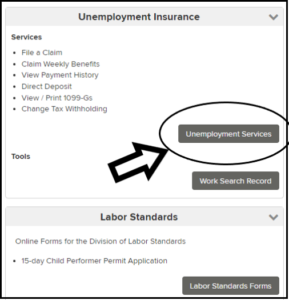

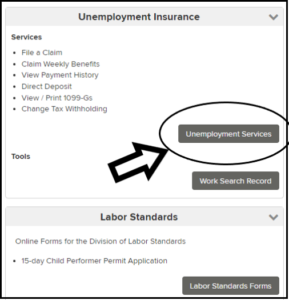

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

If I Work In Ny But Live In Nj Do I Pay Taxes In Both States

Update The Extended New York State Department Of Labor Facebook

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

![]()

New York Unemployment Tips Hotel Trades Council En

New Jersey Nj Tax Rate H R Block

0 Post a Comment: