Detroit issues correction to estimated income tax payment dates. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

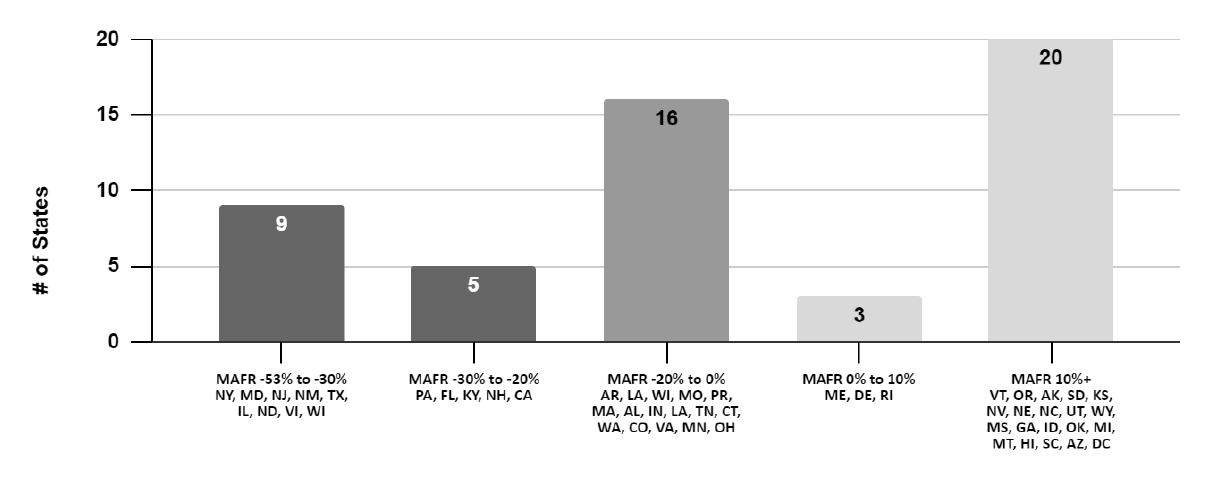

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Your Michigan tax liability has the potential to increase over prior years when the taxable wage base was 9000 due to the current years increase.

Michigan unemployment tax rate 2021. 52 rows For example all new employers receive a SUTA rate of 125 in. It is 100 percent employer financed through state and federal UI taxes. Contributing employers must pay taxes on the first 9500 of each employees wages in the 2021 calendar year.

425 Personal Exemption Amount. For further clarification of the term employee see the IRS Publication 15 Employers Tax Guide Circular E. Notification of State Unemployment Tax Rate.

Previously Michigans experienced a 20-year low of 38 unemployment in February 2020 ranking 32nd among all states. As a result the Obligation Assessment OA added to employer SUI tax rates since 2012. The exception is for new employers in the construction industry whose rate for the first two years is the average construction contractor rate as determined by the Unemployment Insurance Agency each year.

The Michigan income tax has one tax bracket with a maximum marginal income tax of 425 as of 2022. It shows an employers prior Actual Reserve benefits charged and contributions paid basis of the CBC and ABC components since the last annual determination and the employers new Actual Reserve. The increase to the 2021 SUI taxable wage base up from 9000 in 2020 was confirmed by the Michigan Unemployment Insurance Agency UIA.

² Experienced Nebraska and Rhode Island employers that are assessed the maximum unemployment tax rate are assigned a higher wage base. Unemployment Income Rules for Tax Year 2021. Consequently the employer SUI taxable wage base will increase to 9500 for 2021 unless the state legislature reintroduces and enacts similar legislation during the 20212022 legislative session.

Form UIA 1771 Tax Rate Determination for Calendar Year. How does the taxable wage base affect my organizations unemployment tax liability. 4900 2021 Michigan Income Tax Withholding Guide method and the result of the services.

Maximum Social Security tax withheld from wages is 885360 in 2021. Of Treasury has announced that effective for the period April 1 2021 through April 30 2021 the prepaid sales tax rate for the purchase of gasoline will increase to 0129 per gallon from the March 2021 rate of 0115 per gallon. Early each year the UI issues its Tax Rate Determination for Calendar Year 20__ Form UIA 1771.

A 09 additional Medicare tax must be withheld from an individuals wages. Michigan pending legislation would hold the SUI taxable wage base at 9000 for calendar year 2021. State unemployment tax assessment SUTA is based on a percentage of the taxable wages an employer pays.

For Medicare the rate remains unchanged at 145 for both employers and employees. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Compensation The term compensation as used in this guide covers all types.

Additional Med icare Tax. Michigan Governor Gretchen Whitmer announced that Michigan employers will see a state unemployment insurance SUI tax rate reduction for 2020 thanks to the early payoff of the bonds used by the Michigan Unemployment Insurance Agency UIA to repay their federal SUI loan. Recently introduced HB 6136 would if enacted provide that the Michigan state unemployment insurance SUI taxable wage base would remain at 9000 for calendar year 2021 rather than increase to 9500 due to a decrease in the states UI trust fund.

Generally in the first two years of a businesss liability the tax rate is set by law at 27 except for employers in the construction industry whose rate in the first two years is that of the average employer in the construction industry which is announced by UIA early each year. Michigans Unemployment Insurance UI Trust Fund is quickly losing money which is likely to have tax implications for employers in 2021. In 2021 unemployment tax rates ranged from 071 to 964 for experience-rated employers.

Tax Rates Generally in the first two years of liability the tax rate is set by Michigan law at 27. The UI Trust Fund is the fund that the state uses to pay UI benefits to unemployed workers. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year.

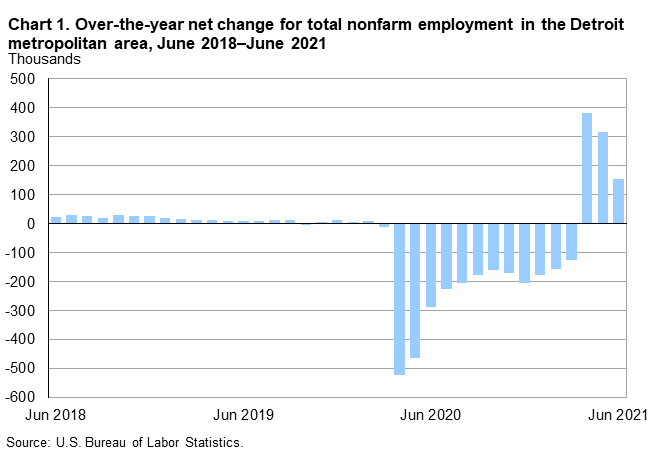

In August 2021 Michigan unemployment rate registered at 47 after a peak in April of 236. The Michigan 2021 state unemployment insurance SUI tax rates continue to range from 006 to 103. New employers except for certain employers in the construction industry pay at 27.

The tax rate is 620 for both employ-ers and employees. Michigan SUI taxable wage base expected to increase for 2021 due to COVID-19s depletion of UI trust fund Michigan employers should expect to see an increase in the state unemployment insurance SUI taxable wage base from the 9000 that has been in effect for the past several years to the 9500 currently only required to be used by delinquent employers. Detailed Michigan state income tax rates and brackets are available on this page.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. For experience-rated employers tax rates will range from 075 to 441 for those with a positive-rating and from 568 to 1039 for those with a negative-rating. 2021 STATE WAGE BASES 2020 STATE WAGE BASES 2019 STATE WAGE BASES.

The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. Business owners across Michigan are getting hit with a surprise tax increase in 2021 after a surge in unemployment claims during the COVID-19 pandemic depleted the states unemployment trust fund.

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

Labor And Economic Opportunity December 2021

Missed Gov Whitmer S Press Conference Here S Her Update On The State S Response To Covid 19 Cbs Detroit

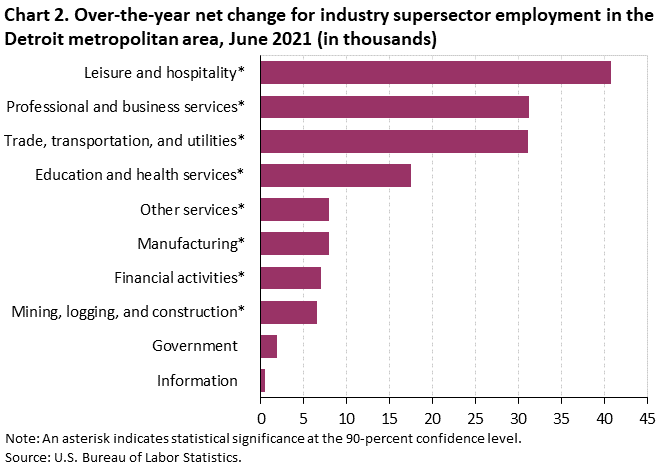

Detroit Area Employment June 2021 Midwest Information Office U S Bureau Of Labor Statistics

Michigan Paid 8 5b In Fraudulent Covid Unemployment Claims

Labor And Economic Opportunity December 2021

Money Monday How To Get Taxes Back On Michigan Unemployment Payments

Detroit Economy Drawing Detroit

Unemployment Benefits Comparison By State Fileunemployment Org

Labor And Economic Opportunity December 2021

Detroit Area Employment June 2021 Midwest Information Office U S Bureau Of Labor Statistics

Unemployment Is Down But Michigan S Shrinking Labor Force Is Still A Problem Citizens Research Council Of Michigan

Labor And Economic Opportunity December 2021

0 Post a Comment: