You may claim the subtraction on your 2020 and 2021 Maryland State Tax Return. For a more detailed description of these services select the Services button from our menu.

Maryland Unemployment Insurance Beacon One Stop Account Activation And Login Youtube

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

Md unemployment tax. Enter the number of individuals including corporate officers to whom you have paid wages or to whom you anticipate paying wages. The 2021 rate range is 220 to 1350 up from the former range of 03 to 75. Unemployment tax rates are to be lower for 2022 and 2023 than in 2021.

Any questions about unemployment insurance benefit taxes need to be directed to. Marylands unemployment tax rates for 2022 and 2023 are to be lower than those in effect for 2021 under a measure signed April 13 by Gov. For questions about the Unemployment Insurance Income Tax Subtraction please contact the Comptrollers Taxpayer Services Division at.

You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000. Under this order an employers 2021 tax rate will be calculated based on their non-pandemic experience by excluding the 2020 fiscal year and instead by. The Internal Revenue Service IRS has started issuing tax refunds to those who received unemployment benefits in 2020 with around 15.

New employers will have a New Employer Rate of 260. We are releasing a new unemployment insurance IT System BEACON 20 for employers on Monday September 21 2020. 1 unemployment tax rates for experienced employers are determined with Table C and range from 1 to 105 the department said on.

2022 Comptroller of Maryland. Chesapeake Financial Advisors is a fee-only financial planning investment advisory and tax planning firm with offices in Towson Columbia and Frederick Maryland. Maryland Unemployment Insurance Quarterly Employment Report 181818 Valid reasons for not entering wages on this page follow.

This tax relief effort will result in a 400 million savings for unemployed workers. You can get ahead of the rush by activating your employer account now at httpsemployerbeaconlabormdgov. For questions about the Unemployment Grants please contact the Maryland Department of Labor.

Unemployment Income Rules for Tax Year 2021. Wage Base and Tax Rates. As noted employers tax rates for 2021 will be based on Table F the states highest rate table.

Any questions about unemployment insurance benefit taxes need to be directed to. Form 1099-G Statement for Recipients of Certain Government Payments is issued to any individual who received Maryland Unemployment Insurance UI benefits for the prior calendar year. In addition to regular tax there is also a special non-resident tax of 175 imposed by the State of MD increasing taxes for non.

For disclaimer please follow our link below. Monday through Friday excluding state holidays Dial 410-260-7980 or 1-800-MD TAXES outside of central Maryland. Income Tax 1099G Information - Unemployment Insurance.

In recent years Maryland has required UI taxes on the first 8500 of each employees wages. COVID-19 Important Information COVID-19 Tax Alert. This tax relief effort will result in a 400 million savings for unemployed workers.

Logically I dont think that non-residents should be penalized and pay MD tax on unemployment benefits. The 1099-G reflects Maryland UI benefit payment amounts that were issued within that calendar year. 410 876-2700 or 410 848-2478 Fax.

You will be able to upload quarterly wage reports and make payments in BEACON 20 starting on Monday September 21 2020. Keep in mind this is the only payroll tax that can be reduced. Comptrollers Taxpayer Services Division at taxhelpmarylandtaxesgov or via phone at 1-833-345-0787.

Federal funds are to be used to increase the solvency of the state unemployment trust fund. Box 2033 Westminster Maryland 21158. Marylands unemployment tax rates for 2022 are determined with a lower tax rate schedule than used for 2021 the state Department of Labor said Jan.

To login to your account enter your username and password below and select Login. No wages were paid to employees this quarter and you choose to file this paper report instead of filing your no wage report by telephone or 2. Enter the date you first paid or anticipate paying wages to individuals including corporate officers.

The range of tax rates will be from 220 to 1350. Unemployment Tax Service Inc. Welcome to the Maryland Department of Labor Unemployment Portal.

Unemployment tax relief for small businesses On December 10 Governor Hogan issued an executive order to prevent small businesses from facing major increases in their unemployment taxes. What if I have more questions. Beginning February 1 and continuing through April 18 2022 the Comptroller of Maryland is extending telephone assistance hours Taxpayer assistance will be available from 830 am.

They work and pay taxes to the State of MD and should be eligible to receive the same benefits as residents. April 14 2021 536 PM. MD Unemployment Tax Rates Have Increased For 2021.

Questions about your Tax Return and Unemployment Benefits. 2021 Maryland UI Tax Liability. The UI tax rate for new employers is also subject to.

Comptrollers Taxpayer Services Division at taxhelpmarylandtaxesgov or via phone at 1-833-345-0787. You choose to file this paper report and your wages are reported on. Due to the COVID-19 pandemic the Division of Unemployment Insurance has increased the range of unemployment tax rates for contributory employers for 2021.

However that amount known as the taxable wage base could change.

Revised Maryland Individual Tax Forms Are Ready

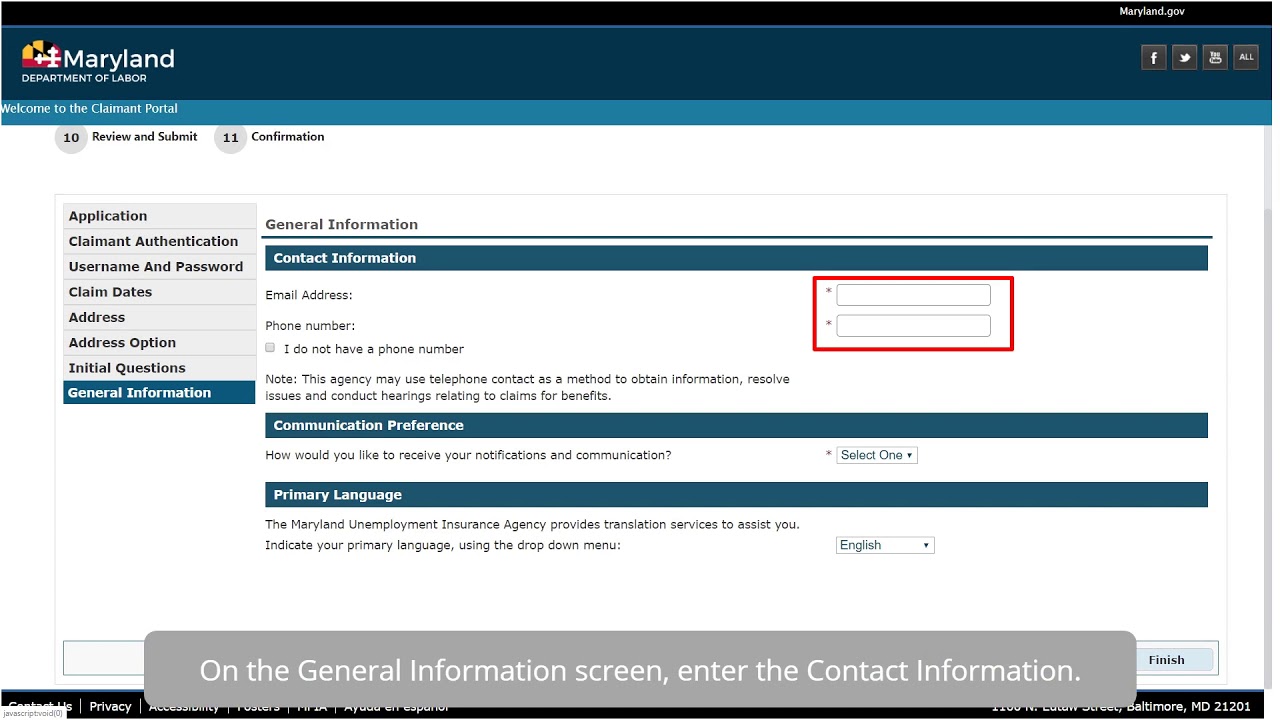

Maryland Unemployment Insurance Beacon Claimant Application Youtube

Maryland Unemployment Insurance Beacon Account Registration Youtube

Maryland Unemployment Insurance Beacon One Stop Overview Of Claimant Portal Youtube

Maryland Md Unemployment Benefits News And Updates On Early End To 2021 Extensions Of 300 Weekly Stimulus Pua Peuc And Eb Programs Aving To Invest

Data Show Maryland Among Slowest States For Unemployment Benefits Maryland Matters

Maryland Unemployment Insurance Beacon One Stop Viewing Correspondence Youtube

![]()

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

While Battle Over Unemployment Benefits Continues In Md Courts Jobless Are Terrified Wtop News

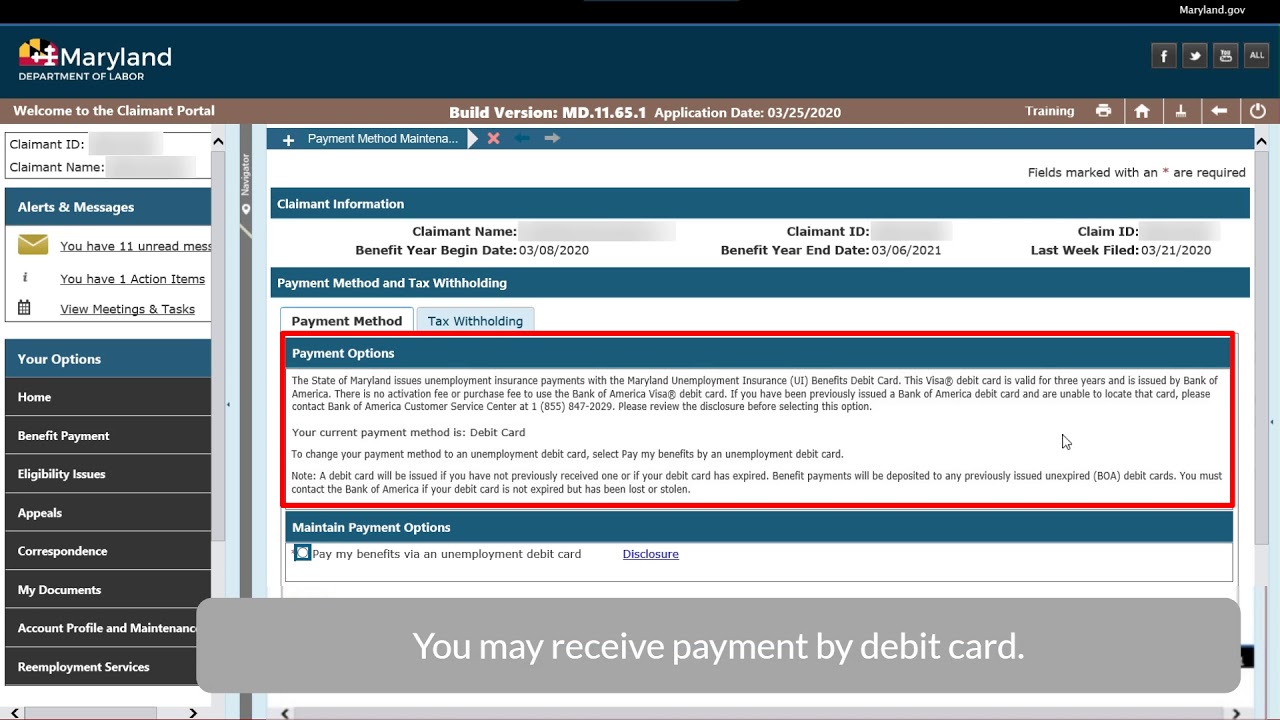

Maryland Unemployment Insurance Beacon Payment And Withholding Information Youtube

11 Tv Hill Unemployment Fraud Issues Persist In Maryland

Md Unemployment Tax Rates Have Increased For 2021 Bormel Grice Huyett P A

0 Post a Comment: