Number of claimants drawing the final payment of their original entitlement for a. If you do not meet your states eligibility requirements you cannot collect unemployment insurance benefits.

Offline Transition Information

Unemployment Benefits and COVID-19.

What is a pa unemployment insurance claim. If you qualify you will receive money for a limited time to help you meet expenses while you seek new employment. Once you have learned who qualifies for unemployment insurance in Pennsylvania you will be able to submit an application to the Office of Unemployment Compensation and have your. To enroll in the Pennsylvania Unemployment Insurance UI program former state workers must file a PA unemployment claim through the Office of Unemployment Compensation OUC of the Department of Labor and Industry.

The wages you earn during your base period determine whether you are eligible to collect unemployment insurance benefits. Extended Unemployment Benefits are obtainable to workers who have worn out regular unemployment insurance benefits all through periods of high unemployment. Online filing for Unemployment Extension Benefits can now be lengthened throughout 2012 via web at Unemployment-ExtensionOrg with Pennsylvania as the state to receive benefits for a full 99.

To enroll in the Pennsylvania Unemployment Insurance UI program former state workers must file a PA unemployment claim through the Office of Unemployment Compensation OUC of the Department of Labor and Industry. The UIF is a fund created to lighten the effects of unemployment for a short period of time. Other important employer taxes not covered here include federal unemployment insurance UI tax and state and federal withholding taxes.

If you are working less than your full-time hours. In order to claim unemployment benefits in Pennsylvania state workers must meet the PA qualifications for unemployment. PAULA virtual assistant general questions.

While employers cannot necessarily avoid paying the tax for unemployment insurance they can reduce the rate of tax that they have to pay by reducing the number of claims filed against them and the number of benefits paid out on those claims. Unemployment insurance is a temporary source of income. Unemployment Insurance is an unavoidable cost that almost every employer is forced to endure.

Unemployment insurance is a combined federal and state program that provides cash benefits to eligible workers that are unemployed through no fault of their own. It can be difficult to get through to the unemployment office to get help with your questions or resolve issues with your claims. Weve made progress in meeting this unprecedented demand for unemployment benefits in Pennsylvania but.

A determination of eligibility based on wages earned by the claimant in the base period. Unemployment insurance is federal money provided to those recently laid off. An initial claim application filed in an attempt to establish a benefit year and eligibility for unemployment insurance benefits.

The minimum wages needed to qualify for UI in Pennsylvania is 800 for high quarter and 1320 for base period. Ucpagov Regular UC and related claim types. The UC tax funds unemployment compensation programs for eligible employees.

If an eligible person loses his job he will be able to receive weekly payments thanks to money that was paid to his unemployment fund by his employer via payroll taxes while he was still gainfully employed. PA residents who have become unemployed through no fault of their own must meet unemployment insurance eligibility requirements in order to apply for unemployment benefits. Unemployment insurance UI also called unemployment benefits is a type of state-provided insurance that pays money to individuals on a weekly basis when they lose their job and meet certain.

The Unemployment Compensation UC program provides temporary income support if you. That means those who quit a job voluntarily or are fired for cause are typically ineligible. Manage PUA Claim Telephone Self-Service.

Pennsylvania residents looking to access the states new Unemployment Compensation UC system will need to use a personal identification code known as their Keystone ID to do so. The qualifying formula for wages and employment used by Pennsylvania is 16 credit weeks and at least 20 BPW Base period wage out of HQ High quarter. When filing a new claim for unemployment insurance benefits you must have earned the minimum amount required.

Extended benefits are additional weeks of unemployment compensation that are available to workers who have exhausted regular unemployment insurance benefits during periods of high unemployment. Lose your job through no fault of your own or. If eligible a person can receive unemployment insurance once all of the proper.

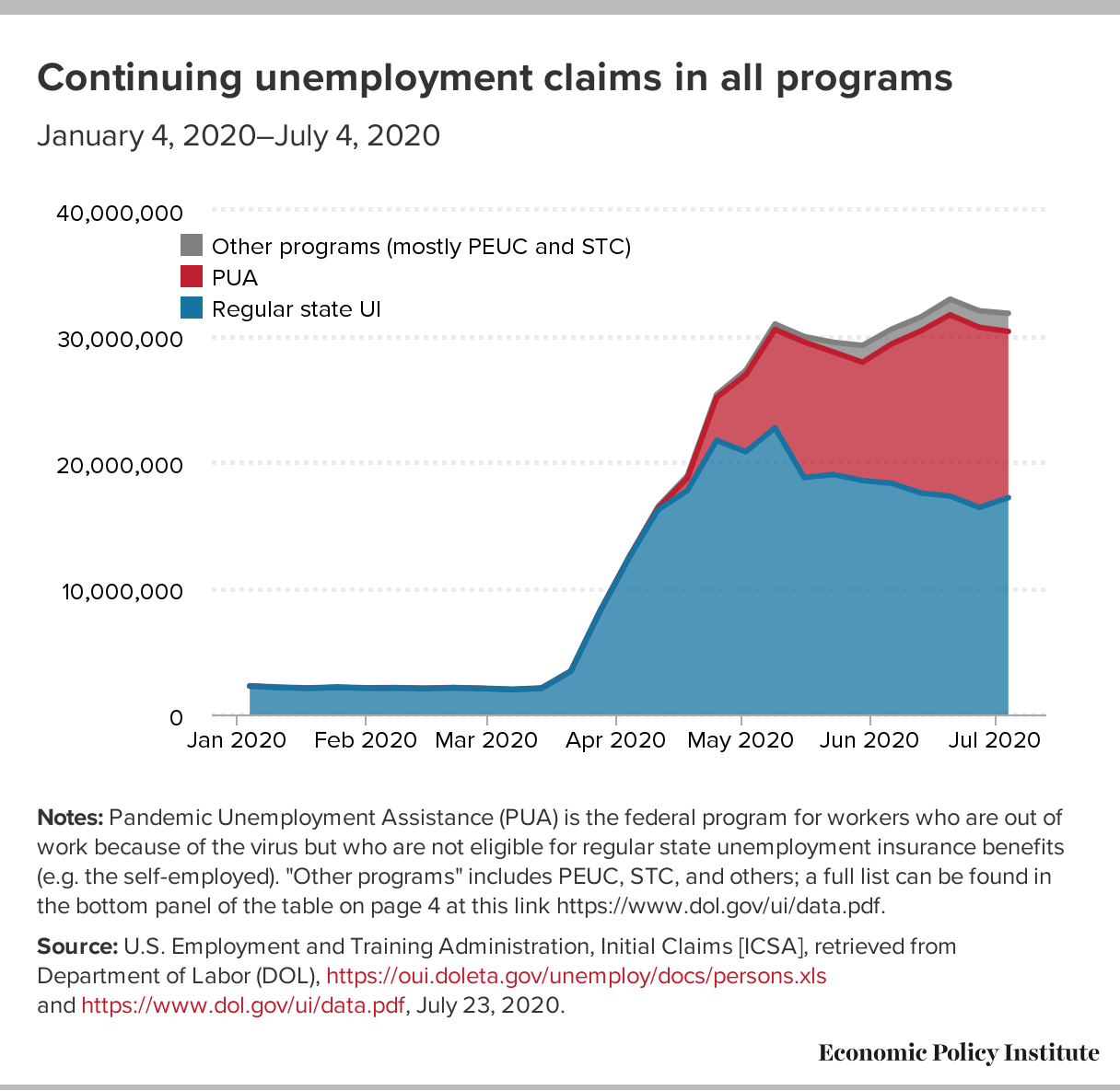

In Pennsylvania we typically use the term Unemployment Compensation whereas at the federal level and in most other states they use the term Unemployment Insurance What are exhaustions. Being unemployed is stressful and sometimes the unemployment benefits process can add to that stress. As a result of the COVID-19 pandemic a historic surge of people are seeking unemployment compensation.

In Pennsylvania state UC tax is just one of several taxes that employers must pay. An employer and hisher employee must each contribute 1 of the employees salary to the UIF monthly contributions in exchange for unemployment insurance benefit payments benefits. Both laid-off employees and gig workers who have lost income during the pandemic can qualify.

In order to claim unemployment benefits in Pennsylvania state workers must meet the PA qualifications for unemployment. It also reflects the maximum benefit amount duration and weekly benefit amount. The basic Extended Benefits EB program provides up to 13 additional weeks of unemployment compensation when a state is experiencing high.

It is the employers responsibility to register an. With so many Pittsburghers and Pennsylvanians out of work during the pandemic Pittsburgh City Paper has some helpful advice for people applying for unemployment claims.

Pennsylvania How Unemployment Payments Are Considered

Joblessness Remains At Historic Levels And There Is No Evidence Ui Is Disincentivizing Work Congress Must Extend The Extra 600 In Ui Benefits Economic Policy Institute

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Pandemic Unemployment Assistance Is Accepting Claims For Self Employed Workers Senator Vincent Hughes

54 999 Unemployment Photos Free Royalty Free Stock Photos From Dreamstime

A Detailed Guide To Unemployment Insurance Compliance Emptech Com

Pa Residents Can Now File For Unemployment Benefits By Phone Pahomepage Com

Pennsylvania How Unemployment Payments Are Considered

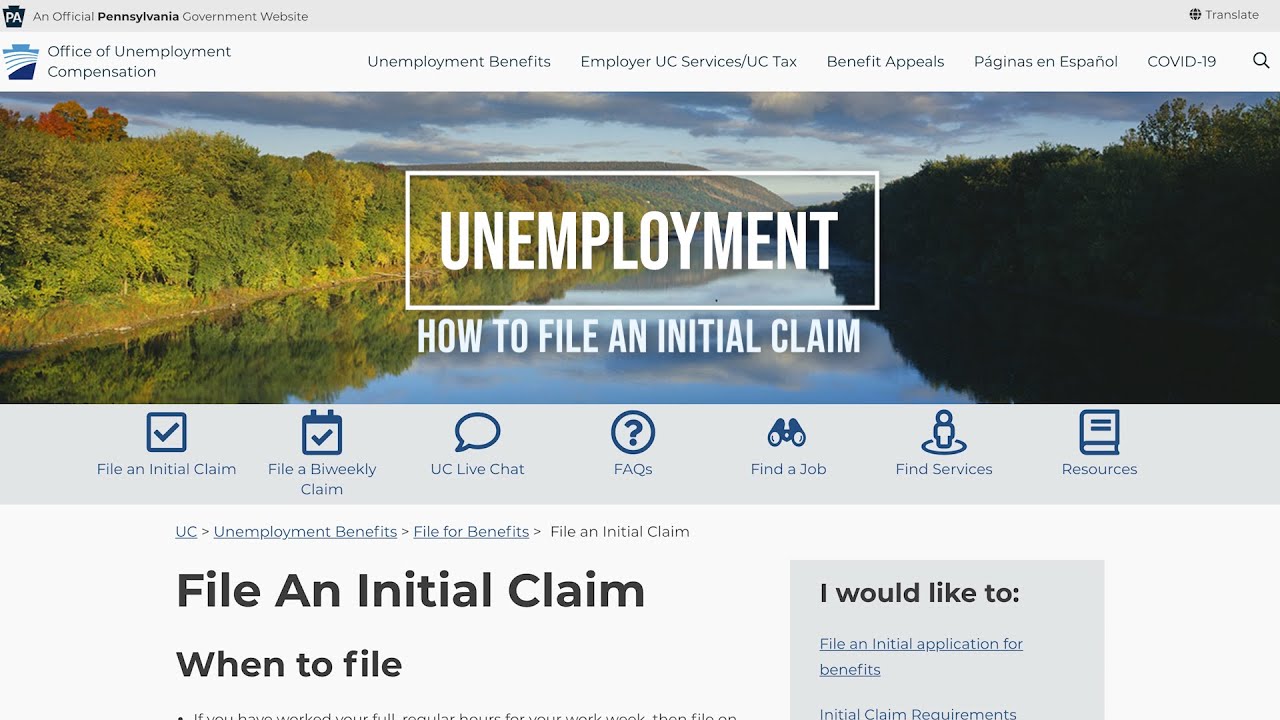

How To File An Unemployment Claim In Pa During The Coronavirus Outbreak Youtube

0 Post a Comment: