Clarifying Information - WAC 388-450-0080 Determining Self Employment SE Income. Many self-employed residents in Washington state have seen their business dry up due to the coronavirus shutdown but so far most have had far more trouble receiving unemployment benefits than.

Washington Employment Security Department Posts Facebook

What unemployment benefits are available for self employed.

Wa unemployment benefits for self employed. The Washington Employment Security Department ESD is implementing the PUA program to provide unemployment assistance for independent contractors and self-employed workers in Washington State. Continuing Unemployment Service Information. Our agency is committed to supporting claimants through benefits and workforce development opportunities for re-employment.

Unemployment benefits are a target for scammers. To be eligible for the Self-Employment Assistance Program SEAP you must. WA state unemployment benefits insurance self employed closed business eligible for unemployment benefits I left a company I worked for in July 2007 since its business was deteriorating and I feared future layoff.

The relief package included an extension of pandemic unemployment benefits for self-employed workers contractors and gig workers. OLYMPIA - Disaster unemployment benefits are now available to workers and self-employed individuals who lost their jobs or had their work hours substantially reduced as a result of the State. Be identified as likely to run out of benefits or be eligible for Commissioner-Approved Training CAT.

However a delay between the vote in Congress and the presidents. SEATTLE In response to the coronavirus pandemic federal lawmakers extended unemployment benefits to the self-employed gig workers and independent. Traditionally self-employed professionals are ineligible for unemployment benefits because they generally do not make contributions to the unemployment taxes that these benefits come from.

The 2011 Self-Employment Assistance Program Legislative Report was prepared in accordance with the Revised Code of Washington section 5020250. When in doubt go directly to esdwagov and click the sign-in links. Unemployment benefits are now available for Washingtonians who have lost work because of the COVID-19 crisisincluding freelancers independent contractors and other self-employed workers.

How to apply for self employed unemployment washington state. Self-employed individuals may enter self-employed for the last employers name and include hisher own address and contact information in lieu of the last employers address and contact information Step 4. To help explain accessing your unemployment benefits we have created a quick guide.

Federal programs ended the Law Cares and other federal programs that expanded and extended unemployment benefits expired next September 4 2021ã visit the Covid-19 to obtain more information In Spain ol Have job search activities work. Washington Unemployment Benefits During COVID-19. The available unemployment benefits are and insurance programs.

Unemployment Benefits for Self-Employed. Pandemic Unemployment Assistance was a federal program that was part of the Coronavirus Aid Relief and Economic Security CARES Act that provided extended eligibility for individuals who have traditionally been ineligible for Unemployment Insurance benefits eg self-employed workers independent contractors. They want to steal your username or password to take control of your claim by pretending to be ESD and sending you links to sign in on fake web pages that look real.

1024 PM PDT April 2 2020. Self-Employment Assistance Program Report The purpose of the Self-Employment Assistance Program SEAP is to assist eligible unemployed individuals in creating new businesses and job opportunities across Washington state. Washington States Employment Security Department ESD will be updating its system today Saturday April 18 2020 and when service resumes if you are self-employed.

As the world economy has come to an unprecedented sudden and grinding halt due to COVID-19 millions of men and women across the country have found themselves out of a job scrambling to make ends meet. Unemployment insurance is one of the benefits that is often cited as unavailable to freelancers and independent contractors. Of course to be eligible for benefits you may have to pay unemployment taxes which some independent.

In order for an individual to be eligible either you or an employer had to make contributions in the past 5 to 18 months. The information in this FAQ document is accurate as of the date of this document and will be modified as additional program guidance is. It is possible that if you are self-employed that you did not make unemployment insurance payments and are therefore.

From NerdWallet Advisor Voices offers a way for self-employed workers to be able to collect unemployment insurance if business tapers off. Disaster unemployment benefits authorized for SR-530 landslide. Child day-care center operators and family home day-care providers are self-employed.

In the 2015 Self-Employment Assistance Program Net impact Study Legislative Report we analyze the effects of SEAP training on participants self-employment wage and unemployment benefits. If youre a self-employed worker whos lost income in this crisis you may now qualify for unemployment. Qualify for regular unemployment benefits.

Unemployment insurance UI claimants identified as likely to exhaust their regular unemployment benefits are notified of. Enroll in a training program that is approved by the Employment Security Departments commissioner. Child Care Child care providers that are subject to the licensing requirements under chapter 7415 RCW are self-employed even if they dont have a current license.

Accessing Unemployment Quick Guide. With the recent introduction of new unemployment and relief benefits for self-employed professionals though your eligibility may change. Next you will have to choose your personal identification number PIN.

Under the CARES act self-employed workers who have been harmed financially by COVID-19 freelancers independent contractors gig worker and other self-employed individuals are now eligible to receive unemployment benefits. DOES offers the following resources to DC residents. The federal CARES Act makes this possible.

Sheryl Hutchison communications director 360-902-9289.

Unemployment Help Metro Washington Council Afl Cio

Washington Employment Security Department Posts Facebook

Unemployment Benefits Comparison By State Fileunemployment Org

![]()

Workers Describe A Painful Wait For Unemployment Benefits During Coronavirus Shutdowns Wamu

Nearly 2 Million People Applied For Unemployment Last Week Even As Economy Shows Signs Of Reopening The Washington Post

Washington Employment Security Department Posts Facebook

A Record 3 3 Million Americans Filed For Jobless Claims As Coronavirus Puts Economy Into Recession The Washington Post

Washington Employment Security Department Posts Facebook

How To File For Unemployment Benefits If You Re Self Employed Youtube

Washington Employment Security Department Posts Facebook

Washington Employment Security Department Posts Facebook

Washington Employment Security Department Posts Facebook

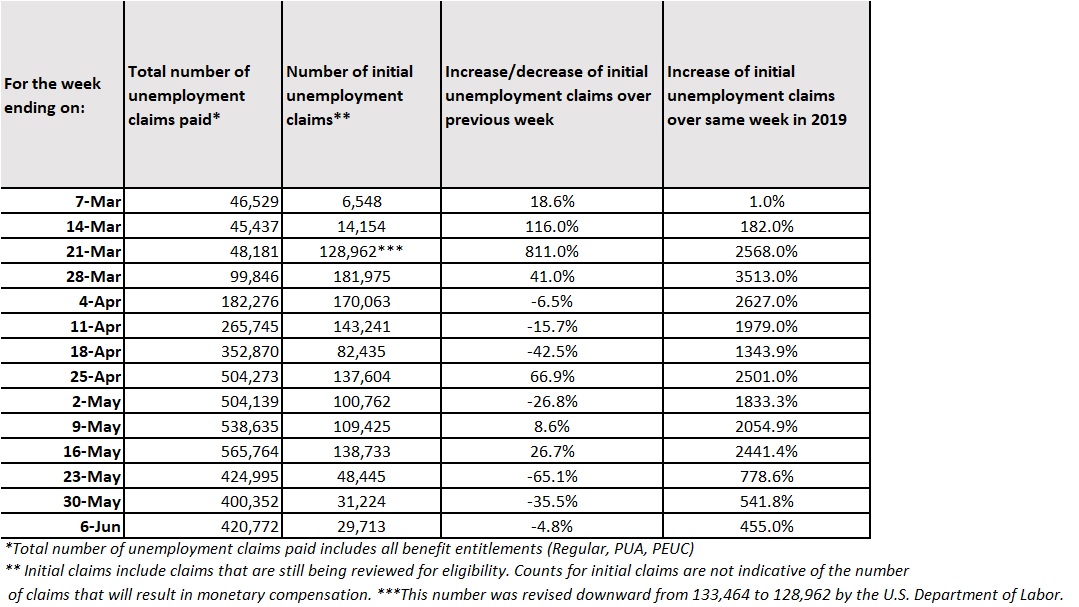

Esdwagov Initial Unemployment Insurance Claims For Week Of May 31 June 6 2020

Resources For Wa Workers In The Coronavirus Crisis Working Washington

0 Post a Comment: