To apply for New York unemployment benefits click here. NY Unemployment Eligibility Requirements.

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

In New York State employers pay contributions that fund Unemployment Insurance.

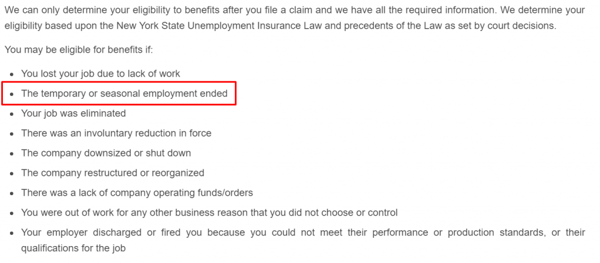

Unemployment ny qualifications. You can collect benefits if you meet a series of legal eligibility requirements. With this change your benefits will not be reduced for each day you engage in part-time work. Are unemployed through no fault of their own.

You earned enough money in the last year and a half. Eligibility for unemployment insurance benefits in New York is determined by how much youve worked and whether youve earned enough wages to be covered by unemployment or not. The New York State Unemployment Insurance Program allows unemployed residents and non-residents to receive wage compensation benefits if they meet a set of two criteria.

Use of a Virtual Private Network VPN proxy or internet anonymizer service will cause problems with your ability to apply or certify for benefits. For an employee to be disqualified for an unemployment insurance claim the employee must have 1 voluntarily separated from the employment and 2 done so without. Typically you can claim the income if.

Unemployment Eligibility Work Requirements. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount. To file for a claim through telephone.

You are totally unemployed. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months.

I applicants must meet three earning requirements and the below qualifications for unemployment in New York. If you are not a resident of New York but worked in New York at your last job you should still have New York unemployment eligibility. New York unemployment insurance benefits are available if you meet these criteria.

In the state of New York employers must pay contributions to the state that ultimately fund Unemployment Insurance for out-of-work employees. The person seeking unemployment benefits must have enough prior earnings from his or her employment job to qualify for benefits. Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced.

To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. Past workers must have been paid at least 1900 in one calendar quarter. If youve lost work and are working less than four days a week making 504 or less you are eligible for unemployment benefits in New York.

61 rows New York County Unemployment Office. Please check with the NYS Department of Labor for the latest facts and figures. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment.

But partial unemployment benefits are calculated based on the number of days you work not the number of hours. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. This article highlights some of the common areas of dispute arising out of unemployment insurance claims that the New York Department of Labor DOL has previously ruled upon.

Be a resident of New York. In order to qualify for unemployment benefits you must be ready willing available and able to work. Total wages paid to you must be at least 15 times the amount paid to you in your highest quarter.

Click File a claim. However states may choose to revise their benefits in times of economic crisis and the federal government may help fund extended state benefits during such times. Your HQW must be a minimum of at least 221 times NYs minimum wage which gets rounded to the next lowest 100 if needed.

NYS DOLs new partial unemployment system uses an hours-based approach. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. New York Unemployment Eligibility.

On the My Online Services page in the Unemployment Insurance section click Unemployment Services. In order to establish unemployment eligibility in New York you have to. If this applies to you your benefit rate will be calculated as follows.

Have worked and earned income in New York. Instead benefits will be reduced in. Call their Telephone Claims Center Monday through Friday 8 am.

Can I work part time and collect unemployment NY. You must have been paid at least 2600 in one calendar quarter for claims filed in 2020. Heres a list of reasons why you may not get unemployment.

Typically New York state law allows eligible residents who are unemployed through no fault of their own to receive weekly unemployment benefits for up to 26 weeks during a one-year period. 1 Hudson Square 75 Varick. I applicants must meet three earning requirements and the below qualifications for unemployment in New York.

You must meet a number of requirements to be approved for unemployment benefits in New York. To qualify for unemployment insurance in NY your total base period earnings must be at least 15 times your HQW. For each day you work your.

Past workers must have been paid at least 1900 in one calendar quarter. NYs minimum wage is 8. If you are not a Shared Work participant and you need to file a new claim please go to unemploymentlabornygov to file your first claim for unemployment insurance benefits.

Have earned qualifying wages. For example if you made 5000 in one quarter then the total for all four quarters must be 7500 or higher. There are reasons that your unemployment claim can be denied and that you can be disqualified from collecting unemployment.

You can find specific information regarding income qualifications on the New York state website. Enter your nygov username and password. Therefore the minimum required HQW is 1700 making the minimum required base.

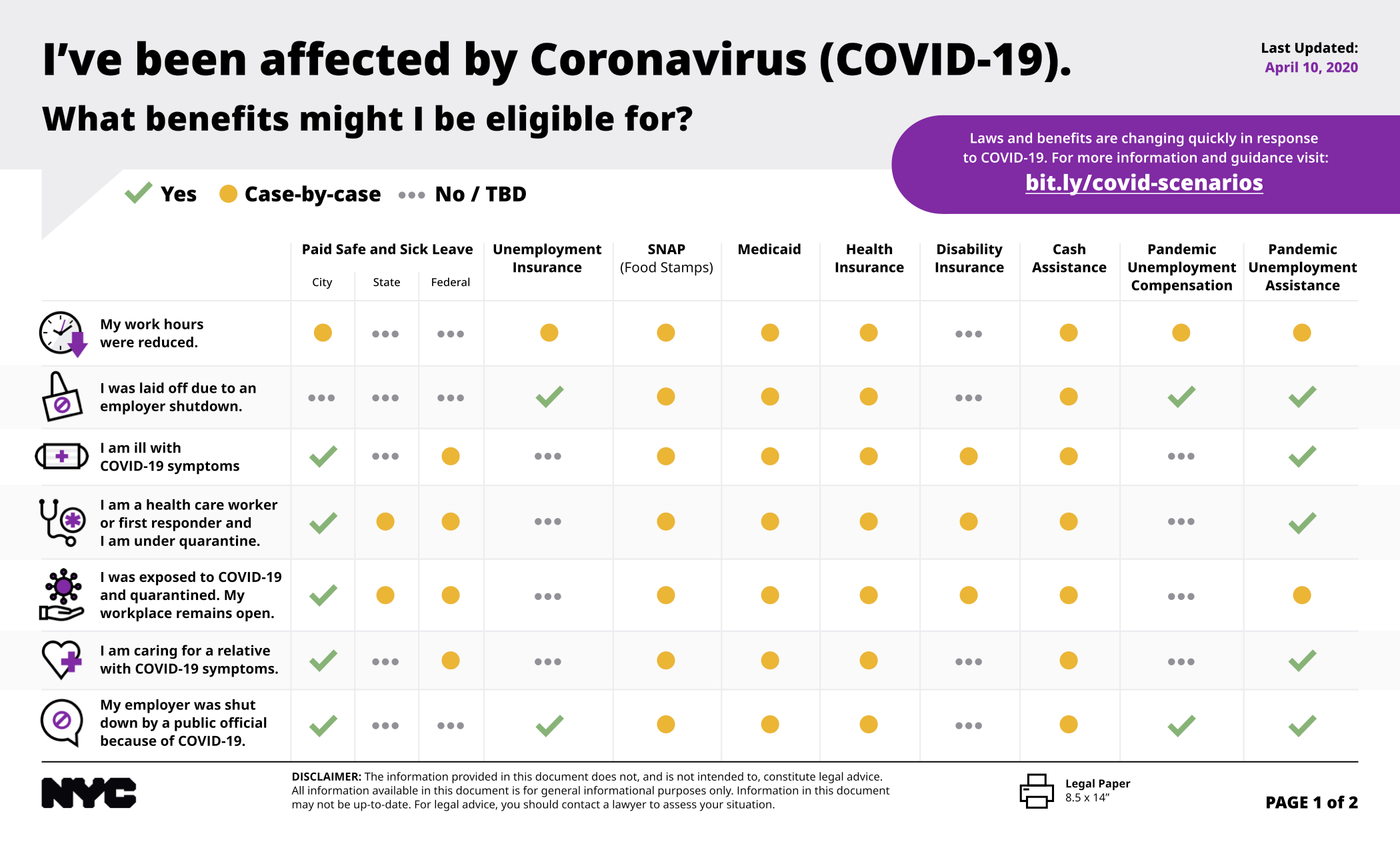

Minimum PUA Benefit Rate-In New York the Minimum PUA Benefit Rate is 182. The most recent figures for New York show an unemployment rate of 74. In order to start your unemployment NY unemployment requirements include the following.

Partial Unemployment-Prior to January 18 2021 you are considered partially unemployed and thereby eligible to collect benefits if you are working 3 days or less and earning 504 or less.

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

How Does Unemployment Work In New York Employment Lawyers

Do Seasonal Workers Qualify For Unemployment

Pandemic Unemployment New York State Department Of Labor Facebook

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

How To Apply For Unemployment Benefits In Ny Credit Karma

Ny Sen Brian Kavanaugh Urges Nysdol To Reconsider Ui Pua Qualifications For Americans Trapped Overseas Due To Covid 19 Issuewire

/cdn.vox-cdn.com/uploads/chorus_asset/file/22253262/unnamed.jpg)

Change For Part Time Workers Receiving Unemployment Benefits The City

New York Unemployment Benefits Eligibility Claims

0 Post a Comment: