If the New York State Department of Labor directed you to file your claim again or you are filing a claim for the Shared Work program please visit Online Services for Individuals enter your NYgov Username and Password and choose Sign In. Many people who are not eligible for state unemployment now become eligible.

Cares Act What You Need To Know Neighborhood Trust Financial Partners

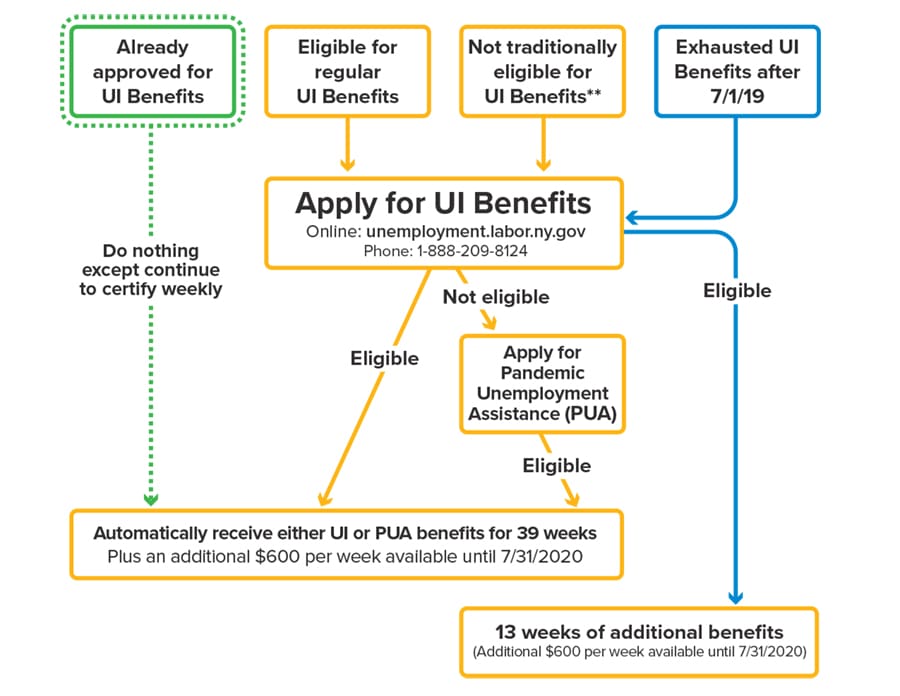

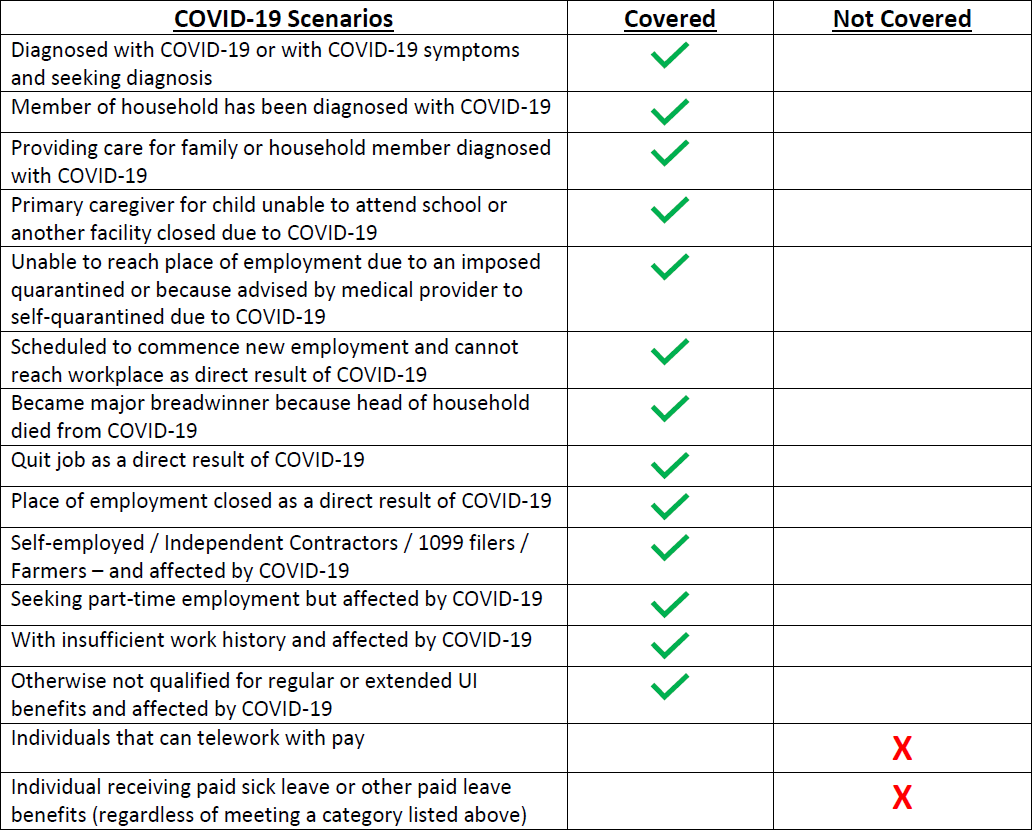

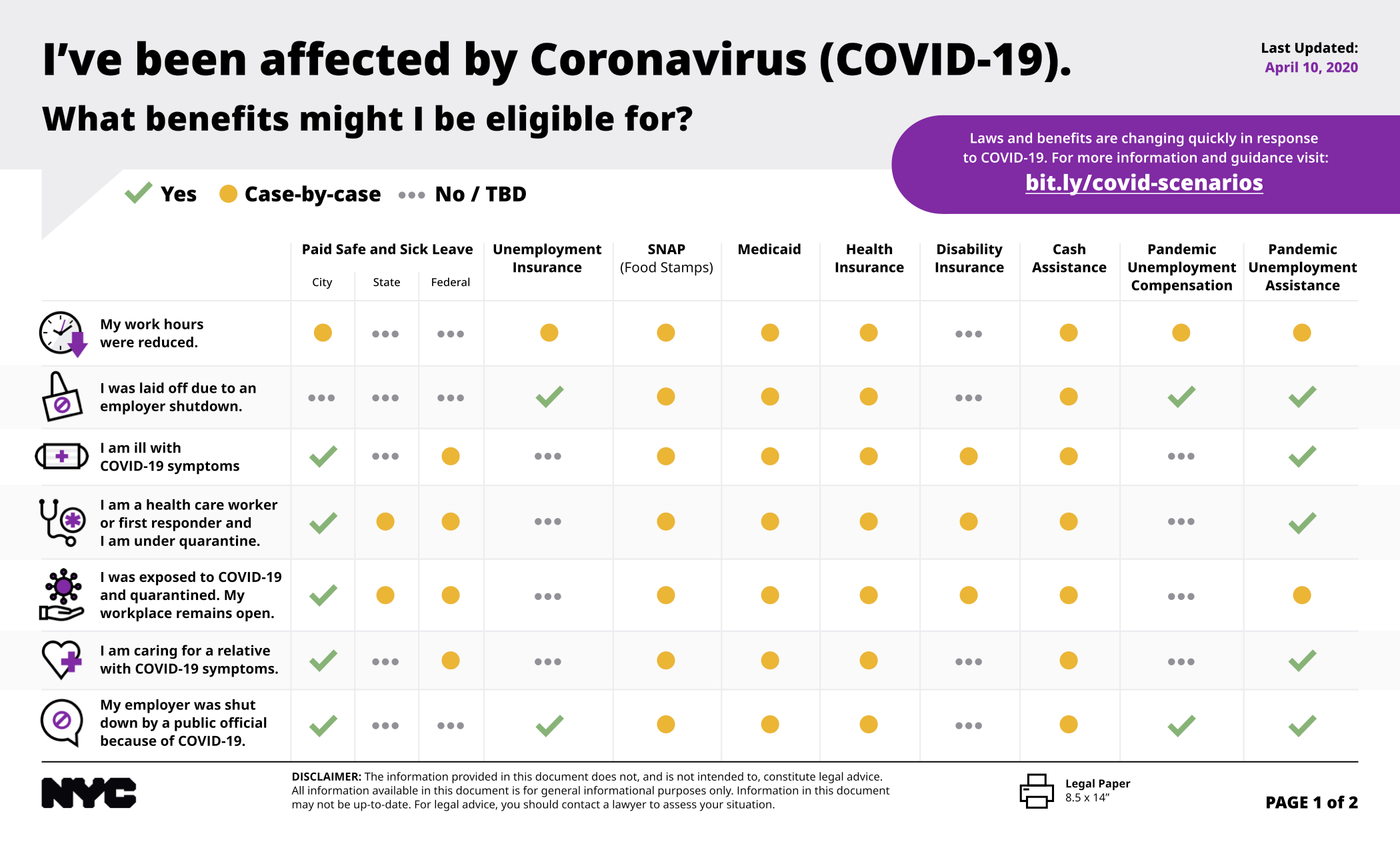

Pandemic Unemployment Assistance PUA greatly expanded who is eligible for unemployment.

Unemployment ny eligibility. In the Unemployment Insurance box on the bottom right section of the next screen select File a. We use your answers to help decide if you are eligible for Unemployment Insurance benefits and to give us an idea of what your prospects are for finding another job. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance.

To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. Earned a minimum amount of wages determined by New York guidelines and. Learn more about Pandemic Unemployment Assistance.

1 Hudson Square 75 Varick Street New York NY 10013. The first four of the five completed calendar quarters before you filed for benefits. To determine eligibility use the information presented in the Determining Disability Eligibility section.

Becoming Eligible vs Staying Eligible NY Unemployment Many people have asked about the difference between becoming eligible for Unemployment and staying eligible in order to get Unemployment payments. Niagara County Unemployment Office. In New York State employers pay contributions that fund Unemployment Insurance.

The normal duration of New York state unemployment benefits is 26 weeks. NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. Hopefully this post will clarify any confusion.

Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. Worked in New York during the past 12 months this period may be longer in some cases and.

Get Unemployment Assistance. NY residents total wages paid must be at least 15 times the amount paid in their highest paid quarter. New York County Unemployment Office.

New York pays eligible workers unemployment benefits on a weekly basis. New York State has modified the rules for partial unemployment eligibility. Other wage requirements also apply.

This update will apply to the benefit week of Monday August 16 2021 to Sunday August 22 2021 and all benefit weeks going forward. A qualified worker will get a weekly benefit payment equal the wages the worker earned in the highest earning calendar quarter of their base year divided by 26. This is automatically added to anyone getting state unemployment from their state.

Among other things you must have lost your job through no fault of your own you must be ready willing and able to accept suitable employment and you must conduct an. First you must have earned a minimum amount during the base period. However states may choose to revise their benefits in times of economic crisis and the federal government may help fund extended state benefits during such times.

600 per week for benefit weeks ending 452020 to 7262020 and 300 per week for benefit weeks ending 132021 to 952021. Typically New York state law allows eligible residents who are unemployed through no fault of their own to receive weekly unemployment benefits for up to 26 weeks during a one-year period. Eligibility Requirements for New York Unemployment Benefits In New York there are two basic eligibility requirements for receiving unemployment benefits.

Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. File a claim online to receive temporary income while you search for a job. Instead benefits will be reduced in.

What You Need to Know. Past workers must have been paid at least 1900 in one calendar quarter. This is also called certifying for benefits You can start certifying as soon as you receive a notification from the DOL.

In NY the regular max is 504week so the amount now jumps to 1104 a week. Actively seeking work each week you are collecting benefits. You must answer the questions on this form and give it to the New York State Department of Labor upon request.

You must meet all requirements to be eligible to collect unemployment insurance in New York. Partial Unemployment Update 81721. 1001 11th Street Niagara Falls NY 14301.

In the state of New York employers must pay contributions to the state that ultimately fund Unemployment Insurance for out-of-work employees. With this change your benefits will not be reduced for each day you engage in part-time work. Have enough employment to establish a claim.

If a disability has caused you to be unable to work or unable to work in the capacity you were once able to you may be eligible for New York disability benefits. To be eligible for this benefit program you must a resident of New York and meet all of the following. Once you have filed a claim for benefits you must also claim weekly benefits for each week you are unemployed and meet the eligibility requirements.

Eligibility for unemployment insurance benefits in New York is determined by how much youve worked and whether youve earned enough wages to be covered by unemployment or not. Past workers must have been paid at least 1900 in one calendar quarter. In New York State employers pay contributions that fund Unemployment Insurance.

In addition if you remain unemployed after your dismissal or severance pay runs out you may be eligible to receive unemployment. In addition to their weekly benefits claimants received a weekly Federal Pandemic Unemployment Compensation FPUC benefit. By law the unemployment insurance program provides benefits to people who.

New York Disability Application. You must continue to certify every week you are. Unemployment Insurance Eligibility Questionnaire.

Yes if the dismissal or severance pay you immediately receive is less than your unemployment insurance eligibility you may still be entitled to the difference between any dismissal or severance pay and unemployment insurance.

Nys Department Of Labor On Twitter New We Ve Updated Our Unemployment Application So New Yorkers Can Apply For Pandemic Unemployment Assistance Without Having To Apply For Traditional Unemployment Insurance First Get

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

Pua Has Extended New York State Department Of Labor Facebook

Unemployment Benefits New York State Department Of Labor Facebook

Unemployment Insurance Representative Joseph Morelle

Covid 19 Resources Gender Equality Law

Coronavirus New York Ny Reboots Unemployment Site To Improve Process Abc7 New York

Pandemic Unemployment Assistance Program Pua Kessler Matura P C

Unemployment Insurance And Covid 19 Make The Road New York

Covid 19 Resources Gender Equality Law

Pandemic Unemployment New York State Department Of Labor Facebook

Actions Taken By The State Government Central New York Labor Council

0 Post a Comment: