On September 5 2021 several federal unemployment benefit programs will expire across the country per federal law. This tool gives an estimate only.

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

Estimate Weekly Unemployment Insurance Benefits.

Unemployment ny amount 2021. If youre receiving unemployment benefits now and want to avoid paying taxes as a lump sum when you file your 2021 tax return fill out a. The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020. This form is sent in late January and outlines the amount of benefits paid to you during the previous year.

You can use this tool to estimate a weekly Unemployment Insurance benefit amount. The state is ahead by about 941 million on personal income tax receipts according to state Comptroller Thomas DiNapolis November State Cash Report. Unemployment is a key economic indicator and can be a sign of economic turmoil.

Those who make around 52000 or more can claim the maximum weekly jobless assistance of 504. You can use this tool to calculate how you should report your hours worked when certifying weekly. Benefits paid to you are considered taxable income.

Theres not really a way around it. No FPUC benefits are payable after September 4 2021 September 5 2021 in New York. As of January 2020 the unemployment rate is 67 according to the Bureau of Labor Statistics.

New York is one of 11 states continuing to tax unemployment benefits even for 2020. The New York State Department of Labor NYSDOL determines your weekly unemployment benefit amount by dividing your earnings for the highest paid quarter of the base period by 26 up to a maximum of 504 per week. As it stands the American Rescue Plan Act of 2021 which sets out to provide relief to individuals who received unemployment compensation in 2020 there is an exclusion cap up to 10200 dollars of.

Unemployment rate seasonally adjusted December 2019 December 2021 Percent 125000 130000 135000 140000 145000. 06 79 including RSF tax of 075 North Carolina. Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York State personal income tax return.

Benefits for weeks of unemployment beginning on or after December 27 2020. And remember tax day is May 17 this year. The state has received an excess of 49.

You must file an Unemployment Insurance claim to find out if you are eligible. If you exclude unemployment compensation on your federal return as allowed under the American Rescue Plan Act of 2021 you must add. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

The unemployment rates for January 2021 through November 2021 as originally published and as revised appear in table A on page 6 along with additional information about the revisions. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020.

In order to start your unemployment NY unemployment requirements include the following. 116 including the 021 Job Development. All contributory employers continue to pay an additional 0075 Re-employment Services Fund surcharge.

Is New York getting the 300 unemployment in 2021. Graph and download economic data for Unemployment Rate in New York NYUR from Jan 1976 to Nov 2021 about NY unemployment rate and USA. For subsequent UI benefit expiration dates provided below the benefit expiration date in New York falls one calendar day later which is due to state definitions of week.

As a result New York is keeping ALL pandemic unemployment benefits including the extra 300 weekly payment until the current program end date which would be the week ending September 4th 2021 in NY. The natural rate of unemployment is between 35 and 45. Out of work compensation amounts in New York are based on your earnings.

This means that even though the first 10200 of unemployment payments are exempt from federal taxes you will still have to pay state taxes on that money. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months. Benefits are available for up to 26 weeks.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your benefits. You are totally unemployed. 102 positive balance 609 negative balance 008 969.

In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer hours in a week and you must earn 504 or less in a week. Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced. Unemployment Income Rules for Tax Year 2021.

You must include this form with your tax filing for the 2021 calendar year. The new employer rate for 2021 increased to 4025 up from 3125 for 2020. Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates.

It does not guarantee that you will be eligible for benefits or a specific amount of benefits.

Unemployment Rate In New York County Ny Nynewy1urn Fred St Louis Fed

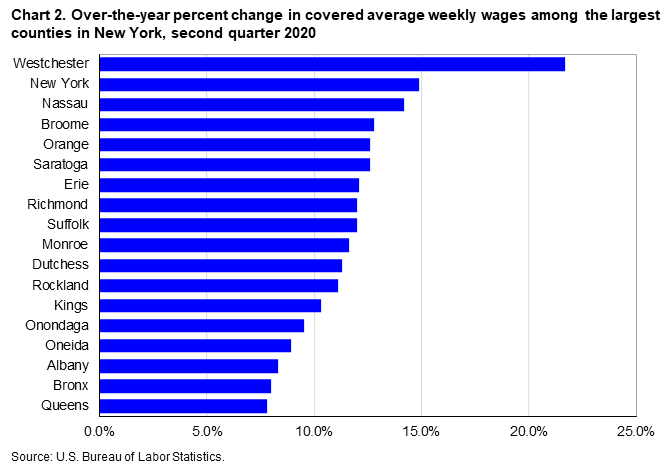

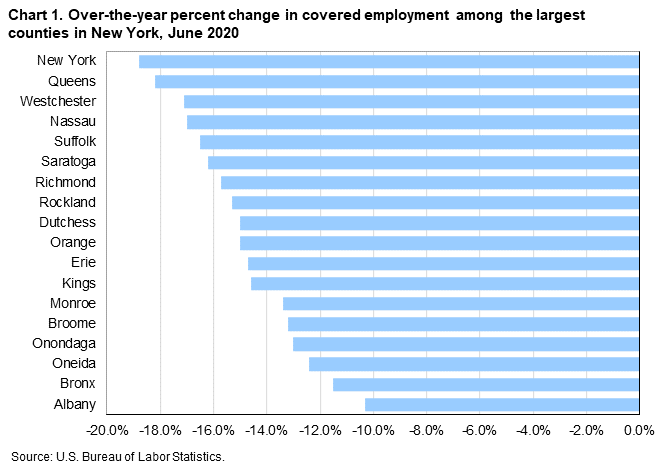

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

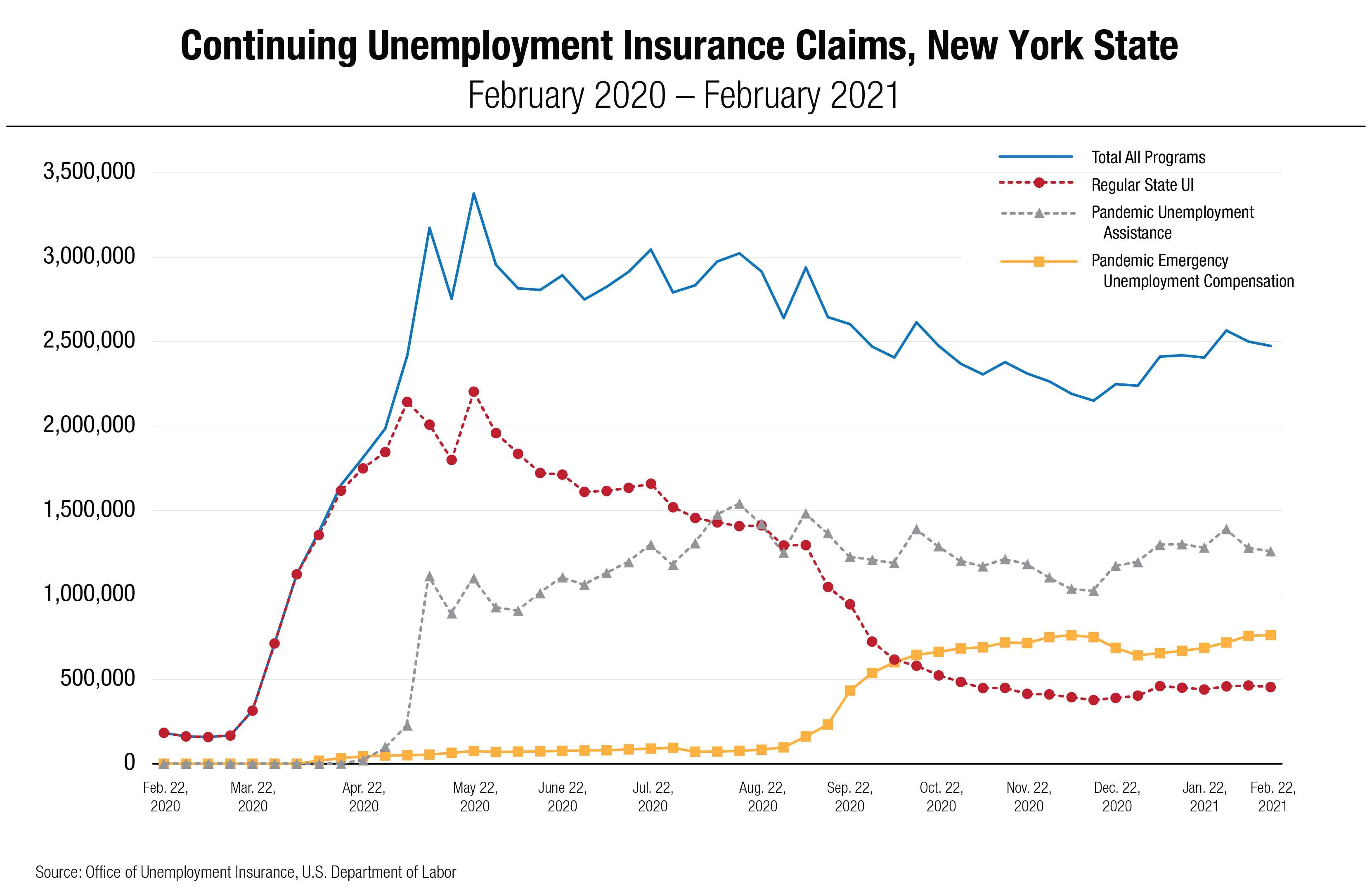

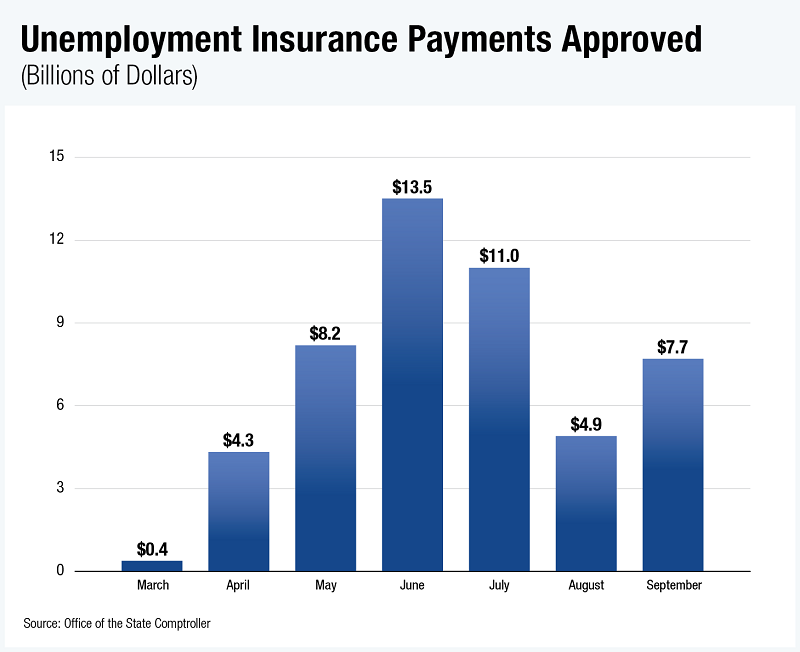

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

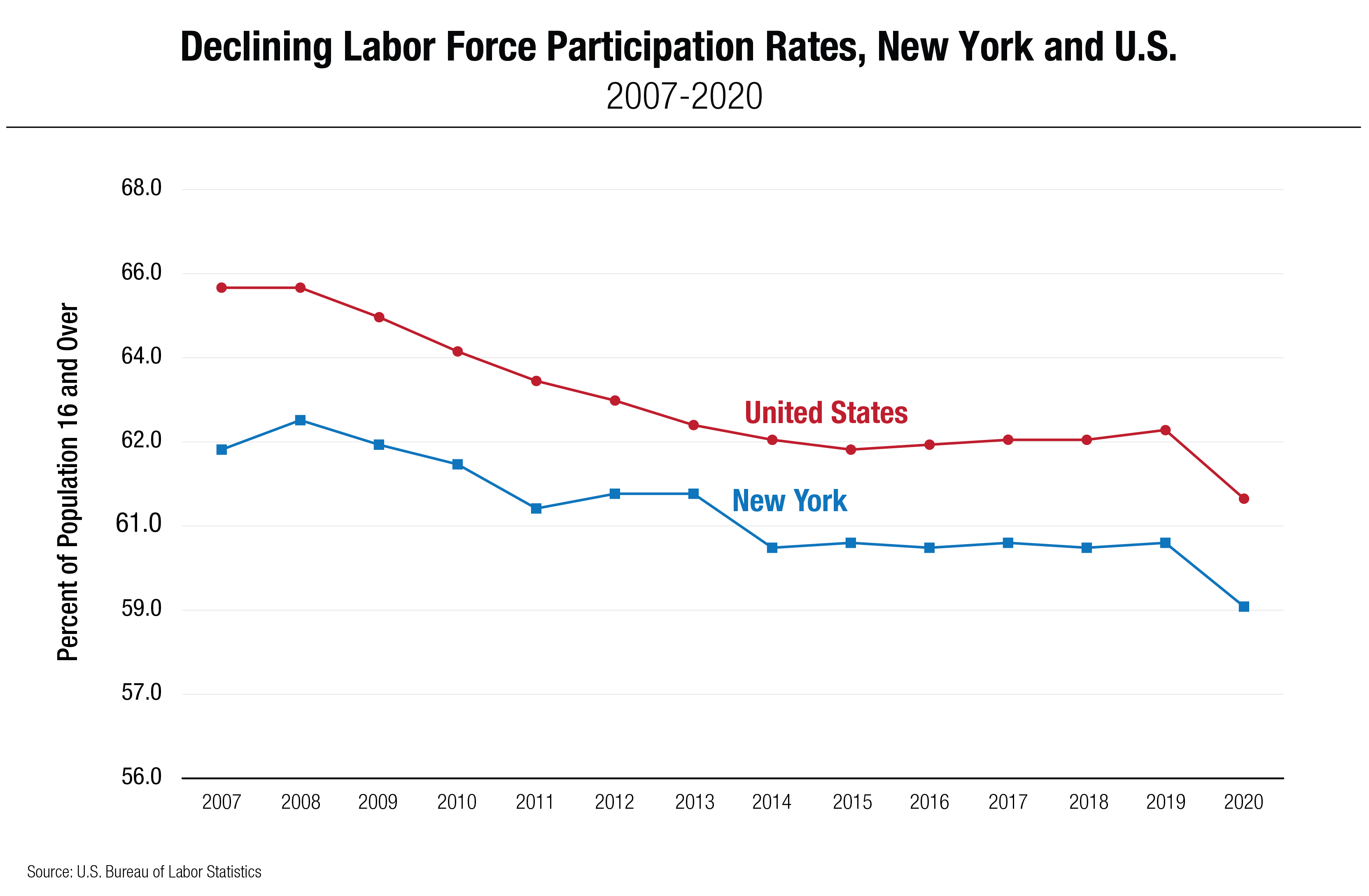

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

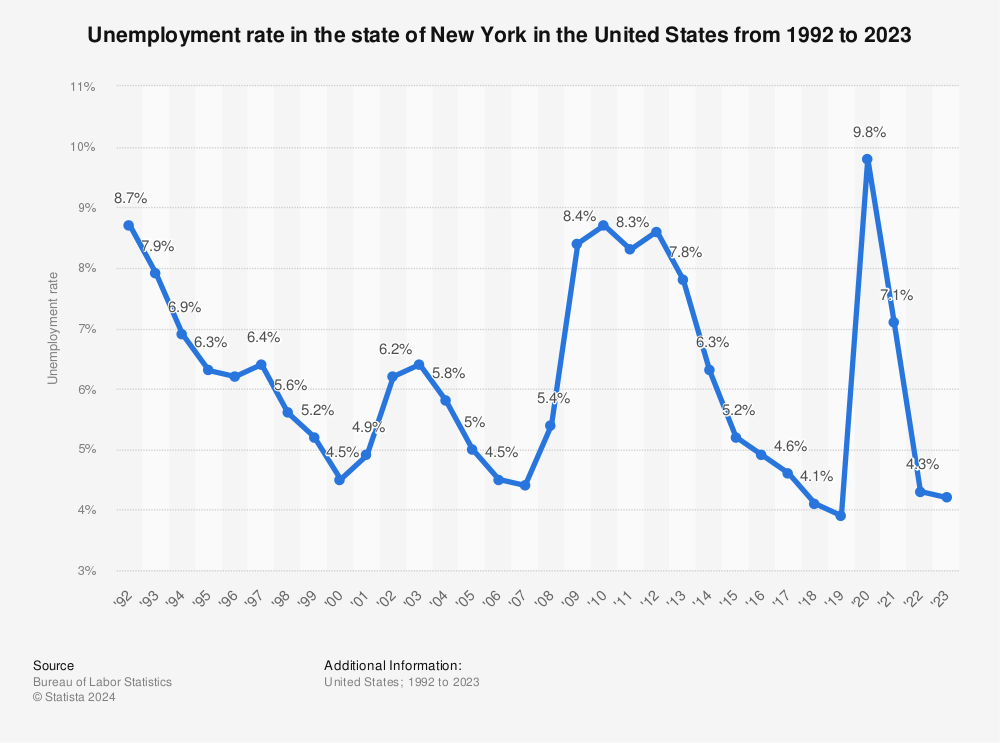

New York Unemployment Rate 2020 Statista

Unemployment Claims Are Lowest Since Pandemic Began The New York Times

Nys Department Of Labor On Twitter Icymi The Best Way To File A New Claim For Unemployment Insurance Ui Benefits Is Online At Https T Co T2tezsp2lf With All The Information Listed Below Click The

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

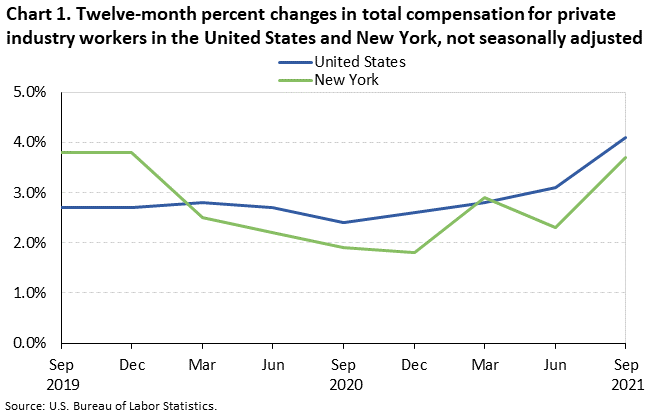

Changing Compensation Costs In The New York Metropolitan Area September 2021 New York New Jersey Information Office U S Bureau Of Labor Statistics

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

0 Post a Comment: