Does unemployment send you a 1099. The earnings must be submitted to your unemployment office when you file your claims.

Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB and Lost Wages Assistance LWA.

Unemployment ny 1099. Although unemployment benefits arent subject to payroll taxes they are considered taxable income. Reporting Form 1099 Income to Your Unemployment Office If youre collecting unemployment insurance benefits you must report any source of income you receive. If you get a file titled null after you click the 1099-G button click on that file.

How To Get My W2 From Unemployment Nj. Everyone must pay Federal taxes on Unemployment payments. Claimants who fail to do so can face serious consequences.

New York State has one of the most generous individual tax. For 2020 if you earned under 150k the first 10200 in Unemployment is tax-free 10200 per spouse if married filing jointly. Beginning October 20 2021 through.

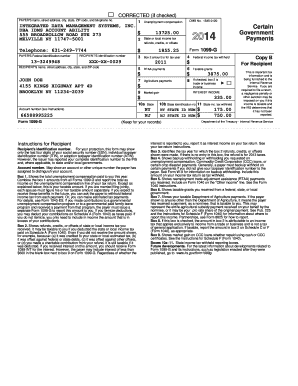

If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. 1099-G Tax Form.

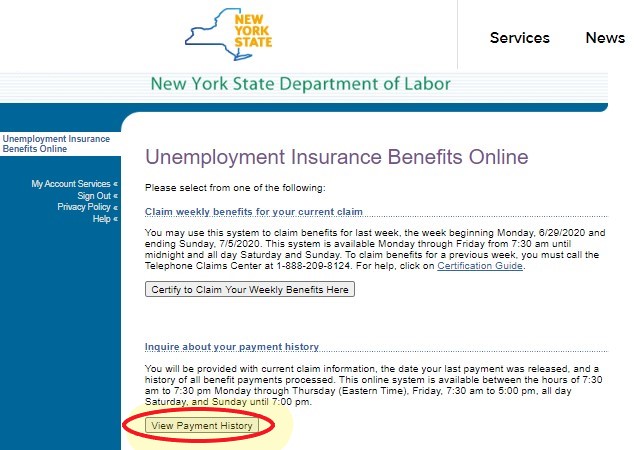

However the federal government created new provisions that allow 1099 earners to tap into unemployment benefits during the ongoing COVID-19 pandemic. The Tax Department issues New York State Form 1099-G. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

So provided you are otherwise eligible for Unemployment as long as your weekly salary from PPP is less than 504 you should be able to collect full Unemployment. From the NYGOV sign in page. To access your Form 1099-G log into your account at labornygovsignin.

View Your 1099-G Information. Tax credits put money back in your pocket. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. Alternative Trade Adjustment Assistance and Reemployment Trade Adjustment Assistance payments. The following security code is necessary to prevent unauthorized use of this web site.

From the Unemployment Insurance Benefits Online page below under the Get your NYS 1099-G section select the year you want in the NYS 1099-G drop-down menu box with an arrow and then select the Get Your NYS 1099-G button. How to get your 1099-G form. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124.

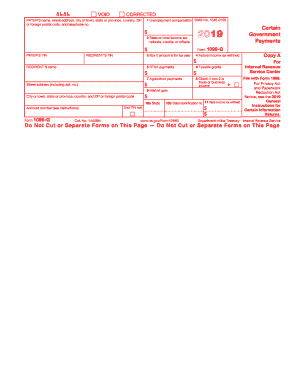

Total the New York State tax withheld amounts from all IT-1099-UI forms. New York State tax withheld Enter the New York State income tax withheld as shown on federal Form 1099-G issued by the New York State Department of Labor. Form 1099-G was issued by the New York State Department of Labor and shows New York State withholding.

File a claim online to receive temporary income while you search for a job. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page. In NY for example you can earn up to 504 a week and still receive full Unemployment payments.

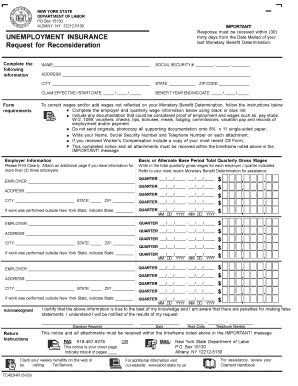

What You Need to Know. State taxes depend on the state NY and NJ both tax Unemployment. Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect.

Federal income tax withheld from unemployment benefits if any. Taxes on Unemployment Payments. Click the Unemployment Services button on the My Online Services page.

How to Get 1099G Online - Department of Labor. Enter only the information requested on Form IT-1099-UI. A 1099-G form is a federal tax form that lists the total amount of benefits TWC paid you including.

If you are using a screen reading program select listen to have the number announced. If you received more than 10 in unemployment compensation during the year your state will send you a Form 1099-G. Click the Get Your NYS 1099-G button on the Unemployment Insurance Benefits Online page.

Visit the Department of Labors website. If you prefer to have your Form 1099-G mailed to you you can call 1-888-209-8124. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

Unemployment compensation is taxed by. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Log in to your NYGov ID account.

New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. To access your Form 1099-G log into your account at labornygovsignin. How to complete Form IT-1099-UI You must complete one Form IT-1099-UI for each federal Form 1099-G you and if filing jointly your spouse received that shows New York State income tax withheld.

See the 1099-G web page for more information. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G. Click the Unemployment Services button on the My Online Services page.

Get Unemployment Assistance. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on. The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

Enter the security code displayed below and then select Continue. Box 1 Enter the unemployment compensation shown in Box 1 of federal Form 1099-G. 4 You may see this box.

Normally self-employed and 1099 earners such as sole independent contractors freelancers gig workers and sole proprietors do not qualify for unemployment benefits. The 1099-G will show the amount of unemployment benefits received during 2020. This is an automated phone line that allows you to request to have your Form 1099-G mailed to the address that you have on file.

This includes Form 1099-NEC income. Recipients must report this information along with information from other income tax forms such as Form W-2 on their 2020 federal and New York income tax returns. Is unemployment compensation taxable in NY.

This form does not include unemployment compensation.

1099 G Tax Form Department Of Labor

How To Get A 1099 G Form From Unemployment In New York State Online Or A Hard Copy By Mail Youtube

Fillable Online New York 1099 G Payers Name Street City State Zip Form Fax Email Print Pdffiller

Unemployment And Withholding Taxes Homeunemployed Com

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

1099 Unemployment Nyc 2011 2022 Fill Out Tax Template Online Us Legal Forms

Nys Unemployment 1099 Fill Online Printable Fillable Blank Pdffiller

Unemployment Compensation Unlike Shah Cpa Firm Pllc Facebook

0 Post a Comment: