Earned at least 8 times your Weekly Benefit Amount WBA through your most recent employer. In South Carolina all workers can receive a maximum benefit amount of 326 per week prior to tax deductions.

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Have lost your job through no fault of your own.

Unemployment benefits south carolina eligibility. The first step to apply for South Carolina unemployment benefits is to file a claim. South Carolina Unemployment Website. Can I receive unemployment benefits.

On the other hand part-time workers can continue to work while they collect benefits as long as they. South Carolina unemployment benefits are only paid to individuals who lose their job for a reason they cannot control such as a lay off or company closure. In South Carolina a person needs to provide their Social Security number and work history for the past 18 months to apply for unemployment benefits.

The unemployment insurance fund is sustained through employer payroll taxes so workers are not obliged to pay for their own benefits. Your job was covered by the state unemployment fund. You must be unemployed through no fault of.

Unemployment insurance eligibility rules and regulations are detailed in Title 41 of the South Carolina Code of Laws. Theyll mail you about your monetary eligibility To receive benefits you must. Your past earnings must meet certain minimum thresholds.

Individuals who are fired for misconduct or quit their job voluntarily are not often eligible for benefits. You can get information related to the unemployment insurance program that includes who is eligible for compensation and how to claim your unemployment benefits. Part-time workers in South Carolina are as eligible to collect unemployment benefits as full-time workers.

The weekly benefit amount in South Carolina ranges from a minimum of 42 a week to a maximum of 326 a week before taxes. Understanding the General Requirements for Unemployment in South Carolina. The fund is controlled by the South Carolina Department of Employment and Workforce DEW.

The South Carolina Department of Employment and Workforce DEW looks at your wages over a 12 month period prior to your filing your claim to determine whether you will qualify for benefits. Earned a minimum of 4455 during your total base period. You earned enough wages to qualify.

Unemployment insurance recipients in South Carolina must meet the following criteria in order to qualify for benefits. Unemployed individuals could receive up to nine additional weeks of benefits if they lived in a state with an unemployment rate of at least seven percent. Have earned at least 4455 from covered employment during the base period.

Applicants must meet the following three eligibility requirements in order to collect unemployment benefits in South Carolina. Recipients must have earned sufficient wages during the base periodthe first 12 months of the 15 months prior to filing a claim. Have at least 1092 in covered employment with an employer who paid UI taxes during the base periods highest quarter.

You must have earned those wages from an employer covered by the states unemployment laws. When you file a South Carolina unemployment claim your eligibility. If you are unsure whether or not the reason you separated from work qualifies you to receive South.

Be seeking full-time employment be able to. Although the monetary eligibility requirement may be harder to meet on part-time work you can still collect benefits if you do meet it. The maximum benefit amount MBA is the amount of money you can be paid over the life of a claim.

Do I qualify for unemployment benefits in South Carolina. To be eligible for this benefit program you must a resident of South Carolina and meet all of the following. South Carolina Unemployment Eligibility.

Visit dewscgov to login or register in the MyBenefits portal. You are able and available to work and were unemployed for one week before applying. About Unemployment by State Learn How to Find a Job How to File Weekly Claims.

Worked in South Carolina during the past 12 months this period may be longer in some cases and. Bility for Unemployment Benefits in. You meet the wages eligibility criteria for South Carolina unemployment benefits if you.

In most cases today that number is now 26 weeks of benefits. Earned a minimum amount of wages determined by South. Originally recipients would be eligible for a maximum of 16 weeks of benefits.

Unemployed individuals would be eligible for up to 14 additional weeks of benefits if they resided in a state with an unemployment rate of at least six percent. The intent of the act was to provide an economic safety net for people when they lost their jobs while also stabilizing the economy. If losing your job wasnt your fault and your employers paid taxes in your name you can receive unemployment benefits if your years income prior to the quarter you lost work meets a specified minimum.

The Monetary Determination will only discuss your eligibility and you may need to submit additional documents before the state can make a final decision. Exclude from the receipt of benefits workers who are not attached to the labor market practically every unemployment compensation law requires that beneficiaries must have worked for a certain period or earned a certain amount of. Were paid at least 1092 in wages in the highest earning calendar quarter of your base period.

You may be eligible if. This is the official South Carolina unemployment insurance website. Recipients must have lost employment through no fault of their own.

WILSO D N. KID anD MELFORd A. To be monetarily eligible for UI benefits you must.

How long do you have to work somewhere to get unemployment in South Carolina. In order to become eligible and remain eligible for Unemployment Insurance UI benefits you must. How do I apply for partial unemployment in South Carolina.

The work history should include their salary from each employer along with the employers business names addresses and phone numbers.

Rules Roundup Supplemental Unemployment Benefits And Their Impact On Public Assistance Programs Making Justice Real

Unemployment Insurance Cares Act Patterson Harkavy Llp

Des Covid 19 Information For Individuals

Cutoff Of Jobless Benefits Is Found To Get Few Back To Work The New York Times

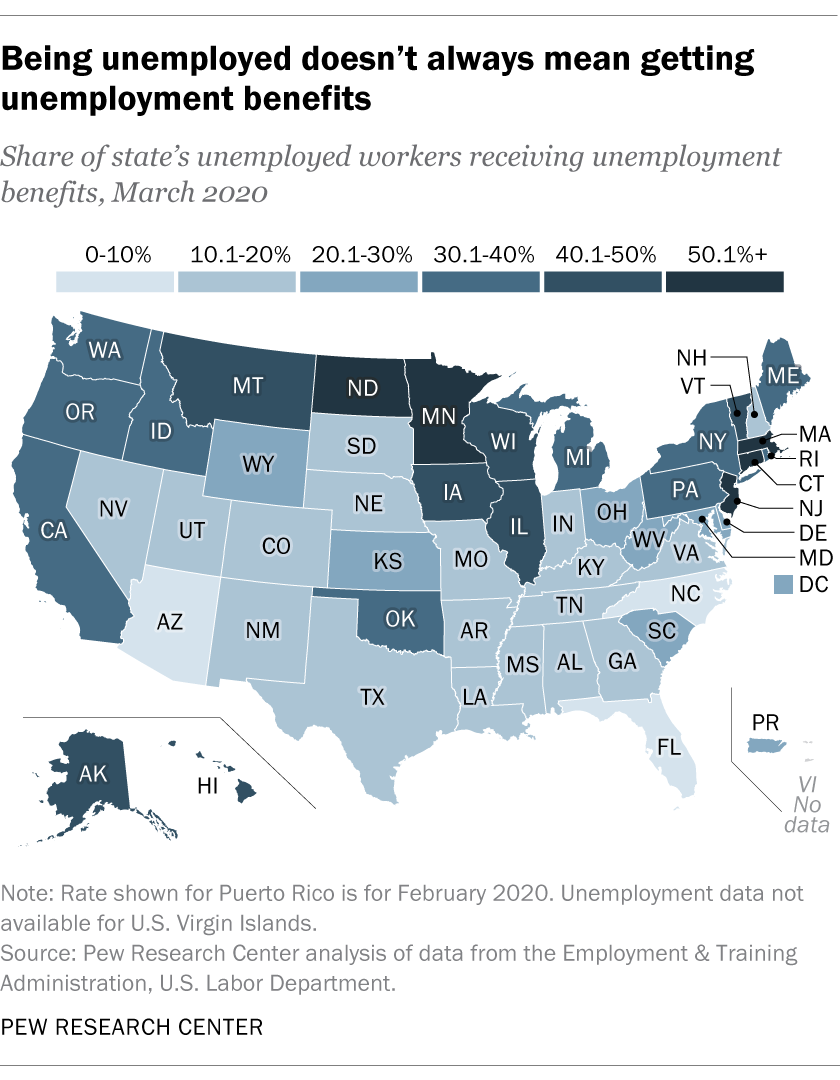

In Some States Very Few Unemployed People Get Unemployment Benefits Pew Research Center

Unemployment Benefits For Veterans Military Benefits

The Long Run Implications Of Extending Unemployment Benefits In The United States For Workers Firms And The Economy Equitable Growth

High Volume Of Sc Unemployment Insurance Applications Delays State Website Wltx Com

Unemployment Benefits Extension 2022 Will Your State Send You Checks In 2022 Marca

How Unemployment Benefits Are Calculated By State Bench Accounting

Unemployment Benefits Comparison By State Fileunemployment Org

Pin By Patty Sallee On Unemployment Benefits Unemployment Need To Know Federation

Federal Pandemic Unemployment Benefit Programs Ending Sept 4

Free Missouri Missouri Unemployment Benefits Labor Law Poster 2022

0 Post a Comment: