Get Information About Starting a Business in PA. Information about Form 940 Employers Annual Federal Unemployment FUTA Tax Return including recent updates related forms and instructions on how to file.

2016 2022 Form Pa Uc 2as Fill Online Printable Fillable Blank Pdffiller

Visit Pennsylvanias business tax site at wwwetidesstatepaus for more information.

Pa unemployment quarterly filing. 4855 Woodland Dr Enola PA 17025 Phone. Monthly If total withholding is 300 to 999 per quarter the taxes are due the 15th day of the following month. Report the Acquisition of a Business.

Get Information About Starting a Business in PA. Paper UC-2 and UC-2A forms are no longer being mailed. Reimbursable Employers should use the UC-2R.

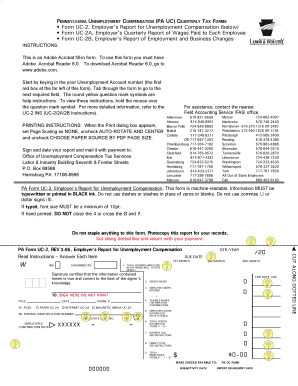

Appeal a UC Contribution Rate. File and Pay Quarterly Wage and Tax Information. The Department of Labor Industry requires that employers file unemployment compensation UC quarterly reports electronically through the Unemployment Compensation Management System UCMS.

Online filing for Unemployment Extension Benefits can now be lengthened throughout 2012 via web at Unemployment-ExtensionOrg with Pennsylvania as the state to receive benefits for a full 99 weeks. A report must be filed even though there has been no employment and no wages have been paid during the calendar quarter. Apply for a Clearance.

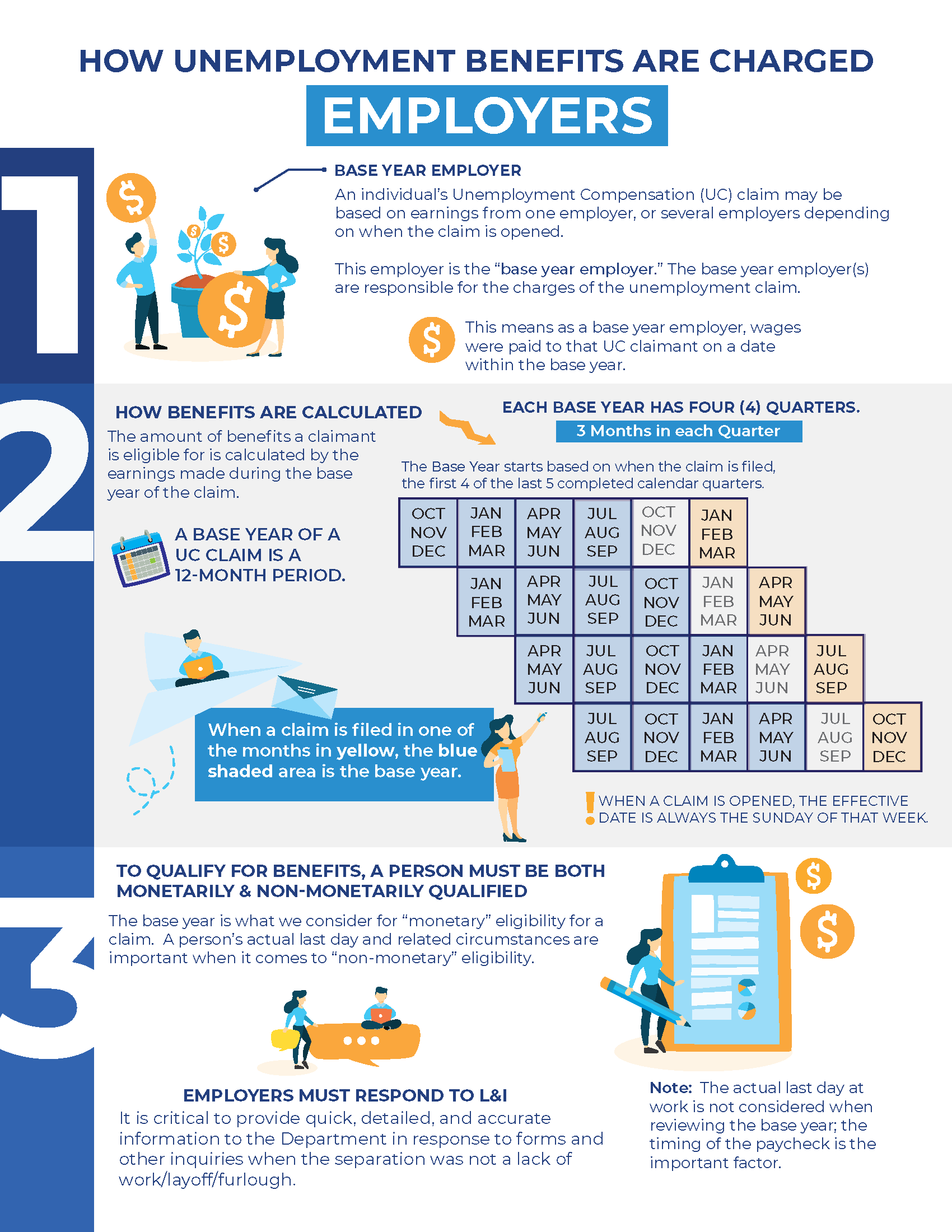

PA UC Tax Online Services top wwwuctaxpagov. The Alternative Base Period for unemployment benefits is the last four completed calendar quarters preceding the starting date of the claim. Employers and third-party administrators can file PA UC quarterly tax reports make payments and maintain important account information.

Learn More About UCMS. Gross wages reported on the PSATS Unemployment Compensation Group Trust Employers Quarterly Report form must be the same gross wages and employees reported on the reports filed with the PA UC. Quarterly If total withholding is under 300 per quarter the taxes are due the last day of April July October and January.

Once you select the quarterly report you want to file if you paid covered wages during this quarteryear click on the radio button in front of Yes and select Continue. Apply for a Clearance. Register for a UC Tax Account Number.

Any employer may file UC reports online and may pay electronically. This is the site where you can manage your UC activity and update your employer account information. The PA Unemployment Report will provide you with a list of all employees their social security numbers their gross wages their taxable wages and tax amounts for both the quarter and year-to-date for both the employee and the employer.

Appeal a UC Contribution Rate. Unemployment insurance supports Colorados economy by providing temporary partial income to workers who have lost their jobs through no fault of their own. PSABs Unemployment Compensation UC Plan was created for your benefit more than 35 years ago.

Do NOT include exempt wages. This program provides you with overall management of your UC claims and gives you a. Do NOT include exempt wages.

If a due date falls on a Saturday Sunday or legal holiday the. Report the Acquisition of a Business. Select the PA UC-2.

Employers covered by the Pennsylvania PA UC Law are required to file reports and remit contributions on a quarterly basis. While unemployment extension benefits differ from state to state the average amount received by a laid off is 298 per week. File and Pay Quarterly Wage and Tax Information.

This report will also provide you with the number or weeks worked for each employee within the quarter in which you are filing. Change My Company Address. PA State Association of Township Supervisors.

Form 940 or Form 940-EZ is used by employers to file annual Federal Unemployment Tax Act FUTA tax. The reports and contributions are due at the end of the month following the calendar quarter April 30 July 31 October 31 January 31. Employers with 250 or more wage entries are required to file items 1 through 10 of Form UC-2A by magnetic media or Internet.

The Colorado Department of Labor and Employment is here to help you understand our states unemployment. 717 763-0930 Mon - Fri 830 am - 430 pm. Additional information such as most recent quarterly earnings proof of wages earned in the form of pay stubs and verification of earned wages may be asked for in case of the Alternate Base Period.

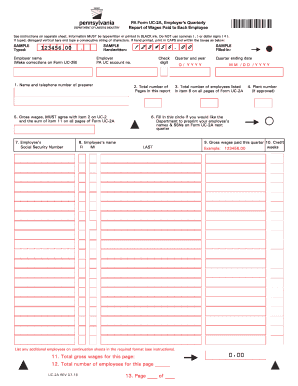

This form is used to report an employers quarterly gross and taxable wages and UC contributions due. If the envelope is missing mail report to the PA Department of Labor Industry Office of Unemployment Compensation Tax Services PO Box 68568 Harrisburg PA 17106-8568. This is the site where you can manage your UC activity and update your employer account information.

Gross wages reported on the PSATS Unemployment Compensation Group Trust Employers Quarterly Report form must be the same gross wages and employees reported on the reports filed with the PA UC. TOTAL TAXABLE WAGES FOR YOUR EMPLOYEES enter the amount of taxable wages paid to employees during this quarter. TOTAL TAXABLE WAGES FOR YOUR EMPLOYEES enter the amount of taxable wages paid to employees during this quarter.

Any employer may file Form UC-2A by magnetic media. Office of Unemployment Compensation Tax Services. There are several options that employers can use to electronically file their state Unemployment Compensation UC wage and tax data.

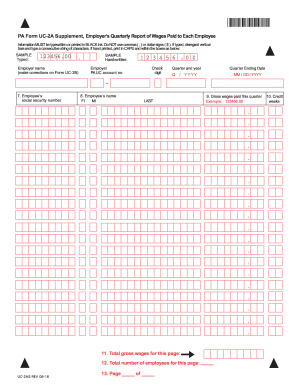

Employers Quarterly Report Of Wages Paid To Each Employee This form is used to list employees social security numbers names gross wages earned and credit weeks for a particular quarter. Choose State Tax Reports. PA FORM UC2 The Pennsylvania Unemployment Form UC2 electronic file should be created if users plan to upload the wage data to the state.

Learn More About UCMS. Use the enclosed return envelope. No wages this quarter.

Unemployment Compensation UC Taxes Businesses can file and pay quarterly PA Unemployment Compensation UC tax through the Pennsylvania Department of Labor and Industrys Unemployment Compensation Management System UCMS. Electronic filing of quarterly tax and wage data Form UC-22A and corresponding payment. State Tax Reports To access the location where the file will be created follow these steps.

Click Reports on the Toolbar. Register to Do Business in PA. Register to Do Business in PA.

Businesses can file and pay quarterly PA Unemployment Compensation UC tax through the Pennsylvania Department of Labor and Industrys Unemployment Compensation Management System UCMS. Register for a UC Tax Account Number. ONLINE REPORTING--Manually input tax and wage data in UCMS at wwwuctaxpagov.

Employers and third-party administrators can file PA UC quarterly tax reports make payments and maintain important account information. Colorado employers pay into the fund to help workers during periods of joblessness. Change My Company Address.

Pennsylvania Form Uc 2a Fill Out And Sign Printable Pdf Template Signnow

2016 2022 Form Pa Uc 2as Fill Online Printable Fillable Blank Pdffiller

Pennsylvania How Unemployment Payments Are Considered

Fillable Online Form Uc 2 Employer S Report For Unemployment Compensation Below Fax Email Print Pdffiller

Pennsylvania How Unemployment Payments Are Considered

Base Period Calculator Determine Your Base Period For Ui Benefits

Pennsylvania How Unemployment Payments Are Considered

0 Post a Comment: