The study also discovered the following about New Yorks unemployment recovery. Following the Federal Unemployment Tax Act FUTA scheme state unemployment contributions taxes are determined by applying a certain percentage to the taxable wages paid by the employer.

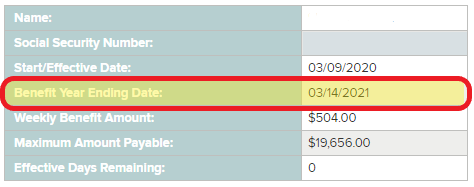

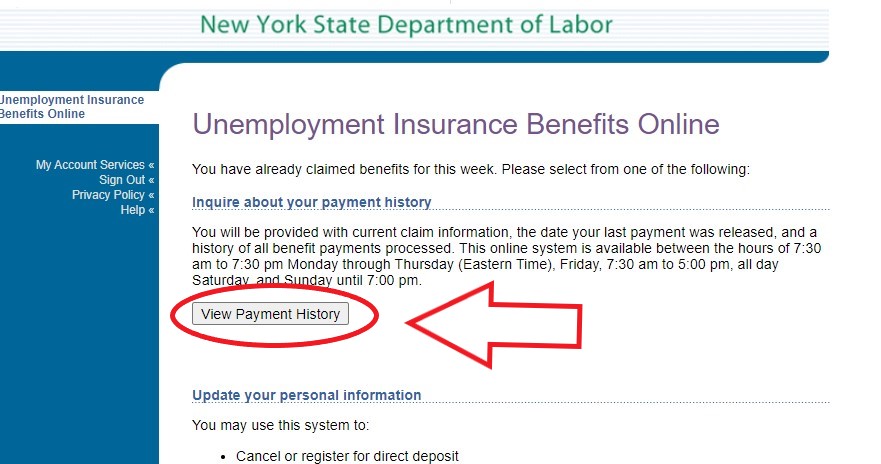

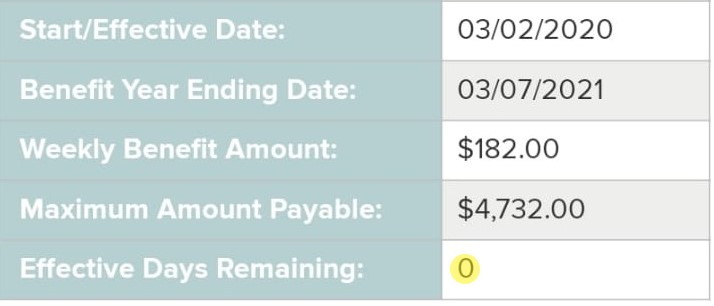

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

2019 legislation HB 198 froze the taxable wage base at 16500 for 2020 under the bill language from July 1 2019 to October 29 2020 so that the Division of Unemployment Insurance and the Unemployment Compensation Advisory Council could determine whether the formula used to.

Nys unemployment 2021 limit. The unemployment-taxable wage base is 11800. The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020. In case the employer starts a new business the states provide a standard new employer SUTA rate.

Pay from a public employer earned January 1 2021 through June 24 2021 will not count toward a retirees annual earnings limit. FUTA requires that each states taxable wage base must at least equal the FUTA taxable wage base of 7000 per employee and most states have wage bases that exceed the. This rate will again change as the business grows depending on the number of unemployment claims made to the state by workers who lose their jobs.

The FUTA tax rate protection for 2021 is 6 as per the IRS standards. The state average annual wage is established no later than May 31 of each year. Given the current negative balance in the state unemployment trust fund 2021 UI rates for New York employers increased to a range of 21 to 99 of taxable payroll up from 2020 rates that ranged from 06 to 79.

The wage base limit is the maximum threshold for which the SUTA taxes can be withheld. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. The 150000 limit included benefits plus any other sources of income.

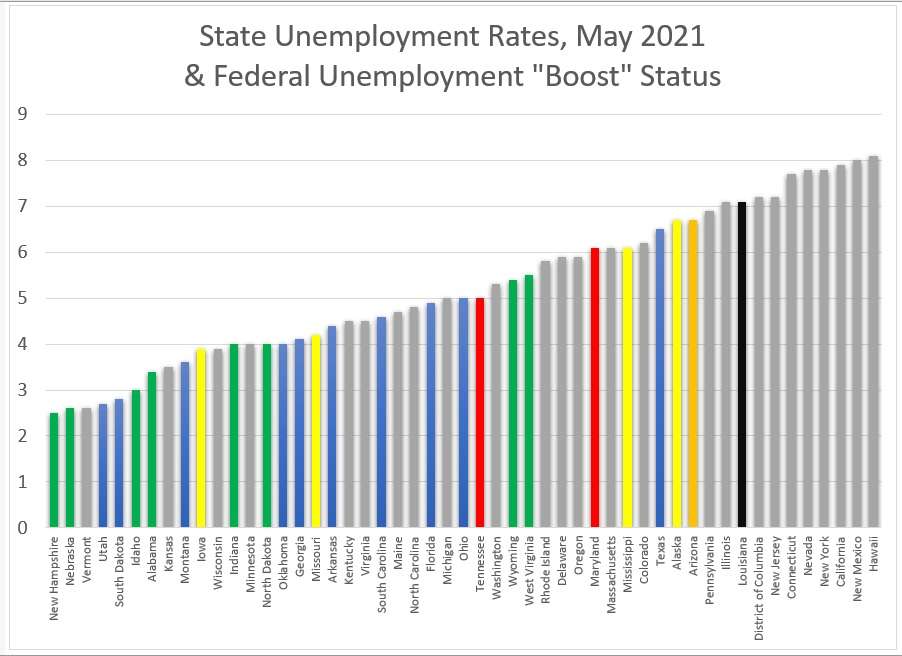

As a result employer tax payments grew between 26 and 160 in 2021. New Yorks unemployment rate between July and August fell from 76 to 74 and the economy added 28000 jobs in the private sector the state Department of Labor announced on Thursday. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

How much unemployment benefits can I get in North Carolina. States who havent released their SUI wage base limits for 2021 are bolded in black. After 2026 the wage base is permanently adjusted on January 1 of each year to 16 of the state average annual wage rounded up to the nearest 100.

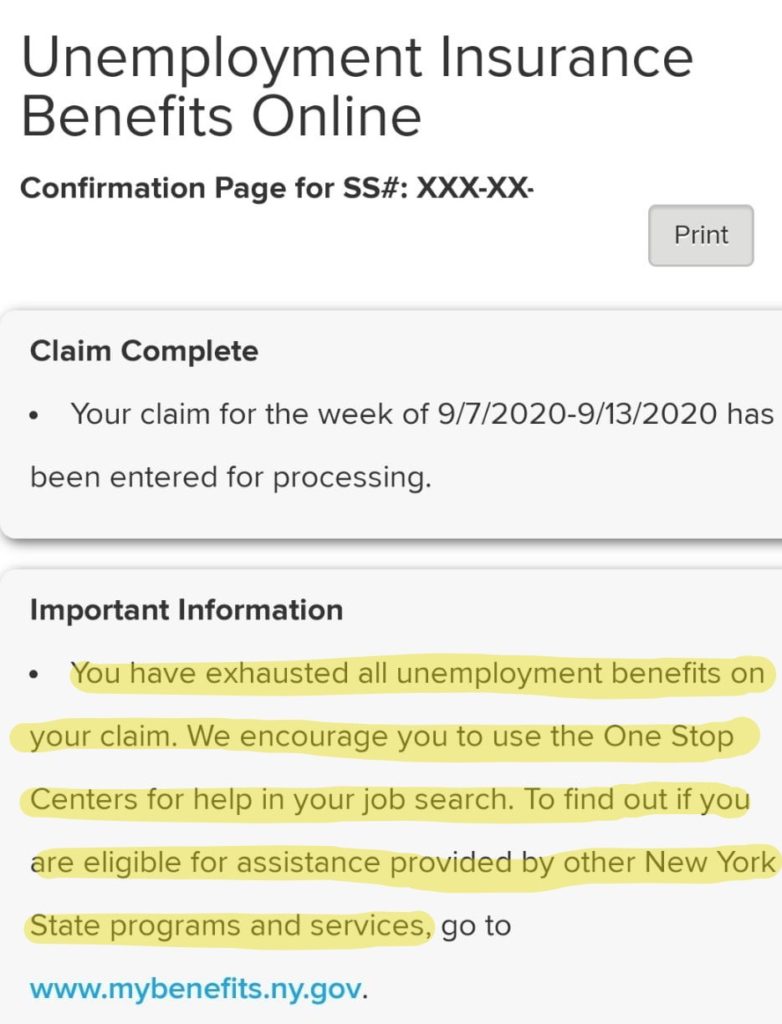

PUBLISHED 1232 PM EDT Sep. This includes the federally funded enhanced extended benefits PUA PEUC and 300 FPUC provided in 2020 and 2021. The maximum unemployment benefit you can get in New York is 804 a week through September 6 2021.

We will update this information as the states do. New York is in the top 20 for the maximum amount of unemployment benefits paid out with up to 99 weeks of benefits are available under covid-19 relief. After that the maximum weekly benefit is 504.

Unemployment tax rates range from 21 to 99. Subsequently former Governor Cuomo signed legislation that further ensured the relief to employers of UI. State Wage Base Alabama 8000 Alaska 43600.

Employer Tax Rate Range 2021 Alabama. Year 2026 - 13000. All contributory employers continue to pay an additional 0075 Re-employment Services Fund surcharge.

States that have decreased their wage bases are highlighted in blue. 5th worst recovery in the US. March 5 2021 1042 AM.

That earnings limit suspension was in place from January 1 2021 through June 24 2021. The new employer rate for 2021 increased to 4025 up from 3125 for 2020. This form is sent in late.

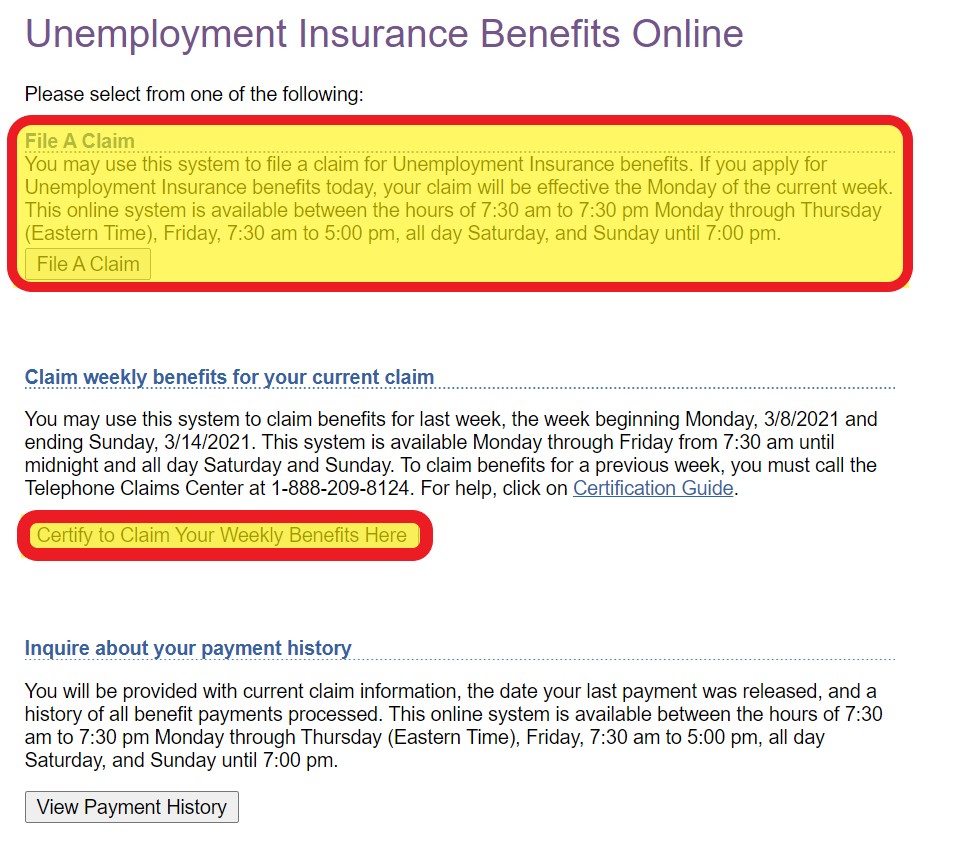

The higher the trust fund balance the lower the taxable wage base. For example Texas will not release 2021 information until June due to COVID-19. Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB 300 Federal Pandemic Unemployment Compensation FPUC 100 Mixed Earner Unemployment Compensation MEUC Learn more from NY State Department of.

Your local state unemployment agency will send you form 1099-G to file with your tax return see due dates. States that have increased their wage bases are highlighted in brown. The first 7000 for each employee will be the taxable wage base limit for FUTA.

Unemployment insurance is taxable income and must be reported on your IRS federal income tax return. The FUTA tax applies to the first 7000 of wages paid to each employee throughout the year. The MCTD includes New York City the counties of New York Manhattan Bronx Kings Brooklyn Queens Richmond Staten.

States are required to maintain an SUI wage base of no less than the limit set under the Federal Unemployment Tax Act FUTA. FUTA Tax Rates and Taxable Wage Base Limit for 2021. Data refer to place of residence.

On January 14 2021 New York State Department of Labor Commissioner Roberta Reardon ordered that employers UI accounts will not be charged for unemployment insurance UI benefits paid during much of the COVID-19 pandemic. Estimates for the current month are subject to revision the following month. 065 68 including employment security assessment of.

Calendar quarter if they are required to withhold New York State income tax from wages paid to employees and their payroll expense for all covered employees is more than 312500 for that calendar quarter. On September 5 2021 these federal unemployment programs expired. The 2021 FUTA wage limit of 7000 has remained unchanged since 1983 despite increases in the federal minimum wage and annual cost-of-living adjustments over the last 36 years.

11 May 2021 0126 EDT. New Yorks unemployment tax rates are higher in 2021 than in 2020 the state Labor Department said March 4. New executive orders again suspended the limit from September 27 2021 through January 25 2022.

9637 Change in Unemployment July 2021 vs July 2019 708641 unemployed people in July 2021 vs 360869 in July 2019. Rates shown are a percentage of the labor force. 9689 Change in Unemployment July 2021 vs January 2020 708641 unemployed people in July 2021 vs 359918 in January.

The following are the 2021 state unemployment insurance SUI wage base limits. SUI New Employer Tax Rate. Year 2025 - 12800.

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

California New York Have The Most To Gain From Ending Bonus Unemployment Benefits They Probably Won T

Will New York Tax Unemployment Payments We Still Don T Know Syracuse Com

Unemployment Benefits Comparison By State Fileunemployment Org

How Much Unemployment Benefits Will I Get In New York As Com

Information For Department Of Labor Employees Department Of Labor

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

California New York Have The Most To Gain From Ending Bonus Unemployment Benefits They Probably Won T

Nys Department Of Labor Nyslabor Twitter

Unemployment Insurance Benefits Faq From The New York State Department Of Labor Ny State Senate

Effective Days Down To Zero Benefit Year Ending Homeunemployed Com

New York Ny Dol Unemployment Insurance Compensation After End Of Pandemic Programs What You Can Get In 2022 And Claiming Retroactive Payments News And Updates Aving To Invest

Dinapoli Unemployment Taxes On Employers Poised To Increase To Repay 9b Owed To Federal Government Office Of The New York State Comptroller

0 Post a Comment: