Motor fueldiesel motor fuel monthly and quarterly March 1 2019 through February 29 2020 Partnership LLCLLP. The 1099-G tax form includes the amount of benefits paid to you for any the following programs.

New York S Economy And Finances In The Covid 19 Era Office Of The New York State Comptroller

All contributory employers continue to pay an additional 0075 Re-employment Services Fund surcharge.

Nys unemployment 2020 tax form. The new employer rate for 2021 increased to 4025 up from 3125 for 2020. Petroleum business tax and Publication 532. If you received unemployment compensation in 2020 including any income taxes withheld visit the New York State Department of Labors website for Form 1099-G.

Log in to your NYGov ID account. How to find form 1099-G on the New York Department of Labors website. You may be entitled to against the annual federal unemployment tax.

Taxes on Unemployment Payments. To request your form by mail call 888-209-8124 after the NYS DOL announces the 1099-G tax forms are available. Failure to file or late filing of all required parts of Form NYS-45 andor Form NYS-45-ATT may subject you to a penalty which can increase the later the return is filed.

The State of New York does not imply approval of the listed destinations warrant the accuracy of any information set out in those destinations or endorse any opinions expressed therein. For more information call 888 899-8810. The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

File the NYS-45 online by visiting the Department of Taxation and Finance website. Unemployment Insurance UI Pandemic Unemployment Assistance PUA Pandemic Emergency Unemployment Compensation PEUC Extended Benefits EB Federal Pandemic. If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments.

Find the forms you need - Choose Current year forms or Past year forms and select By form number or By tax type. Filing of all required parts of Form NYS-45 andor Form NYS-45-ATT may subject you to a penalty which can increase the later the return is filed. For 2020 if you earned under 150k the first 10200 in Unemployment is tax-free 10200 per spouse if married filing jointly.

If the federal Form W-4 most recently submitted to an employer was for tax year 2019 or earlier and the employee did not file Form IT-2104. Phone 518 485-8589 or write to the address on page one of this form to request information and necessary forms. Unemployment Income Rules for Tax Year 2021.

You must include this form with your tax filing for the 2020 calendar year. If you do not file using software make sure to add back the federal. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

If you claimed unemployment benefits in 2020 you will need it to correctly file your tax return this year. Completing Form NYS-45 This return and related forms are designed to be read by information processing equipment. Standard payments and bonuses are.

We comply with the state law that requires agencies to post all application forms for general public use on their Web sites. Completing Form NYS-45 This return and related forms are designed to be read by information processing equipment. New York would legalize mobile sports betting.

See our numerical list of forms. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. New York State Department of Labor - Unemployment.

Visit the Department of Labors website. Please note that tax form 1099-G will only be mailed upon request. If you are a business employer or a household employer of domestic services complete and return Form NYS-100.

How to Get 1099G Online - Department of Labor. If you are a nonprofit agricultural or governmental employer do not complete Form NYS-100. IRS Tax Refunds highlights.

By the end of January New Yorkers who received unemployment or pandemic benefits in 2020 will be able to view and print their 1099-G tax forms through NYS DOLs website. External web sites operate at the direction of their respective owners who should be contacted directly with questions regarding the content of these sites. The 2021 New York state unemployment insurance SUI tax rates range from 2025 to 9826 up from 0525 to 7825 for 2020.

Everyone must pay Federal taxes on Unemployment payments. They do this on the Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45 which must be filed online see below for information about electronic filing. This applies even if the wages are not.

State taxes depend on the state NY and NJ both tax Unemployment. If you are liable for Unemployment Insurance you must electronically submit a Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return Form NYS-45. And to 633 for those in the next income tax bracket which ranges up to 323200.

For joint filers the personal income tax rate would drop in the 2021 tax year to 597 for those earning between 43000 to 161550. To assist be sure to send us original forms not photocopies. Each calendar quarter the law requires liable employers to report their payroll and pay unemployment insurance contributions.

As a result of the COVID-19 pandemic and limited resources the IRS was forced to delay 2020 tax returns especially those that need to be reviewed. How to get your 1099-G form. If you have not yet filed your 2020 New York State return and file using software the software should already account for this update and add back the unemployment compensation excluded from federal gross income.

How changes to federal Form W-4 affect NYS withholding For tax years 2020 or later withholding allowances are no longer reported on federal Form W-4 Employees Withholding Certificate. See Personal income tax up-to-date information for 2020 Articles 22 and 30. Highway usefuel use tax.

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

![]()

New York Unemployment Tips Hotel Trades Council En

New York State Nys Tax H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

1099 G Tax Form Department Of Labor

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Stimulus Payments Start To Arrive The Latest On The Coronavirus Relief Bill The New York Times

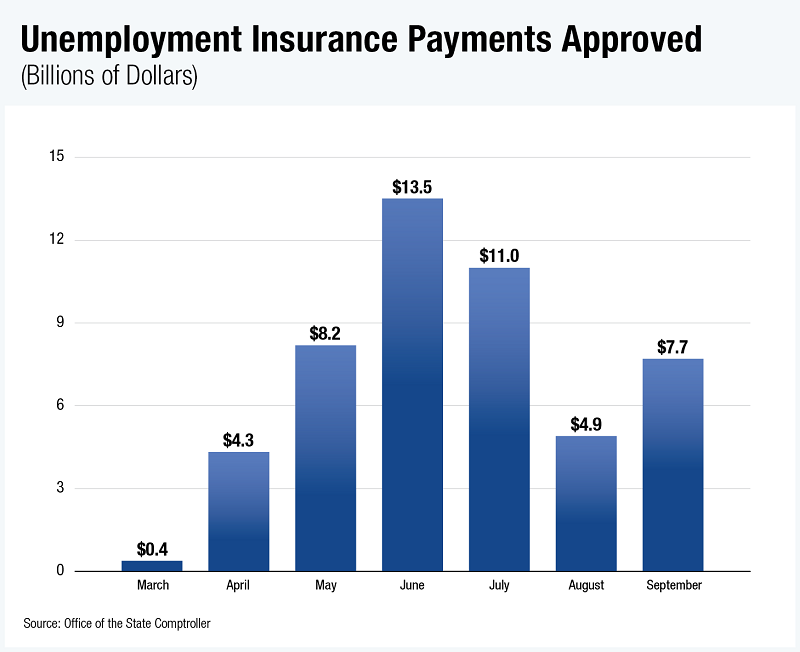

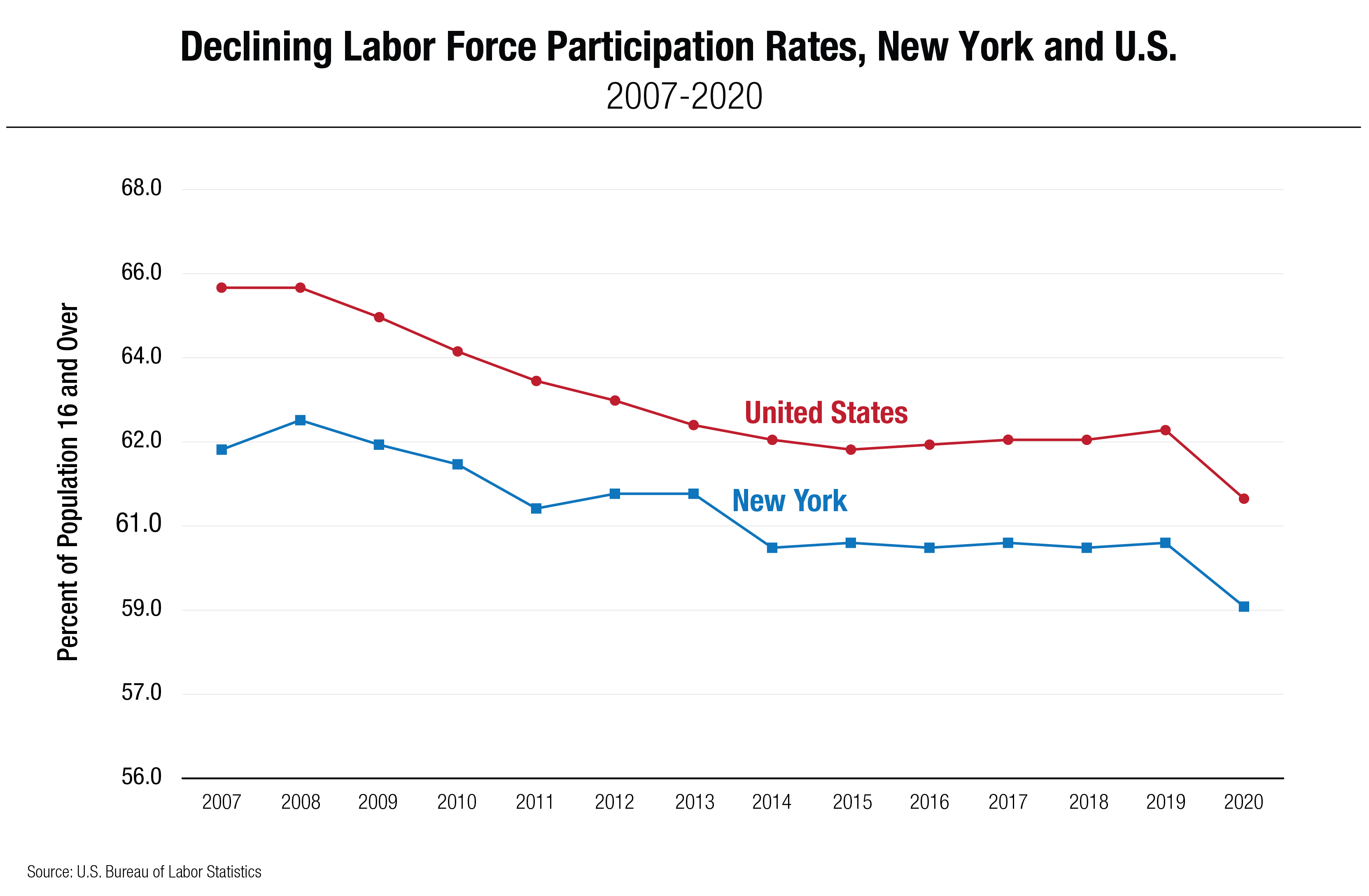

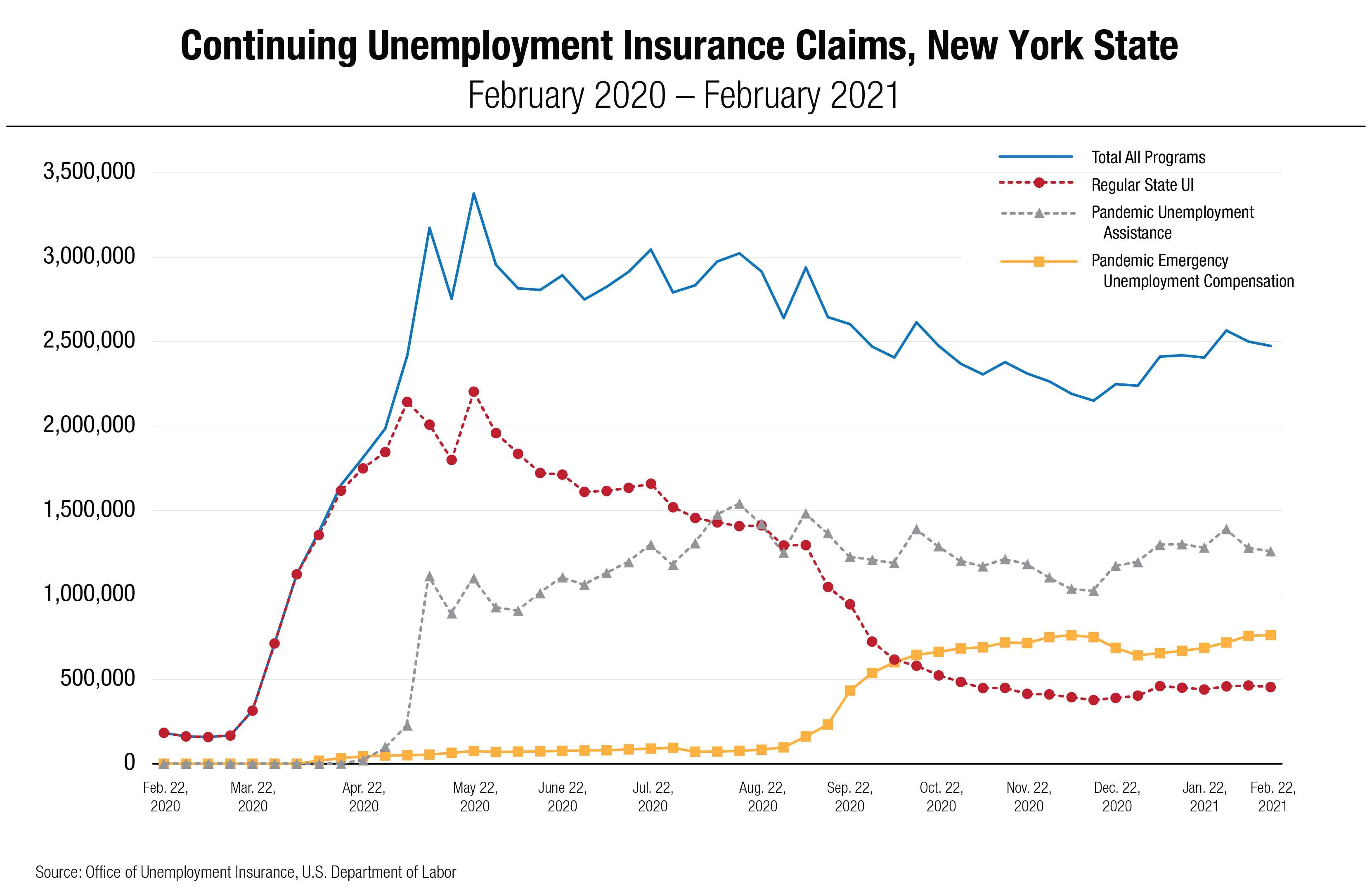

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

New York S Economy And Finances In The Covid 19 Era March 4 2021 Office Of The New York State Comptroller

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

0 Post a Comment: