December 9 2021. If you are not entitled to the weekly maximum benefit amount you may be able to increase your entitlement with dependency benefits.

You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development Unemployment Insurance PO Box 908 Trenton NJ 08625-0908.

Nj unemployment statement. Each claimant who iswas an employee is identified by name and Social Security number. Read our FAQs on paid leave job protection and caregiving. Federal benefits created during the benefit expired September 4 2021.

Your official business name as it appears on forms NJ-927 and WR-30 no abbreviations. See Form Use. What is the maximum unemployment in NJ 2021.

1099-G Tax Statement Available Online Only. To give employers an itemized listing of unemployment benefits charged to their experience rating account. She has not received any statement detailing the accounting of the deposits above.

If you filed a paper claim call 609-292-2305 have your claim number available. The tax rate is 6 but states can apply an unemployment tax credit of up to 54 when they have no federal loans outstanding meaning employers might only pay 06. You dont need to include a copy of the form with your income tax return.

Considering she was unemployed for approximately 8 weeks her total unemployment calculates to be 3712 464 8. You will still be able to receive benefits for eligible weeks prior to September 4 2021. Unemployment Insurance UI is a program that gives financial support to people who lose their jobs through no fault of their own.

I last wrote to the South Jersey Times in late August to voice my displeasure with the New Jersey Division of Unemployment Insurance. How do I know if my nj unemployment claim was approved. Form 1099-G Income Tax Statement showing the amount of Unemployment Insurance benefits paid and amount of federal income tax withheld will be in January following the calendar year in which you received benefits.

Live customer service representatives from New Jersey Department of Labor and Workforce Development are available from 830am to. Bureau of Labor Statistics. It will show you the amount of money you may collect each week weekly benefit rate and the total amount of money you may be entitled to collect during the one-year period that your claim is in effect maximum benefit amount.

To make this even more confusing for us there. We only send this code out by mail once to each employer. You must enter the security code.

However the form will no longer be automatically mailed. N ew Jersey Unemployment Claims customer service phone number is 1-201-217-4602. Claimants who exhaust extended benefits will have received up to 88 weeks of unemployment a maximum of 26 weeks of regular state.

Click here for the Request for Change in Withholding Status form. TRENTON The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation for calendar year 2022. That is EIN number assigned to NJ Department of Labor 22-2488181.

This was the case for NJ for FY2020. If you have had any employment in New Jersey during the period of time used to calculate your benefits you will receive this form. The CARES Act extended it to 39.

Your unemployment statements allow you to keep track of your income while you are out of work and are a good way to calculate how much you made. We provide the IRS with a copy of this information. The increased rates will be effective for new claims dated January 2 2022 and later.

We determine the average weekly wage based on wage information your employer s report. December 16 2021. This statement will be mailed to you each quarter.

Address Unemployment Insurance P O Box 916 Trenton NJ --. For 2021 the maximum weekly benefit rate is 731. Form 1099-G for New Jersey Income Tax refunds is only accessible online.

If you received Unemployment Insurance benefits the New Jersey Department of Labor and Workforce Development LWD will provide you with Income Tax Form 1099-G Certain Government Payments. It is important to have a way to verify that you are unemployed because social services that help the unemployed will need verification of your income and when you file your taxes you will need to include your unemployment income. Anyone who exhausted their benefits after July 1 2019 is eligible to receive 13 additional week of benefits.

We do not mail these forms. TRENTON Nonfarm wage and salary employment in New Jersey increased by 25800 in November to reach a seasonally adjusted level of 4060900 according to Preliminary estimates by the US. You can opt to have federal income tax withheld when you first apply for benefits.

To download your year-end statement you will need your Federal Employer Identification Number FEIN formatted as a 15-digit number and the permanent authorization code issued by the Department of Labor not to be confused with the PIN used to file your NJ-927 and WR-30 with the Division of Revenue. In short I dont know why she received 5452. Social Security Number is required.

Those who meet the requirements may receive benefits for up to 26 weeks during a one-year. Unemployment system again still one hot mess Letters. TRENTON Approximately 80000 New Jersey workers receiving extended unemployment Insurance UI are due to exhaust these state benefits in coming weeks as they reach the 13-week maximum.

To qualify for Unemployment Insurance benefits you must meet all of the eligibility requirements of the New Jersey Unemployment Compensation Law. If unemployment is your only income and the state deposits the money into your account you may not have your statements available when you need them. PEUC also increased unemployment benefits by.

Employed persons can show pay sheets or a printout from their employers. Statements for Recipients of New Jersey Income Tax Refunds Form 1099-G Electronic Services. The amount from the prior quarter of the total of all wages paid that are subject to Unemployment Temporary Disability Workforce and Family Leave Insurance line 8 of the States form NJ-927.

New Jersey normally has 26 weeks of unemployment insurance. Enter your Date of Birth Name or Zip Code. If you filed your claim online you may check the status of your claim by going to wagehournjgov have your confirmation number available.

Add in the 556 partial rate and that equals 4268. New Jersey makes statements available on the Internet to anyone with an account. FUA is funded by federal unemployment tax rates on the first 7000 employers pay to each employee.

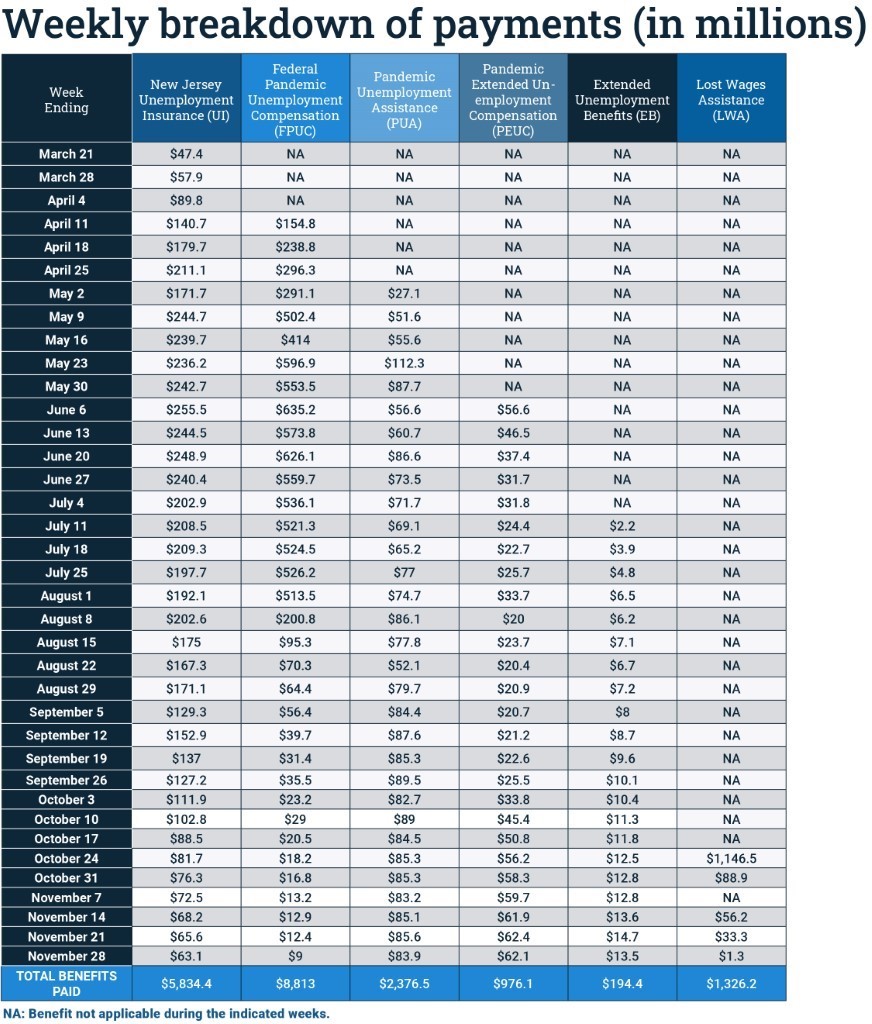

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Division Of Unemployment Insurance How To Certify For Benefits Online

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Help Your Nj Unemployment Questions Answered 7 P M Thursday

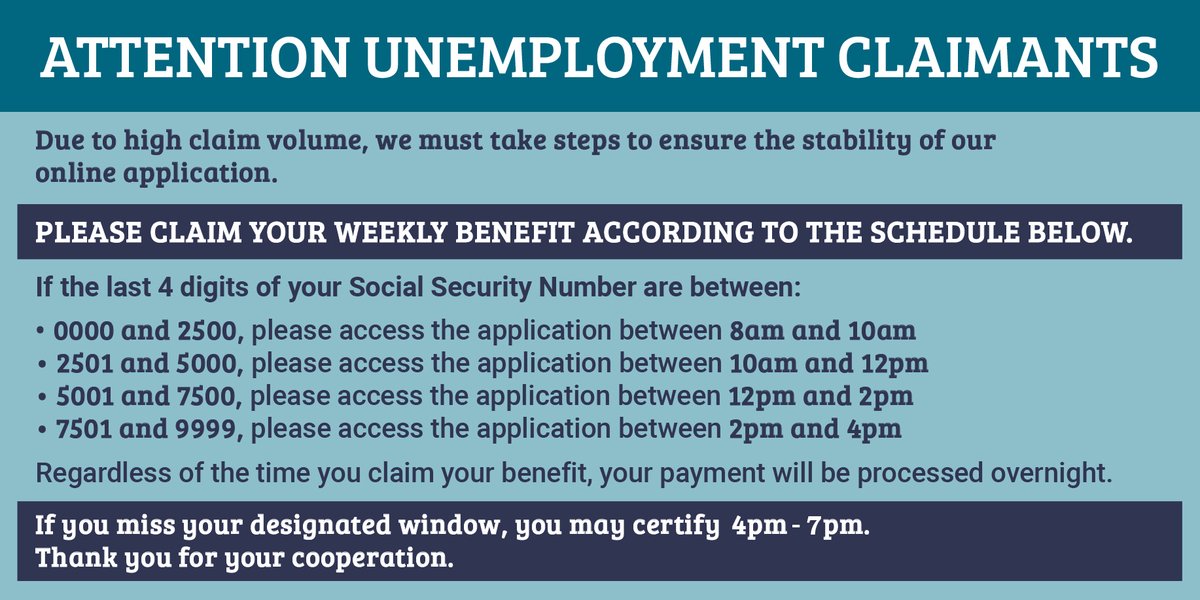

Nj Labor Department Njlabordept Twitter

Nj Labor Department On Twitter Amirita26 Just Tweeted New Info Too No Self Employed Will Qualify For Regular Ui In New Jersey Being Denied In Nj Is Step 1 To Being Eligible For

Nj Labor Department On Twitter Attention Self Employed Gig Workers If You Were Notified That You Can Claim Pandemic Unemployment Assistance Starting Friday Please Follow The Schedule Below To Claim Your Weekly

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Division Of Unemployment Insurance How To Certify For Benefits Online

Njdol New Unemployment Claims Rise During Thanksgiving Week Federal Jobless Benefits Set To Expire Dec 26

Njuifile New Jersey Unemployment Claim At Www Njuifile Com Jersey Lilly Ingomar

Njdol Commissioner Njdolcommish Twitter

0 Post a Comment: