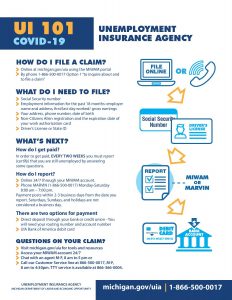

Telephone Call 1-866-500-0017. It usually takes about 45 minutes to apply online and you need to fulfill the following criteria to reap Michigan unemployment benefits.

Unemployment Resources Aft Michigan

As a result the Obligation Assessment OA added to employer SUI tax rates since 2012.

Michigan unemployment for employers. Michigans unemployment tax system is one of the most highly experience rated systems in the country. Michigan unemployment benefits and unemployment compensation are meant to provide a temporary source of income until you are able to find another job. Worker Adjustment and Retraining Notification Act WARN Act Employment Relationship.

An unemployed worker looks at the State of Michigan unemployment site Wednesday April 29 2020 in Detroit. You can apply online or through phone or in person. With MiWAM you can apply for benefits certify for benefits send a message update your account information and more.

Virtually all employers are subject to unemployment insurance taxes under the Michigan Employment Security Act MI Comp. The percentage is the employers share of each. While we can answer general questions about unemployment and tips to guide you through MIWAM unfortunately we are unable to file claims or provide customer specific information about your unemployment claim because.

Office of Employer Ombudsman. The state uses a strict formula to determine unemployment benefits amounts based on an employees recent salary. MI Safe Start Employer Guidance.

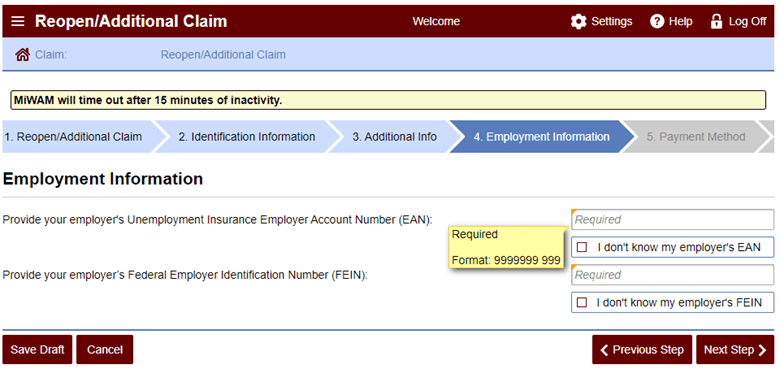

Effective January 1 2014 employers with more than 5 employees will be required to submit their quarterly reports on MiWAM Michigan Web Account Manager and by January 1 2015 all employers will be required to submit their quarterly reports on MiWAM. Your unemployment claim online through the Michigan Web Account Manager online easy convenient. UIA 1025 Employer Request for AddressName Change On-Line and Downloadable.

However unemployment benefits are just a small percentage of an unemployed workers previous income. In Michigan unemployment benefits are also available for workers who have an unanticipated family care responsibility for loved ones who become ill. MI Safe Start Employee Guidance.

How to apply for MI Unemployment benefits. Then the wages paid by each employer are compared to the total wages paid by all employers during the base period and a percentage is calculated for each employer. You obtain the required UIA Employer Account Number by registering with the Michigan Department of Treasury DOT either online or on paper.

All employers in the state pay unemployment taxes which are then paid out weekly to workers who lose their jobs. You worked under a single social security number. For the last 18 months you have worked for 1-19 Michigan employers.

The state of Michigan has developed numerous resources to help keep you informed about COVID-19 and the states response. Michigan works by listing of benefits paid is a finding that the implicated claimant was neither jobless or underemployed capable of working available for employment and had compensation as stated on Form UIA 1136 for the weeks paid and has attested truthfully. There are two ways to file a new unemployment claim.

We encourage you to visit our COVID-19 Frequently Asked Questions Resource site to explore employee and employer frequently asked questions and answers. A contributing employer files a tax report with the UIA at the end. ÂPPLY FOR UNEMPLOYMENT BENEFITS is.

Berrien Cass Van Buren is here to help you by email phone or remote appointment with job search and career services. Therefore liable under the Michigan Employment Security Act are responsible for paying state unemployment taxes to the Unemploy-ment Insurance Agency UIA. T he base period employers are charged proportionately for the remaining weeks.

Staff and verify their registration with either an in person or virtual appointment. Michigans Work Share program allows you to keep your employees working with reduced hours while employees collect partial unemployment benefits to make up a portion of the lost wages. Michigans unemployment insurance program is a financial haven for employees who have lost their jobs.

Michigan Governor Gretchen Whitmer announced that Michigan employers will see a state unemployment insurance SUI tax rate reduction for 2020 thanks to the early payoff of the bonds used by the Michigan Unemployment Insurance Agency UIA to repay their federal SUI loan. How does Michigan unemployment work for employers. UIA 1045 - Fillable Status Questionnaire for Employee Leasing Companies ELC UIA 1110 Application for Michigan Unemployment Tax Credit in 2010.

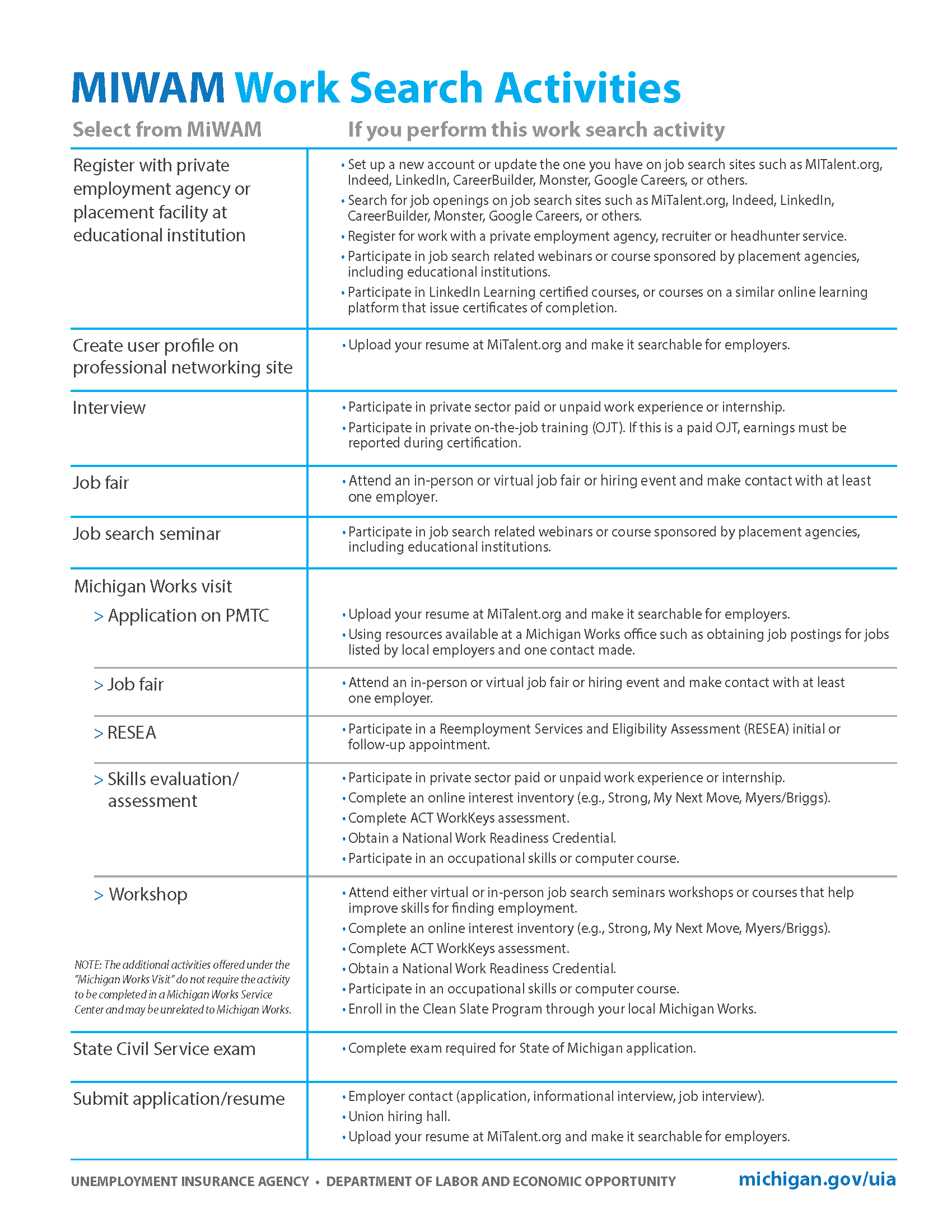

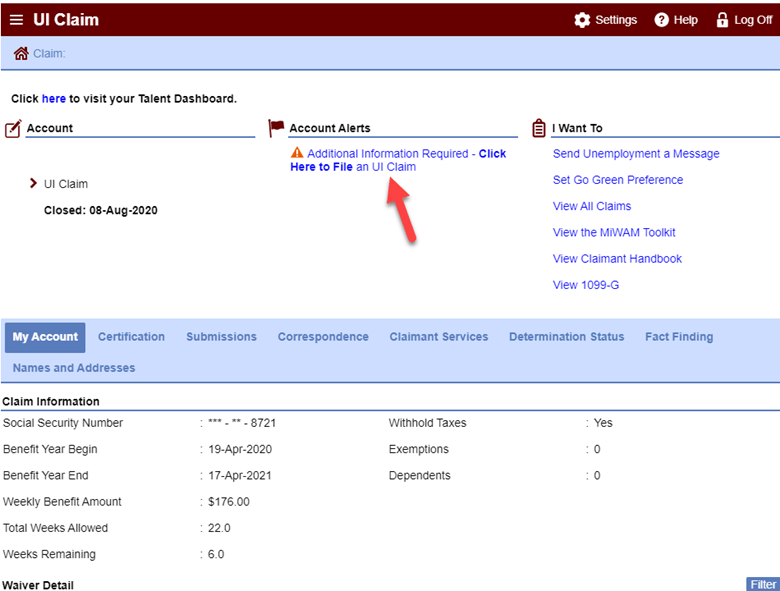

The Michigan Web Account Manager MiWAM is the UIAs updated and enhanced method for online managing your unemployment account by imparting some unemployment benefits for you. This generally means that a Michigan employers tax is more closely based on the actual benefit charges to its account and the size of payroll than employers in most other states. LANSING MI - Beginning November 7 2021 unemployed workers filing a new claim for benefits will be required to register for work with Michigan Works.

Online Visit MichigangovUIA. Employers could reduce hours and wages for workers between 10 and 60 and still be. Labor and Economic Opportunity - The Michigan Web Account Manager MiWAM is the UIAs online system for filing your unemployment insurance claim and managing your unemployment account electronically.

New filers for unemployment benefits must now register with Michigan Works. Michigan Unemployment Reporting for Employers Jan 20 2022 Effective Jan 20 2022 employers with more than 5 employees will be required to submit their quarterly reports on MiWAM Michigan Web Michigan Unemployment Insurance 9000 vs. And is available 24 hours a day.

This service is provided by the states Unemployment Insurance Agency UIA. To register online use Michigans Business One Stop website. If you are hearing impaired TTY service is available at.

UIA 1027 Business Transferors Notice to Transferee of Unemployment Tax Liability Rate. Unemployment Insurance Taxes. Click on MIWAM for Workers to begin your claim.

What you need to know. With Work Share you can maintain operational productivity and hang on to your skilled workers. Most employers are contributing employers and the taxes they pay the UIA are called contributions.

For a Limited Time receive a FREE Compensation Market Analysis Report. As a Michigan employer you need to establish a Michigan UI tax account with the states Unemployment Insurance Agency UIA. Michigan Unemployment Reporting for Employers - January 2014 Change.

The Employer Web Account Manager EWAM is replaced by MiWAM and simplifies speeds up and improves the efficiency with which you do business with the UIA. View the MiWAM Toolkit for Claimants for step by step instructions on how create your account.

I M Not Lazy Michigan S Jobless Fought Stigma The System For Months They Ll Be Cut Off Sept 4 Mlive Com

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Cont Bookkeeping Business Small Business Bookkeeping Small Business Organization

Labor And Economic Opportunity Submitting Your Work Search Activity In Miwam

Labor And Economic Opportunity Steps To Restart Your Ui Claim

Michigan Paid 8 5b In Fraudulent Covid Unemployment Claims

Uia Michigan Employer Informational Webinar Youtube

Michigan Works Helping Reopen Michigan S Economy Semca

Unemployment Benefits And Paid Leave Detroit Regional Chamber

Michigan Work Share Program Expanded To Help Employers Bring Back Employees Detroit Regional Chamber

Labor And Economic Opportunity December 2021

How Rick Snyder Made Collecting Unemployment Benefits Harder Opinion

Labor And Economic Opportunity Steps To Restart Your Ui Claim

0 Post a Comment: