The Connecticut Department of Labor administers unemployment insurance benefits for workers in the state who are either partially or fully unemployed and who are either looking for new jobs in training or waiting to be recalled back to their jobs. Dan Haar Hearst Connecticut Media While lawmakers scramble to assist residents who have been told they must repay millions of dollars in excess unemployment benefits they collected without fraud during the pandemic labor officials cautioned this.

Connecticut Department Of Social Services Connect

This is the agency to which unemployment insurance UI claims are submitted.

Ct unemployment benefits services. Connecticut employers can file unemployment taxes get necessary forms and understand benefit payment procedures here. Ale Dallman R-Green Lake said. Department of Labor Eligibility requirements for filing unemployment claims can be found as well as insurance information on weekly requirements and maximum entitlement.

Department of Revenue Services. Thanks to multiple application methods deciding where to sign up for unemployment is easier than ever. Recruitment training assistance Labor Relations Mediation Arbitration unemployment taxes resources forms.

Find more information about the benefits offered. Under Connecticut state law an unemployed person who qualifies for UI benefits can get their weekly benefit for up to 26 weeks. Unemployment Online Assistance Center.

UNEMPLOYMENT INSURANCE REEMPLOYMENT SERVICES AND ELIGIBILITY ASSESSMENT UI RESEA UI RESEA is a program funded by the US. The states CT Direct Benefits is the system that is used to administer and process benefit requests. The Connecticut Tax and Benefits System CTABS will allow you to file your weekly claims select payment options and provide answers to questions regarding unemployment benefits.

Under Connecticut state law an unemployed person who qualifies for UI benefits can get their weekly benefit for up to 26 weeks. However this time period has been extended by federal pandemic. Claiming benefits for unemployment is a straightforward process that can either be completed online or over the phone.

The Unemployment Insurance CT Direct Benefits online system will allow you to complete applications for new and reopened claims for benefits. File an employer appeal online. You can receive benefits if you meet a series of legal eligibility requirements.

The scale would provide 14 weeks of unemployment insurance benefits when the states unemployment rate is at its lowest at 35 and up to 26 weeks if the rate rises up to be above 9 Rep. In the state of Connecticut employees who are temporarily out of work through no fault of their own may qualify for unemployment insurance benefits. FILE - Signage at a Job News USA career fair in Louisville Kentucky on June 23 2021.

It evaluates individual claimant. She submitted an unemployment claim and waited anxiously to hear if shed receive jobless benefits to help cover her rent utilities groceries car insurance and other living expenses. Unemployment Insurance is temporary income for workers who are unemployed through no fault of their own and who are either looking for new jobs in approved training or are awaiting recall to employment.

Department of Labor to help unemployment insurance claimants return to work faster. Taxation of Unemployment Compensation Connecticut residents are subject to Connecticut income tax on unemployment benefits accrued. Amount and Duration of Unemployment Benefits in Connecticut The DOL determines your weekly benefit amount by averaging your wages from the two highest quarters in.

Applicants now have the ability to file an online application for unemployment in Connecticut making the overall process much faster and more straightforward. In most cases the maximum number of weeks you can receive unemployment benefits is 26 weeks unless you are given an unemployment benefits extension during a time of high statewide unemployment. Interstate Claim If you have earned wages in Connecticut and are eligible your benefits will be paid from Connecticut and will be subject to all the requirements of Connecticut law.

Applying for Benefits in Connecticut. Individuals who filed a claim prior to this date and who have been collecting unemployment insurance benefits are. Employer Unemployment Tax Filing.

Connecticut unemployment registration does not need to be an overwhelming ordeal. The states unemployment insurance program is managed by the Connecticut Department of Labor DOL. You can also continue to.

Trade Readjustment Assistance Services. A Guide to Your Rights Responsibilities When Claiming Unemployment Benefits in Connecticut Basic Eligibility Requirements. The Connecticut Department of Labor eventually ruled that Nigro was eligible and the weekly payments began arriving in her account.

It is vital that. File a claimant appeal online. Claimants are selected to participate based on multiple factors including most likely to exhaust UI benefits.

Get tax info 1099G form File your application for Extended Benefits EB Received an extended benefits letter. You must be monetarily eligible. The revised rate is 18 above the current 631 weekly maximum rate and will apply to claims filed for the benefit year starting on and after October 6 2019.

Jobs data economic information workforce analysis. UC-1099G Tax Form Information The UC-1099G Tax Form details the amount of unemployment benefits an employee received for a specific tax year. To file a Weekly Continued claim you can use the internet WebBenefits by selecting File a Weekly Continued Claim online or telephone.

SIDES E-Response Registration for employers Employer Resources. You must be totally or partially unemployed. The number of Americans applying for unemployment benefits fell below 200000 more evidence that the job.

File for Pandemic Unemployment Assistance PUA File your weekly PUA certification. Connecticut law provides for up to 26 weeks of unemployment insurance. Dante Bartolomeo was named commissioner of the Connecticut Department of Labor in June 2021.

Select a benefits payment option. Incumbent Worker Training Program can provide your company with up to 50000 in matching funds.

Torrington American Job Center Contact Information

Ct Unemployment Collecting Unemployment Benefits Ctlawhelp

Welcome To The American Job Center

Bureau Of Rehabilitation Services

Hartford American Job Center Contact Information

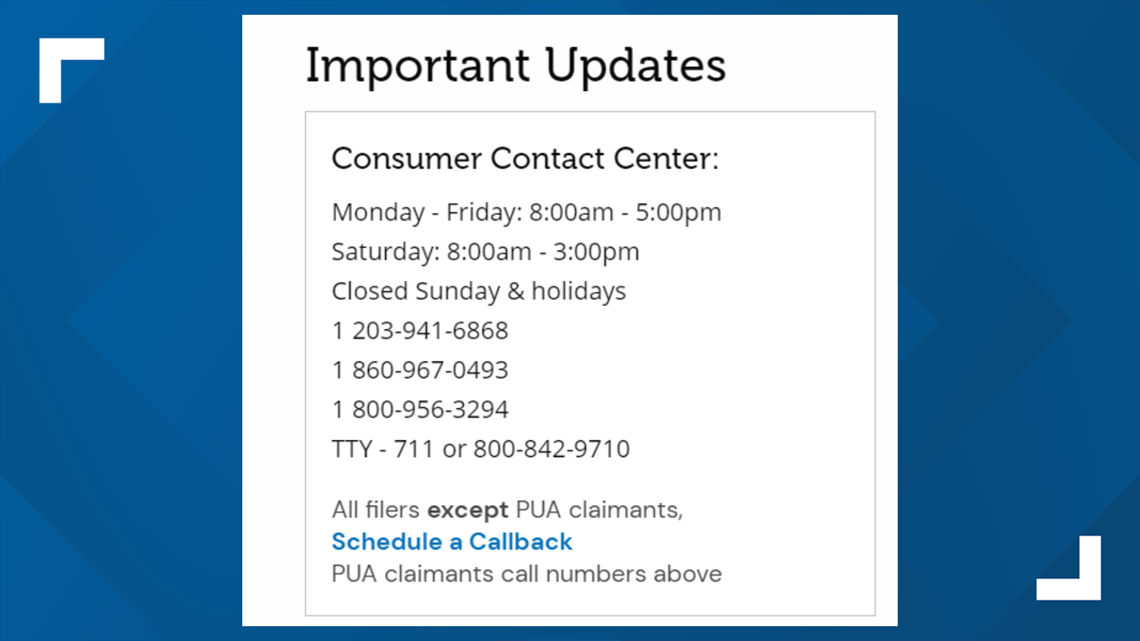

Connecticut Unemployment Helpline Phone Number Fox61 Com

American Rescue Plan Federal Programs

World S Largest Professional Network Employment Service American Jobs Job Center

Ct Department Of Labor Announces Customer Contact Center To Help With Unemployment Claims Connecticut News Wfsb Com

0 Post a Comment: