Eligibility for unemployment insurance benefits in New York is determined by how much youve worked and whether youve earned enough wages to be covered by unemployment or not. Past workers must have been paid at least 1900 in one calendar quarter.

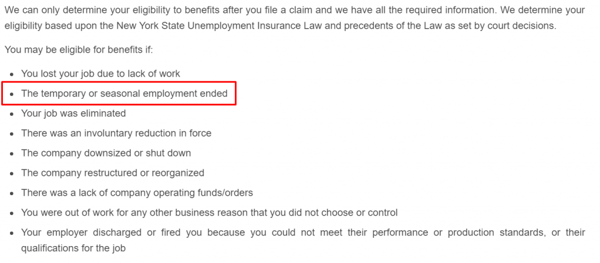

Other than meeting the aforementioned qualifications for unemployment benefits in NY you must also meet certain criteria to be awarded unemployment insurance within the state.

Unemployment ny qualifications. Under FPUC eligible people who collect certain unemployment insurance benefits including regular unemployment compensation received an extra 600 in federal benefits each week through July 31 2020. You must be available to work. With this change your benefits will not be reduced for each day you engage in part-time work.

A New York worker is not eligible for federal pandemic unemployment benefits unless they meet the financial qualifications for state benefits. Past workers must have been paid at least 1900 in one calendar quarter. 26 2020 until Sept.

In most cases poor performance will not rise to the level of misconduct under the New York unemployment law. You earned enough money in the last year and a half. The minimum rate increases to 108 for claims filed in 2021.

Unemployment Eligibility Work Requirements. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance. That means that a failure to meet any of these earnings-based state requirements will disqualify the worker from both state and federal benefits.

I applicants must meet three earning requirements and the below qualifications for unemployment in New York. The most recent figures for New York show an unemployment rate of 74. The Federal Pandemic Unemployment Compensation FPUC program provided additional unemployment benefits600 weekly until July 31 2020 and 300 a week from Dec.

You can find specific information regarding income qualifications on the New York state website. Other than meeting the aforementioned qualifications for unemployment benefits in NY you must also meet certain criteria to be awarded unemployment insurance within. Examples of misconduct that may justify a denial of unemployment benefits include theft physical violence falsifying documents and workplace drug useIn addition any misconduct that constitutes a felony should disqualify an employee.

Beginning October 20 2021 through November 18 2021 DUA is available to New Yorkers in the following New York Counties Bronx Dutchess Kings Nassau Queens Richmond Rockland Suffolk and Westchester who 1 lost employment as a direct result of Hurricane Ida and 2 live or work in an impacted county. You must have been paid at least 2600 in one calendar quarter for claims filed in 2020. You can collect benefits if you meet a series of legal eligibility requirements.

Total wages paid to you must be at least 15 times the amount paid to you in your highest quarter. You have worked and earned a minimum amount of wages in work covered by unemployment tax during the past 18 months. Indiana unemployment laws require you to be able to find new work before you can receive benefits.

There are three specific requirements mandated by the Indiana unemployment department that impact whether or not you qualify for unemployment. Are unemployed through no fault of their own. Your unemployment is not due to any fault of your own.

In New York State employers pay contributions that fund Unemployment Insurance. Similarly to receive PUA an individual must be ineligible for regular unemployment compensation or extended benefits under state or federal law or pandemic emergency unemployment compensation and satisfy one of the eligibility criteria enumerated in the CARES Act as explained in Unemployment Insurance Program Letter 16-20. New York former employees must be unemployed through no fault of their own in order to meet unemployment insurance eligibility requirements.

Have earned qualifying wages. Heres a list of reasons why you may not get unemployment. Waiting Week- NY is waiving the one-week unpaid waiting period so you can collect benefits for the first week you are out of work.

Instead benefits will be reduced in. However states may choose to revise their benefits in times of economic crisis and the federal government may help fund extended state benefits during such times. You are able to work.

You are totally unemployed. Under the new rules you can work up to 7 days per week without losing full unemployment benefits for that week if you work 30 hours or fewer and earn 504 or less in gross pay excluding earnings from self-employment. In the state of New York employers must pay contributions to the state that ultimately fund Unemployment Insurance for out-of-work employees.

Typically you can claim the income if. There are reasons that your unemployment claim can be denied and that you can be disqualified from collecting unemployment. In order to start your unemployment NY unemployment requirements include the following.

Other than meeting the aforementioned qualifications for unemployment benefits in NY you must also meet certain criteria to be awarded unemployment insurance within the state. Disaster Unemployment Assistance. You must file an Unemployment Insurance claim to find out if you are eligible and learn your actual benefit amount.

You must meet a number of requirements to be approved for unemployment benefits in New York. Be sure that you can not quit your job because you didnt like it or it was too hard or because it didnt pay enough or because the hours didnt work for your schedule and still expect to collect. Unemployment Benefit Rate- In NY the Unemployment Benefit Rate ranges from 104 to 504 per week.

To calculate your Benefit Rate click here. Typically New York state law allows eligible residents who are unemployed through no fault of their own to receive weekly unemployment benefits for up to 26 weeks during a one-year period. Former employees must have worked and been paid wages in at least two calendar quarters by companies who have unemployment insurance.

In order to be eligible for unemployment benefits in New York you have to have lost your job through no fault of your own. This means that if you quit your job you cant get unemployment. You must be able to work.

I applicants must meet three earning requirements and the below qualifications for unemployment in New York. In order to qualify for unemployment benefits you must be ready willing available and able to work. To apply for New York unemployment benefits click here.

New York former employees must be unemployed through no fault of their own in order to meet unemployment insurance eligibility requirements. To qualify for Unemployment Insurance benefits you must have worked and earned enough wages in covered employment. For example if you made 5000 in one quarter then the total for all four quarters must be 7500 or higher.

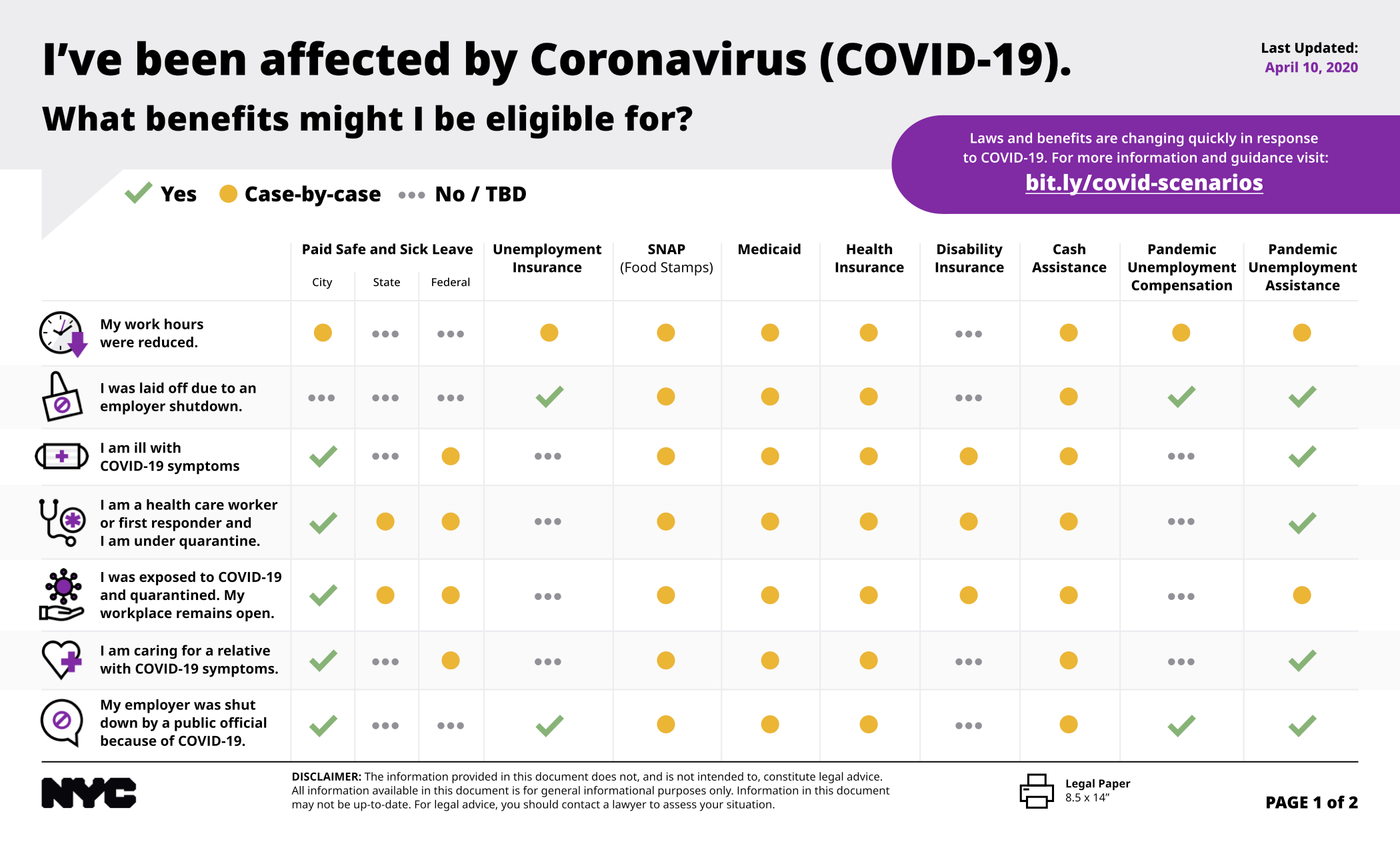

Depending on your vocation and industry you may qualify for unemployment if you have had your hours reduced.

/cdn.vox-cdn.com/uploads/chorus_asset/file/22253262/unnamed.jpg)

Change For Part Time Workers Receiving Unemployment Benefits The City

Nystateunemployment Fill Online Printable Fillable Blank Pdffiller

Can I Collect Nys Unemployment Benefits Workers Compensation Syracuse Ny Workers Compensation Lawyers Mcv Law

How Does Unemployment Work In New York Employment Lawyers

Pandemic Unemployment New York State Department Of Labor Facebook

New York State Department Of Labor Update The Extended Benefits Eb Program Is Now In Effect In Nys Thanks To The Pandemic Emergency Unemployment Compensation Peuc Eb Programs New Yorkers

How To Apply For Unemployment Benefits In Ny Credit Karma

Ny Sen Brian Kavanaugh Urges Nysdol To Reconsider Ui Pua Qualifications For Americans Trapped Overseas Due To Covid 19 Issuewire

Do Seasonal Workers Qualify For Unemployment

New York Unemployment Benefits Eligibility Claims

0 Post a Comment: