Employers liable under the Texas Unemployment Compensation Act must display a poster that includes information about both unemployment compensation and the Texas Payday Law. Do employees pay into unemployment in Texas.

Texas Workforce Commission Answers Questions About Unemployment Benefits Texas Hotel Lodging Association

Texas is whats referred to as a PEO-reporting state for unemployment insurance.

Texas unemployment employer. Employers can submit basic worker information on behalf of their employees to initiate claims for unemployment benefits before the layoff date or up to seven days after the layoff. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees paychecks. Definition of an Employer Top of Page.

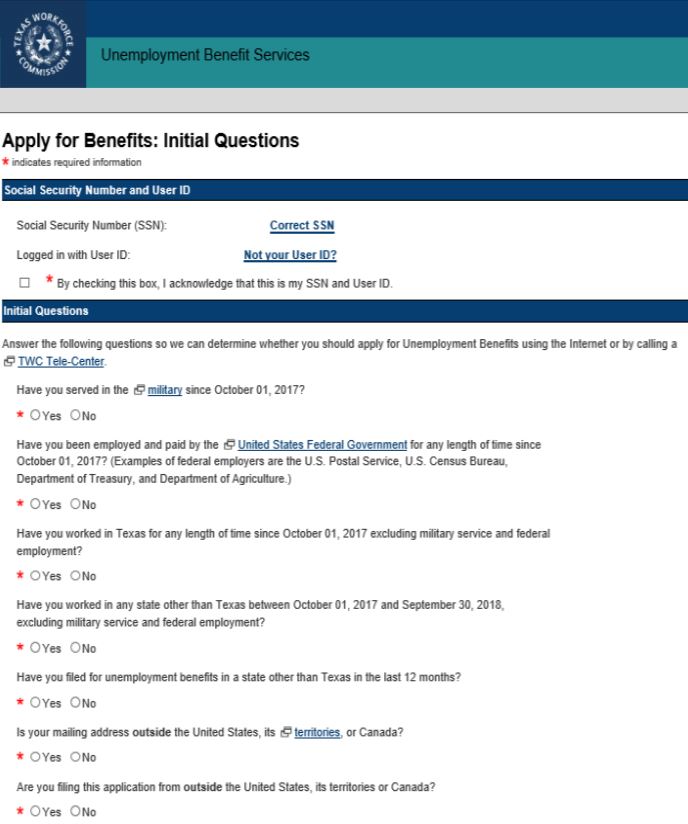

Before you apply for Texas unemployment benefits you will need to have the following information available to support your claim. Otherwise please sign up for a User ID. Employers and former employees have the right to appeal any decision that affects unemployment benefits.

Employer taxes pay for unemployment benefits. Your companys SUI rate no longer applies in Texas. While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a maximum of 631 percent it is not all good news for employers.

Learn about unemployment tax and review tax publications and news. New to Employer Benefit Services. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period whichever is less.

State unemployment charges will be invoiced by Justworks. EMPLOYMENT SERVICES AND UNEMPLOYMENT. The book Especially for Texas Employers is published as a service and a form of assistance to the employers of Texas by the Office of the Commissioner Representing Employers of the Texas Workforce Commission under the authority of Texas Labor Code Section 301002a2.

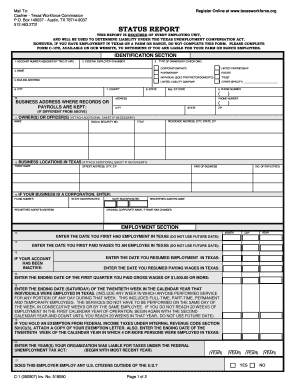

You can submit a Mass Claim Request on Employer Benefits Services EBS 24 hours a day seven days a week. Employers pay unemployment insurance taxes and reimbursements that support unemployment benefit payments. Update and review the status of your tax account.

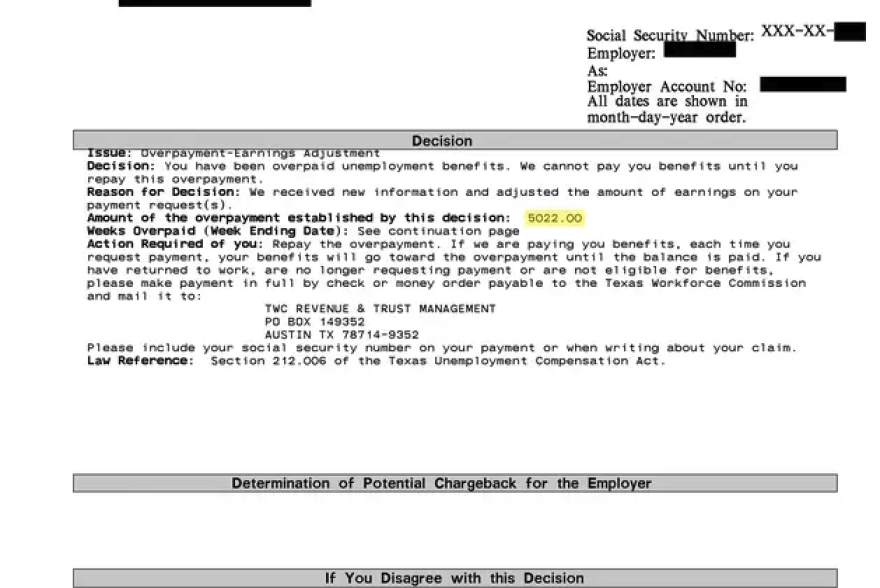

Assume that your company receives a good assessment and your SUTA tax rate for 2019 is 27. TWC had given Texas employers the direction that COVID-related charges would not go against the state fund and as of today that is not the case - this will ultimately drive higher rates across the state for. TWC will request job separation and past wage information related to individuals unemployment claims.

Once employers decide to appeal it is very important to do so timely. The UI tax funds unemployment compensation programs for eligible employees. Using the formula below you would be required to pay 1458 into your states unemployment fund.

New Texas Employer Information. If your small business has employees working in Texas youll need to pay Texas unemployment insurance UI tax. Click here to be taken there.

First and last dates month day and year you worked for your last. REIMBURSEMENTS OR CONTRIBUTIONS BY GOVERNMENTAL ENTITY. Register a New Tax Account File Pay Taxes.

Do I have to pay. Also every employer with 15 or more employees and smaller employers with federal grants and contracts must post the notice entitled Equal Employment Opportunity Is the. Employer-paid UI taxes replenish the Texas Unemployment Compensation Trust Fund which provides temporary income for workers who lose their jobs through no fault of their own.

Generally heres a summary of what you need to apply for Texas Unemployment. Employees do not pay unemployment taxes and employers cannot deduct unemployment taxes from employees paychecks. Otherwise please sign up for a User ID.

The first thing you need to do when creating a Texas Unemployment account is to visit the Texas Workforce Commission TWC Unemployment Benefit Services site. Each employers UI tax rate is unique tied to unemployment benefits paid. New employers should use the greater of the average rate for all employers in the NAICS code or use 27.

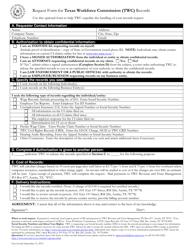

Each employers tax account is managed separately so you must have the appropriate permissions established for each tax account. Contact a tax office for assistance. Employers pay unemployment insurance taxes and reimbursements which support unemployment benefit payments.

Do I need separate TWC Internet User IDs if I represent more than one employer. ELECTION TO BECOME REIMBURSING EMPLOYER. To calculate your WBA divide your base period quarter with the highest wages by 25 and round to the nearest dollar.

The Texas Workforce Commission TWC announced that the impact of regular COVID-19 state unemployment insurance UI benefits on the states UI trust fund balance will have less of an impact on employer 2021 SUI tax rates than would have otherwise been the case because it has modified the rate computation. An unemployment hearing is conducted when an employer contests a former employees right to unemployment benefits. Every state has its own rules for filing an appeal.

A A state a political subdivision of a state an Indian tribe or an. Unlike most other states Texas does not have state withholding taxes. Texas will be announcing 2021 tax rate changes in February.

As a result of the TWCs. New to Unemployment Tax Services. Justworks will report unemployment taxes under the Justworks unemployment account number.

Your last employers business name address and phone number. Select the Request Employer Access link from the My Home page. 2021 SUI tax rates.

How to calculate unemployment benefits in Texas. In Texas state UI tax is one of the primary taxes that employers must pay. There is a difference under the TUCA between employing unit and employer as shown by the following definitions from the statute.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. Once there click on the Log on with your existing TWC User ID or create a. Establish a new unemployment tax account file wage reports and pay unemployment tax.

These requirements for Texas claimants are found in the Texas Unemployment Compensation Act TUCA - Texas Labor Code Sections 201001 et seq. TEXAS UNEMPLOYMENT COMPENSATION ACT. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

You can use the same TWC Internet User ID for all your employer unemployment tax accounts.

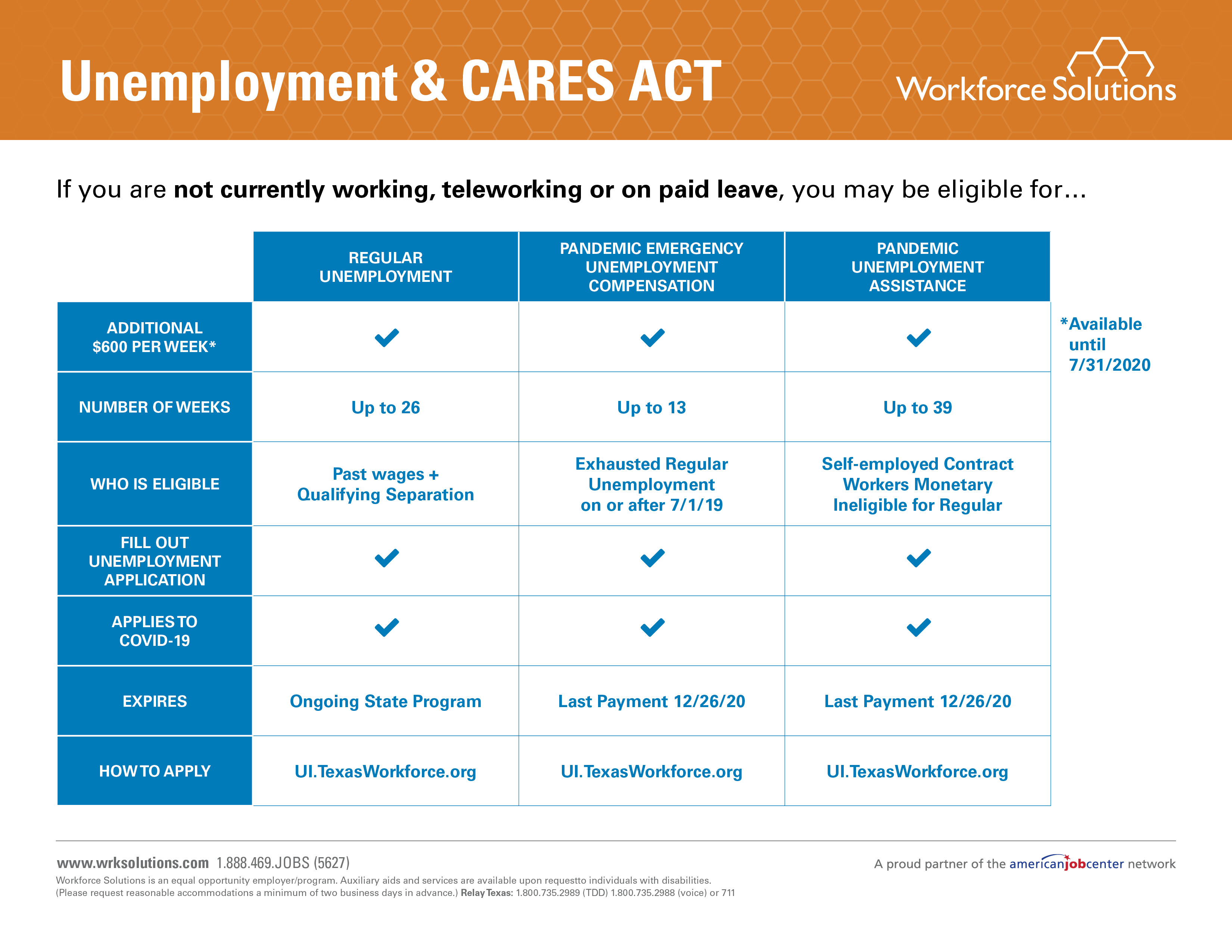

Unemployment Benefits Workforce Solutions

Unemployment Insurance How To Guide Texas Afl Cio

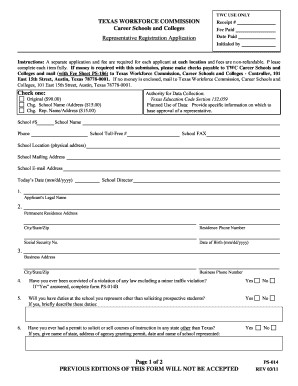

Get And Sign Texas Workforce Ps 014b Form

Unemployment Insurance Flowchart Checklist Texas Afl Cio

Twc Login Fill Online Printable Fillable Blank Pdffiller

Contact For Texas Unemployment Benefits Phone Email

Texas Unemployment Login Twc Logon Help Unemployment Portal

Texas Request Form For Texas Workforce Commission Twc Records Download Fillable Pdf Templateroller

Texas Unemployment System Is Confusing And Frustrating Here S How To Navigate It Kera News

Texas Twc Enhanced Unemployment Benefits With The End Of Pandemic Unemployment Programs How Much You Can Get In 2022 And Claiming Back Dated Payments Aving To Invest

Texas Unemployment Login Twc Logon Help Unemployment Portal

0 Post a Comment: