Questions Answered Every 9 Seconds. A Michigan tax ID number can make your business feel more professional.

This Quarterly Tax Reference Guide Is For Any Business That Has Employee S And Cont Bookkeeping Business Small Business Bookkeeping Small Business Organization

They let your small business pay state and federal taxes.

State of michigan unemployment tax id number. The simplest and preferred way is to apply for an EIN with the IRS online. Instead of providing an employer with a Social Security number an individual can provide their Michigan tax ID number. 0800500000 For all University of Michigan campuses.

One of several steps most businesses will need to take when starting a business in Michigan is registering for an Employer Identification Number EIN and Michigan state tax ID numbers. The state number is the filers identification number assigned by the individual state If I read this right the filer is them not us. Questions regarding the online registration process can also be sent to MiWAMSupportmichigangov or you can call 313-456-2188 Monday through Friday from 8 am to 430 pm.

The online application will open in a new tab or window on your web browser. For base period earnings prior to January 1 2020. One of the main purposes of a Michigan tax ID number is protecting the identity of your business by linking your important business information to this single number.

Ad A Tax Advisor Will Answer You Now. As a Michigan employer you need to establish a Michigan UI tax account with the states Unemployment Insurance Agency UIA. The MILogin User ID Merge initiative launched Dec.

After completing this on-line application you will. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes from employee. Find the employers Federal Employer Identification Number in box B of the W-2 form.

Obtain an Employer Identification Number also known as an EIN or FEIN for your business if you do not already have one. Ad A Tax Advisor Will Answer You Now. If the business has a federal Employer Identification Number EIN the EIN will also be the Treasury business account number.

What is the State of Michigan federal identification number used on the Substitute Form 1099-G. Questions Answered Every 9 Seconds. 0800500001 Ann Arbor Campus.

In box 10b enter the filers state identification number. We guarantee you will receive your EIN within 1-2 business days but many applications are processed and EINs are delivered to â State Employer Identification is assigned by the state where the company is headquartered and is used to collect state taxes from clients or customers and to file state income tax. Apply for an EIN View Details.

The University of Michigan Employer Account Numbers EANs for the State of Michigan Unemployment Insurance Agency UIA are as follows. Register With the Department of Treasury and Unemployment Insurance Agency. By performing a User ID Merge claimants will have to remember only one username and password to access services such as Pure Michigan Talent Connect MI Bridges and others.

Step 3 Call your most recent employer if you cannot locate your former employers federal EIN because you dont have a W-2 form to check. The Unemployment Insurance Agency offers an online process to register for and receive you UIA Employer Account Number. This is the number being referenced in the messages above for the state of Michigan If you did not have any state taxes withheld then leave all the boxes blank boxes 10a 10b.

Op 6m Michigan. Employer information includes name address phone number of lastemployer employers Federal ID Number from W2 form or pay stubdates of employment employee salary or other monetary. If you had state taxes withheld from your unemployment but there is not a state ID number on your form then use the Federal ID number shown on your form in box 10b.

Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. Michigan residents who have lost their job through no fault of their. State of Michigan Department of Treasury Lansing MI 48922 Federal ID.

For base period earnings on or after January 1 2020. Once you know the advantages it is simple to get started by registering for a Federal Tax ID also know commonly as an Employer Identification Number EIN. The online registration eliminates the need to complete and mail in the Form 518 Michigan Business Tax Registration booklet.

To begin your registration for Michigan Taxes click on. The process is easy fast secure and convenient. You obtain the required UIA Employer Account Number by registering with the Michigan Department of Treasury DOT either online or on paper.

There is no cost to apply for an EIN. So we might all have the same number. The Payers name address and federal identification number are.

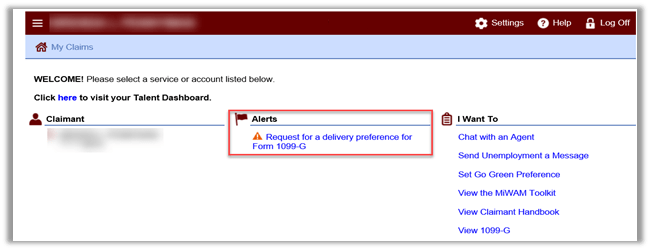

Register for an EIN Fast and Easy. On the MTO homepage click Start a New Business E-Registration to register the business with Treasury for Michigan taxes. Unemployment Insurance claimants who have multiple state accounts can now combine them for easier access to state services.

To apply for EIN Michigan sounds complicated but it is as easy as clicking a few buttons and filling out a form with GovDocFiling.

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Hav In 2021 Bookkeeping Business Business Tax Small Business Bookkeeping

Michigan Unemployment Appeals Surge Amid Overpayment Mistakes

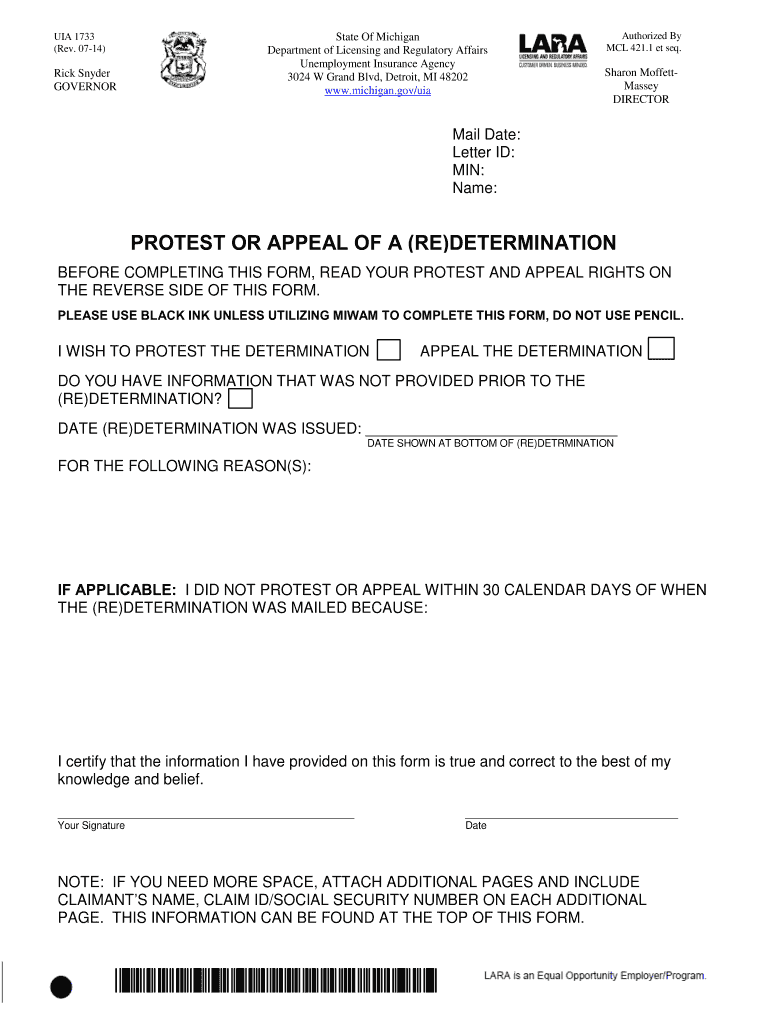

Form Uia 1733 Fill Online Printable Fillable Blank Pdffiller

Some Families Face Paying Back Money To State That S Already Been Spent On Household Bills And Food

Youth Unemployment Essay Economics Summary Writing Essay Love Essay

Is There A Way To Find My Unemployment Id Number I

Labor And Economic Opportunity How To Request Your 1099 G

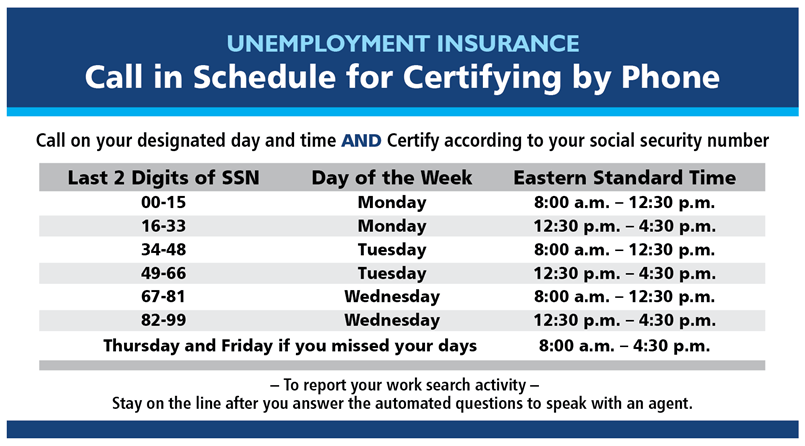

Labor And Economic Opportunity How To Certify For Benefits

Labor And Economic Opportunity How To Request Your 1099 G

Michigan Doled Out 3 9 Billion In Improper Unemployment Payments Audit Says Bridge Michigan

0 Post a Comment: