New York State Department of Labor has sent you this form to inform you about the end of your benefit year on your unemployment insurance claim and to establish your ongoing benefit eligibility. The Board considered the arguments contained in the written statement submitted on behalf of the Commissioner of Labor.

As per the Department of Labor between.

Nys unemployment year end statement. The BYE date is the date when an individuals unemployment insurance UI claim ends after a claims BYE date. Your unemployment claim remains valid for one year from the date it is filed unless you exhaust benefits sooner. NYS-45 Quarterly Combined Withholding Wage Reporting and Unemployment Insurance Return.

Box 15130 Albany New York 122125130 If you have not received a response to your request within 7 business days please call the NYS Department of Labor at 518 4851283. If you are applying for financial assistance a loan or declaring bankruptcy you typically must show proof of income. The year-end statement provides all the required information for inclusion on a W-2 form.

If you need a copy of your 1099G you can view and print your 1099G for calendar year 2013 on the NYS Department of Labor website. You can also request a mailed reprint of your current years Statement once the Statement mailing is completed usually in July. Year Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec.

If you received unemployment benefits in 2020 you will receive Form 1099-G Certain Government Payments. New Unemployment Insurance claims filed on and after June 28 2021 will include an unpaid waiting week. I began collecting unemployment at that time as I searched for a new job.

IRS Form 1099-G will be mailed to everyone who was paid Minnesota unemployment benefits in 2021. The form shows the total benefits paid and. According a the Department of Workforce Development DWD unemployment insurance 2020 tax statements are now available online.

Filers of paper returns may be subject to penalties and delays in processing. Verification of income is one of the reasons that a person receiving unemployment in New Jersey can have for wanting to see a statement. Additionally a year-end summary of all payment activity is mailed to employers by January 15.

Year-end tax information IRS Form 1099-G. Prior to calendar year 2019 Part C columns d and e were only completed on the 4th quarter return You must electronically file and pay your withholding tax returns. Employed persons can show pay sheets or a printout from their employers.

This tax form provides the total amount of money you were paid in benefits from NYS DOL in 2021 as well as any adjustments or tax withholding made to your. For April 1 2020 June 30 2020 the minimum benefit rate is 182. Please contact us to request your reprint.

Before sharing sensitive information make sure youre on a federal government site. Benefit Year End BYE date arrives for many New Yorkers some have trouble receiving benefits Not everyone receiving Unemployment Insurance UI. I began a part time job at the end of October 2020 ending 25 weeks of unemployment and that position ended in June 2021.

I write today because I submitted a claim for unemployment for my remaining 14 weeks and it was denied. Log in with your NYGOV ID then click on. This form is sent to the employee federal state and local governments.

Was a self employed consultant at that time. NYS Department of Labor 518 4579841 PO. Federal government websites often end in gov or mil.

The minimum PUA benefit rate is 50 of the average weekly benefit amount in New York. The permanent authorization code issued by the Department of Labor not to be confused with the PIN used to file your NJ-927 and WR-30 with the Division of Revenue. In order to receive the benefits you are entitled to moving forward you must accurately complete and return this form.

You can choose to receive your 1099-G. The Statement for Recipients of Certain Government Payments 1099-G tax forms are expected to be available in mid-January 2022 for New Yorkers who received unemployment benefits in calendar year 2021. A New York State Form 1099-G statement issued by the Tax Department does not include unemployment compensation.

Jan 10 2022 Following the expiration of New York States COVID-19 State of Emergency the Unemployment Insurance unpaid waiting period rule is once again in effect. It is important to have a way to verify that you are unemployed because social services that help the unemployed will need verification of your income and when you file your taxes you will need to include your unemployment income. Local Area Unemployment Statistics - New York City.

For January 1 2020 March 31 2020 the minimum benefit rate is 172. NYS DOL has updated its guidance to ensure that New Yorkers approaching their benefit year ending BYE date will receive the new or extended benefits they are entitled to as quickly as possible. STATE OF NEW YORK UNEMPLOYMENT INSURANCE APPEAL BOARD PO Box 15126 Albany NY 12212-5126 DECISION OF THE BOARD.

The end of the academic year. Anyone who received Unemployment Insurance UI benefits in 2020 is reminded that they must report them on their 2020 state and federal tax returns as taxable income. The deadline for your employer to send your W-2 form to you is January 31.

For NYS unemployment you should have received a 1099G. The form will be mailed to the address listed in your account on December 31 2021. Your Statement provides information as of March 31 2021.

Please be aware some claims cannot be automatically processed and will require manual review from a. PUA is available for periods of unemployment between January 27 2020 and December 31 2020. Disability During Unemployment benefits and Unemployment Insurance benefits are also taxable for federal income tax purposes.

Sign in to your Retirement Online account to view or print this years Statement even if you received it by mail. The Internal Revenue Service Form W-2 is the wage and tax statement you receive from your employer at the end of the year. Typically the end of the benefit year means the jobless would have to establish a new claim to determine eligibility for benefits and to.

Mailing will begin in mid-January and will be completed by January 31 2022. If you received unemployment compensation in 2021 including any income taxes withheld visit the New York State Department of Labor website log in to your NYGov ID account and select Unemployment Services and ViewPrint 1099-G. If you got an authorization code by mail in the last two years use that.

Your unemployment statements allow you to keep track of your income while you are out of work and are a good way to calculate how much you made. Federal law requires a review for new wages after one year. Status of the Civilian Labor Force - New York City Civilian Labor Force - Seasonally Adjusted.

The statements called 1099-G or Certain Government Payments are prepared by UIA and report how much individuals received in unemployment benefits and income tax withheld last year.

Resume Janine J9 Micheletti Resume Examples Job Resume Examples Good Resume Examples

Staff Progress Report Template Unique Hr Letters To Employees Inspirational New Employee Boarding Te Internship Resume Functional Resume Human Resources Resume

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

Unemployment Pakistan Essay Essay Format Essay Mission Statement Examples

Brush Up Your Cobol Why Is A 60 Year Old Language Suddenly In Demand Stack Overflow Blog Cobol Ibm Language

Senior Accountant Resume Sample Fresh Resume Sample Professional Resume Sample Resume Template Professional Accountant Resume Job Resume Template

New Yorkers Seeking Unemployment Benefits Still Desperate To Reach Help Here Are Tips Syracuse Com

May 5 2020 Urgent Solution To Unemployment Benefits Delay Are You Still Waiting To Be Called By Dol Follow This Walkthrough Ny State Senate

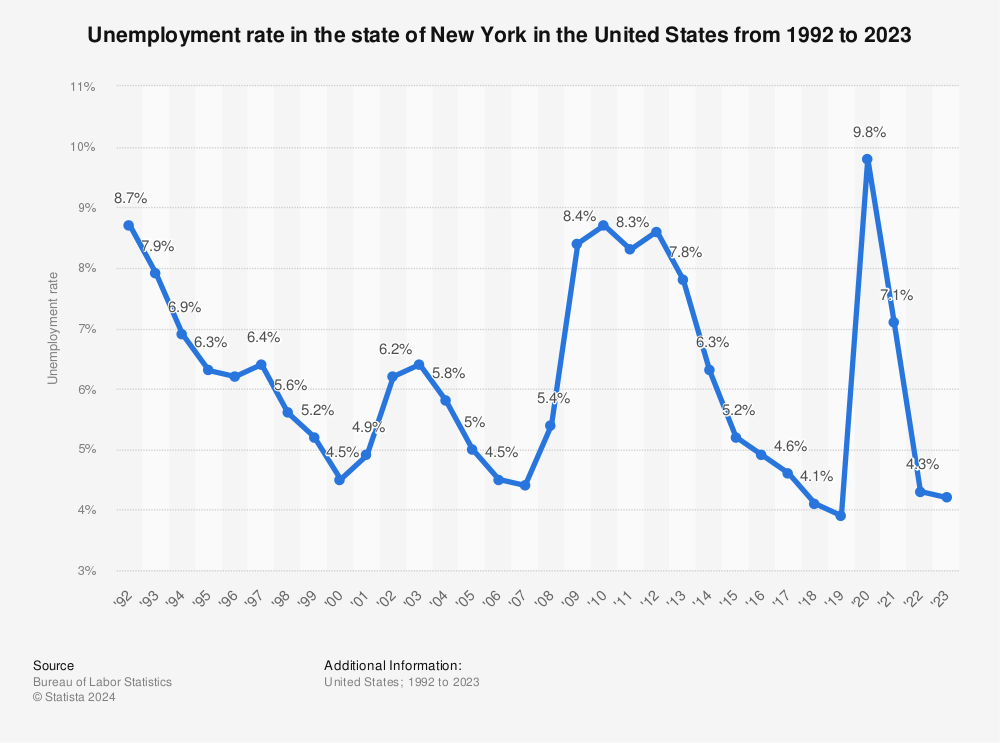

New York Unemployment Rate 2020 Statista

0 Post a Comment: