Eligibility Requirements of Unemployment Benefits in Connecticut. Generally Republican governors are very strict when it comes to unemployment benefits and people following the rules said Stettner who analyzed the impact of the early terminations on the jobless.

New Jersey Unemployment Tips Hotel Trades Council En

An estimated 75 million workers lost benefits on September 6 2021the largest cutoff of unemployment payments in history many times larger than any previous cessation of disbursements such as the 13 million Americans whose support ended in 2013 or the 800000 in 2003.

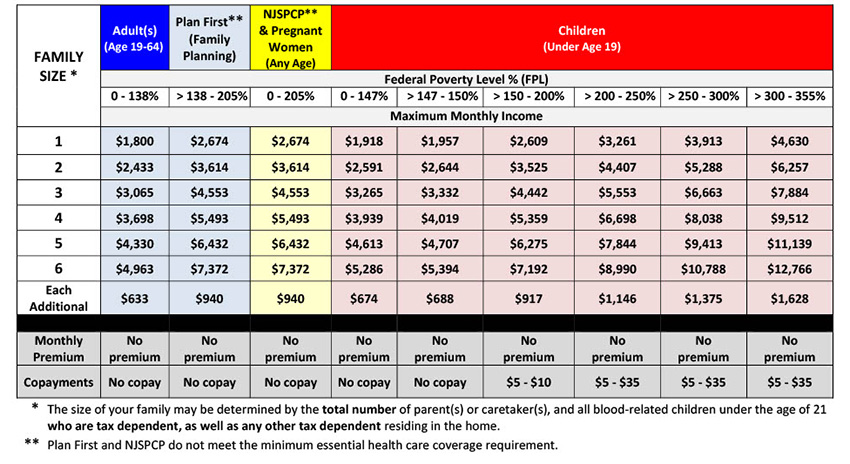

Ny vs nj unemployment benefits. To be eligible for unemployment benefits an employee must have earned at least 8300 or have worked for a minimum of 20 weeks. The unemployment benefit payments listed are based upon previously supplied wage and separation data. For January 1 2020 March 31 2020 the minimum benefit rate is 172.

Your unemployment insurance UI benefit rate depends on 2 factors. New legislation S4049A5678 changes the cap on Shared Work benefits from a maximum of 26 weeks to a maximum of 26 times an individuals weekly benefit rate. TTYTDD users should call 800 662-1220.

856-507-2340 So you have lost your job or learned that you soon will. Ineligibility for unemployment insurance benefits will continue for each week in which the weekly severance payment exceeds the maximum weekly unemployment benefit rate. YC VL Inc 100 NJ.

Also include your full name. NJ wins here too. In roughly 22 months the Labor Department has paid 36 billion to about 15 million claimants said spokeswoman Angela Delli-Santi.

The charges made to your account will be used to determine your. Eligibility Requirements of Unemployment Benefits in New Jersey. If you are unable to access the internet please call.

The New Jersey Department of Labor and Workforce Development administers unemployment insurance benefits for citizens in the state. Just the limited old state unemployment benefits which can be as few as 12 weeks. Pandemic Unemployment Assistance PUA.

If you prefer to speak to an advocate please call 855 528-5618. You will still be able to receive benefits for eligible weeks prior to September 4 2021. 1 Weekly benefit rate Your weekly benefit rate is 60 of your average weekly wage up to the maximum benefit amount.

Any out of state resident claiming EB benefits against the State of New Jersey will only be entitled to two 2 weeks of extended benefits unless the state where they reside is also in an EB on period or they are defined to be a commuter under the New Jersey Unemployment Compensation Law. Customers needing to file for unemployment insurance are urged to apply online at MyUnemploymentnjgov. Federal benefits created during the benefit expired September 4 2021.

When you receive the B-187Q you should check each item against your records. Those missing 5-10 days to recover from covid will not be able to get any type of financial help and if they do not have PTO may be losing savings to deal with isolating. For example New York explicitly disqualifies health care workers from unemployment benefits if they quit or are terminated for not adhering to.

Now there are no pandemic benefits at all for those losing their jobs. The maximum weekly benefit is 696 in 2019. If the employer structures the severance payment as a lump sum the NY Department of Labor will apply a formula using the former employees prior actual or average weekly.

Your weekly benefit rate and your maximum claim benefit amount described below. The Sporn decision was expressly ratified by the New Jersey Supreme Court in NJ. The minimum PUA benefit rate is 50 of the average weekly benefit amount in New York.

DEEP DIVE An expert News 12 spoke to says you. The New Jersey 4. The Telephone Claims Center can be reached at 888 209-8124.

Looks like I would be delayed in NY httpswwwlabornygovuiclaimantinfobeforeyouapplyfaqshtm19 It looks like a maximum 26 weeks of benefits in either state. Please email only the last four digits of your Social Security number not the entire number. Weekly max is 657 NJ vs 430 NY.

Wages from the previous 52 weeks are used to determine eligibility. I would think each state has different rules but appears NY wants you to report - normally you would then take credit on you home state tax return for the taxes paid to NY but in this case NJ does not tax unemployment so no credit would be available. The American Rescue Plan Act passed in March of 2021 waived federal taxes on up to 10200 of benefits per person for 2020 but not for 2021.

The New Jersey Supreme Court has also expressly included the prohibition against deduction of unemployment benefits in its Model Jury Instructions. 52 rows New Jersey. Extending Shared Work Benefits - 91721.

The New York state tax starts at 4 and goes as high as 882 while in New Jersey rates start at 14 though they go as high as 118 if you make more than 5000000. It pays benefits to workers who have lost their job through no fault of their own and also assists with helping unemployed workers find jobs by providing search and training services. To file a New York unemployment claim you will need.

The maximum benefit rate is 504 the same as the maximum benefit rate for regular unemployment insurance benefits. You will use this pin when you call the New York unemployment number the Telephone Claims Center to claim your weekly benefits or to certify your benefits. Then click on the envelope icon at the top of the My Online Services page.

Phil Murphy has the authority to extend the payments using. The Shared Work program allows employers to keep employees and avoid layoffs by allowing staff members to receive partial Unemployment Insurance. Although the state relied on archaic systems and complex outdated benefit requirements the technology performed remarkably well she said.

For April 1 2020 June 30 2020 the minimum benefit rate is 182. Read our FAQs on paid leave job protection and caregiving. New Jersey defends its handling of unemployment matters.

See links to assistance with food housing child care health and more.

Nj Labor Department Njlabordept Twitter

Nj Unemployment 75 000 Residents Still Owed Thousands In Benefits Abc7 New York

Employee Benefits And Executive Compensation Proceedings Of The New York University 59th Annual Conference On Labor Hardcover Walmart Com Employee Benefit York University Compensation

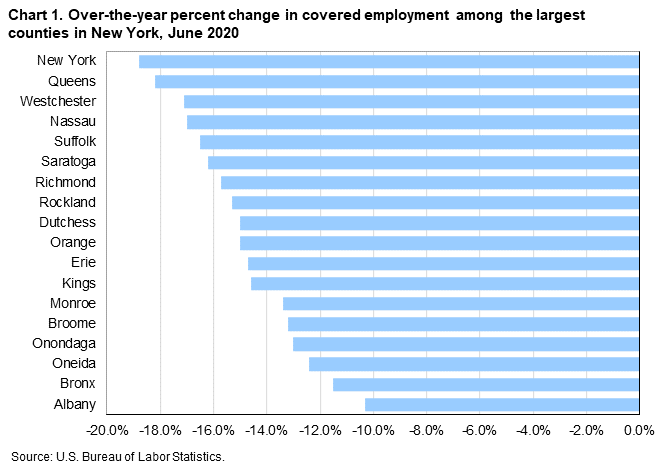

County Employment And Wages In New York Second Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Ends Covid Unemployment Benefits The New York Times

Unemployment Benefits Comparison By State Fileunemployment Org

Disqualification New Jersey Employment Litigation Lawyers

New Jersey New York New Jersey Information Office U S Bureau Of Labor Statistics

Division Of Temporary Disability And Family Leave Insurance

Nj Unemployment 75 000 Residents To Start Receiving Thousands In Owed Benefits This Weekend Abc7 New York

0 Post a Comment: