To be eligible for Unemployment Insurance benefits in 2022 you must have earned at least 240 per week a base week during 20 or more weeks in covered employment during the base year period or you must have earned at least 12000 in total covered employment during the base year period. The more money that you made in your base period the larger the amount that you will recieve every week for unemployment.

Unemployment Benefits Comparison By State Fileunemployment Org

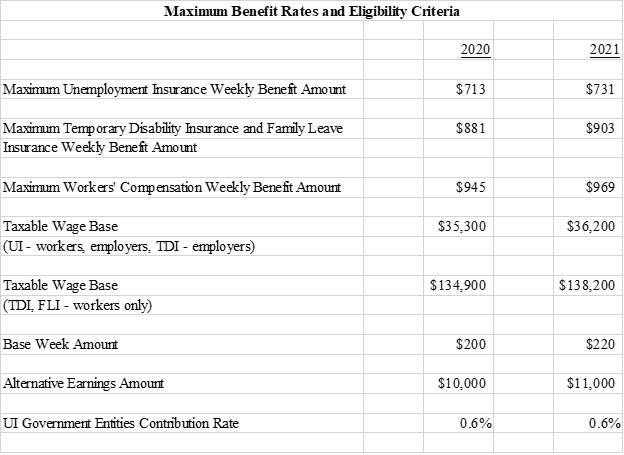

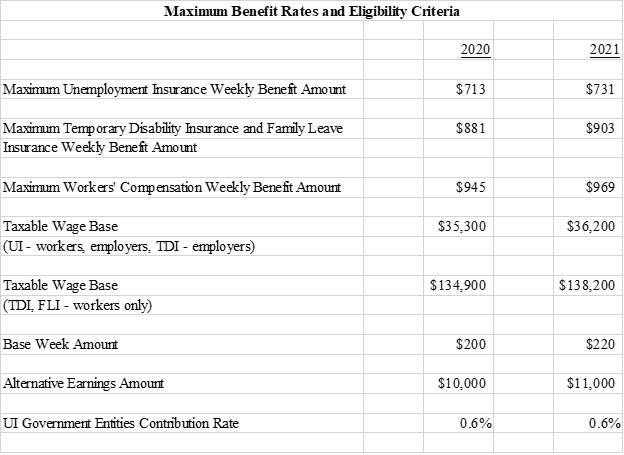

For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development.

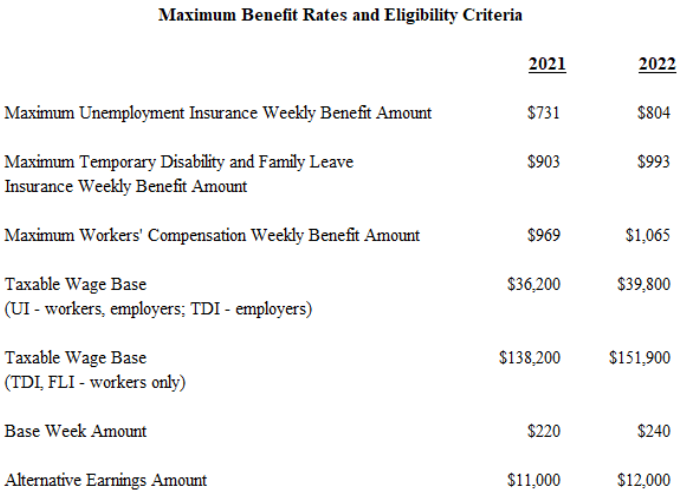

Nj unemployment base year. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. The weekly benefit rate is capped at a maximum amount based on the state minimum wage. New Jersey Unemployment Tax.

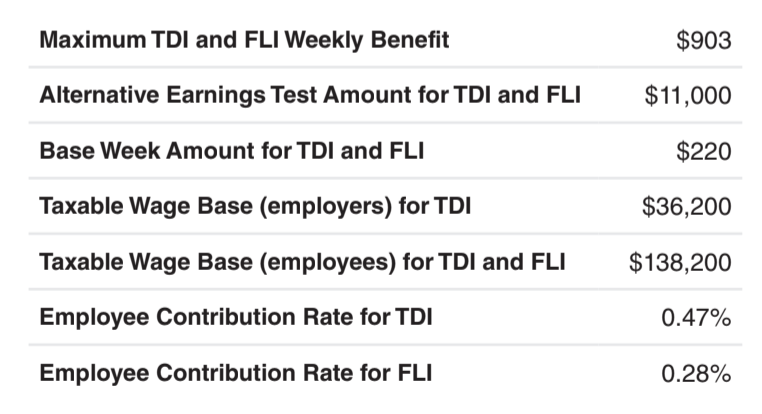

To establish a valid claim in 2017 a worker must have had at least 20 base weeks of New Jersey covered employment or in the alternative must have earned 8400 or more in covered employment during the 52 weeks immediately preceding the week in which the disability begins. The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. How much will the unemployment benefit be in New Jersey.

Please select a date from which to base your claim. Alternative Base Year 1 consists of the four most recently completed calendar quarters preceding the date of a claim and Alternative Base Year 2 consists of the three most recently completed calendar quarters preceding the date of the claim and weeks in the filing quarter up to the date of the claim. The taxable wage base for workers covered under the Temporary Disability and Family Leave Insurance programs will increase to 151900 for 2022.

If you have sufficient wages in the regular base year to file a claim you may use the base year to calculate your Unemployment Insurance benefit amount. What is the maximum unemployment in NJ 2021. New Jersey unemployment claims are dated for the Sunday of the week in which the claim is filed.

If you are not entitled to the weekly maximum benefit amount you may be able to increase your entitlement with dependency benefits. Help Unemployment 2 replies NJ Should I Appeal Base Year Decision Unemployment 17 replies NJ Appeal for Claim date Base Year Unemployment 6 replies. You must have filed for Unemployment Insurance benefits within four weeks of your recovery.

To qualify for Unemployment Temporary Disability or Family Leave benefits in 2022 an applicant must have earned at least 240 per week for 20 base weeks or alternatively have earned at least 12000. Federal law requires a review for new wages after one year. The 2022 TDIFLI taxable wage base will increase to 151900 up from 138200 for 2021.

January 1 2020 to December 31 2020. Your base period is the period of time that you worked prior to losing your job in which you establish the amount of money that you will receive in unemployment. July 1 2020 to June 30 2021.

For employers for 2021 the wage base increases to 36200 for unemployment insurance disability insurance and workforce development. Employees unemployment and workforce development wage base increase to 36200 maximum. April 2021 May 2021 June 2021.

New Jersey Unemployment Base Period. If a claim is filed anytime between January to March 2020 the base period will be 12 months from October 1 2018 through September 30 2019. Your weekly benefit rate will be calculated at 60 of the average weekly wage you earned during the base year up to the maximum of 713.

Your regular base year period consists of 52 weeks and is determined by the date you apply for Unemployment Insurance benefits as outlined in the chart below. NJ Unemployment Base Year Appeal extension file claim qualify - benefits rate legislation insurance jobless extension jobs employers employees hiring resumes occupations government laws unions contracts. October 1 2020 to September 30 2021 January 23 2022.

New Jersey Department of Labor and Workforce Development regulatory update website The 2022 employeremployee SUI taxable wage base will increase to 39800 up from 36200 for calendar year 2021. January 2021 February 2021 March 2021. If your claim is dated in.

For 2021 the maximum weekly benefit rate is 731. Please be aware some claims cannot be automatically processed and will require manual review from a. July 2021 August 2021 September 2021.

NJ Unemployment Base Year Confusion Unemployment 1 replies Old employer trying to appeal unemployment after receiving unemployment for almost a year. New Jersey Unemployment Tax The wage base is computed separately for employers and employees. All new employers except successors are assigned new employer rates for the first three calendar years after which a calculated rate is assigned based on employment experience.

For 2020 the maximum weekly benefit rate is 713. Your claim is based on. Employment in Alternate Base Year 1 from.

April 1 2020 to March 31 2021. How to find Standard Base Period. Date Selection January 16 2022 Your base year will be.

In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731. The wage base is computed separately for employers and employees. We determine the average weekly wage based on wage information your employer s report.

October 2021 November 2021 December 2021. The maximum weekly benefit for new state plan Temporary Disability and Family Leave Insurance claims increases to 993 from 903 while the maximum weekly benefit for new Workers Compensation claims rises to 1065 from 969. What is the Alternative or Alternate Base Period.

October 1 2020 to September 30 2021. Regular Base Year Earnings. Unemployment and Temporary Disability contribution rates in New Jersey are assigned on a fiscal year basis July 1 st to June 30.

Hi I couldnt find an answer to this anywhere else so I was just wondering if anyone has filed an appeal to have your base year recalculated and won. Your unemployment claim remains valid for one year from the date it is filed unless you exhaust benefits sooner. This year they have decided that anyone receiving a 1099-G aka unemployment cant use the free version and now has to pay 39 dollars per tax.

The alternate base year cannot be used if work was available and you did not return to work.

New Jersey U S Department Of Labor

Base Period Calculator Determine Your Base Period For Ui Benefits

New Jersey Releases 2021 Disability And Family Leave Amounts Schulman Insurance

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Jersey City Skyline In New Jersey Jersey City City Skyline City

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

New Jersey Unemployment Benefits Eligibility Claims

New Jersey U S Department Of Labor

Why Young Koreans Love To Splurge Foreign Policy Splurge Are You Happy Now Is Good

A Guide To The Extended Unemployment Benefits In New Jersey

Legal Letter Format Pdf Editable Pack Of 5 Legal Letter Business Letter Template Lettering

County Employment And Wages In New Jersey Fourth Quarter 2020 New York New Jersey Information Office U S Bureau Of Labor Statistics

Njdol Maximum Unemployment Benefit Rates Increase On January 1st

0 Post a Comment: