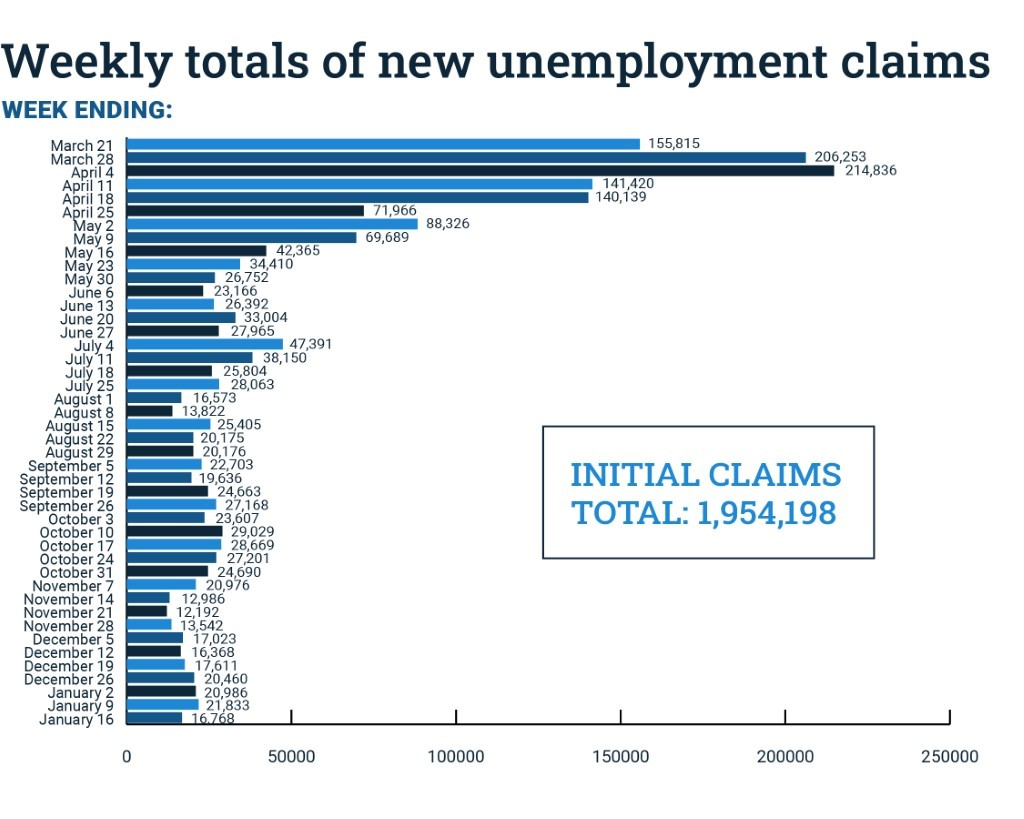

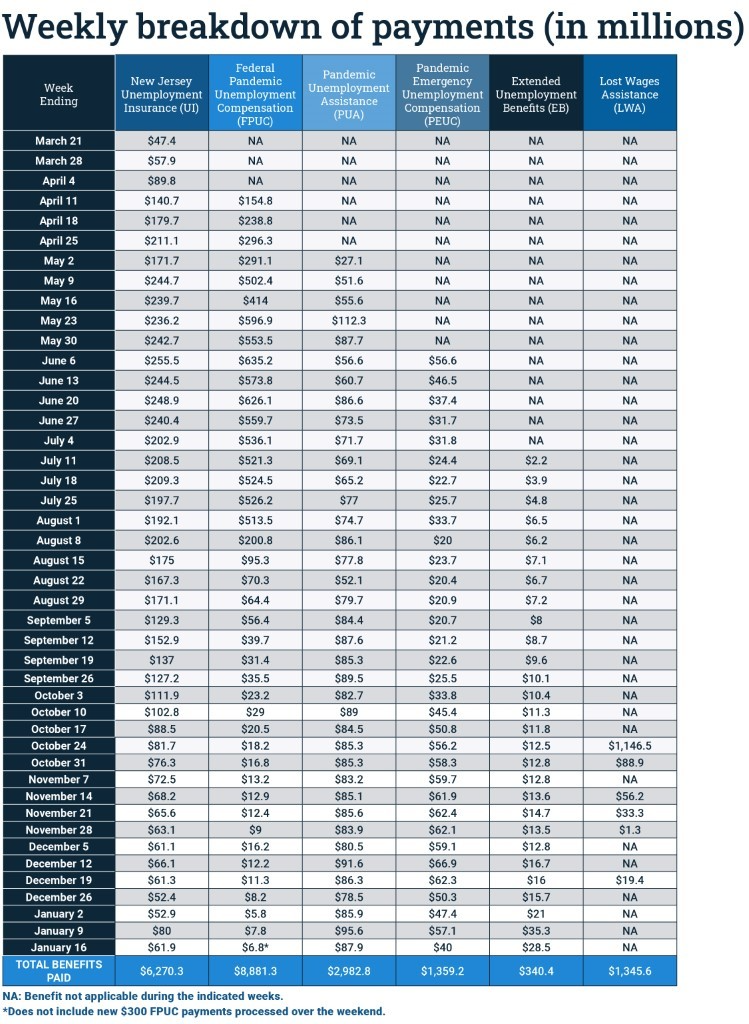

The CARES Act relief law created a temporary unemployment program offering jobless aid to sick individuals and others like gig workers who typically dont qualify for unemployment insurance. NEW JERSEY The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation for calendar year 2022.

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

In December employment gains were recorded in eight out of nine major private industry sectors.

Nj unemployment 2022. But those centers still wont offer services for people seeking help with unemployment until some point in 2022 at least. The increased rates will be effective for new claims dated January 2 2022 and later. Click to read more on New Jerseys minimum wage increase.

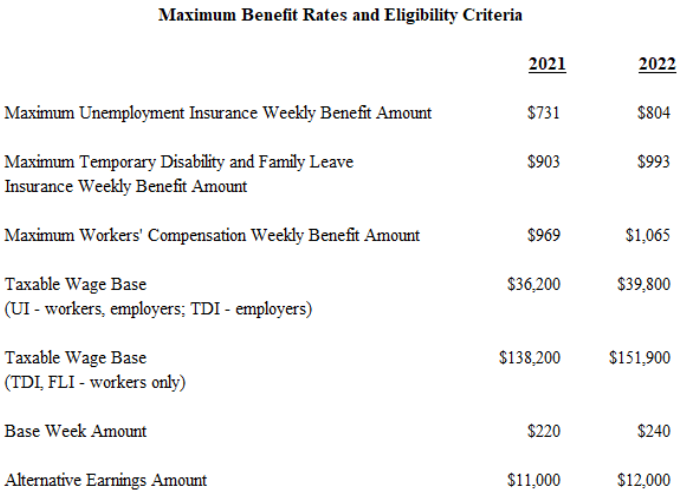

Listed below are the 2022 maximum benefit amounts taxable wages and earning requirements for New Jersey Un employment Compensation State Temporary Disability Family Leave and Workers Compensation Programs. New Jersey hit a high threshold earlier in the pandemic with a three-month average of 8 or higher so it Nj unemployment unable to certify for weekly benefits Nj. The increased rates will be effective for new claims dated January 2 2022 and later.

Congress hasnt passed a law offering a. 9 Oct 2020 She said the agency communicates with claimants via email for a variety of reasons such as when an e-adjudication or e-monetary. While both the employer and employee contribute to Temporary Disability Insurance for Family Leave Insurance only the employee contributes to the program.

TRENTON The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation for calendar year 2022. New Jerseys family-leave insurance and temporary-disability insurance tax rates for employees are to decrease for 2022 the state Department of Labor and Workforce Development said on its website. In the new year the maximum weekly benefit amount for new Unemployment Insurance beneficiaries increases to 804 from 731 the New Jersey Department of Labor Workforce Development NJDOL said.

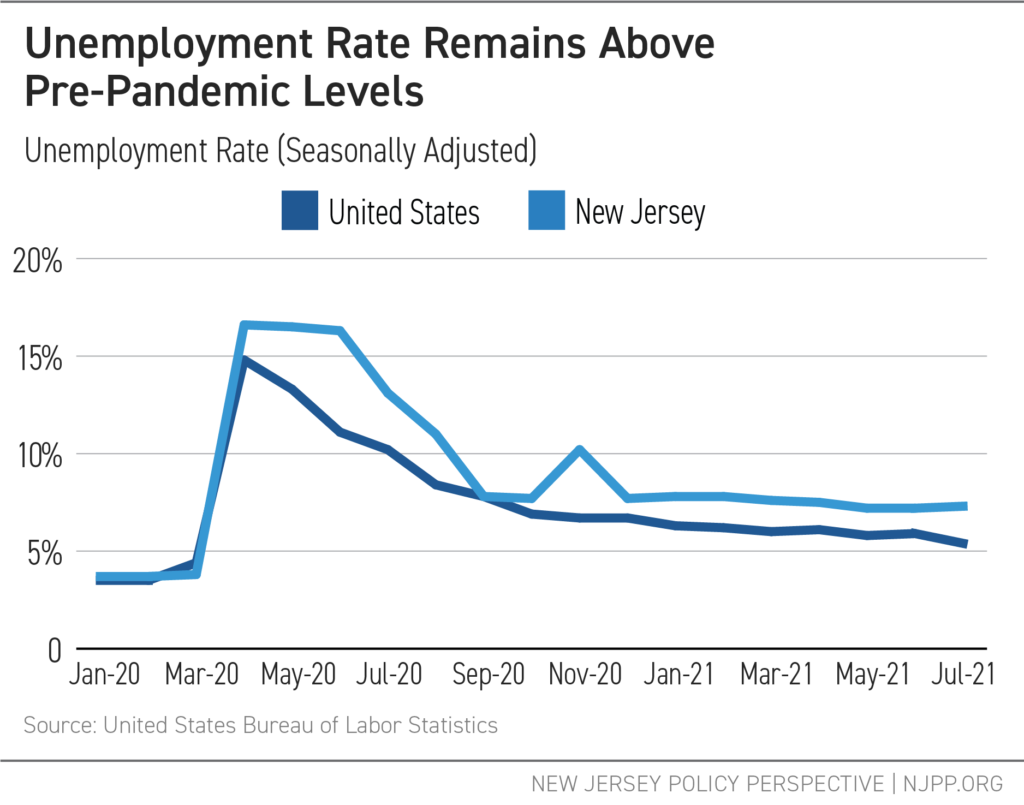

Importantly just before Murphy took office in early 2018 New Jersey had an unemployment rate that was two full percentage points lower than the 66 unemployment rate that was measured at the end of November 2021 according to federal statistics. New Jersey NJ Taxes and Considerations For 2021-2022 Tax Season Checking Your Refund Status Payment Delays and Getting a Live Agent California CA 2021-2022 Tax Considerations Refund Status and Stimulus Checks. New Jersey is tied for the fifth-highest unemployment rate in the nation behind Nevada New York New Mexico and California.

Tuesday January 4 2022. TRENTON The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers. The New Jersey Department of Labor and Workforce Development released its proposed annual regulatory update to reflect an increase to the calendar year 2022 state unemployment insurance SUI temporary disability insurance TDI and family leave insurance FLI taxable wage bases.

New Jerseys wage bases for the unemployment insurance temporary disability insurance and family-leave insurance programs would increase for 2022 under proposed rules issued Sept. Phil Murphy said theres no timeline for when those services begin or what they will be. The withholding tax rates for 2022 reflect graduated rates from 15 to 118.

The increased rates will be effective for new claims dated Jan. Income Up Despite High Unemployment By Kyle Sullender Executive Director Focus NJ On Jan 3 2022 New Jersey has the third highest unemployment rate in the nation according to the Bureau of Labor Statistics October data release. The 118 tax rate applies to individuals with taxable income over 1000000.

The effective rate per hour for 2022 is 1300 effective 01012021. New Jersey Minimum Wage. The unemployment tax rate for employees is not to change in 2022.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. 7 by the state Department of Labor and Workforce Development. Although COVID-19 may have caused last year to feel like a long extension of 2020 2021 saw several significant changes to New Jerseys employment law landscape that.

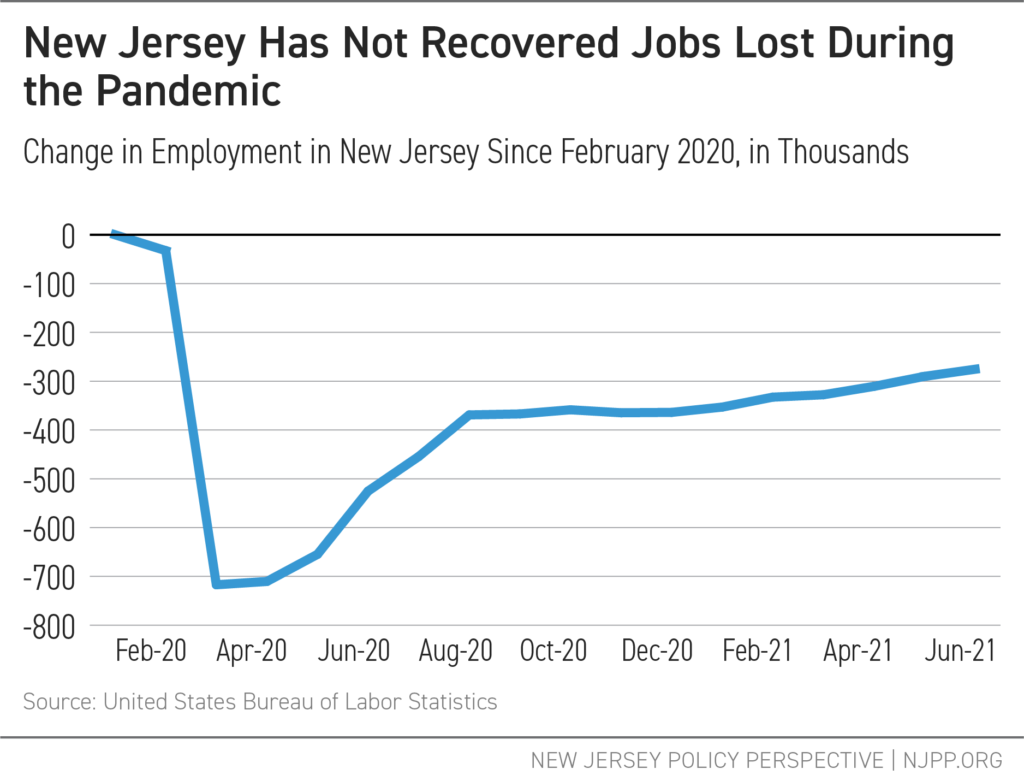

By the end of November all state offices are scheduled to be open including New Jerseys One-Stop Career Centers. New Jersey has now recovered 561200 jobs or about 78 of the number lost in March and April 2020 due to the impact of the COVID-19 pandemic. 2 2022 and later.

The unemployment rate for the Garden State fell by 04 of a percentage point to 63 for the month. 1 2022 the family-leave insurance tax rate for employees is to be 0. 993 2022 Alternative earnings test.

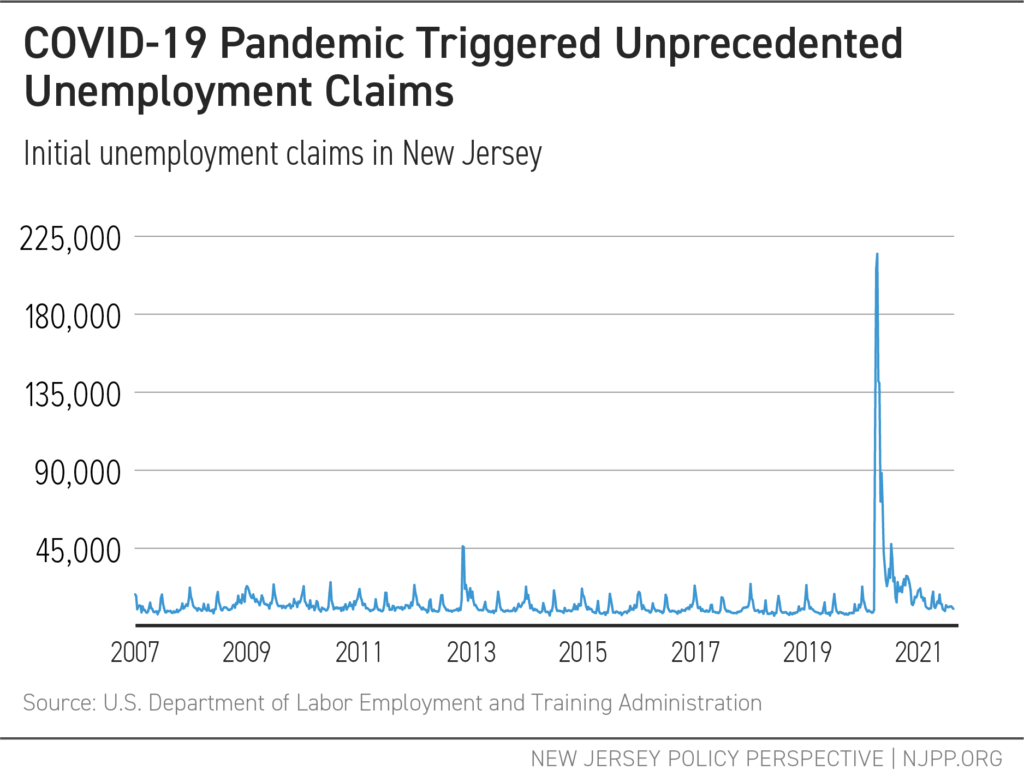

New Jerseys unemployment rate is currently 73 down from the 166 high reached in April 2020. With that the 2022 maximum employee contribution for NJ Temporary Disability Insurance TDI will be 21266 per year. New Jersey Gross Income Tax.

NEW JERSEY The New Jersey Department of Labor and Workforce Development NJDOL announced increases in the maximum benefit rates for Unemployment Insurance Temporary Disability Insurance Family Leave Insurance and Workers Compensation for. 2022 Benefit Rates Announced for Unemployment Compensation Temporary Disability Family Leave and Workers Compensation. 804 2022 Maximum Temporary Disability Insurance weekly benefit rate.

NJ Department of Labor and Workforce Development Announces Benefit Rate Increases for 2022. 2022 Maximum Unemployment Insurance weekly benefits rate. The updated taxable wage base for employers will be set at 39800 for 2022.

Division Of Unemployment Insurance Training Education Programs

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

300k Workers Move To N J S Unemployment Benefits After Federal Programs End New Jersey Monitor

Njdol Jobless Residents Receive New Stimulus Payments

Median Household Income In New Jersey 2020 Statista

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

Njdol Jobless Residents Receive New Stimulus Payments

Labor Day Snapshot New Jersey S Uneven Recovery New Jersey Policy Perspective

New Jersey Nj Dol Enhanced Unemployment Benefit Programs 300 Fpuc Peuc And Pua Have Ended But Missing Payments And Retroactive Claim Processing Delays Continue Updates And Latest News Aving To Invest

0 Post a Comment: