Yes unemployment compensation is reported on your tax return differently than and separately from W-2 wage income. What to do if your w2 is lost or missing.

1099 G Tax Form Why It S Important

You have to get it yourself.

How do i get my w2 from unemployment benefits. If you cant get your Form W-2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the IRS for a fee. Contact the IRS at 800-829-1040 to request a copy of your wage and income information. Unemployment and family leave.

All inquiries can be directed to a DFA Service Representative at 501-682-1100 or 800-882-9275. Firstly you need to log onto the website that you use to make your unemployment claims. I need to know how to get w2 form form my unemployment.

You get a 1099G and no TurboTax cannot get it for you. You have to get it yourself. Call the IRS at 1-800-829-1040 after February 23.

How Do I Get My W2 From Unemployment. To enter it on your tax return go to FederalWages IncomeUnemployment Government benefits on Form 1099G. How Do I Get My W2s From Unemployment.

Many states now offer online access to 1099-G forms which is a big help when its time to file but you never received the form. Your local unemployment office may be able to supply these numbers by phone if you cant access the form online. The Irs for some reason did not receive my 2007 taxes that I filed myself.

Usually you need to go to the states unemployment web site to get it and print it out. Your unemployment payments were not earned income. However if you receive supplemental unemployment benefits from a company-financed fund they are reported on Form W-2 by the end of January.

You do not get a W-2 that reports the unemployment compensation you received during the year. ESD sends 1099-G forms for two main types of benefits. You may choose to have federal income tax withheld from your benefit payments at the rate of 10 percent of your weekly benefit rate plus the allowance for dependents if any.

I am having to. Iaf44 You do not get a W-2 for unemployment benefitsYou get a 1099G and no TurboTax cannot get it for you. Call Tele-Serv at 800-558-8321.

- Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website. You do not get a W-2 for unemployment benefits. Answer 1 of 2.

Click here for the Request for Change in Withholding Status form. How do I obtain. Allow 75 calendar days for us to process your request.

Each January we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. In the US the form for unemployment is the 1099 and not the W2 which is for people who work so you should be looking for that instead. How To Get My W2 From Unemployment Nj.

For unemployment compensation benefits you should probably receive a Form 1099-G from your state government. The 1099-G form provides information you need to report your benefits. I claimed unemployment benefits but I have not received a 1099.

Requests for W-2 and 1095-C reprints for Executive Branch employees should be directed to the Employee Call Center which can be reached by phone at 465-3009 by fax at 465-6624 or by email at employeecallcenteralaskagov. Those who received unemployment benefits for some or all of the year will need a 1099-G form. Instead this is reported to you on a Form 1099-G.

You have to get it yourself. Select option 2 and follow the prompts. You do NOT get a W2 from unemployment unless you worked for the unemployment office.

Complete and mail Form 4506 Request for Copy of Tax Return along with the required fee. I have mine from my employer but i lost my unemployment w2. If you do not receive your Form 1099-G by February 1 and you received unemployment benefits during the prior calendar year you may request a duplicate 1099-G form by phone.

A W2 form reports earned income. You can also select or change your withholding status at any time by writing to the New Jersey Department of Labor and Workforce Development Unemployment Insurance PO Box 908 Trenton NJ 08625-0908. Every January we send a 1099-G form to people who received unemployment benefits.

The 1099-G is a tax form for Certain Government Payments. Mail the completed form to. This page should explain your states time frame to mail 1099-Gs to residents who received unemployment benefits during the tax year in question.

To enter it on your tax return go to Federal Wages Income Unemployment Government benefits on Form 1099G. How do I get my w2 from Alaska unemployment. In general your 1099 form can be found online so visit wwwirsgov to view and print a universal 1099 form.

To view and print your current or. Usually you need to go to the states unemployment web site to get it and print it out. I have misplaced my unemployment w-2.

The 10 percent deduction is based on your net amount payable ie the amount of benefits payable before deductions for earnings benefit reduction child. Can I Get My Kentucky Unemployment W2 Online. Filing taxes is much easier when you have all the forms you need in front of you.

For wages you should receive a W-2 from your employer or employers. For example if you collected unemployment in 2018 the 1099-G should have been mailed by January 31 2019. If you are receiving Pandemic Unemployment Assistance PUA you can view your current withholding selections and change your withholding preferences by logging into the PUA portal and selecting Federal Tax Deduction from the Unemployment Services section of your dashboard.

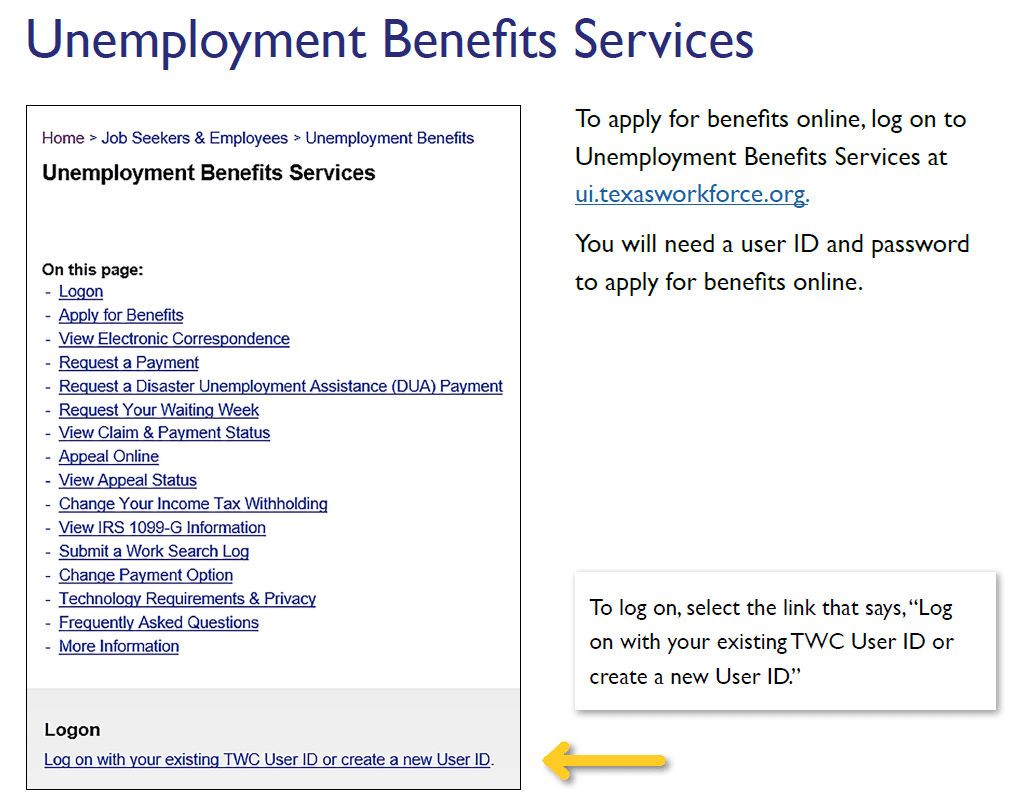

Use the information from the form but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS. I Need A Copy To Print So I Can File. The state that you live in is responsible for getting this tax document to you each year but here are some instructions on how to get your W2 from unemployment in states such as Colorado.

You get a 1099G and no TurboTax cannot get it for you. Usually you need to go to the states unemployment web site to get it and print it out. Click here for the Request for Change in Withholding Status form.

You do not get a W-2 for unemployment benefits. And Administration DFA will be making system changes to exclude unemployment from taxes refund any excess taxes paid. After making your tax withholding selection click save to have your preference.

In most cases 1099-Gs for the previous year are mailed on or before January 31. Youll transfer the amount in Box 1 of Form 1099-G to Line 7 of Schedule 1 then the withholding amount in Box 4 of the 1099-G if any goes directly onto your 1040 tax return on. This can vary from state to state so you will need to find out the process for your local area.

If you received payments for unemployment benefits you will get a Form 1099-G.

Tax Form Now Arriving Tied To Fake Unemployment Claims

Covid 19 Unemployment Benefits Hamilton Ryker

That Extra 600 A Week In Unemployment Benefits Is Taxable Weareiowa Com

Supplemental Unemployment Benefit Plans A Tool For Employers Responding To The Covid 19 Crisis

Paying Taxes On Unemployment Checks Everything You Need To Know Cnet

Covid 19 Unemployment Benefits Hamilton Ryker

How To File For Unemployment Filing Claims Collecting Benefits

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg)

Form 1099 G Certain Government Payments Definition

1099 G Tax Information Ri Department Of Labor Training

How To Claim Unemployment Benefits H R Block

![]()

How To Get My W2 From Unemployment

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Frequently Asked Questions About Unemployment Benefits For The Self Employed Cares Act Nav

0 Post a Comment: