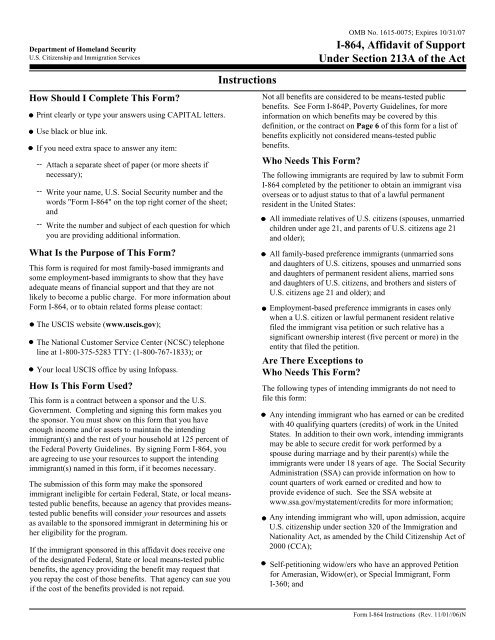

The Form I-864 Affidavit of Support requires sponsors to financially support their immigrant beneficiaries by paying them an amount equal to the difference between the immigrants actual income and 125 of the federal poverty guidelines. The I-864 is used to prove to the US government that the person you are attempting to immigrate to the US will not burden our welfare system.

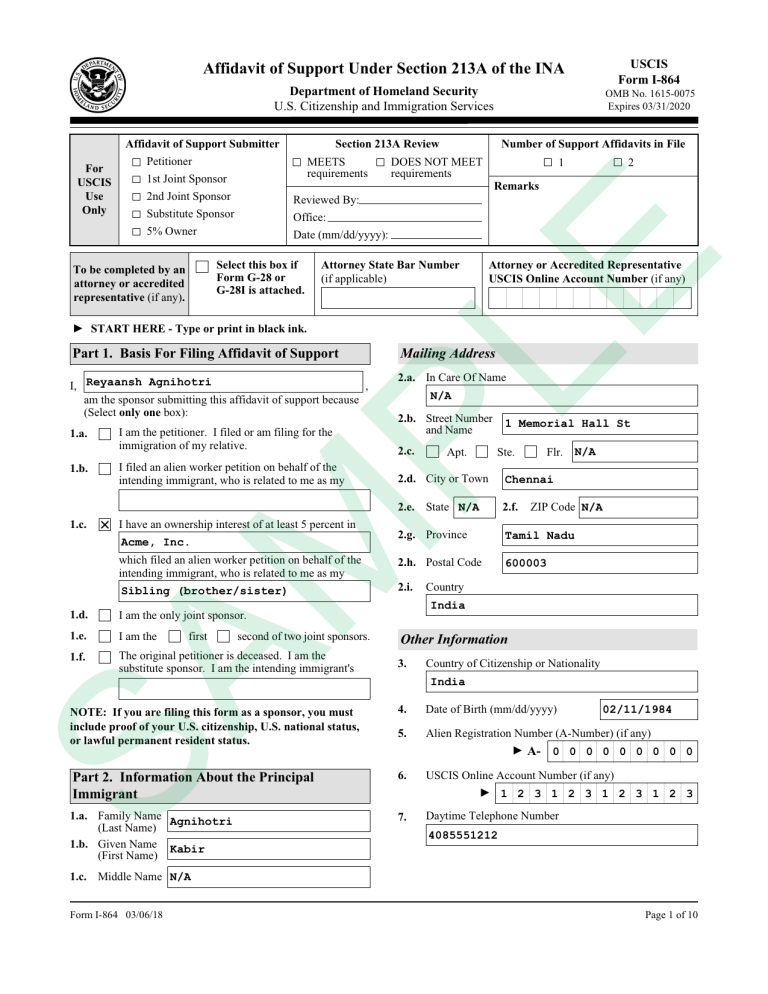

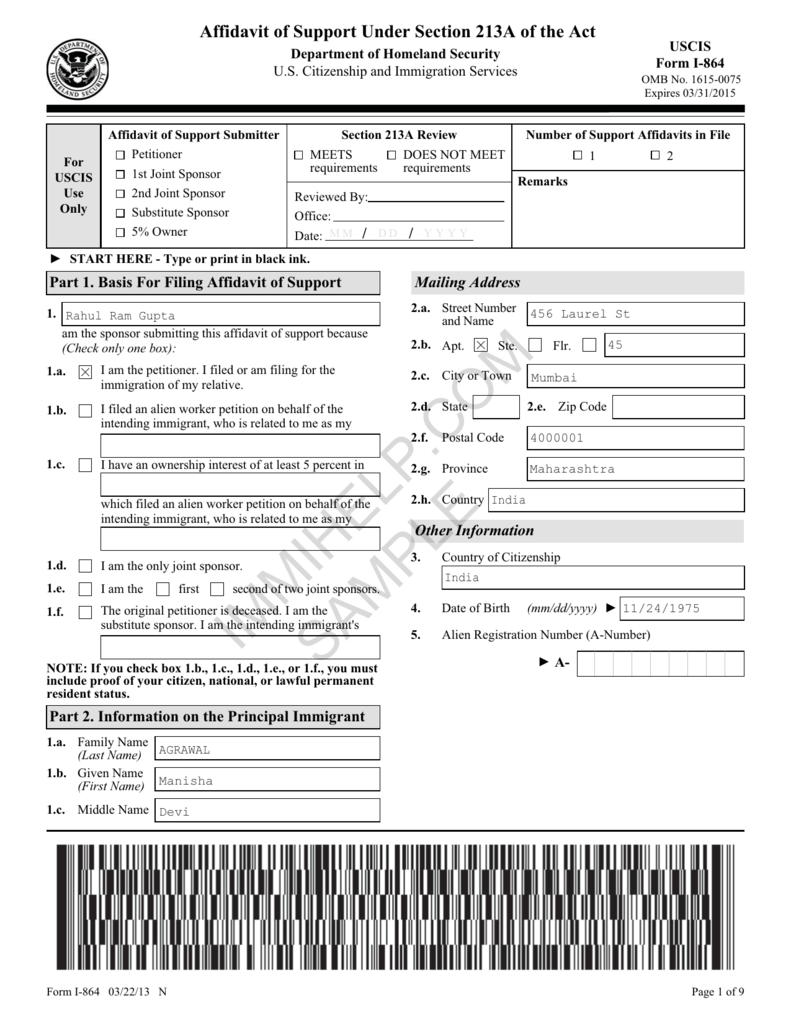

Affidavit Of Support Sample For Form I 864 Citizenpath

So if her payments exceed the required support level that is good.

Unemployment benefits i-864. Although some sources of money related to unemployment cannot be counted toward income for purposes of Form I-864 such as food stamps SSI Medicaid and TANF unemployment benefits are in a different category. I was in the same situation and did just that. What happens if the petitioner doesnt have enough income.

Now we are filing for AOS. Form I-864 Affidavit of Support. Your wife and your father in law each have to fill out the I-864 form.

Not all benefits are considered as means-tested public benefits. Although some sources of money related to unemployment cannot be counted toward income for purposes of Form I-864 such as food stamps SSI Medicaid and TANF unemployment benefits are in a different category. Officials are looking to see whether or not you have a joint sponsor and how close your relationship is.

After end of unemployment benefits I started a freelancing business which is not generating income yet. The adjudication process for these considerations is still under development. Its a contract between a sponsor and the US.

This support is based on the Form I-864 Affidavit of Support. I-864 Affidavit of Support Under Section 213A of the INA. Im in the process of filling out the I-864.

Im currently a full time student and am applying an adjustment of status for my husband. I-864 Affidavit of Support Hi I am an F-1 student visa holder in the US who got married to a US Citizen last year. Although some sources of money related to unemployment cannot be counted toward income for purposes of Form I-864 such as food stamps SSI Medicaid and TANF unemployment benefits are in a different category.

We are planning to apply for my adjustment of status to a permanent resident by jointly filing I-130 I-485 along with I-131 and I-765. The consular officer will determine whether the income claimed by the sponsor and documented with financial evidence meets the poverty guidelines in effect at the time the I-864 was filed. My fiancé entered US with K1 visa last month and we just got married.

Such benefits should therefore not be considered for I-864 purposes. Most family-based immigrants and some employment-based immigrants use this form to show they have adequate means of financial support and are not likely to rely on the US. And your wife needs so send a letter attached to her I-864 form the reason of her unemployment and how long.

Unemployment benefits are normally temporary in nature and would not meet the criteria of sustainable income. They are basically insurance payments which you are allowed to collect upon based on your employer having paid into a federalstate. Can income from unemployment benefits or workmans compensation be considered as income for I-864 purposes.

The Benefits of I-864 Financial Support. Government for financial support. Since I am currently unemployed I am wondering what kind of supporting documents I need submit with I-864 to use assets.

I-864 A is if you all live together. If the sponsor needs the income of the spouse to satisfy the 125 percent of poverty requirement then the spouse will complete an I-864A and will include his or her income on Part 6 line 6c. No the Form I-864 remains valid indefinitely unless evidence of failure to meet the poverty guidelines in effect on the date of I-864 filing arises.

They are basically insurance payments which you are allowed to collect upon based on your employer having paid into a. Sponsors Contract Statement Contact Information Declaration Certification and Signature of Form I-864 for a list of benefits explicitly not. Can you use unemployment for I-864.

If I do use my income my husband would still have to fill in the I-864 and check the unemployed box but do I have to fill in a separate I-864 with my income and place of employment or using the I-864 filled out by my husband would be enough and I would just attach my employment letter and ask the IO to consider my income when analyzing the I. Question 4B of the September 26 2000 version of the Form I-864 asks if the sponsor or any member of his or her household has used means-tested benefits during the past 3 years. If you dont have income adequate to support them you can attempt to convince them in Part 7 that you have other assets to supplement income.

Should I check of the unemployed box on I864 form and list assets that in excess of 3X federal poverty line or should I check the self-employed box list assets that in excess of 3X federal poverty line. I-864 Affidavit of Support Under Section 213A of the INA. I also have assets in checkingsaving account and real estate.

One of the required documents is I-864 Affidavit of Support and I have a few questions. The reason for this question is to ensure that the value of any such means-tested public benefits is not. Hi I have some questions regarding I-864 and would appreciate the helpadvice.

Unemployment insurance is indeed useable on the I-864. Although some sources of money related to unemployment cannot be counted toward income for purposes of Form I-864 such as food stamps SSI Medicaid and TANF unemployment benefits are in a different category. Do not disqualify a sponsor based on a positive response to this question.

See Form I-864P Poverty Guidelines for more information on which benefits are covered by this definition or the contract in Part 8. Concerning I-864 does unemployment benefits count toward sponsorship of my husband. Government in which the sponsor promises to support the intending immigrant if he or she is unable to do so on their own.

USCIS requires Form I-864 Affidavit of Support for most family-based applications and some employment-based applications. The NVC will return the I-864 if the reported income on the tax return is different from what is indicated in line 13a. Note that USCIS will want to know the continued source of income at the time of the interview.

Do unemployment checks count toward I-864.

On The I 864 Do I Include Unemployment Benefits From The Texas Workforce Commission To My Current Annual Income Legal Answers Avvo

Keeping The Hope Alive Creative Ways To Obtain

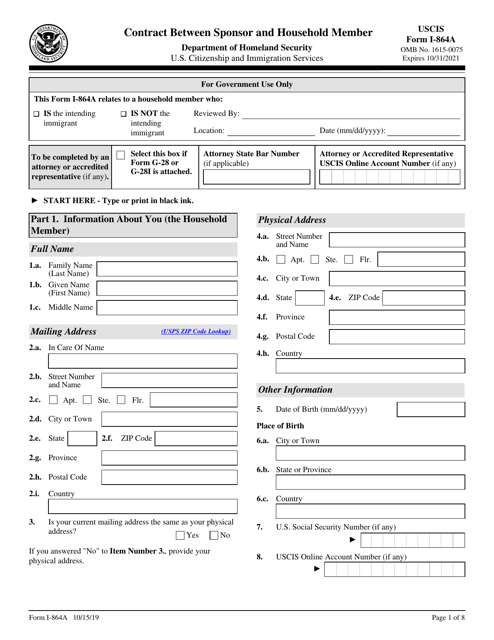

Uscis Form I 864a Download Fillable Pdf Or Fill Online Contract Between Sponsor And Household Member Templateroller

Sample I 864 Affidavit Of Support

I 864 Affidavit Of Support Under Section 213a Of The Act Ilw Com

Form I 864 Enforcement Litigation

Unemployment Benefits For Green Card Holders Citizenpath

Affidavit I 864 Under213a Pdf Means Test Permanent Residence United States

Dear Sophie Is Unemployment Considered A Public Benefit Alcorn Immigration Law A Silicon Valley Immigration Firm

Form I 864 Affidavit Of Support Help Center Chodorow Law Offices

How To Complete Part 6 On The Form I 864 Sponsor S Employment And Income Sound Immigration

Changes To Uscis Public Charge Determinations And Use Of The Form I 864 Sound Immigration

How To Complete The Form I 864 Sound Immigration

0 Post a Comment: