While the Texas unemployment tax rate range remains the same for 2021 from a minimum of 031 percent to a maximum of 631 percent it is not all good news for employers. Updated April 29 2020 Webinar On April 13 THLA hosted a webinar with experts at the Texas Workforce Commission TWC.

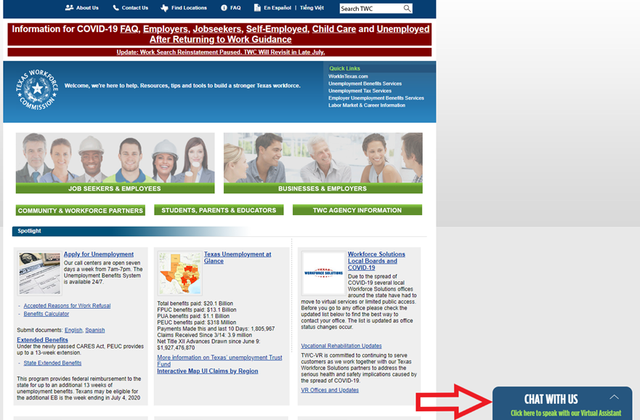

Unemployment Benefits Services allows individuals to submit new applications for unemployment benefits submit payment requests get claim and payment status information change their benefit payment option update their address or phone number view IRS 1099-G information and respond to work search log requests.

Texas unemployment employer. View a video recording of the. An unemployment hearing is conducted when an employer contests a former employees right to unemployment benefits. REIMBURSEMENTS OR CONTRIBUTIONS BY GOVERNMENTAL ENTITY.

The Texas Workforce Commission does not have jurisdiction or enforcement of qualifying paid sick leave. Every state has its own rules for filing an appeal. First and last dates month day and year you worked for your last.

New to Employer Benefit Services. Generally heres a summary of what you need to apply for Texas Unemployment. Once employers decide to appeal it is very important to do so timely.

2 an employing unit that the Federal Unemployment Tax Act 26 USC. New employers should use the greater of the average rate for all employers in the NAICS code or use 27. How to calculate unemployment benefits in Texas.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. The UI tax funds unemployment compensation programs for eligible employees. Last employers business name and address.

After several unemployment claims that result in a Charge Back amounts to the employer an employers unemployment tax rate will increase. The Mass Claims program streamlines the UI benefit claims process for employers and employers may submit basic information about the employees to initiate. First and last dates month day and year you worked for your last employer.

EMPLOYMENT SERVICES AND UNEMPLOYMENT. Alien Registration Number if not a US. Once there click on the Log on with your existing TWC User ID or create a new User ID link as shown below.

TEXAS UNEMPLOYMENT COMPENSATION ACT. Employers can submit basic worker information on behalf of their employees to initiate claims for unemployment benefits before the layoff date or up to seven days after the layoff. Applicants Social Security Number.

Employers and former employees have the right to appeal any decision that affects unemployment benefits. You can submit a Mass Claim Request on Employer Benefits Services EBS 24 hours a day seven days a week. Texas is whats referred to as a PEO-reporting state for unemployment insurance.

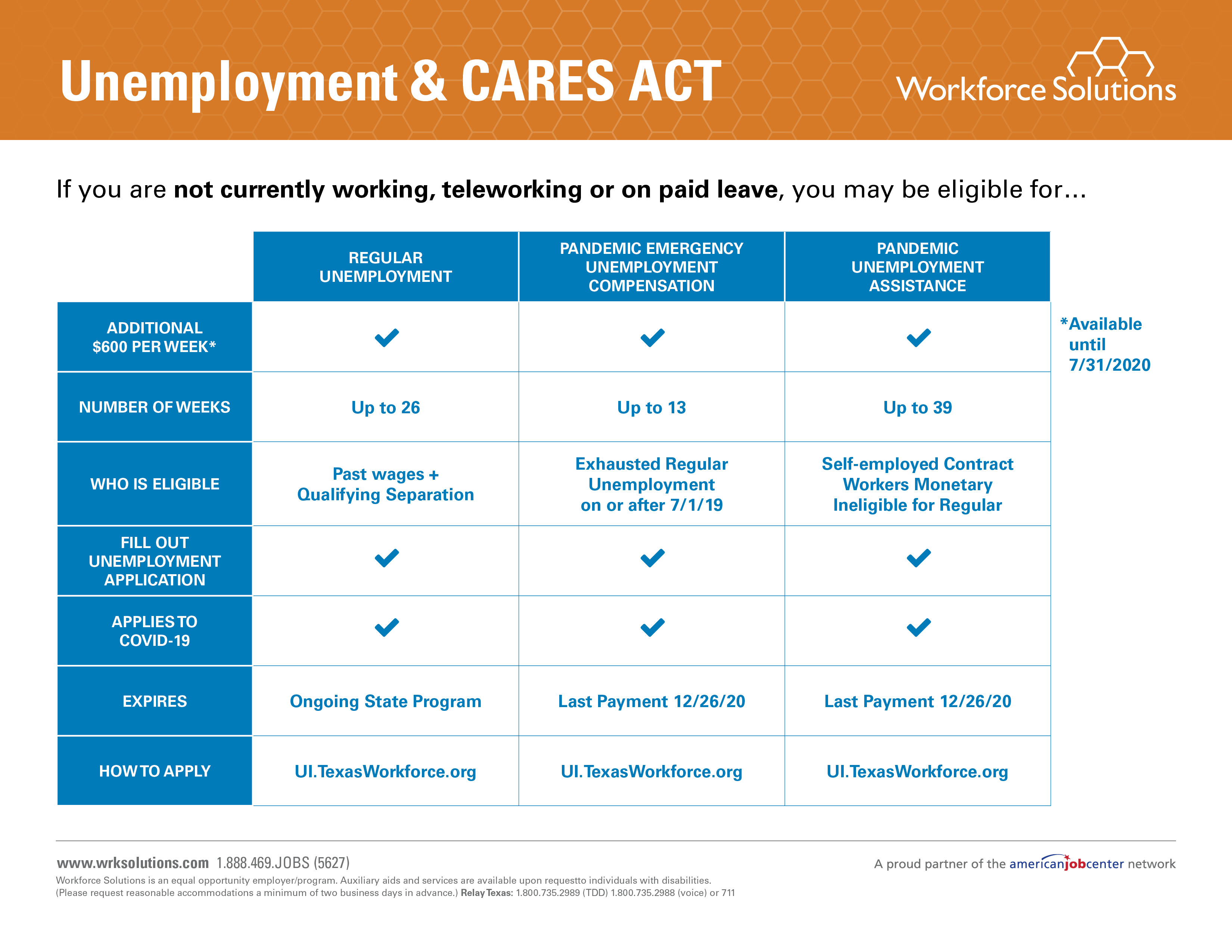

New to Unemployment Tax Services. This article explains basic TUCA concepts and provides important practice pointers for employers who seek to better understand the Texas unemployment insurance system and how best to defend claims that the employer. Texas Unemployment Insurance Fact Sheet - Employers Updated 32620 Coronavirus Aid Relief and Economic Security CARES Act.

Your last employers business name address and phone number. Policies related to paid sick leave are between employers and employees. We asked the TWC questions about applying for unemployment benefits employee eligibility employer unemployment tax liability partial benefits and more in response to the COVID-19 coronavirus crisis.

State unemployment charges will be invoiced by Justworks. Click here to be taken there. In Texas state UI tax is one of the primary taxes that employers must pay.

ELECTION TO BECOME REIMBURSING EMPLOYER. If your small business has employees working in Texas youll need to pay Texas unemployment insurance UI tax. Unlike most other states Texas does not have state withholding taxes.

Otherwise please sign up for a User ID. Texas will be announcing 2021 tax rate changes in February. Under Texas state rule usage may be subject to security testing and monitoring applicable privacy provisions and criminal prosecution for misuse or unauthorized use.

Section 3301 et seq requires to be an employer under this subtitle as a condition for approval of this subtitle for full tax credit against the tax imposed by the Federal Unemployment Tax Act. Employers who lay off their employees temporarily or permanently as a result of COVID-19 are encouraged to submit a Mass Claim for unemployment benefits on behalf of all impacted employees. Justworks will report unemployment taxes under the Justworks unemployment account number.

Posted in Texas Workforce Commission Unemployment Austin Employment Lawyer Jairo Castellanos As the Texas Workforce Commission TWC begins moving through the backlog of unemployment appeals and through the sheer glut of unemployment claims many claimants that were originally awarded unemployment claims are finding themselves being. A A state a political subdivision of a state an Indian tribe or an. The Texas Unemployment Compensation Act TUCA defines which employers must pay unemployment taxesThey are referred to as liable employers Liable employers report employee wages and pay the unemployment tax based on state law under the Texas Unemployment Tax Act TUCALiability for the tax is determined by several different criteria.

Before you apply for Texas unemployment benefits you will need to have the following information available to support your claim. Your MBA is 26 times your weekly benefit amount or 27 percent of all your wages in the base period whichever is less. Unemployment Insurance Employer Response Logon.

To calculate your WBA divide your base period quarter with the highest wages by 25 and round to the nearest dollar. The first thing you need to do when logging into your Texas Unemployment Login is to visit the Texas Workforce Commission TWC Unemployment Benefit Services site. TWC had given Texas employers the direction that COVID-related charges would not go against the state fund and as of today that is not the case - this will ultimately drive higher rates across the state for.

Your companys SUI rate no longer applies in Texas. Number of hours worked and pay rate if you worked this week including Sunday Information related to your normal wage. Otherwise please sign up for a User ID.

10 Employment Verification Forms Word Excel Pdf Templates Employment Form Letter Of Employment Employment Letter Sample

Anti Poverty Programs Success Refutes Rep Ryan S Claims Online Dating Profile Poverty Dating Profile

Unemployment Insurance How To Guide Texas Afl Cio

Unemployment Benefits Information

Hunter S Thompson Quotes And Notes Cool Words Quotes To Live By

Now Hiring Good People Do You Have What Employers Are Demanding Www Resumebutterfly Com Good Resume Examples Job Letter Job Search Tips

How To Survive Losing Your Job Infographic Manolith Job Info Job Hunting Social Media

Fake Credit Report Template Inspirational 9 10 Free Fake Credit Report Template Doctors Note Template Report Template What Is Cover Letter

20 Sample Of Job Confirmation Letter From Employer Valid Pertaining To Employment Verification Lette Letter Template Word Letter Of Employment Transition Words

Texoma Covid 19 Employer Job Seeker And Claimant Resources Workforce Solutions Texoma

Unemployment Insurance Flowchart Checklist Texas Afl Cio

Why Texas Is Good For Business Texas Is Creating Jobs And Thriving While Many States Like California Infographic Business Infographic Small Business Resources

Unemployment Benefits Workforce Solutions

Career Outlook Concepts And Terminology Economic Analysis Career Decisions Marketing Information

0 Post a Comment: