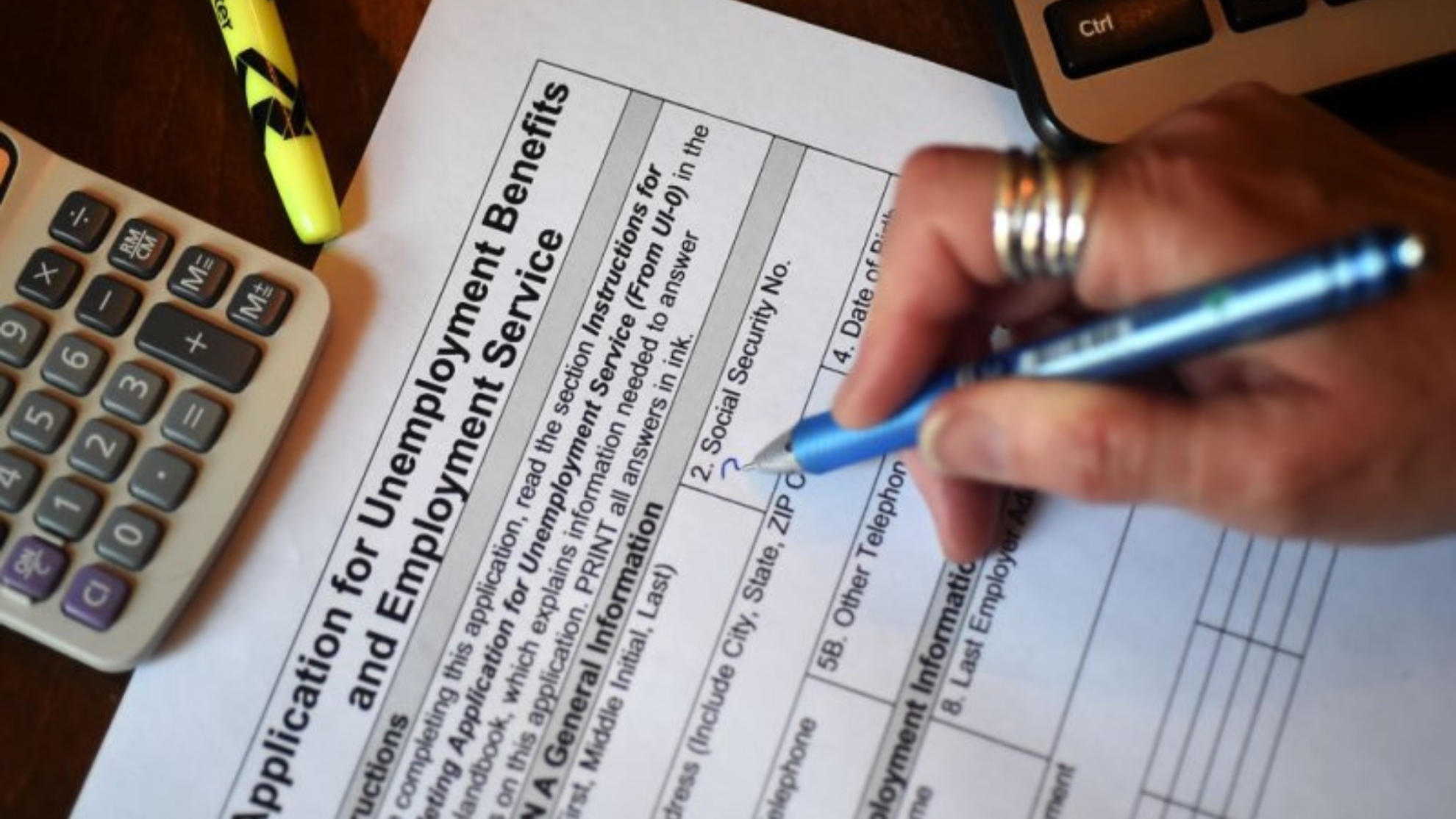

Given the current negative balance in the state unemployment trust fund 2021 UI rates for New York employers increased to a range of 21 to 99 of taxable payroll up from 2020 rates that ranged from 06 to 79. This is higher than the long term average of 784.

Pin On America S Great Recession

The minimum rate increased to 108 for claims filed in 2021 and 116 for claims filed in 2022.

Nys unemployment rate today. Unemployment Rate in New York. The seasonally adjusted unemployment rate for New York state dropped from 71 in September to 69 in October and once again fell in November to 66. The seasonally-adjusted unemployment rate for New York state dropped from 71 in September to 69 in October and once again fell in November to 66.

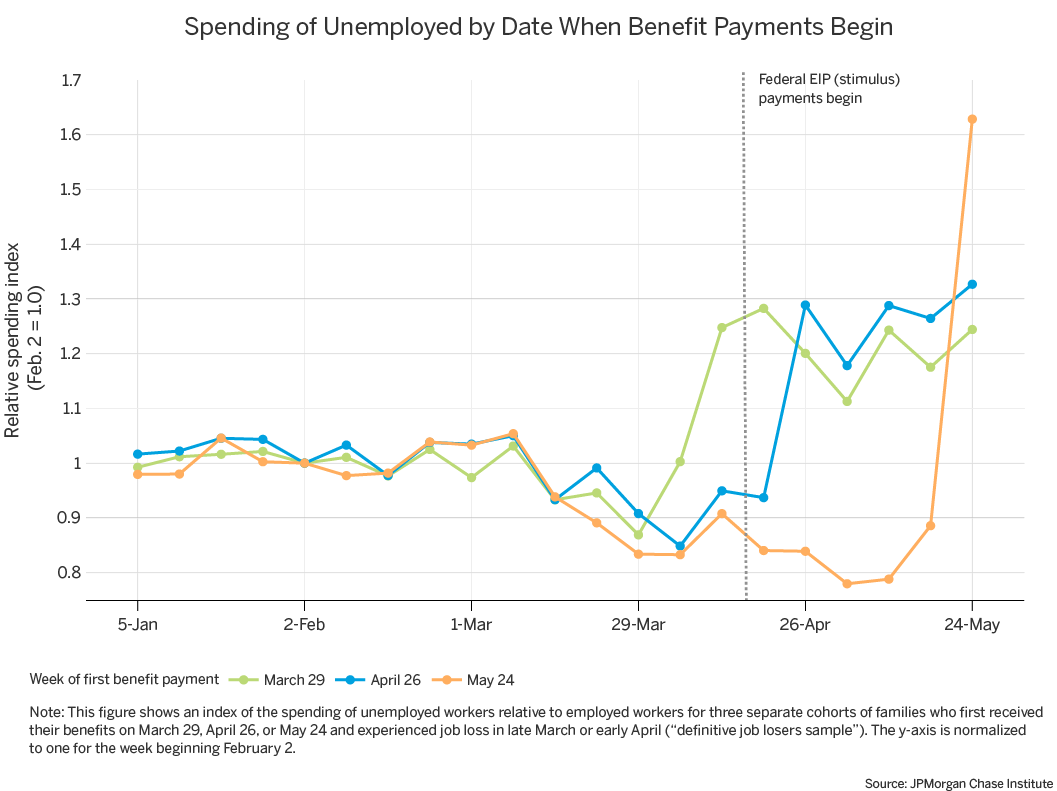

Unemployment Benefit Rate-In NY the Unemployment Benefit Rate ranges from 104 to 504 per week. Labor officials say the states seasonally adjusted unemployment rate was 66 for the month which is down from Octobers jobless rate of 69. The unemployment rate in New York peaked in April 2020 at 162 and is now 96 percentage points lower.

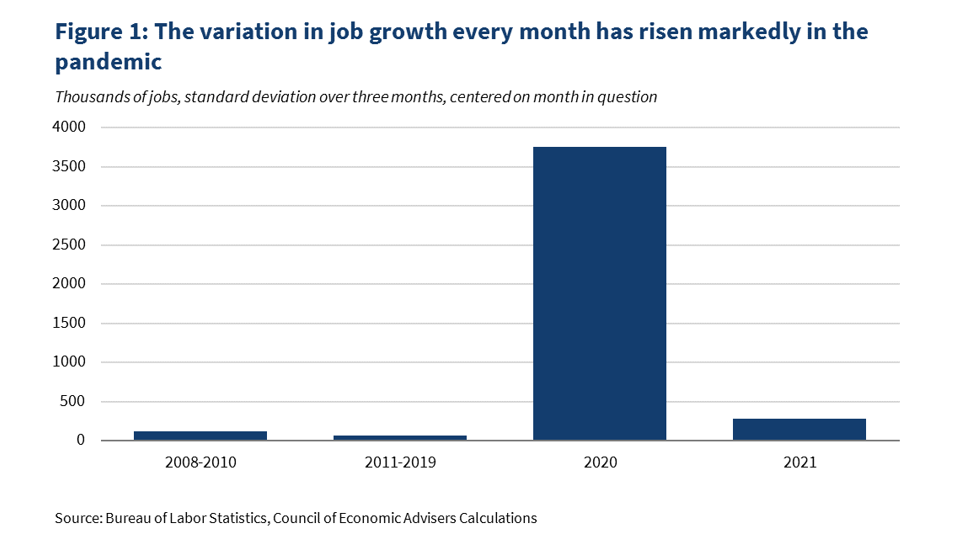

Preliminary figures released on Thursday by the State Labor Department show that the states unemployment rate was 76 which is down by one-tenth of a percent from June. The number of private sector jobs in the state increased by 43800 or 06 during that same time marking the states largest net gain in private sector jobs since March. Data refer to place of residence.

The share of the citys working age population 16 who were either employed or looking for a job was 605 in November. The Capital Regions unemployment stood at 57 Watertown-Fort Drum was at 58. The state added more jobs at a faster clip than the rest of the country but New Yorks unemployment rate remains higher than the national average at 52.

According to the personal-finance website WalletHub the US. According to the BLS current population survey CPS the unemployment rate for New York fell 03 percentage points in November 2021 to 66. Out of 62 New York state counties Cayugas unemployment rate last month ranked 27th lowest.

Unemployment rate currently sits at 54 a vast improvement from the nearly historic high of 148 in April 2020. 26 rows New York NY Unemployment Rate is at 900 compared to 940 last month and 1200 last year. Estimates for the current month are subject to revision the following month.

Americas unemployment rate currently stands at 54 a big improvement from the near-record high of 148 in April 2020 but New York has an employment rate of 76. Labor force data include estimates of the civilian labor force the number employed the number unemployed and the unemployment rate. Kathy Hochul will support an.

The citys seasonally adjusted unemployment rate was 90 percent in November 2021 a drop of 04 percent from October and a decrease of 30 percent from November 2020. Date Rate Date Rate. To calculate your Benefit Rate click here.

Meanwhile the state added 24200 private sector jobs in November. 66 Percent Monthly Updated. NYS Unemployment Insurance Total UI Contribution Rates UI Rate RSF Total.

Rates shown are a percentage of the labor force. The state unemployment rate was 24 percentage points higher than the national rate for the month. Yates and Saratoga.

Labor force figures are available for New York State labor market regions metropolitan areas counties and municipalities of at least 25000. Unemployment Rate Drops Harlem Restaurant Owner Finds Promise In Younger Workforce. The Department of Labor added more than 500000 jobs in October bringing the unemployment rate to pre.

New York States rate was 66 percent in November 2021. Now with the change of leadership in the governorship the 400000 New Yorkers on the verge of losing unemployment assistance wonder if Gov. The Rochester and Syracuse areas were both at 64 labor statistics showed.

The county rate was nearly as low as the pre-pandemic November 2019 mark of 36. 66 more Updated. State November 2021 rate Historical High Historical Low.

Buffalo and Niagaras unemployment rate was 69 ticking upward slightly from September. Regions where many people hold public sector jobs are faring slightly better. Rates can grow with increased employee UI claims or a low UI fund balance.

26 rows Unemployment rates for a large state like New York give a good idea on. Estimates are developed and distributed monthly. New Yorks unemployment rate between July and August fell from 76 to 74 and the economy added 28000 jobs in the private sector the state Department of Labor announced on Thursday.

The unemployment rate rose an average of 18 from April 2019 to 2021 for all metro areas besides NYC which fell far outside the average with a difference of 71. New York currently has an employment rate of 76. Current Unemployment Rates for States and Historical HighsLows Seasonally Adjusted.

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-06-2022/t_b60123f975cd461394b6bd492399ed59_name_file_960x540_1200_v3_1_.jpg)

Follow Us

Were this world an endless plain, and by sailing eastward we could for ever reach new distances